As Middle Eastern stock markets see mixed performances, with most Gulf bourses advancing alongside rising oil prices, investors are keenly observing the region's economic movements. For those interested in smaller or newer companies, penny stocks—despite their somewhat outdated moniker—remain a relevant investment area. These stocks can offer growth opportunities at lower price points when backed by strong financials and fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.69 | TRY1.82B | ✅ 2 ⚠️ 2 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.00 | SAR1.6B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.953 | ₪206.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.91 | ₪2.83B | ✅ 1 ⚠️ 2 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.719 | ₪12.49M | ✅ 1 ⚠️ 4 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.238 | ₪166.38M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.715 | AED434.9M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.00 | AED346.5M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2.02B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.41 | AED10.29B | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 95 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Commercial Bank International P.S.C (ADX:CBI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Commercial Bank International P.S.C. offers a range of banking products and services to both individuals and businesses in the UAE and internationally, with a market capitalization of AED1.37 billion.

Operations: The company's revenue is primarily derived from its Wholesale Banking segment at AED253.01 million, followed by Real Estate at AED247.30 million, with additional contributions from Treasury and Retail Banking segments amounting to AED53.75 million and AED53.34 million respectively.

Market Cap: AED1.37B

Commercial Bank International P.S.C. demonstrates a stable financial foundation with 95% of its liabilities funded through low-risk customer deposits, maintaining an appropriate Loans to Deposits ratio of 85%. The bank's earnings have grown significantly by 34.1% annually over the past five years, although recent growth has decelerated to 14.3%. Despite a lower-than-industry earnings growth and a Return on Equity of 6.7%, the bank's Price-To-Earnings ratio is attractive at 7.6x compared to the AE market average of 12.5x. Recent first-quarter net income rose to AED41.71 million from AED35.92 million year-on-year, reflecting continued profitability amidst challenges like high bad loans at 15.5%.

- Click here to discover the nuances of Commercial Bank International P.S.C with our detailed analytical financial health report.

- Gain insights into Commercial Bank International P.S.C's historical outcomes by reviewing our past performance report.

Escort Teknoloji Yatirim (IBSE:ESCOM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Escort Teknoloji Yatirim A.S. offers technology-based products, solutions, and services both in Turkey and internationally, with a market cap of TRY1.93 billion.

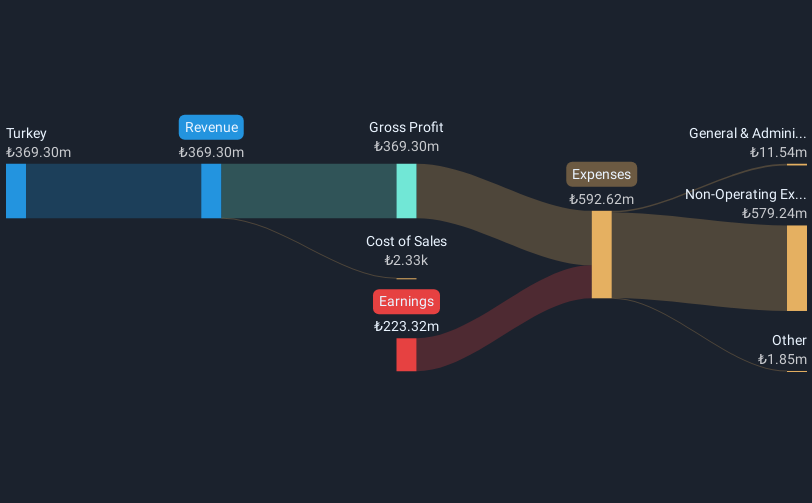

Operations: The company generates revenue primarily from its operations in Turkey, amounting to TRY369.27 million.

Market Cap: TRY1.93B

Escort Teknoloji Yatirim A.S., with a market cap of TRY1.93 billion, is currently unprofitable but has managed to reduce its losses by 23.9% annually over the past five years. The company operates without debt and has short-term assets of TRY26.3 million, which exceed its long-term liabilities but fall short of covering short-term liabilities totaling TRY60.2 million. Recent earnings reports show a significant decline in sales and profitability, with first-quarter sales at TRY0.43 million and a net income drop from TRY59.4 million to TRY4.49 million year-on-year, highlighting ongoing financial challenges amidst high volatility in share price movements.

- Jump into the full analysis health report here for a deeper understanding of Escort Teknoloji Yatirim.

- Learn about Escort Teknoloji Yatirim's historical performance here.

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi is a Turkish company specializing in the production and sale of foam sheets, with a market capitalization of TRY767.25 million.

Operations: Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi has not reported any specific revenue segments.

Market Cap: TRY767.25M

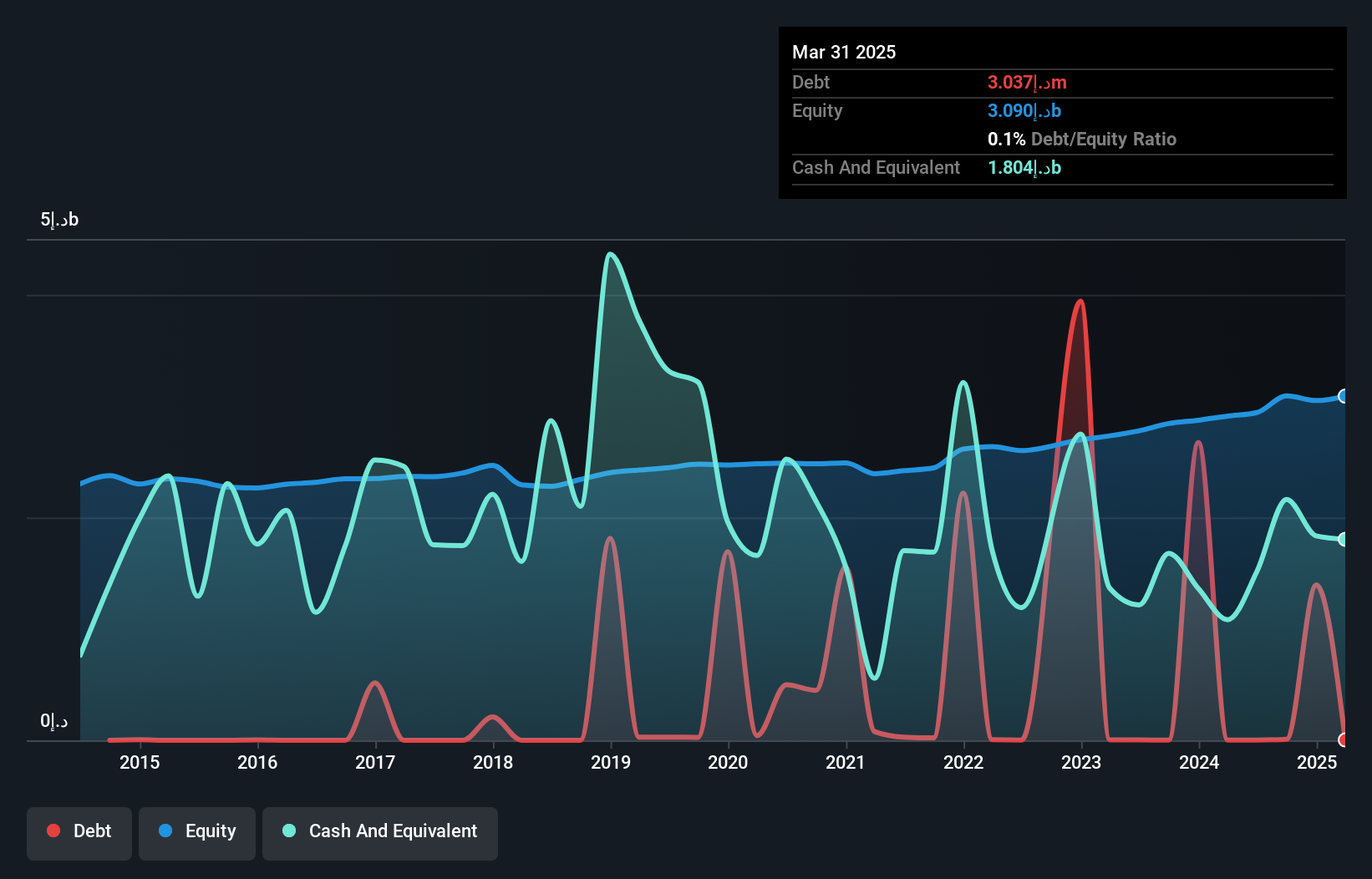

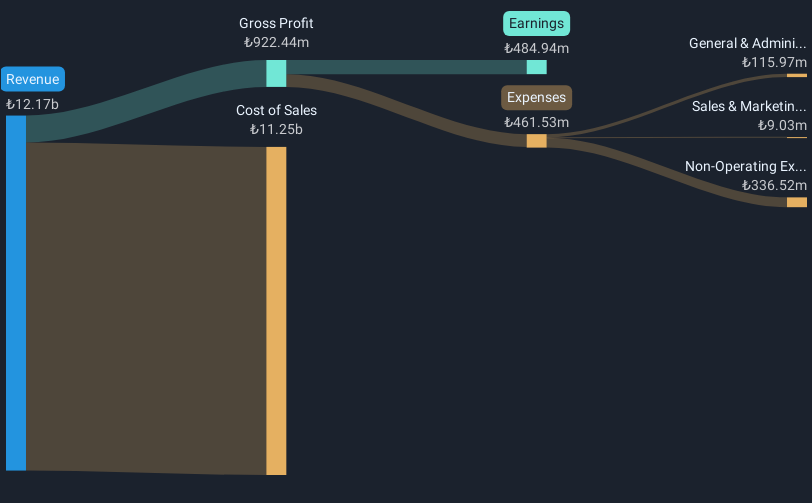

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi, with a market cap of TRY767.25 million, has demonstrated robust earnings growth, increasing by 212.6% over the past year and significantly outpacing the chemicals industry. The company's recent financial results highlight a turnaround from a net loss to a net income of TRY52.14 million in Q1 2025 and substantial revenue growth from TRY5,900.24 million to TRY12,170.73 million year-on-year for 2024. Despite high volatility in its share price and negative operating cash flow impacting debt coverage, MEGAP maintains satisfactory debt levels with strong asset coverage for liabilities and an attractive P/E ratio of 1.3x compared to the TR market average.

- Click to explore a detailed breakdown of our findings in Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's financial health report.

- Review our historical performance report to gain insights into Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's track record.

Taking Advantage

- Click here to access our complete index of 95 Middle Eastern Penny Stocks.

- Interested In Other Possibilities? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:MEGAP

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi

Produces and sells foam sheets in Turkey.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives