As global markets navigate a period of broad-based gains and record highs, smaller-cap indexes have notably outperformed their larger counterparts, driven by strong labor market data and positive sentiment in sectors like utilities. In this dynamic environment, identifying undiscovered gems requires a keen eye for companies that can capitalize on stabilizing economic indicators and sector-specific growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 34.23% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Savencia (ENXTPA:SAVE)

Simply Wall St Value Rating: ★★★★★★

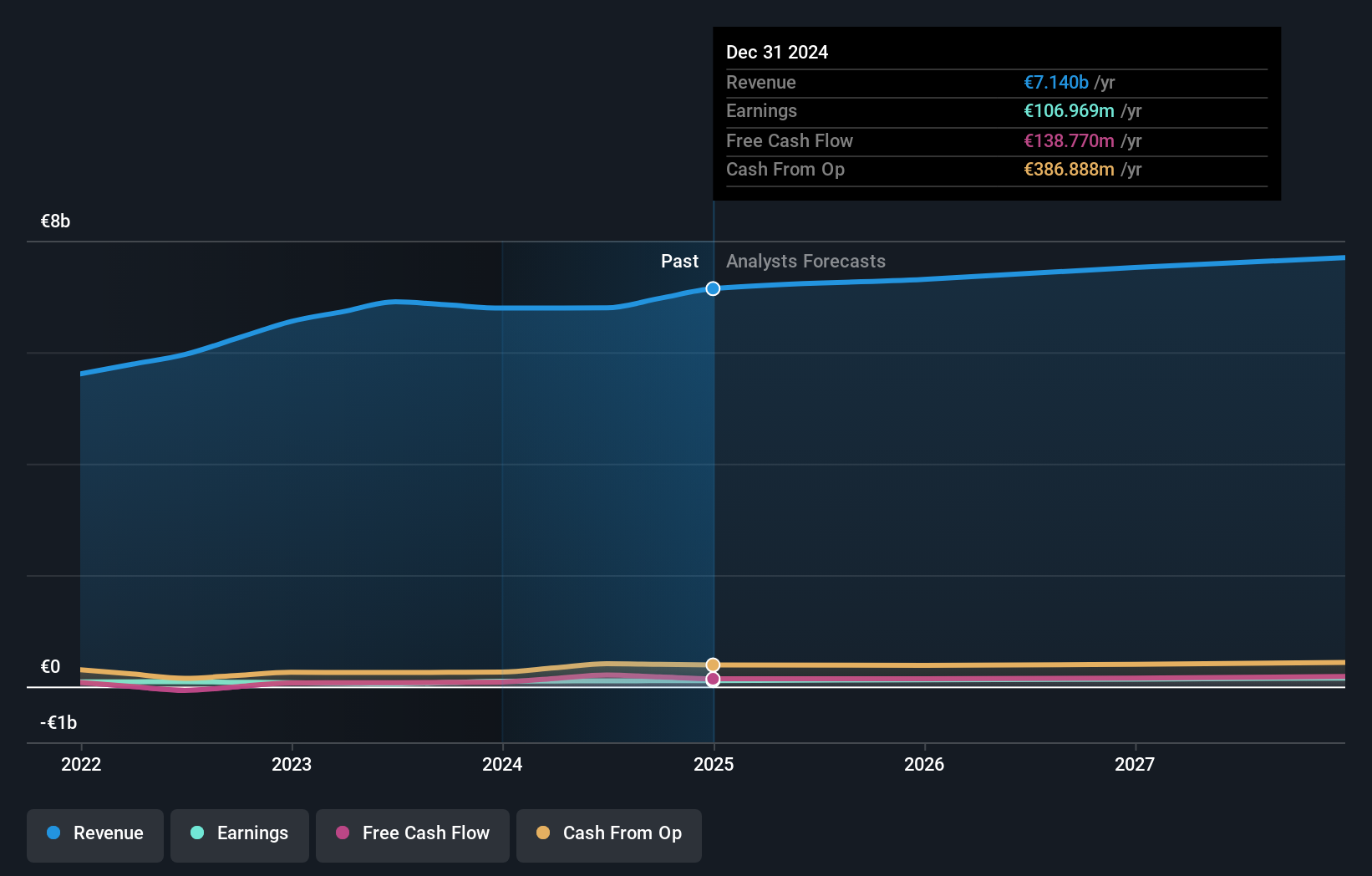

Overview: Savencia SA is a company that produces, distributes, and markets dairy and cheese products across France, the rest of Europe, and internationally with a market capitalization of €682.06 million.

Operations: Savencia generates revenue primarily from its dairy and cheese products distributed across various regions, including France and other parts of Europe. The company's financial performance is influenced by its cost structure related to production and distribution.

Savencia, a smaller player in the food industry, has shown impressive earnings growth of 114.7% over the past year, outpacing its industry's 49.7%. Trading at 70.4% below estimated fair value suggests potential undervaluation compared to peers. The company's net debt to equity ratio is a satisfactory 24.9%, indicating a solid financial footing with interest payments well covered by EBIT at 32.3 times coverage. Recent results highlight sales of €3,380 million for the half-year ending June 2024 and net income rising to €57.92 million from €51.29 million last year, reflecting steady performance improvements despite previous one-off losses of €43.6 million impacting financials earlier this year.

- Click to explore a detailed breakdown of our findings in Savencia's health report.

Examine Savencia's past performance report to understand how it has performed in the past.

Kerevitas Gida Sanayi ve Ticaret (IBSE:KERVT)

Simply Wall St Value Rating: ★★★★☆☆

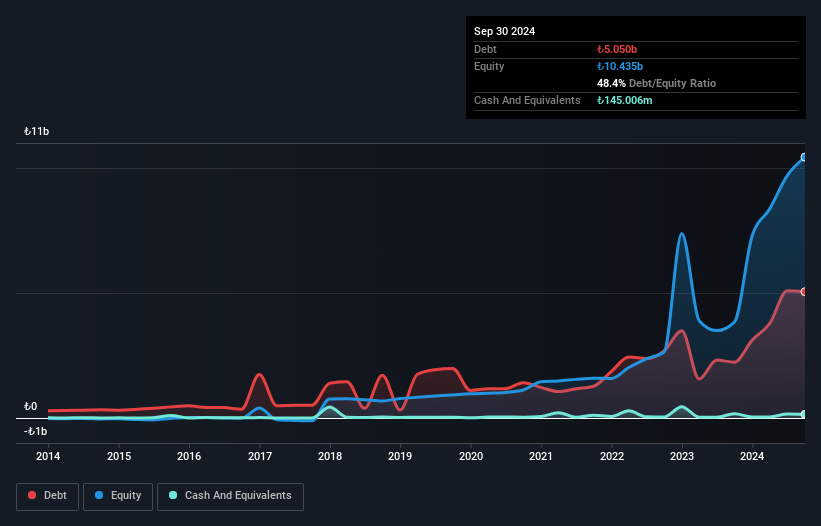

Overview: Kerevitas Gida Sanayi ve Ticaret A.S. is a Turkish company specializing in the production and trade of frozen and canned products, with a market capitalization of TRY9.45 billion.

Operations: Kerevitas generates revenue primarily from its Frozen Food segment, contributing TRY6.09 billion, and its Oil Business Unit, which adds TRY10.85 billion.

Kerevitas Gida Sanayi ve Ticaret, a nimble player in the food sector, has shown impressive earnings growth of 56.8% over the past year, outpacing its industry peers. The company's debt to equity ratio has significantly improved from 214.5% to 48.4% over five years, although its net debt to equity remains high at 47%. With a price-to-earnings ratio of 7.5x, it is attractively valued below the TR market average of 15.6x. Despite sales dipping from TRY 19 billion to TRY 17 billion for nine months ending September, net income surged from TRY 314 million to TRY 981 million in the same period.

Tigerair Taiwan (TWSE:6757)

Simply Wall St Value Rating: ★★★★★★

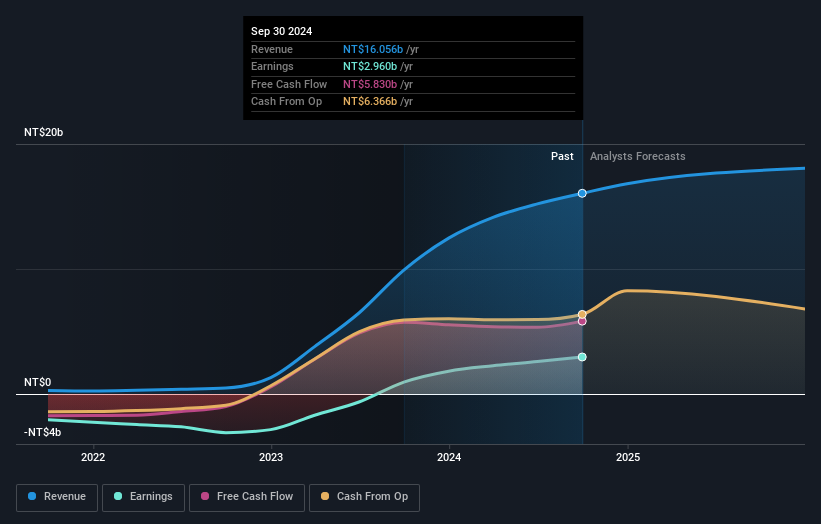

Overview: Tigerair Taiwan Co., Ltd. offers airline services in Taiwan and has a market capitalization of NT$35.16 billion.

Operations: Tigerair Taiwan generates revenue primarily from passenger and cargo air transportation, amounting to NT$16.06 billion. The company's financial performance can be assessed through its net profit margin, which reflects the efficiency of its operations and cost management strategies.

Tigerair Taiwan, a notable player in the airline industry, has shown impressive financial performance recently. Its earnings growth of 210% over the past year outpaces the broader airline sector's 13%. The company reported net income of TWD 942.68 million for Q3 2024, up from TWD 578.38 million a year ago, with sales reaching TWD 4.42 billion compared to last year's TWD 3.58 billion. With its debt to equity ratio dropping from 24.5% to just 3.5% over five years and trading at a significant discount to its estimated fair value, it presents an intriguing investment opportunity despite recent share price volatility.

- Click here to discover the nuances of Tigerair Taiwan with our detailed analytical health report.

Evaluate Tigerair Taiwan's historical performance by accessing our past performance report.

Make It Happen

- Dive into all 4640 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kerevitas Gida Sanayi ve Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:KERVT

Kerevitas Gida Sanayi ve Ticaret

Produces and trades in frozen and canned products in Turkey.

Solid track record with adequate balance sheet.