- Turkey

- /

- Retail REITs

- /

- IBSE:YGGYO

Exploring Undiscovered Gems With Potential In February 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by mixed corporate earnings, AI competition fears, and steady interest rates from the Federal Reserve, investors are increasingly seeking opportunities in small-cap stocks. In this dynamic environment, identifying undiscovered gems requires a keen eye for companies with strong fundamentals and potential resilience amid shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 18.60% | 31.35% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.78% | 27.31% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. is a real estate investment company with operations primarily focused on managing commercial properties, and it has a market capitalization of TRY16.53 billion.

Operations: YGGYO generates revenue primarily from the Ankamall Shopping Mall, contributing TRY1.96 billion, and CP Ankara Hotel with TRY154.24 million. The net profit margin for the company is not specified in the provided data.

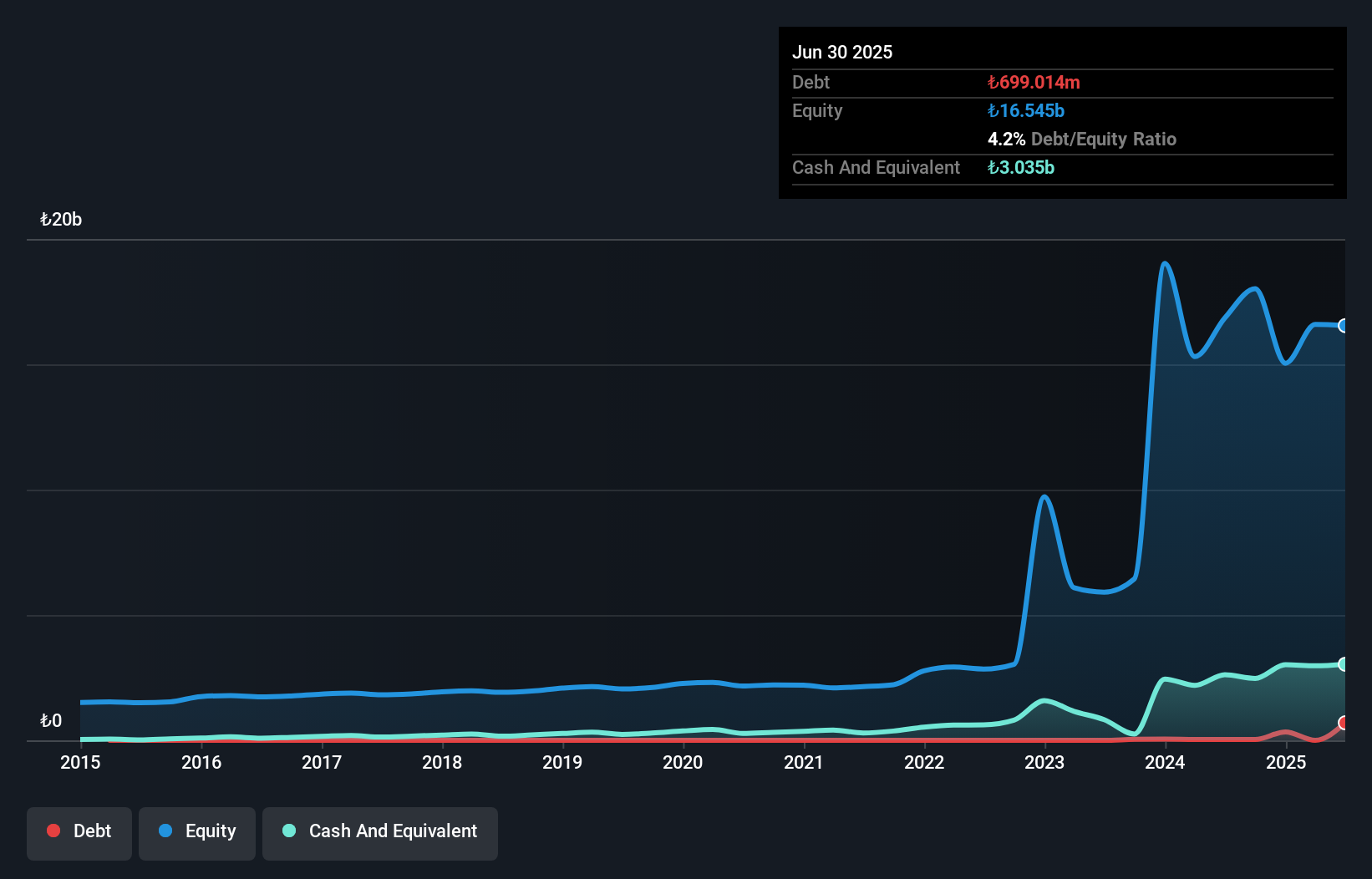

Yeni Gimat Gayrimenkul Yatirim Ortakligi, a relatively small player in the Retail REITs sector, has seen its earnings grow at an impressive 65% annually over the last five years. Despite this growth, recent performance indicates some challenges; third-quarter sales jumped to TRY 904 million from TRY 216 million year-on-year, yet net income fell sharply to TRY 564 million from TRY 2.48 billion. The company's debt-to-equity ratio remains low at just 0.2%, and it trades significantly below estimated fair value by around 83%. While cash flow is positive and interest coverage is not a concern, earnings growth of only 4% last year lagged behind industry peers.

- Navigate through the intricacies of Yeni Gimat Gayrimenkul Yatirim Ortakligi with our comprehensive health report here.

Understand Yeni Gimat Gayrimenkul Yatirim Ortakligi's track record by examining our Past report.

Diplomat Holdings (TASE:DIPL)

Simply Wall St Value Rating: ★★★★★★

Overview: Diplomat Holdings Ltd. is a sales and distribution company in the fast-moving consumer goods sector with a market cap of ₪1.42 billion.

Operations: Diplomat Holdings generates revenue primarily from its role in sales and distribution within the fast-moving consumer goods sector. The company reported a market cap of ₪1.42 billion, reflecting its scale in this industry.

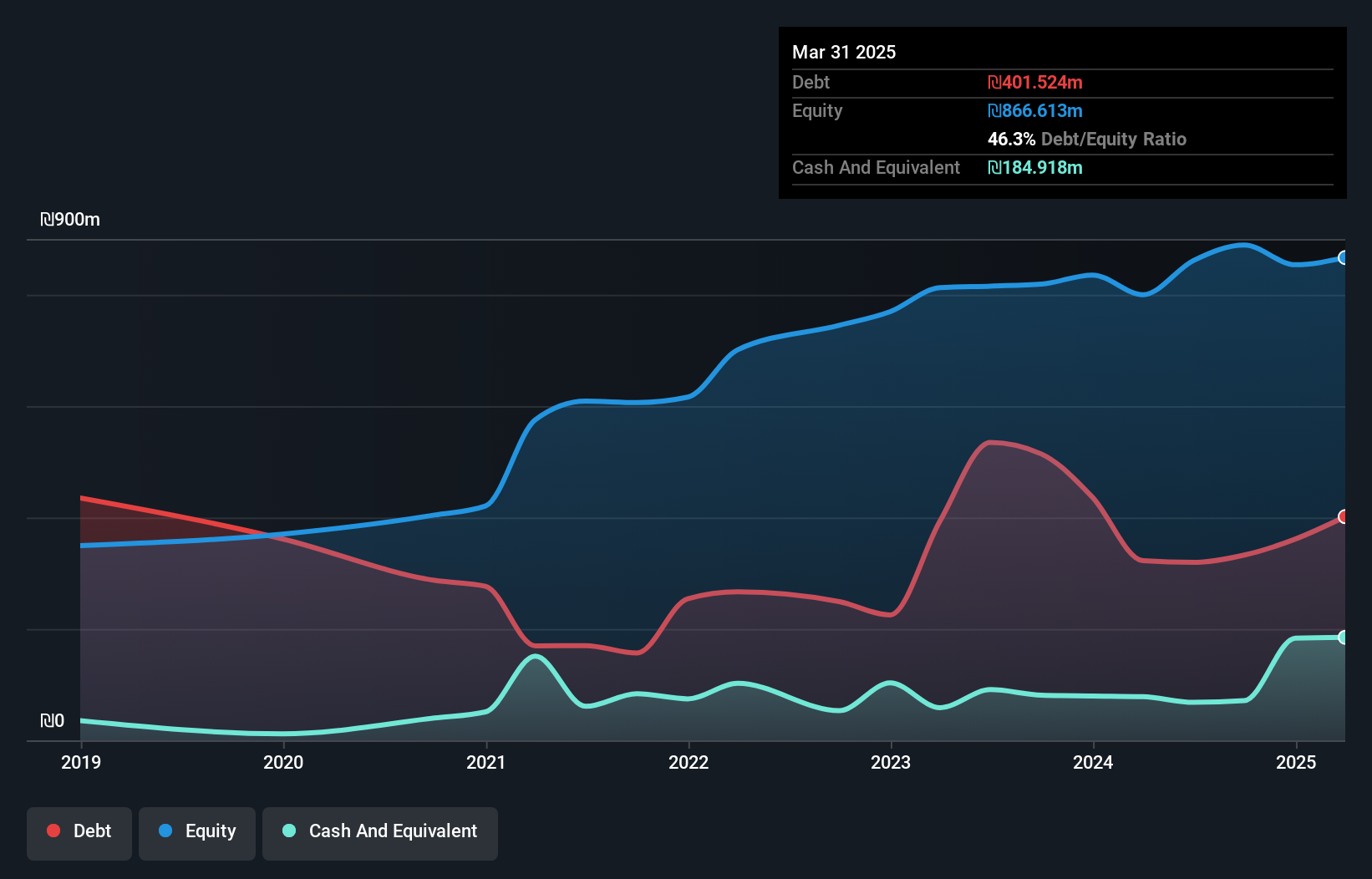

Diplomat Holdings, a smaller player in its field, has shown promising financial health with earnings growing 3.1% annually over the past five years and high-quality past earnings. The company's debt situation has improved significantly, with the debt-to-equity ratio dropping from 120.3% to 37.1% over five years, while interest payments are comfortably covered at 7.5 times by EBIT. Despite not outpacing industry growth last year at 53.8%, it remains a good value proposition trading at nearly 96% below estimated fair value and maintains satisfactory net debt levels of 29.2%. A recent cash dividend of ILS0.65 further highlights its shareholder returns focus.

- Get an in-depth perspective on Diplomat Holdings' performance by reading our health report here.

Assess Diplomat Holdings' past performance with our detailed historical performance reports.

Tsubakimoto Kogyo (TSE:8052)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsubakimoto Kogyo Co., Ltd. is involved in the sale of machinery, equipment, parts, and accessories in Japan with a market cap of ¥39.62 billion.

Operations: The company generates revenue primarily from the sale of machinery, equipment, parts, and accessories. It has a market cap of ¥39.62 billion.

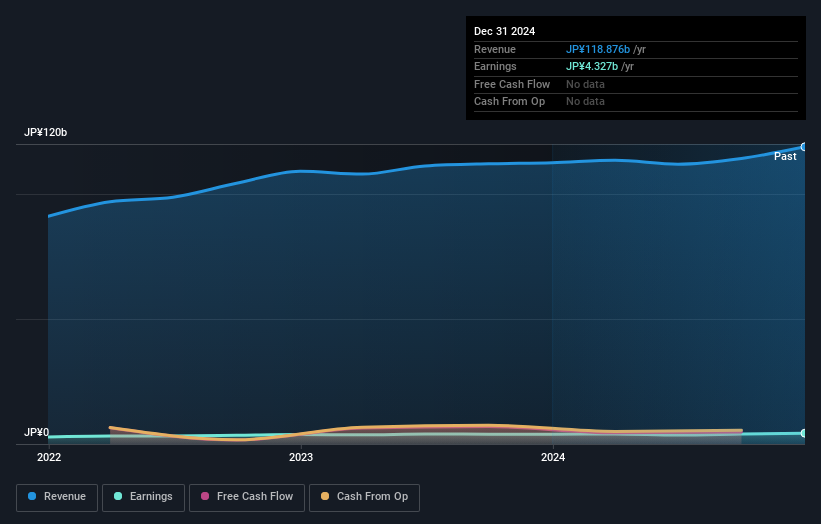

Tsubakimoto Kogyo, a nimble player in the Trade Distributors industry, is trading at 60.6% below its estimated fair value, suggesting potential undervaluation. The company has demonstrated robust earnings growth of 10.2% over the past year, outpacing the industry's modest 0.4%. With no debt on its books for five years and high-quality earnings reported, it appears financially sound and agile in capital management. Recently, Tsubakimoto completed a share buyback of 450,000 shares for ¥843 million to enhance shareholder returns and capital efficiency—highlighting proactive financial strategies amidst evolving market dynamics.

Make It Happen

- Discover the full array of 4682 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:YGGYO

Yeni Gimat Gayrimenkul Yatirim Ortakligi

Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives