Exploring Three Hidden Gems In Middle Eastern Markets With Strong Potential

Reviewed by Simply Wall St

The Middle Eastern markets have recently experienced a downturn, influenced by softer oil prices that have led to declines in most Gulf indices, although expectations of a U.S. interest rate cut have helped limit losses. Amid these fluctuating conditions, identifying stocks with strong fundamentals and growth potential becomes crucial for investors looking to capitalize on market opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Rimoni Industries | NA | 1.42% | -1.24% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.65% | 46.83% | 48.76% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 35.76% | 53.34% | ★★★★★☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.16% | -34.78% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

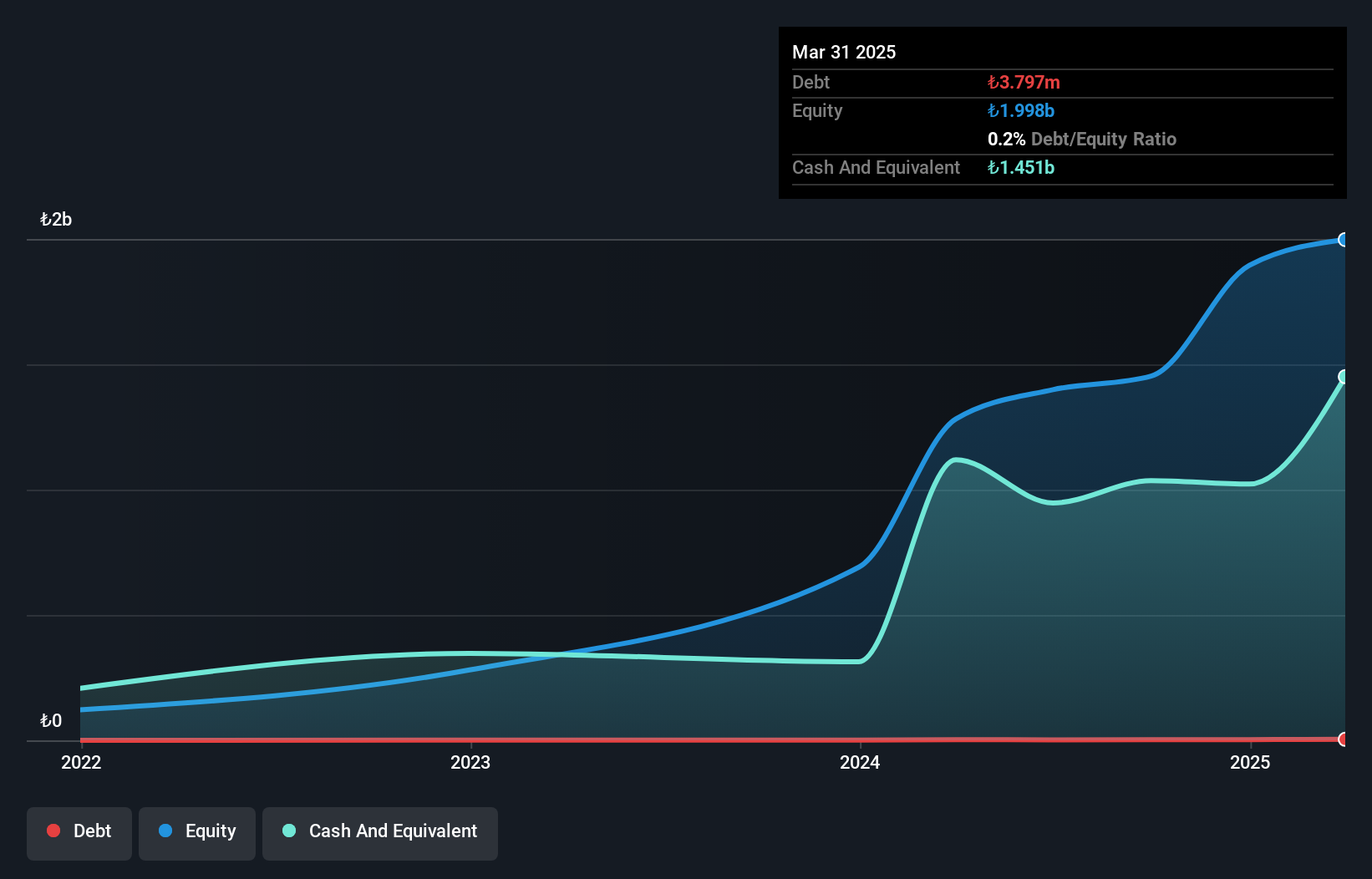

Odine Solutions Teknoloji Ticaret ve Sanayi (IBSE:ODINE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Odine Solutions Teknoloji Ticaret ve Sanayi A.S. operates in the technology sector and has a market capitalization of TRY25.70 billion.

Operations: Odine Solutions generates revenue primarily from its technology-related services and products. The company's financial performance is characterized by a gross profit margin of 45%.

Odine Solutions, a small player in the tech space, has been making waves with its robust earnings growth of 44.5% over the past year, outpacing the IT industry's 11.4%. Despite reporting a net loss of TRY 27.93 million for the first nine months of 2025 compared to a net income of TRY 15.61 million last year, it boasts high-quality earnings and sufficient cash to cover its total debt. The company reported third-quarter sales at TRY 448.55 million, significantly higher than last year's TRY 157.89 million, though net income dipped to TRY 5.88 million from TRY 17.15 million previously.

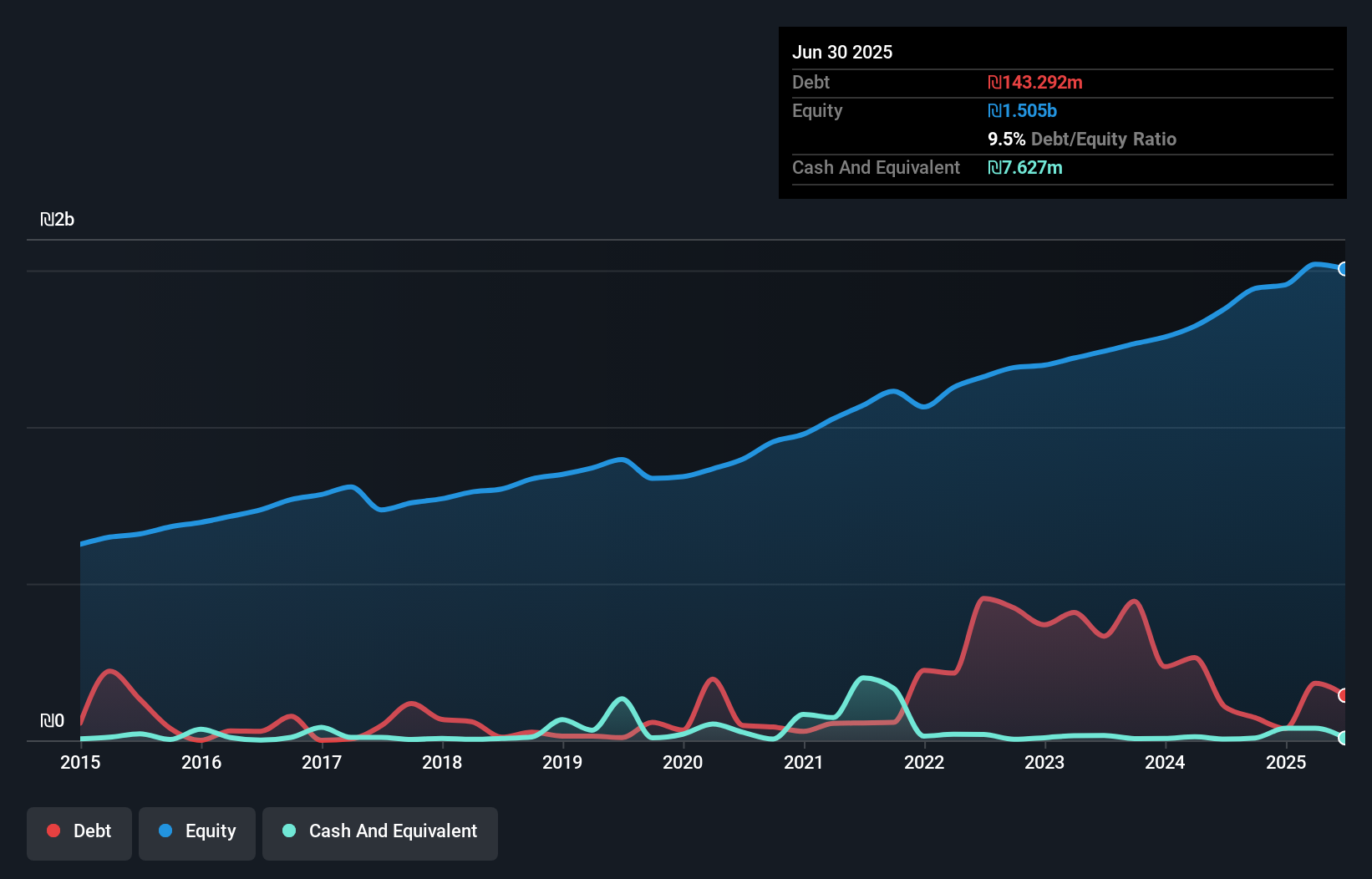

Neto Malinda Trading (TASE:NTML)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neto Malinda Trading Ltd. is involved in the manufacturing, importing, marketing, and distribution of kosher food products with a market cap of ₪2.99 billion.

Operations: Neto Malinda Trading generates revenue from three primary segments: Import (₪1.86 billion), Local Market (₪2.32 billion), and Neto Group Factories (₪757.57 million).

Neto Malinda Trading, a promising player in the Middle East's food sector, is showing robust performance with earnings growth of 71% over the past year, surpassing the industry's 42.1%. The company boasts high-quality earnings and a price-to-earnings ratio of 13.3x, which is favorable compared to the IL market's 15.4x. Despite an increase in its debt to equity ratio from 5.3% to 9.5% over five years, its net debt to equity remains satisfactory at 9%. Recently added to the S&P Global BMI Index, Neto Malinda seems poised for greater visibility and potential future growth opportunities.

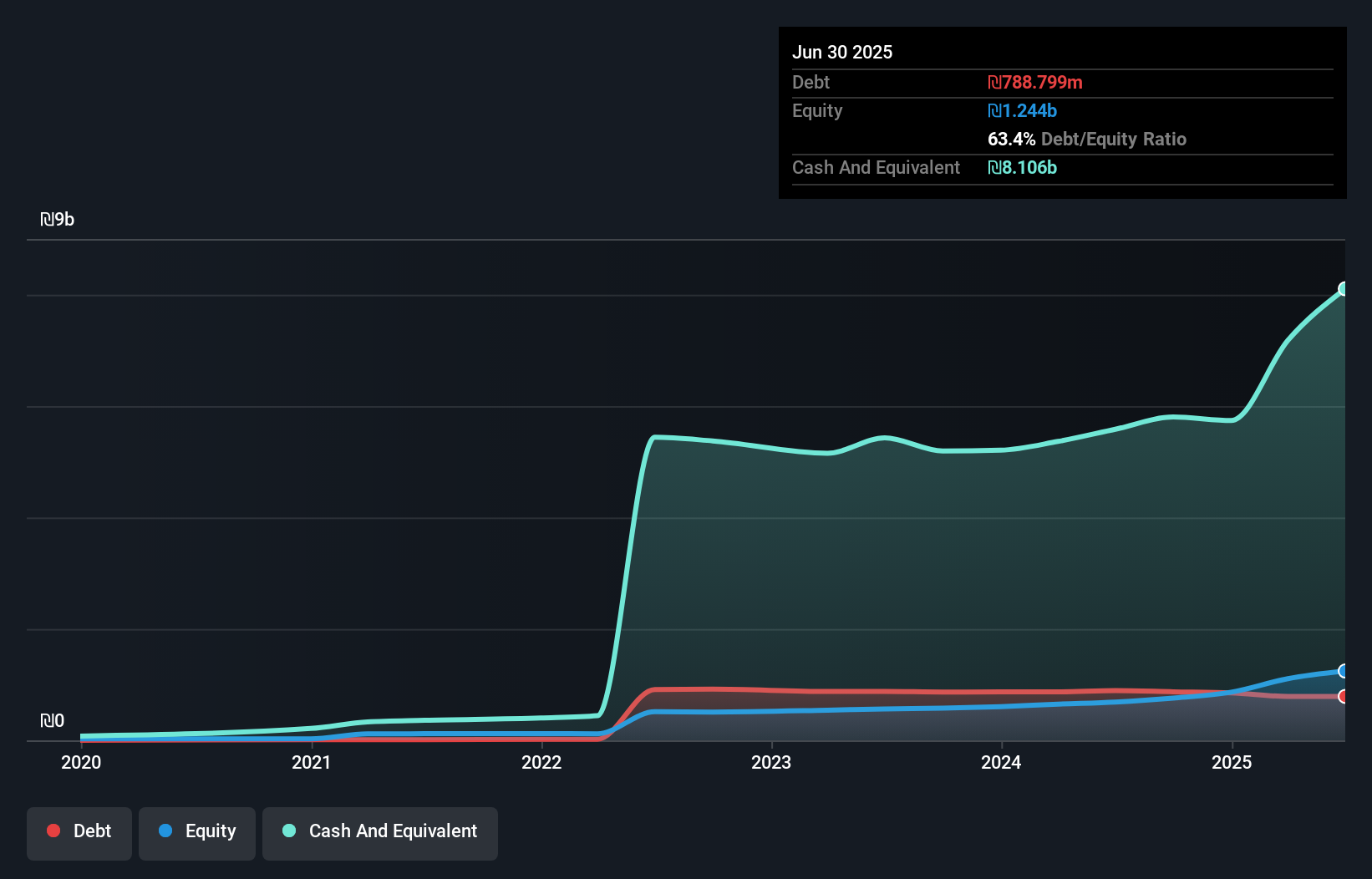

Wesure Global Tech (TASE:WESR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wesure Global Tech Ltd, with a market cap of ₪1.65 billion, operates in the insurance and finance industry by developing and marketing technologies for digital platforms globally.

Operations: Wesure Global Tech generates revenue primarily through its general insurance segments, with Ayalon Insurance contributing ₪2.44 billion and Wesure Insurance adding ₪327.35 million. The company also derives significant income from life insurance and long-term savings, amounting to ₪1.55 billion, along with health insurance revenues of ₪760.70 million.

Wesure Global Tech, with its nimble market presence, has demonstrated strong financial performance. Over the past year, earnings surged by 55%, outpacing the insurance sector's 35% growth. Despite a volatile share price recently, Wesure's fundamentals remain robust with net income for Q2 reaching ILS 95.88 million compared to ILS 45.55 million last year. Its price-to-earnings ratio of 10.6x is attractive against the IL market average of 15.4x, suggesting good value potential. The company's debt situation appears manageable as cash holdings exceed total debt and interest payments are comfortably covered six times by EBIT.

Make It Happen

- Investigate our full lineup of 188 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neto Malinda Trading might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NTML

Neto Malinda Trading

Manufactures, imports, markets, and distributes kosher food products.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success