- United Arab Emirates

- /

- Beverage

- /

- DFM:ERC

Exploring Three Undiscovered Gems in the Middle East Market

Reviewed by Simply Wall St

The Middle East market has recently experienced mixed performance, with Saudi Arabia and Abu Dhabi indices slipping due to lackluster earnings, while Dubai's index rose to a 17-1/2-year high on strong corporate results and optimism about future earnings. In this dynamic environment, identifying promising stocks often involves looking for companies that demonstrate resilience in challenging conditions and potential for growth amidst cautious trade outlooks.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.23% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Emirates Reem Investments Company P.J.S.C (DFM:ERC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emirates Reem Investments Company P.J.S.C operates in the bottling, distribution, and trading of mineral water, carbonated drinks, soft drinks, juices, and evaporated milk across the United Arab Emirates and broader Middle East and Africa regions with a market capitalization of AED927.63 million.

Operations: Emirates Reem Investments Company P.J.S.C generates revenue primarily from its operations segment, amounting to AED169.67 million.

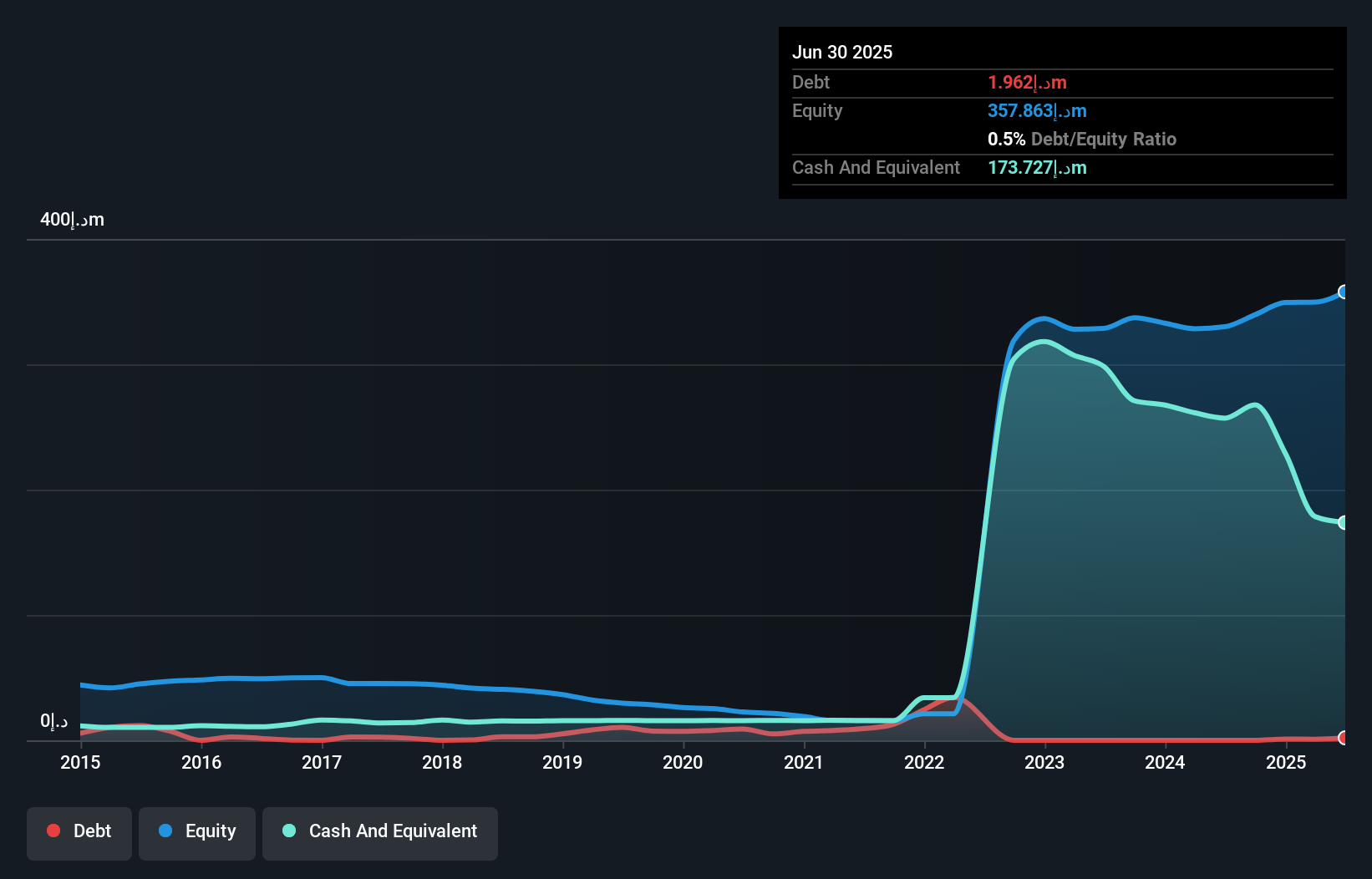

Emirates Reem Investments, a notable player in the Middle East's investment landscape, has shown remarkable earnings growth of 484.5% over the past year, far outpacing the Beverage industry's 3.3%. The company's debt to equity ratio impressively reduced from 31.2% to just 0.3% over five years, indicating strong financial health and prudent management. Recent results highlight a turnaround with sales reaching AED 38.19 million for Q1 2025 compared to AED 18.51 million last year, while net income swung from a loss of AED 4.48 million to a profit of AED 0.18 million, reflecting its potential as an emerging investment opportunity.

Akfen Gayrimenkul Yatirim Ortakligi (IBSE:AKFGY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Akfen Gayrimenkul Yatirim Ortakligi A.S. operates as a real estate investment trust, having been restructured from Aksel Turizm Yatirimlari ve Isletmecilik AS, with a market cap of TRY11.54 billion.

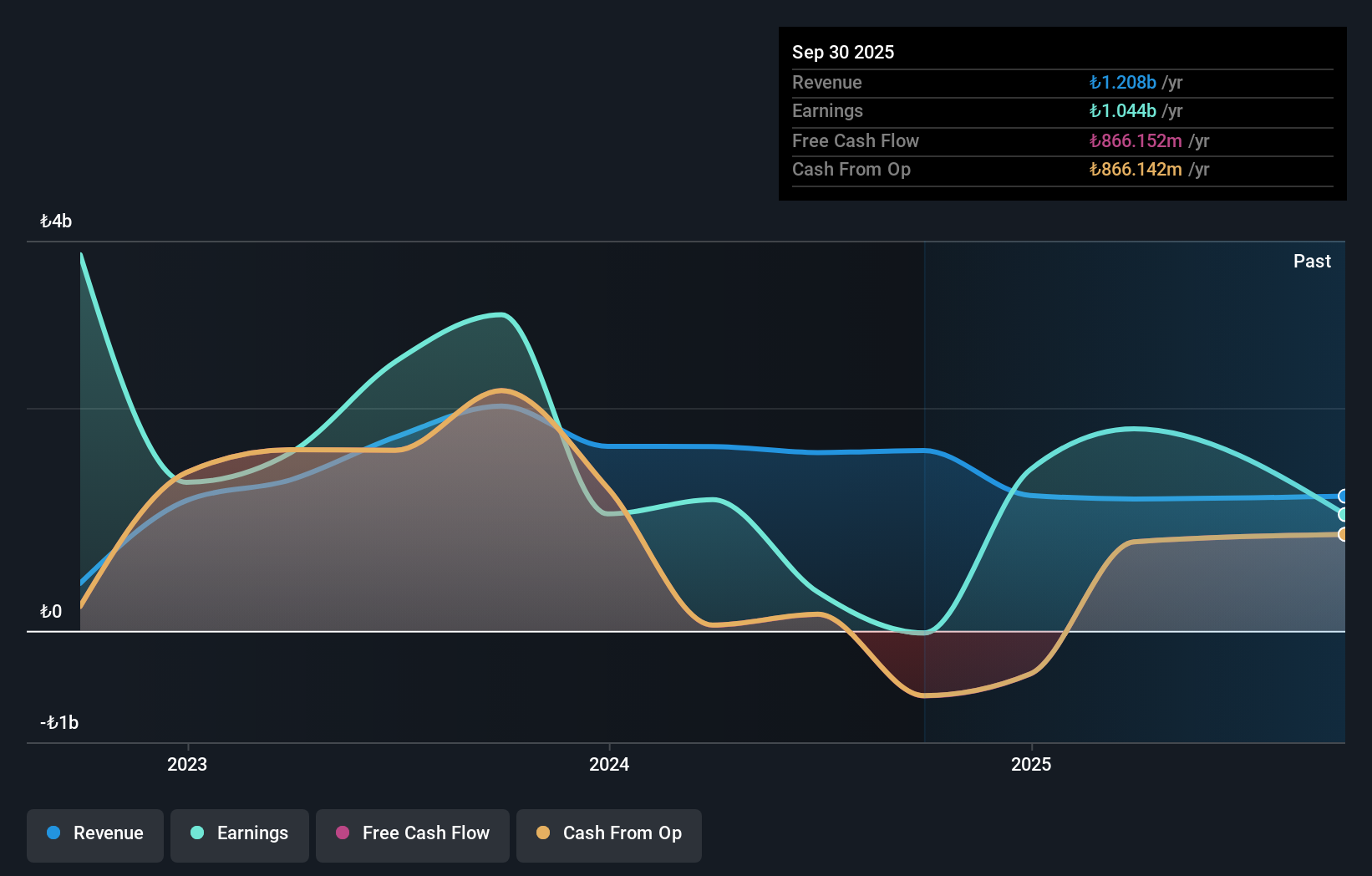

Operations: Akfen GYO generates revenue primarily from its real estate investments, amounting to TRY1.18 billion. The company's financial structure is centered around these investments, contributing significantly to its overall market presence.

Akfen Gayrimenkul Yatirim Ortakligi has demonstrated impressive growth, with earnings surging 54% over the past year, outpacing its industry peers. The debt to equity ratio has significantly improved from 186% to a manageable 14.2% in five years, while interest payments are comfortably covered by EBIT at 89.6 times. Despite a notable one-off gain of TRY1.4 billion affecting recent results, the company remains profitable with positive free cash flow and a favorable price-to-earnings ratio of 6.4x compared to the TR market's 19.3x, suggesting potential value for investors seeking opportunities in emerging markets like Turkey's real estate sector.

Middle East Pharmaceutical Industries (SASE:4016)

Simply Wall St Value Rating: ★★★★★☆

Overview: Middle East Pharmaceutical Industries Company focuses on the research, development, manufacture, and marketing of generic medicines and pharmaceutical preparations both within Saudi Arabia and internationally, with a market capitalization of SAR2.40 billion.

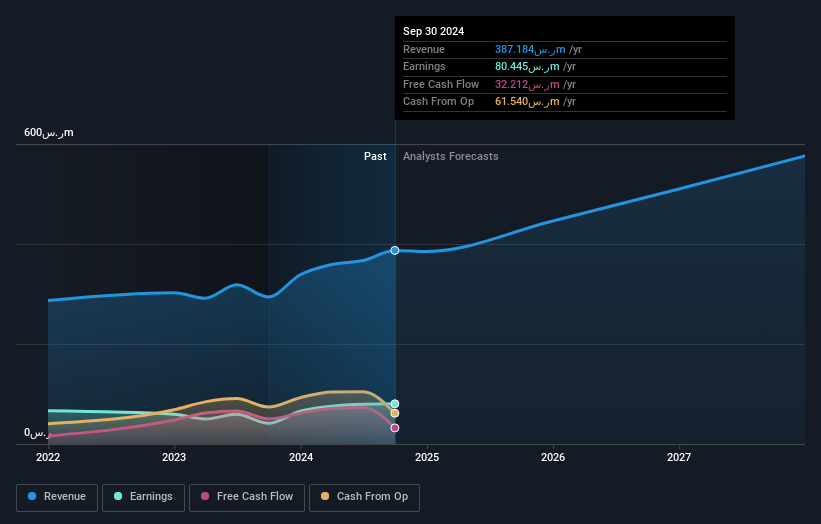

Operations: The company generates revenue from three main segments: Export Customers (SAR46.04 million), Public Customers (SAR89.71 million), and Private Customers (SAR279.79 million).

Middle East Pharmaceutical Industries, a smaller player in its sector, has shown impressive financial performance recently. Over the past year, earnings surged by 18.7%, outpacing the broader pharmaceuticals industry growth of 5.3%. The company's net income for Q1 2025 was SAR 19.4 million, more than doubling from SAR 9.37 million a year earlier, with basic earnings per share rising to SAR 0.97 from SAR 0.47. Its debt situation appears manageable with a satisfactory net debt to equity ratio of 7.4%, and interest payments are well-covered at an EBIT coverage of approximately 27 times, indicating financial stability and potential for future growth in revenue forecasted at nearly 13% annually.

Summing It All Up

- Reveal the 221 hidden gems among our Middle Eastern Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates Reem Investments Company P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:ERC

Emirates Reem Investments Company P.J.S.C

Engages in the bottling, distribution, and trading of mineral water, carbonated drinks, soft drinks, juices, and evaporated milk in the United Arab Emirates, rest of the Middle East, and Africa.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives