- United Arab Emirates

- /

- Capital Markets

- /

- ADX:TNI

November 2025's Middle Eastern Penny Stocks To Watch

Reviewed by Simply Wall St

As Gulf stocks follow a global rally, buoyed by positive sentiment from strong earnings reports and anticipation of U.S. job data, the Middle Eastern markets are capturing investor attention. Investing in penny stocks—once a buzzword but now more of a niche—can still open doors to growth opportunities, typically in smaller or newer companies. We'll spotlight several penny stocks that stand out for their financial strength, making them promising candidates for investors seeking under-the-radar companies poised for long-term success.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.37 | SAR1.35B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.90 | ₪279.61M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2.06B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.29 | AED13.99B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.808 | AED2.31B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.815 | AED495.73M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.70 | ₪211.95M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Apex Investment PSC (ADX:APEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Apex Investment PSC engages in the manufacturing, distribution, and sale of clinkers and cement products both in the United Arab Emirates and internationally, with a market cap of AED13.40 billion.

Operations: The company's revenue is primarily derived from catering (AED594.16 million), manufacturing (AED238.21 million), facility management services (AED110.42 million), contracting (AED28.73 million), and investments (AED0.13 million).

Market Cap: AED13.4B

Apex Investment PSC, with a market cap of AED13.40 billion, is a debt-free company that has demonstrated substantial earnings growth recently. For the third quarter of 2025, sales increased to AED233.15 million from AED197.47 million in the previous year; however, it reported a net loss due to significant one-off expenses impacting financial results. Despite this setback, Apex's net profit margin improved significantly over the past year and its short-term assets comfortably cover both short and long-term liabilities. The board is experienced with an average tenure of 3.7 years, although management experience data remains insufficient for assessment.

- Take a closer look at Apex Investment PSC's potential here in our financial health report.

- Gain insights into Apex Investment PSC's historical outcomes by reviewing our past performance report.

National Investor Pr. J.S.C (ADX:TNI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The National Investor Pr. J.S.C., with a market cap of AED122.20 million, operates in the United Arab Emirates offering private equity, real estate investment and consultancy, economic feasibility consultancy and studies, commercial agencies, and hospitality services through its subsidiaries.

Operations: The company generates revenue from its Principal Investments segment, amounting to AED31.79 million.

Market Cap: AED122.2M

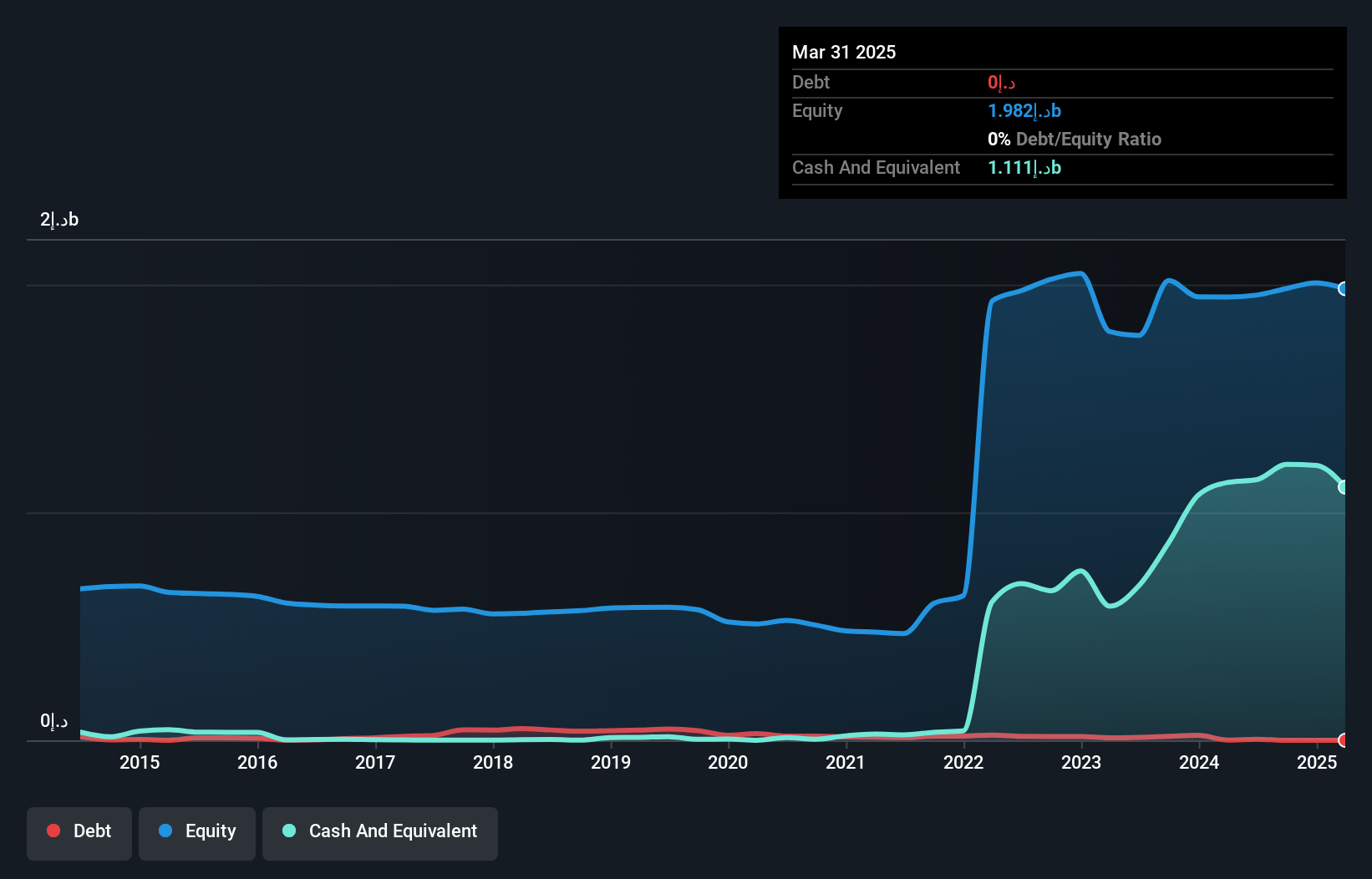

National Investor Pr. J.S.C., with a market cap of AED122.20 million, remains unprofitable but has managed to reduce its losses by 1.3% annually over the past five years. The company benefits from a strong financial position, having more cash than total debt and short-term assets of AED29.8 million exceeding both short-term and long-term liabilities. Despite high share price volatility, TNI maintains a positive free cash flow, supporting a cash runway exceeding three years if current conditions persist. The experienced board boasts an average tenure of 6.6 years, though management experience data is lacking for further evaluation.

- Unlock comprehensive insights into our analysis of National Investor Pr. J.S.C stock in this financial health report.

- Explore historical data to track National Investor Pr. J.S.C's performance over time in our past results report.

Escort Teknoloji Yatirim (IBSE:ESCOM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Escort Teknoloji Yatirim A.S. offers technology-based products, solutions, and services both in Turkey and internationally with a market cap of TRY2.37 billion.

Operations: The company generates revenue from its operations in Turkey, amounting to TRY369.24 million.

Market Cap: TRY2.37B

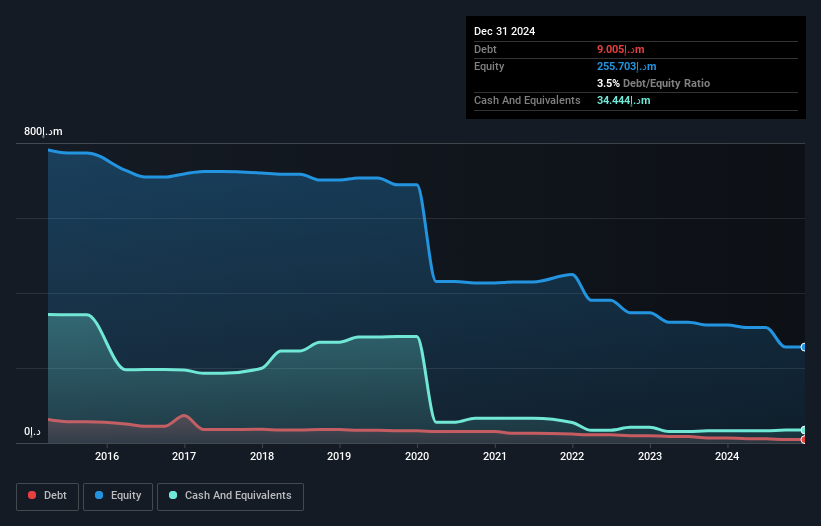

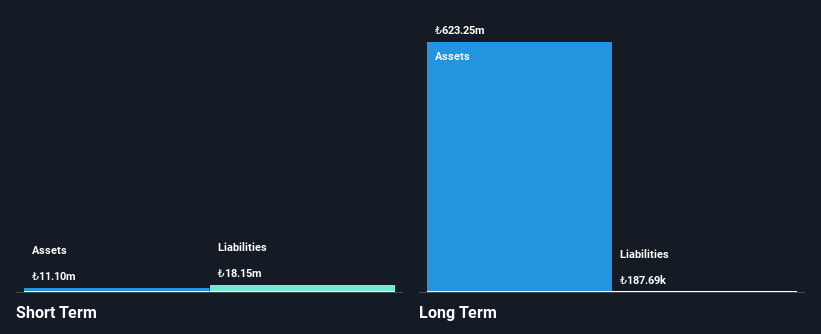

Escort Teknoloji Yatirim A.S., with a market cap of TRY2.37 billion, is currently unprofitable, experiencing increased losses at 4.5% annually over the past five years. Despite no debt and short-term assets of TRY27.8 million exceeding long-term liabilities, the company struggles with short-term liabilities totaling TRY65.4 million. Recent earnings show a net loss reduction to TRY0.20 million from TRY7.11 million year-over-year for Q3 2025, though sales decreased slightly to TRY0.43 million from TRY0.47 million in the same period last year, highlighting ongoing financial challenges amidst limited revenue growth prospects.

- Click here to discover the nuances of Escort Teknoloji Yatirim with our detailed analytical financial health report.

- Learn about Escort Teknoloji Yatirim's historical performance here.

Make It Happen

- Click this link to deep-dive into the 80 companies within our Middle Eastern Penny Stocks screener.

- Curious About Other Options? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Investor Pr. J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:TNI

National Investor Pr. J.S.C

Provides private equity, real estate investment and consultancy, economic feasibility consultancy and studies, commercial agencies, and hospitality services in the United Arab Emirates.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives