- United Arab Emirates

- /

- Entertainment

- /

- ADX:PALMS

Middle East's Hidden Treasures These 3 Stocks Shine with Strong Potential

Reviewed by Simply Wall St

As Gulf markets experience mixed performances due to softer oil prices and fluctuating expectations around U.S. interest rate cuts, the region's financial landscape remains dynamic and full of potential opportunities. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for investors looking to navigate the complexities of Middle Eastern markets effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | NA | 41.94% | 8.07% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Palms Sports PJSC (ADX:PALMS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Palms Sports PJSC operates in the United Arab Emirates, offering sports training programs with a focus on Jiu-Jitsu and holds a market cap of AED1.22 billion.

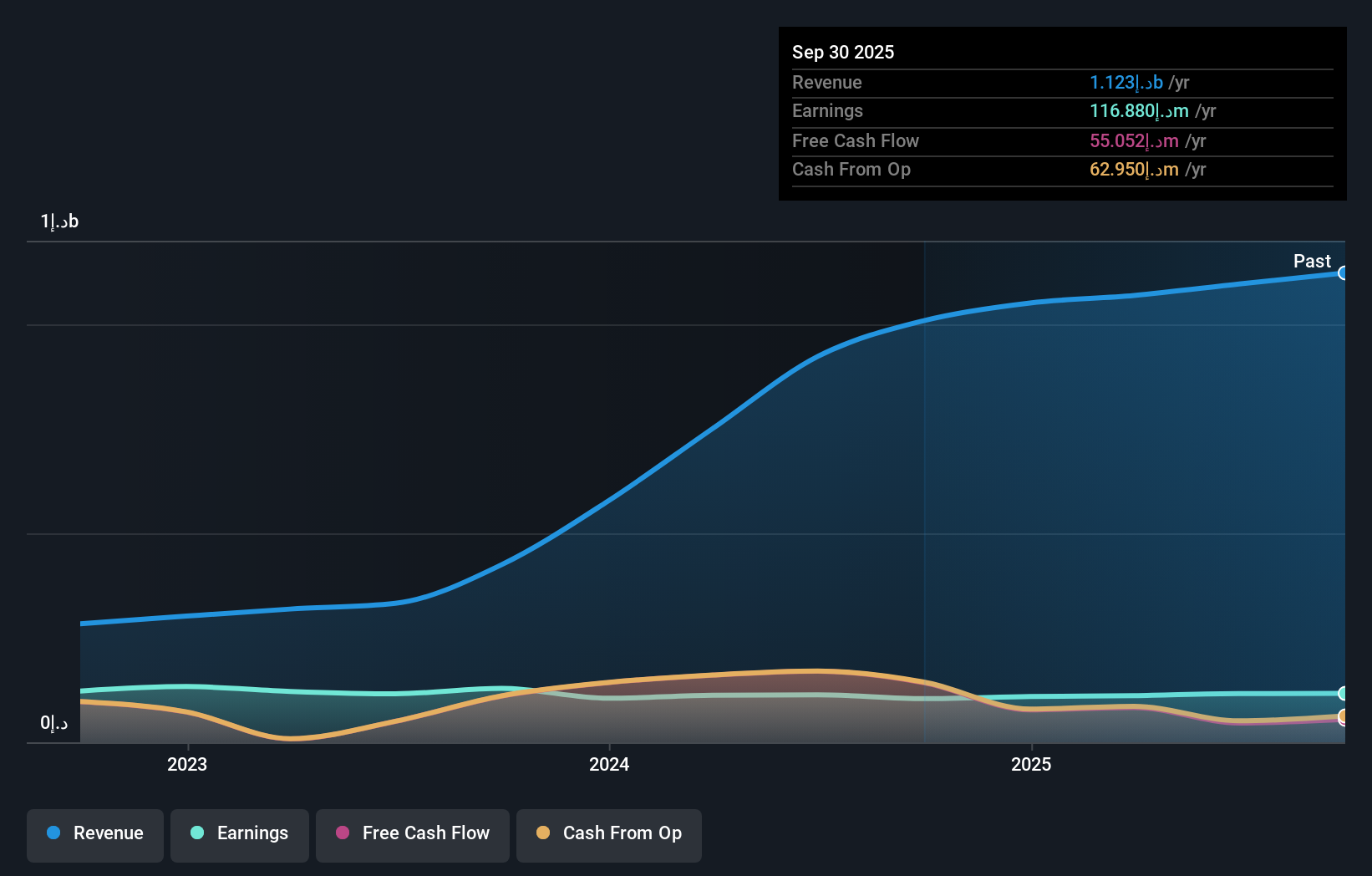

Operations: Palms Sports PJSC generates revenue primarily from Coaching and Training, which contributes AED427.15 million, and Guarding and Cleaning services, amounting to AED596.20 million. The company's focus on these segments reflects its diversified approach within the sports training industry in the UAE.

Palms Sports PJSC, a promising player in the Middle East's market, showcases solid financial health with earnings growing at 7% annually over five years. Despite a rise in debt-to-equity from 0% to 19.6%, it holds more cash than total debt. The company's price-to-earnings ratio of 10.4x is favorable compared to the AE market's 11.7x, indicating potential value for investors. Recent earnings reveal sales of AED 284.79 million for Q3 and net income of AED 38.84 million, reflecting stability with high-quality earnings and well-covered interest payments by EBIT at a robust coverage of 21 times.

- Click here to discover the nuances of Palms Sports PJSC with our detailed analytical health report.

Assess Palms Sports PJSC's past performance with our detailed historical performance reports.

Reysas Gayrimenkul Yatirim Ortakligi (IBSE:RYGYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Reysas Gayrimenkul Yatirim Ortakligi A.S. operates as a real estate investment trust focusing on commercial properties, with a market capitalization of TRY42.48 billion.

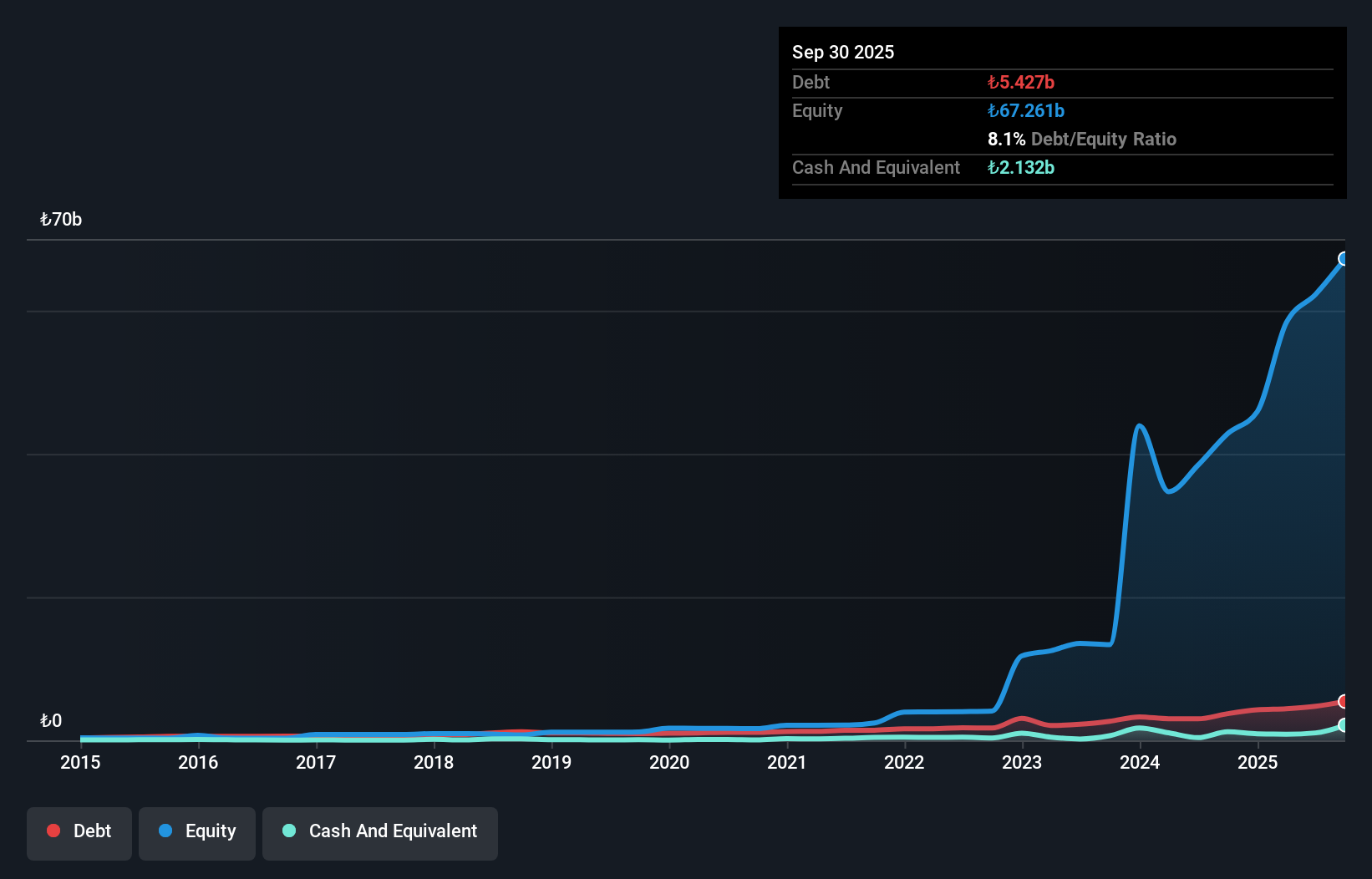

Operations: Reysas generates revenue primarily from its commercial real estate investments, reporting TRY2.60 billion in this segment. The company's net profit margin reflects its ability to manage costs and profitability effectively, with recent figures indicating a noteworthy trend.

Reysas Gayrimenkul Yatirim Ortakligi, a smaller player in the Industrial REITs sector, has shown robust earnings growth of 18.2%, outpacing the industry's 4.2%. The company seems to be on solid financial footing with a reduced debt to equity ratio from 67.9% to 8.1% over five years and a satisfactory net debt to equity ratio of 4.9%. Despite trading at a significant discount of 74.4% below its estimated fair value, recent results show some challenges with third-quarter sales at TRY923 million and net income at TRY371 million compared to last year's figures, indicating potential areas for improvement moving forward.

- Click to explore a detailed breakdown of our findings in Reysas Gayrimenkul Yatirim Ortakligi's health report.

Learn about Reysas Gayrimenkul Yatirim Ortakligi's historical performance.

Tümosan Motor ve Traktör Sanayi (IBSE:TMSN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tümosan Motor ve Traktör Sanayi A.S. is involved in the production, marketing, and sale of diesel engines and tractors both within Turkey and internationally, with a market capitalization of TRY12.11 billion.

Operations: Tümosan generates revenue primarily from the sale of diesel engines and tractors. The company has a market capitalization of TRY12.11 billion.

Tümosan, a player in the machinery sector, has shown resilience with a debt to equity ratio dropping from 51.3% to 30.9% over five years, indicating improved financial health. Despite the machinery industry's struggles, Tümosan turned profitable recently, contrasting with the industry’s -48.6% earnings growth. The company's price-to-earnings ratio of 1.8x suggests it is undervalued compared to the TR market's 17.8x average. Recent earnings reveal a significant turnaround; net income for nine months reached TRY 7 billion from a previous loss of TRY 328 million, although third-quarter sales fell sharply year-over-year to TRY 599 million from TRY 1 billion.

Summing It All Up

- Get an in-depth perspective on all 189 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:PALMS

Palms Sports PJSC

Provides sports training programs for Jiu-Jitsu and other sports in the United Arab Emirates.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success