- Turkey

- /

- Transportation

- /

- IBSE:GRSEL

3 Undiscovered Gems In The Middle East With Strong Potential

Reviewed by Simply Wall St

As Gulf bourses track a global selloff due to fading hopes of a U.S. Federal Reserve rate cut, the Middle East market is experiencing notable volatility, with key indices like Qatar's benchmark index reaching its lowest level in nearly five months. Amidst this backdrop of shifting monetary policies and investor sentiment, identifying stocks with strong fundamentals and growth potential becomes crucial for navigating the current economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Rimoni Industries | NA | 1.42% | -1.24% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Baazeem Trading | 9.71% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.46% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -4.20% | -30.22% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Gür-Sel Turizm Tasimacilik ve Servis Ticaret (IBSE:GRSEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gür-Sel Turizm Tasimacilik ve Servis Ticaret A.S. operates in the transportation and service industry, with a market capitalization of TRY33.86 billion.

Operations: GRSEL generates revenue primarily from its transportation and service operations. The company's financial performance is characterized by its market capitalization of TRY33.86 billion.

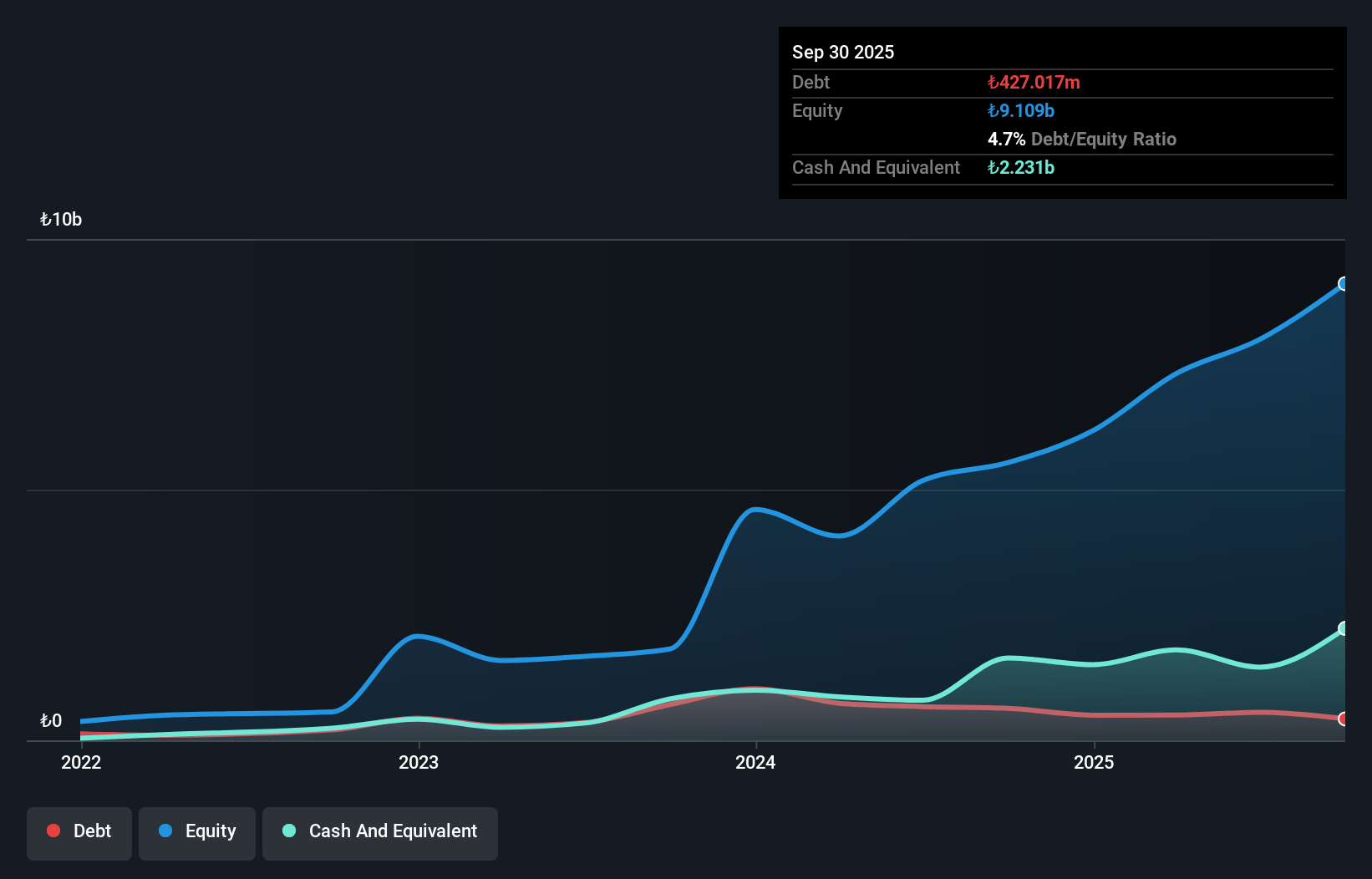

Gür-Sel Turizm Tasimacilik ve Servis Ticaret, a niche player in the transportation sector, has shown mixed performance. Despite a 4% earnings drop over the past year compared to the industry average of 0.9%, its net income for Q3 2025 rose to TRY 651.67 million from TRY 471.58 million last year, indicating resilience in profitability. The company also boasts strong liquidity with cash exceeding total debt and levered free cash flow reaching TRY 426.73 million by September 2025, reflecting improved financial health amidst challenges like reduced sales from TRY 3,081.76 million to TRY 2,484.63 million in Q3 this year.

Ray Sigorta Anonim Sirketi (IBSE:RAYSG)

Simply Wall St Value Rating: ★★★★★★

Overview: Ray Sigorta Anonim Sirketi operates in the non-life insurance sector in Turkey with a market capitalization of TRY40.44 billion.

Operations: Ray Sigorta Anonim Sirketi generates revenue primarily from its accident and fire insurance segments, which contribute TRY15.98 billion and TRY2.20 billion, respectively. The company has a significant presence in the accident insurance market, indicating a strong focus on this segment for revenue generation.

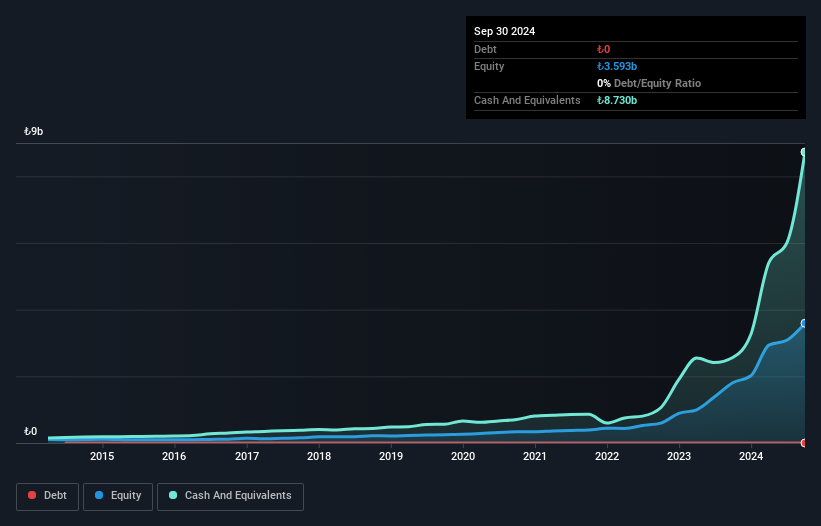

Ray Sigorta Anonim Sirketi, a nimble player in the insurance sector, has showcased impressive financial health with earnings surging by 122.4% over the past year, outpacing the industry’s 83.8%. The company is debt-free and boasts high-quality earnings, reflecting its robust operational framework. Its price-to-earnings ratio stands at 10.7x, which is attractive compared to the TR market average of 17.8x. Recently reported net income for Q3 hit TRY 1,045 million from TRY 511 million last year, while basic earnings per share doubled to TRY 6 from TRY 3 a year ago—demonstrating strong profitability momentum despite being dropped from an index recently.

- Click to explore a detailed breakdown of our findings in Ray Sigorta Anonim Sirketi's health report.

Jamjoom Fashion Trading (SASE:9649)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jamjoom Fashion Trading Company operates in the retail sector, focusing on apparel and fashion products, with a market capitalization of SAR1.10 billion.

Operations: Jamjoom Fashion Trading generates revenue primarily from its apparel retail segment, which brought in SAR680.04 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability within the competitive fashion retail market.

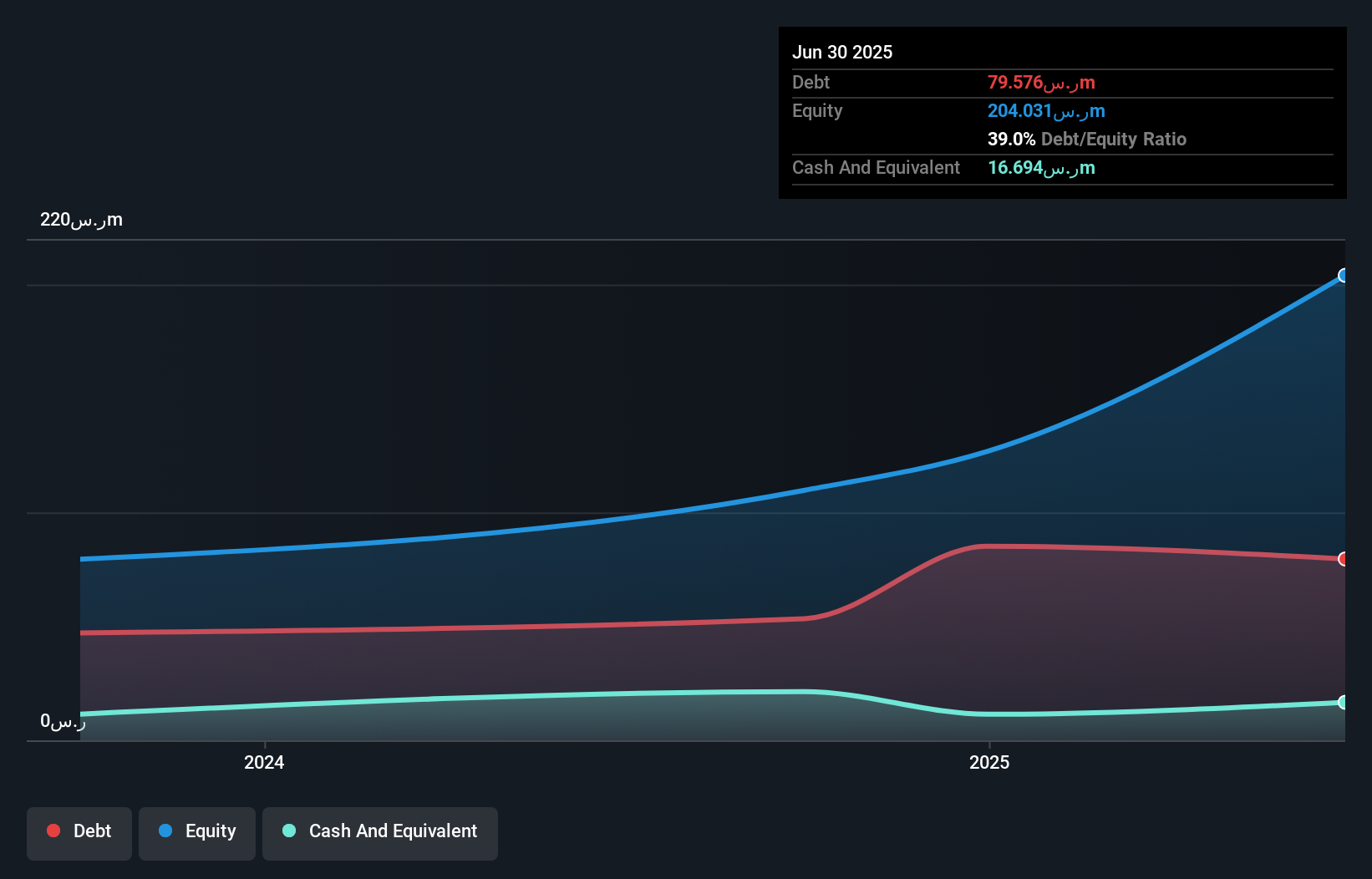

Jamjoom Fashion Trading, a relatively small player in the Middle East's retail sector, has shown promising growth with earnings rising 23% over the past year, outpacing the industry average. The company's net debt to equity ratio stands at 30.8%, which is considered satisfactory, indicating prudent financial management. Recently completing an IPO worth SAR 345 million at a price of SAR 145 per share suggests investor confidence and potential for expansion. With a P/E ratio of 11.5x below the market average and revenue projected to grow by over 11% annually, Jamjoom seems poised for continued success despite recent share price volatility.

- Click here to discover the nuances of Jamjoom Fashion Trading with our detailed analytical health report.

Understand Jamjoom Fashion Trading's track record by examining our Past report.

Where To Now?

- Click through to start exploring the rest of the 195 Middle Eastern Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:GRSEL

Gür-Sel Turizm Tasimacilik ve Servis Ticaret

Gür-Sel Turizm Tasimacilik ve Servis Ticaret A.S.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives