- Turkey

- /

- Residential REITs

- /

- IBSE:ADGYO

Exploring Three Promising Middle East Stocks with Strong Potential

Reviewed by Simply Wall St

The Middle East stock markets have recently experienced muted performances, largely influenced by lower oil prices and uncertainties surrounding U.S. Federal Reserve rate decisions. Despite these challenges, the region continues to offer opportunities for investors seeking stocks with strong potential, particularly those that can navigate economic fluctuations and leverage unique market positions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 9.71% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.46% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.57% | -36.80% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

R.A.K. Ceramics P.J.S.C (ADX:RAKCEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: R.A.K. Ceramics P.J.S.C. is involved in the manufacture and sale of ceramic products across the Middle East, Europe, Asia, and other international markets with a market capitalization of AED2.49 billion.

Operations: RAKCEC generates revenue primarily from the sale of ceramic products in various international markets. The company's financial performance is characterized by a notable gross profit margin trend, which has been observed at different levels over recent periods.

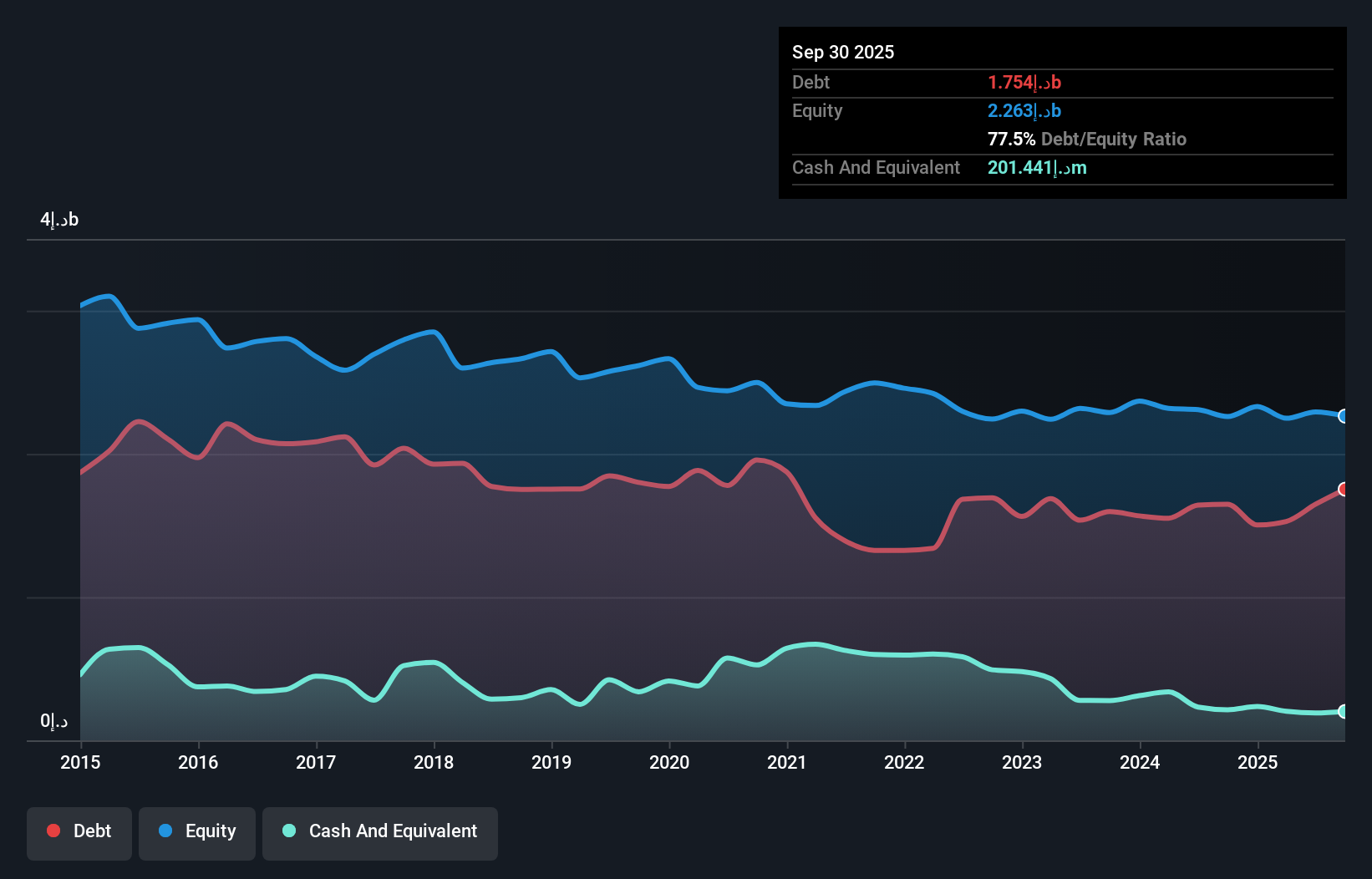

R.A.K. Ceramics, a prominent player in the Middle Eastern ceramics market, showcases a robust financial profile with recent earnings growth of 1.8%, outperforming the building industry's -3.9%. The company reported third-quarter sales of AED 824.92 million and net income of AED 66.88 million, reflecting solid performance compared to last year’s figures. With a price-to-earnings ratio of 10.5x below the AE market average, it offers good value despite its high net debt to equity ratio at 72.8%. While geopolitical tensions pose risks, strategic expansions and interest rate cuts could bolster its profitability in key markets like the UAE and Europe.

Adra Gayrimenkul Yatirim Ortakligi Anonim Sirketi (IBSE:ADGYO)

Simply Wall St Value Rating: ★★★★★★

Overview: Adra Gayrimenkul Yatirim Ortakligi Anonim Sirketi functions as a real estate investment trust in Turkey with a market capitalization of TRY14.20 billion.

Operations: Adra Gayrimenkul generates revenue through its real estate investments in Turkey. The company's financial performance is characterized by a focus on managing costs and optimizing returns from its property portfolio.

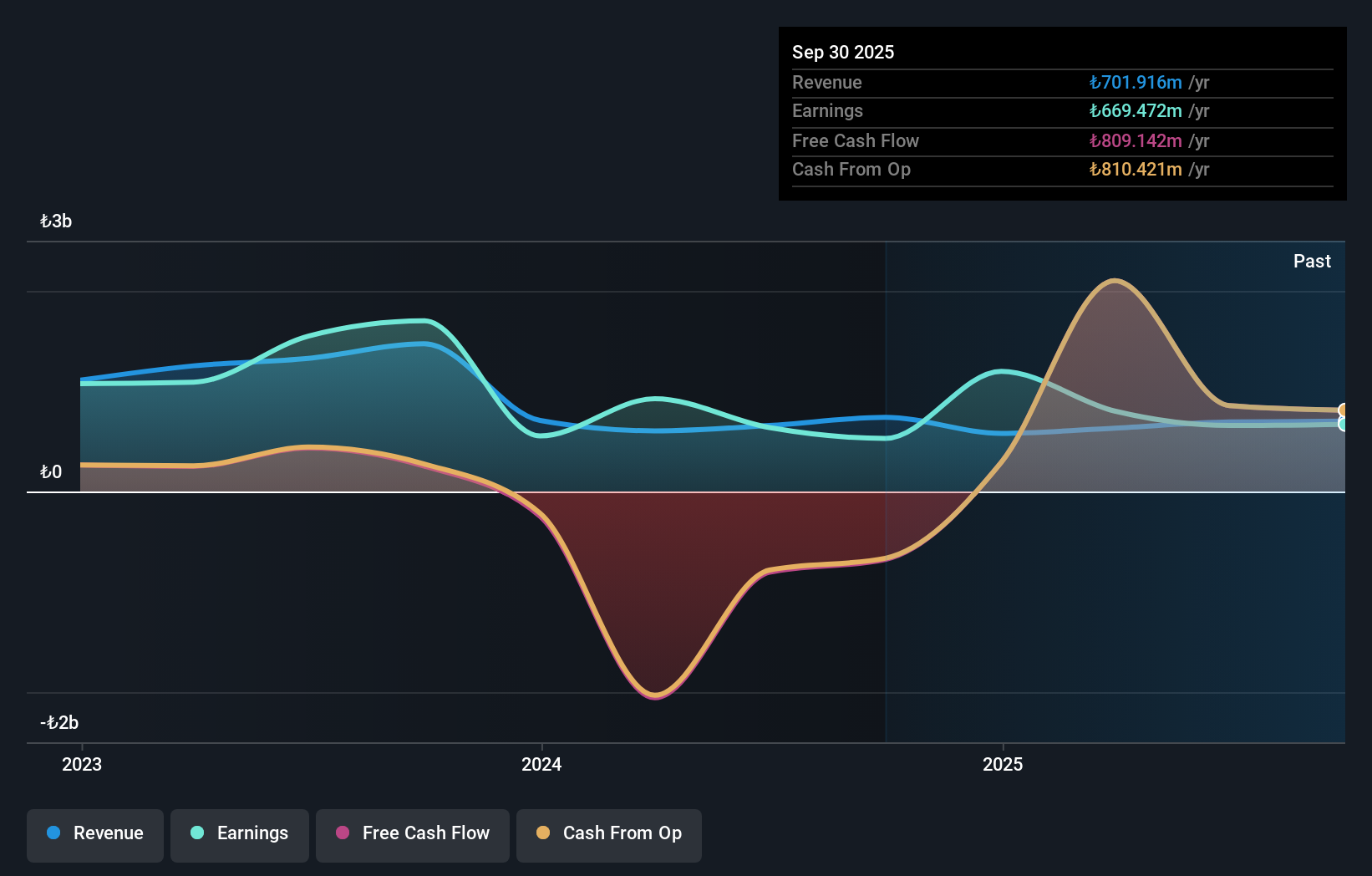

Adra Gayrimenkul Yatirim Ortakligi Anonim Sirketi, a nimble player in the real estate investment sector, showcases impressive growth with earnings surging 26.5% over the past year, outpacing its industry peers. The firm remains debt-free, eliminating concerns over interest payments and suggesting a solid financial footing. However, recent figures reveal a substantial one-off gain of TRY251.9 million impacting its latest annual results through September 2025. While trading at 15.8% below estimated fair value suggests potential upside, investors should note net income for the nine months ended September was TRY193.87 million compared to TRY722.67 million previously due to these non-recurring items.

Marketing Home Group Company for Trading (SASE:4194)

Simply Wall St Value Rating: ★★★★★★

Overview: Marketing Home Group Company for Trading operates as a trading company across several countries, including Saudi Arabia, the UAE, China, Spain, and Egypt, with a market cap of SAR1 billion.

Operations: The company generates revenue primarily from its Lighting segment, contributing SAR176.23 million, and the Ceramics and Sanitary Ware segment, which adds SAR240.80 million to its earnings. Consulting, Supplies, Installations contribute an additional SAR5.41 million to the total revenue stream.

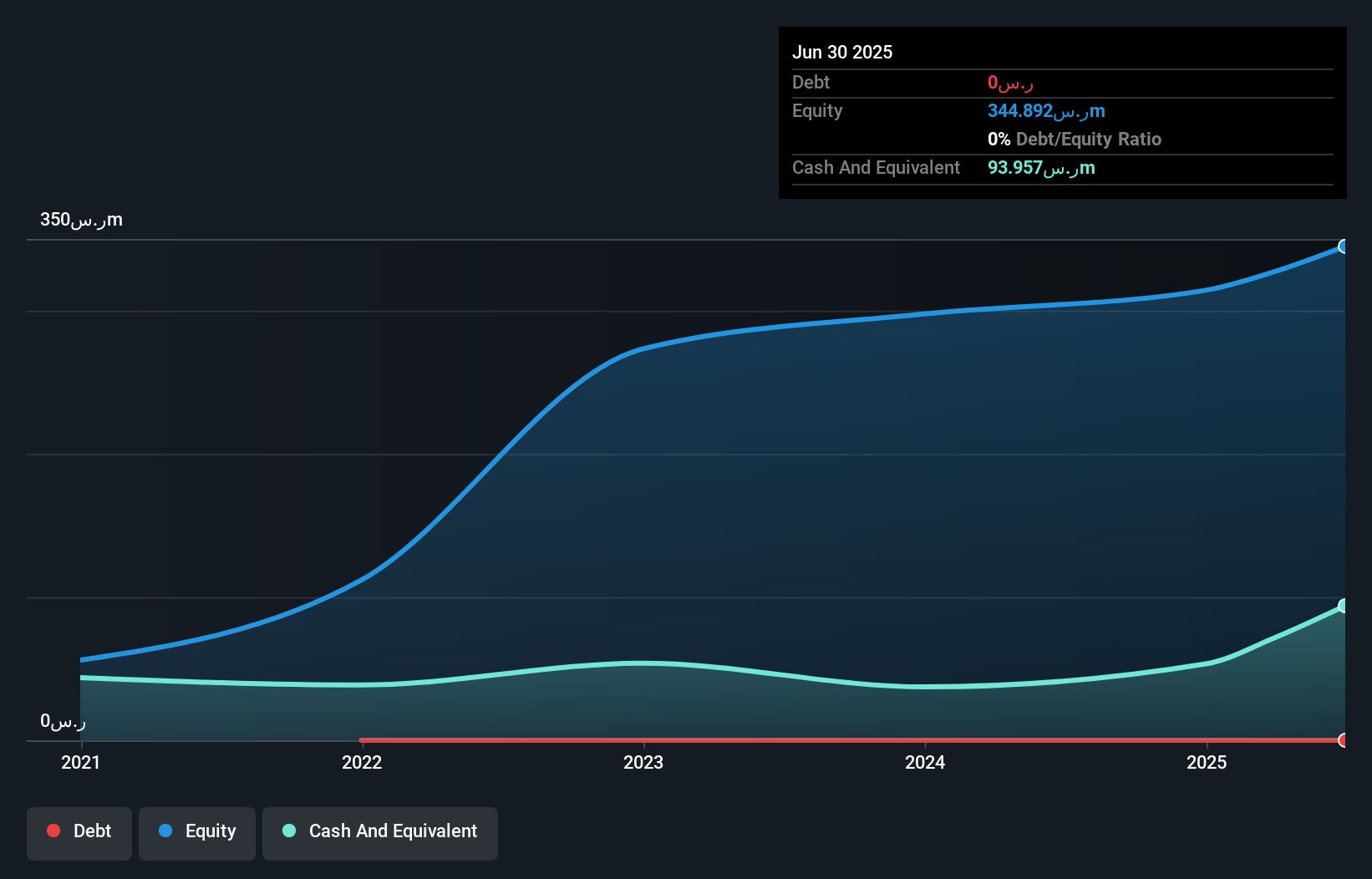

Marketing Home Group Company for Trading, a small player in the Middle Eastern market, recently reported third-quarter sales of SAR 103.11 million and net income of SAR 17.38 million, with earnings per share at SAR 1.03. Despite a past five-year earnings decline of 3% annually, recent growth outpaced the Specialty Retail industry at 1.9%. The company is debt-free with high-quality earnings and trades significantly below its estimated fair value by about 70%. A recent IPO raised SAR 408 million, and a strategic partnership aims to enhance service quality in Riyadh's residential projects through premium materials supply agreements.

Where To Now?

- Embark on your investment journey to our 199 Middle Eastern Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ADGYO

Adra Gayrimenkul Yatirim Ortakligi Anonim Sirketi

Operates as a real estate investment trust in Turkey.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives