Undiscovered Gems In The Middle East To Explore This June 2025

Reviewed by Simply Wall St

As Gulf markets show resilience and gain momentum, buoyed by positive developments in U.S.-China trade talks, investors are increasingly optimistic about the potential for further advances in the region's indices. With this backdrop of solid market fundamentals and a focus on sectors poised for growth, identifying stocks with strong financial health and strategic positioning can offer intriguing opportunities for exploration.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

AgeSA Hayat ve Emeklilik Anonim Sirketi (IBSE:AGESA)

Simply Wall St Value Rating: ★★★★★☆

Overview: AgeSA Hayat ve Emeklilik Anonim Sirketi operates in the pension and life insurance sector mainly in Turkey, with a market capitalization of TRY26.28 billion.

Operations: AgeSA Hayat ve Emeklilik Anonim Sirketi generates revenue primarily from its life insurance and pension segments, with significant contributions from retirement (TRY8.41 billion) and personal accident insurance (TRY2.52 billion).

AgeSA Hayat ve Emeklilik, a nimble player in the insurance sector, has been making waves with an impressive earnings growth of 85.6% over the past year, outpacing the industry benchmark of 47.7%. This debt-free entity showcases high-quality earnings and a favorable price-to-earnings ratio of 7.7x compared to the TR market's 17.3x, indicating potential undervaluation. Recent financial results highlight net income reaching TRY 1.18 billion for Q1 2025, up from TRY 653 million previously, while basic EPS rose to TRY 6.57 from TRY 3.63 last year—an encouraging sign for prospective investors seeking value in emerging markets.

Borusan Yatirim ve Pazarlama (IBSE:BRYAT)

Simply Wall St Value Rating: ★★★★★★

Overview: Borusan Yatirim ve Pazarlama A.S. is a company that, along with its subsidiaries, invests in the industrial, commercial, and service sectors and has a market capitalization of TRY52.40 billion.

Operations: Borusan Yatirim ve Pazarlama generates revenue through investments in the industrial, commercial, and service sectors. The company's financial performance is reflected in its market capitalization of TRY52.40 billion.

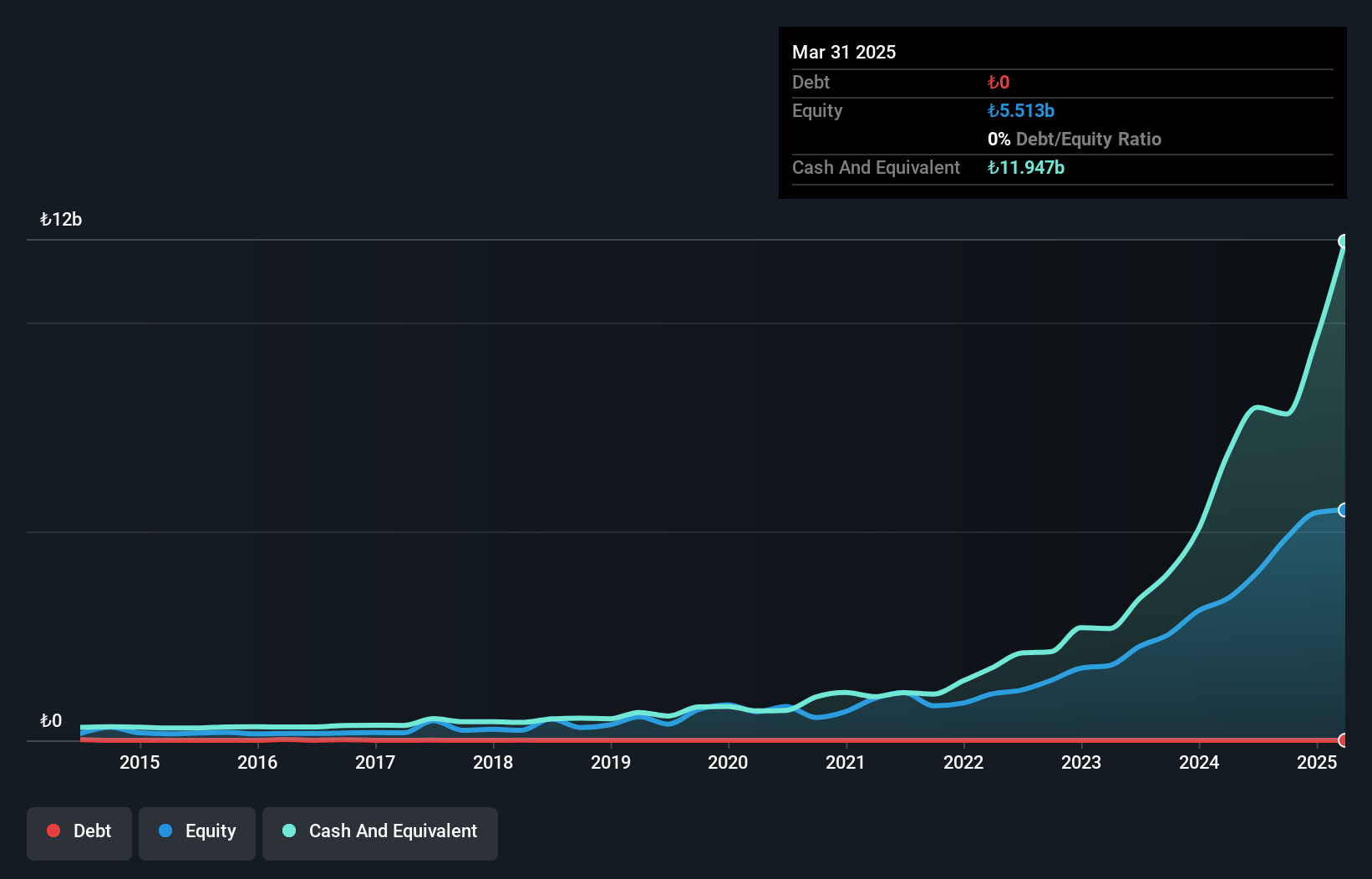

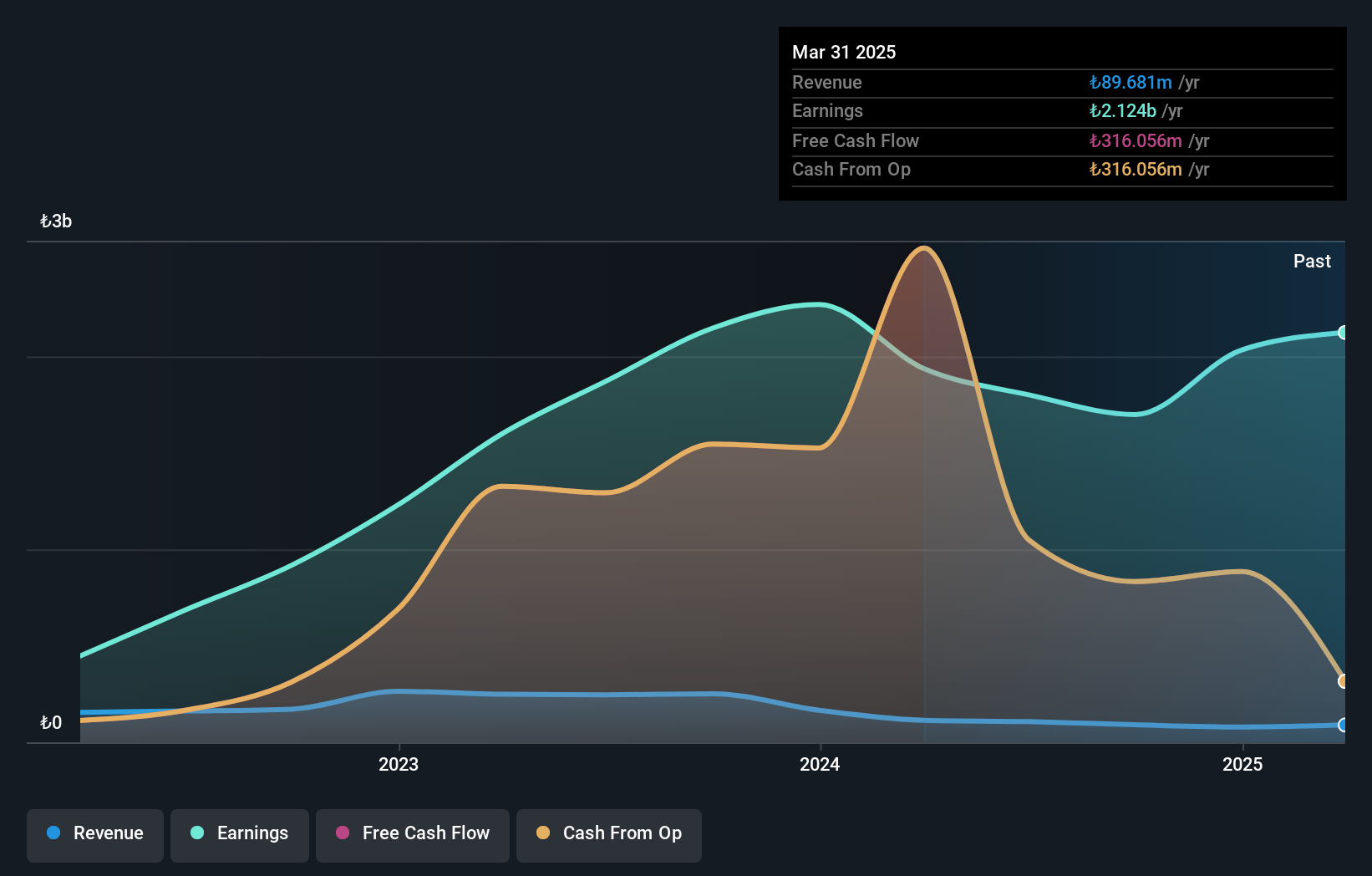

Borusan Yatirim ve Pazarlama, a nimble player in the financial sector, has shown impressive earnings growth of 48.4% annually over the past five years. The company operates debt-free now, contrasting with a 1% debt to equity ratio five years ago. Despite its revenue of TRY90M not being substantial by industry standards, Borusan's high-quality earnings and profitability are noteworthy. Recently reported Q1 sales reached TRY89.68 million, up from TRY79.45 million last year, while net income climbed to TRY355.02 million from TRY263.77 million previously, reflecting robust operational efficiency amidst modest revenue figures.

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Çelebi Hava Servisi A.S. is a Turkish company offering ground handling, cargo, and warehouse services to airlines and private air cargo companies, with a market cap of TRY44.76 billion.

Operations: Çelebi Hava Servisi A.S. generates revenue primarily from its cargo and warehouse services, amounting to TRY7.04 billion. The company's financial data includes segment adjustments of TRY13.92 million and consolidation adjustments of -TRY0.10 million, which impact the overall financial performance.

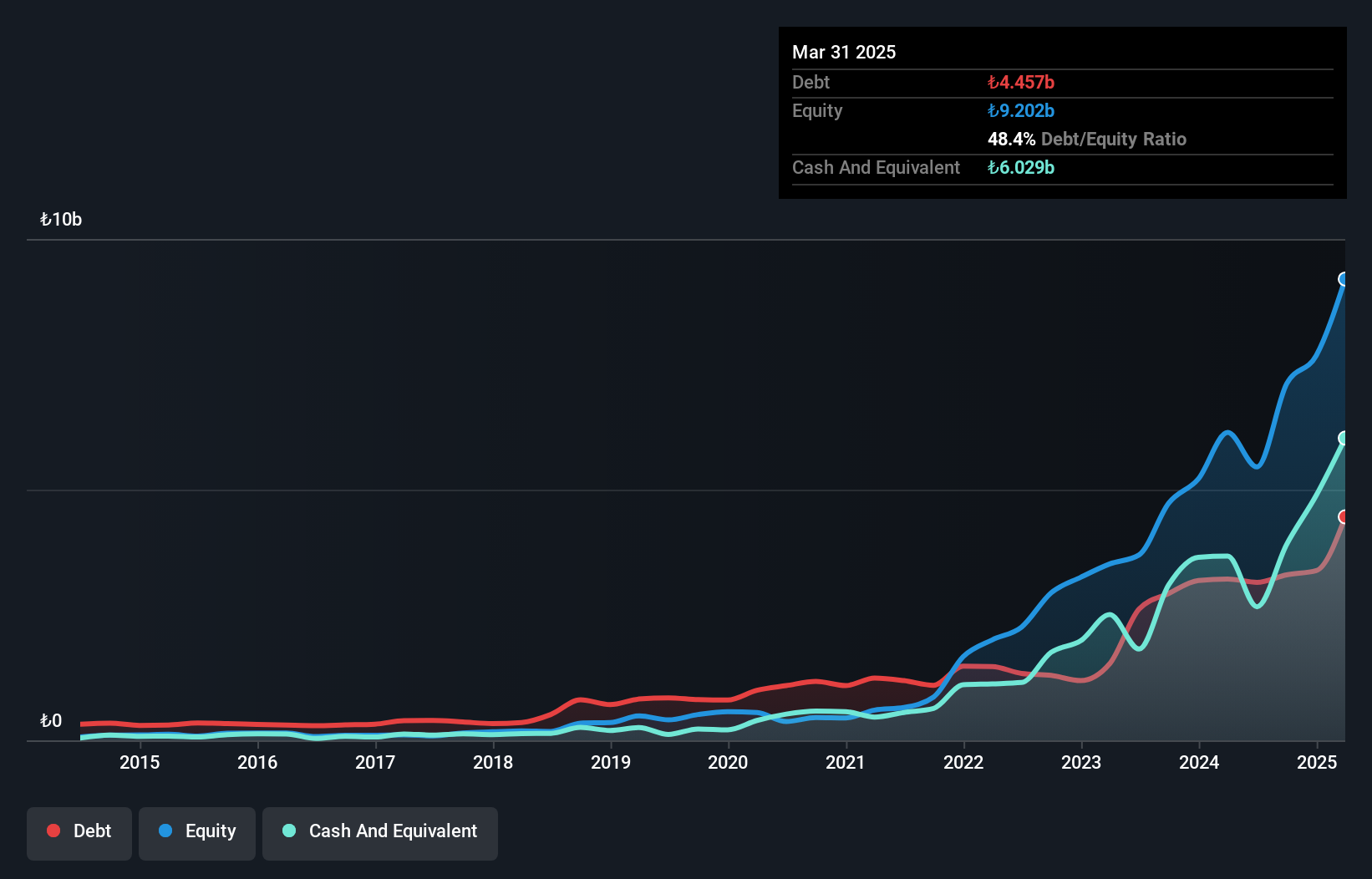

Çelebi Hava Servisi, a notable name in the Middle East's aviation services sector, has shown impressive financial resilience. Over five years, its debt to equity ratio improved from 180% to 48.4%, indicating stronger financial health. The company’s earnings growth of 71.7% over the past year significantly surpassed the industry average of 9.4%. Despite recent share price volatility, Çelebi is trading at a value considered 23% below its fair estimate. With EBIT covering interest payments by an impressive factor of 50.3 times and more cash than total debt, it seems well-positioned for continued stability and potential growth in the future.

Key Takeaways

- Unlock our comprehensive list of 223 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AGESA

AgeSA Hayat ve Emeklilik Anonim Sirketi

Engages in the pension and life insurance business primarily in Turkey.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives