- Taiwan

- /

- Construction

- /

- TWSE:2597

Exploring Undiscovered Gems In The Stock Market This July 2024

Reviewed by Simply Wall St

As July 2024 unfolds, global markets are presenting a mixed bag of performances with small-cap stocks showing resilience amid broader market fluctuations. This dynamic backdrop sets the stage for investors to explore potential opportunities in lesser-known stocks that might be poised to thrive in these conditions. In this environment, a good stock may be characterized by robust fundamentals, strategic management responses to current economic indicators, and the agility to capitalize on market shifts—qualities that could be particularly valuable given the recent economic data and market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xxentria Technology Materials | 36.02% | 8.57% | 8.79% | ★★★★★☆ |

| Apacer Technology | 3.62% | 0.71% | 11.29% | ★★★★★☆ |

| MOBI Industry | 28.24% | 6.15% | 18.49% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Nuh Çimento Sanayi (IBSE:NUHCM)

Simply Wall St Value Rating: ★★★★★★

Overview: Nuh Çimento Sanayi A.S. is a Turkish company engaged in the production and sale of cement, clinker, and mineral additives, with a market capitalization of TRY 43.19 billion.

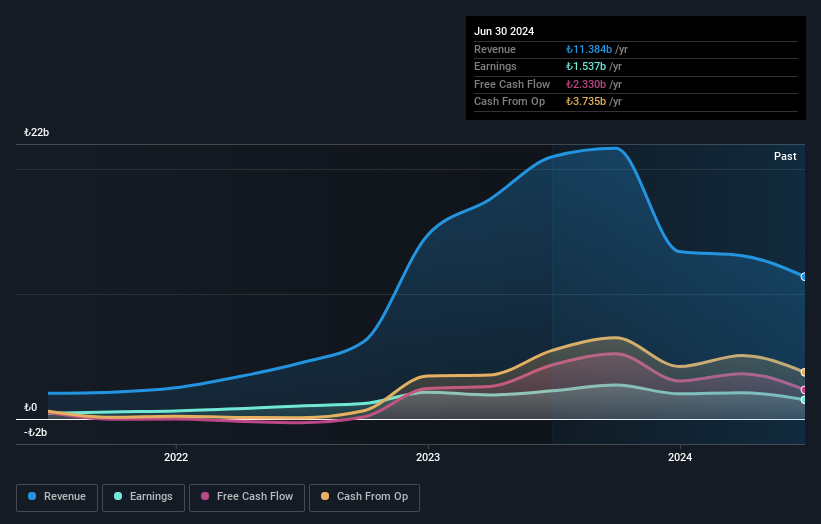

Operations: The company primarily operates in the construction and construction materials sector, generating significant revenue of ₺14.54 billion, alongside a smaller contribution from the energy sector amounting to ₺47.84 million. It has demonstrated a notable net income growth, reaching ₺2.86 billion by September 2023, supported by a gross profit margin of approximately 23.44% during the same period.

Nuh Çimento Sanayi, a lesser-highlighted entity in the market, has shown impressive financial resilience with a five-year earnings growth of 50.9% per year, significantly enhancing its investment appeal. Recently, the company reported a substantial increase in net income to TRY 108 million from TRY 20.2 million year-over-year for Q1 2024, reflecting robust operational efficiency and market adaptation. Trading at 28.6% below its estimated fair value and with a reduced debt-to-equity ratio now at 18.4%, Nuh Çimento presents an attractive valuation gap for discerning investors looking for growth intertwined with stability.

- Get an in-depth perspective on Nuh Çimento Sanayi's performance by reading our health report here.

Gain insights into Nuh Çimento Sanayi's past trends and performance with our Past report.

Türk Tuborg Bira ve Malt Sanayii (IBSE:TBORG)

Simply Wall St Value Rating: ★★★★★★

Overview: Türk Tuborg Bira ve Malt Sanayii A.S. is engaged in the production, sale, and distribution of beer and malt both within Turkey and globally, with a market capitalization of TRY 36.86 billion.

Operations: The company primarily operates in the alcoholic beverages sector, generating revenue through the production and sale of beer and malt. It incurs significant costs related to goods sold and operating expenses, which include substantial sales & marketing expenditures to support its product offerings.

Türk Tuborg Bira ve Malt Sanayii, a lesser-known gem in the beverage industry, has demonstrated robust financial health and growth potential. Over the past year, earnings surged by 84%, outpacing the industry's 19% growth. With a debt-to-equity ratio improvement from 30% to 18% over five years and more cash than total debt, its financial stability is evident. Recent reports show a significant sales increase to TRY 17 billion in 2023 from TRY 15 billion the previous year, with net income slightly rising to TRY 1.03 billion.

Ruentex Engineering & Construction (TWSE:2597)

Simply Wall St Value Rating: ★★★★☆☆

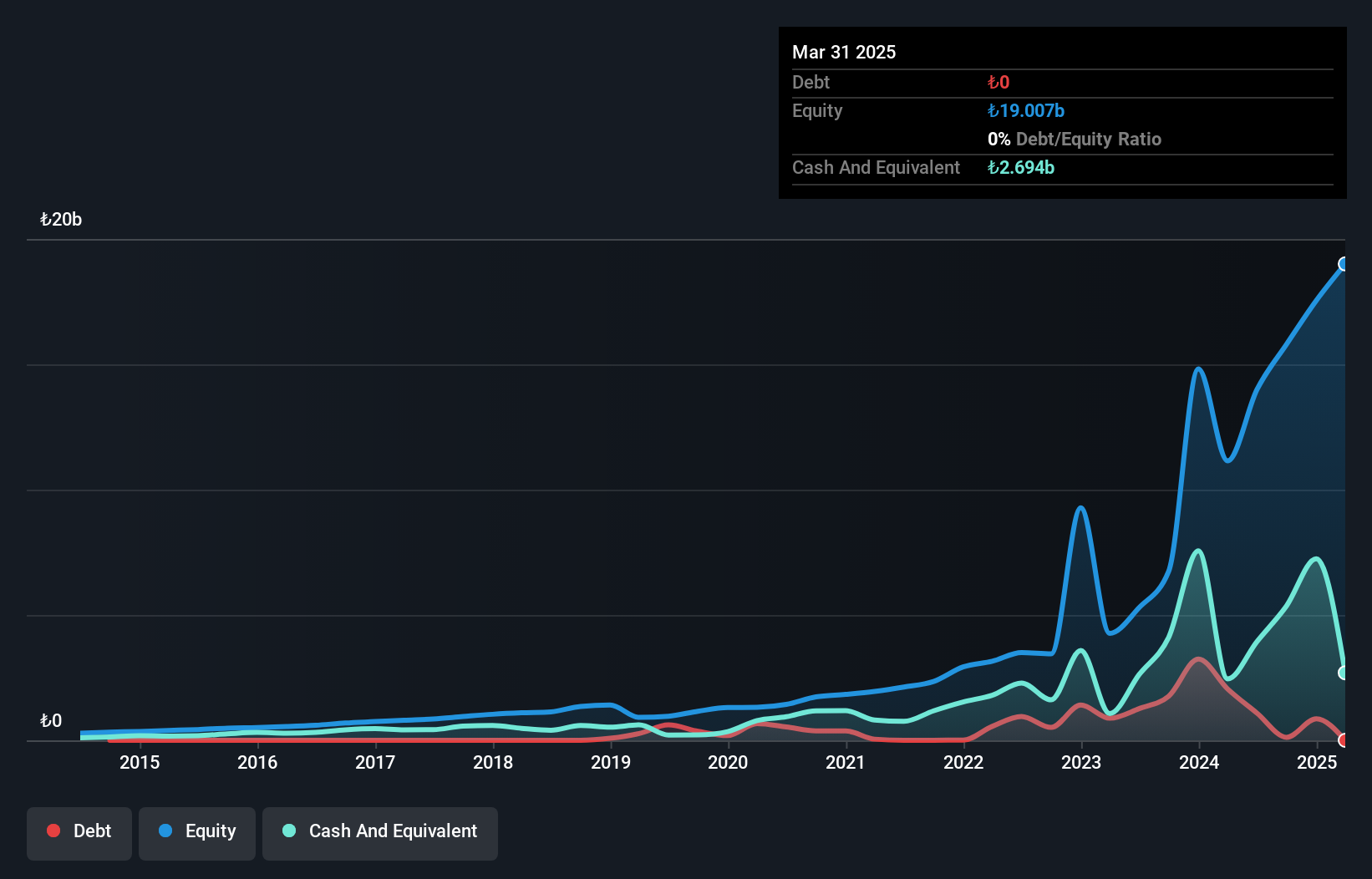

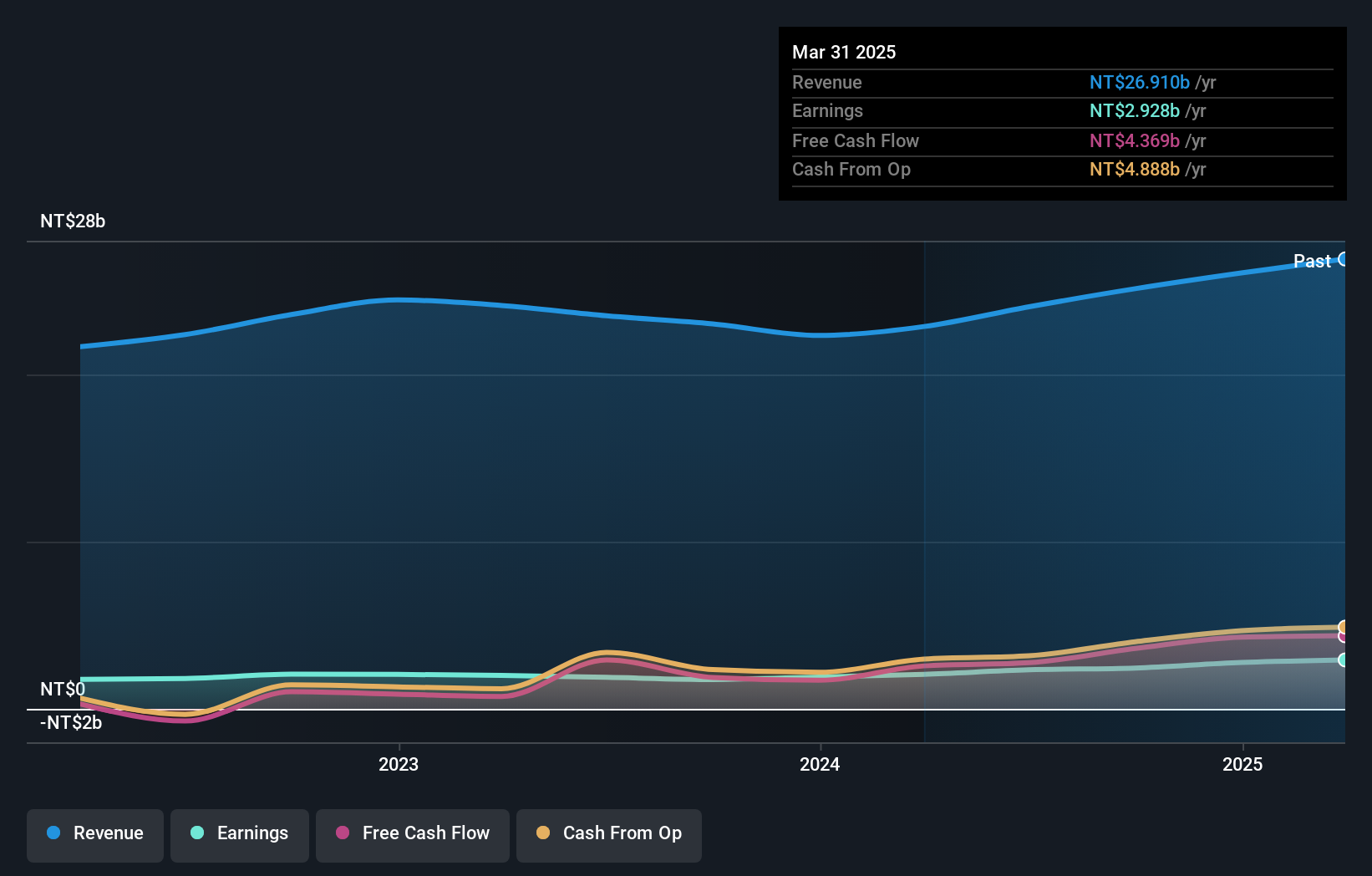

Overview: Ruentex Engineering & Construction Co., Ltd. is a Taiwan-based company primarily engaged in construction and engineering services, with a market capitalization of NT$51.01 billion.

Operations: The company generates its revenue from various segments, with a significant portion coming from its Construction Division (excluding Interior Design Department) which accounted for NT$17.39 billion. Additionally, it has diversified interests in the Construction Materials Business and Interior Decoration Design segments, contributing NT$4.18 billion and NT$1.68 billion respectively to the total revenue.

Ruentex Engineering & Construction, a lesser-known yet promising entity in the construction sector, has shown robust financial performance with a notable 24.7% annual growth in earnings over the past five years. Recently, the company secured significant contracts totaling over TWD 521 million, enhancing its project portfolio and potentially boosting future revenues. Despite a recent dividend cut to TWD 5.4 per share, Ruentex's strategic amendments to its corporate charter could streamline operations and foster growth.

- Delve into the full analysis health report here for a deeper understanding of Ruentex Engineering & Construction.

Learn about Ruentex Engineering & Construction's historical performance.

Make It Happen

- Explore the 4809 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2597

Ruentex Engineering & Construction

Ruentex Engineering & Construction Co., Ltd.

Outstanding track record with excellent balance sheet and pays a dividend.