- Turkey

- /

- Marine and Shipping

- /

- IBSE:GSDHO

Middle Eastern Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

As Gulf markets grapple with weak oil prices and an uncertain Federal Reserve rate outlook, most indices in the region have been trending downward. For investors considering smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area. These stocks can offer surprising value when backed by strong financials, providing potential opportunities for growth and stability amidst broader market challenges.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.53 | SAR1.42B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.25 | AED13.86B | ✅ 3 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.795 | AED2.32B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.838 | AED509.72M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.726 | ₪213.99M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 75 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi (IBSE:AVOD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi operates in Turkey, offering dried vegetables and vegetable-based convenience foods under the Farmer's Choice brand, with a market cap of TRY1.29 billion.

Operations: The company generates revenue primarily from its food activities, amounting to TRY1.41 billion.

Market Cap: TRY1.29B

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi, with a market cap of TRY1.29 billion, is currently unprofitable but maintains a strong cash position, ensuring a runway of over three years due to positive free cash flow. Despite its high net debt to equity ratio of 59.1%, the company has reduced this from 113.7% over five years, indicating improved financial management. Recent earnings reports show increased sales but also growing losses, highlighting volatility and risk typical in penny stocks. The company's share price has been highly volatile recently, reflecting broader market uncertainties and internal challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi.

- Evaluate A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi's historical performance by accessing our past performance report.

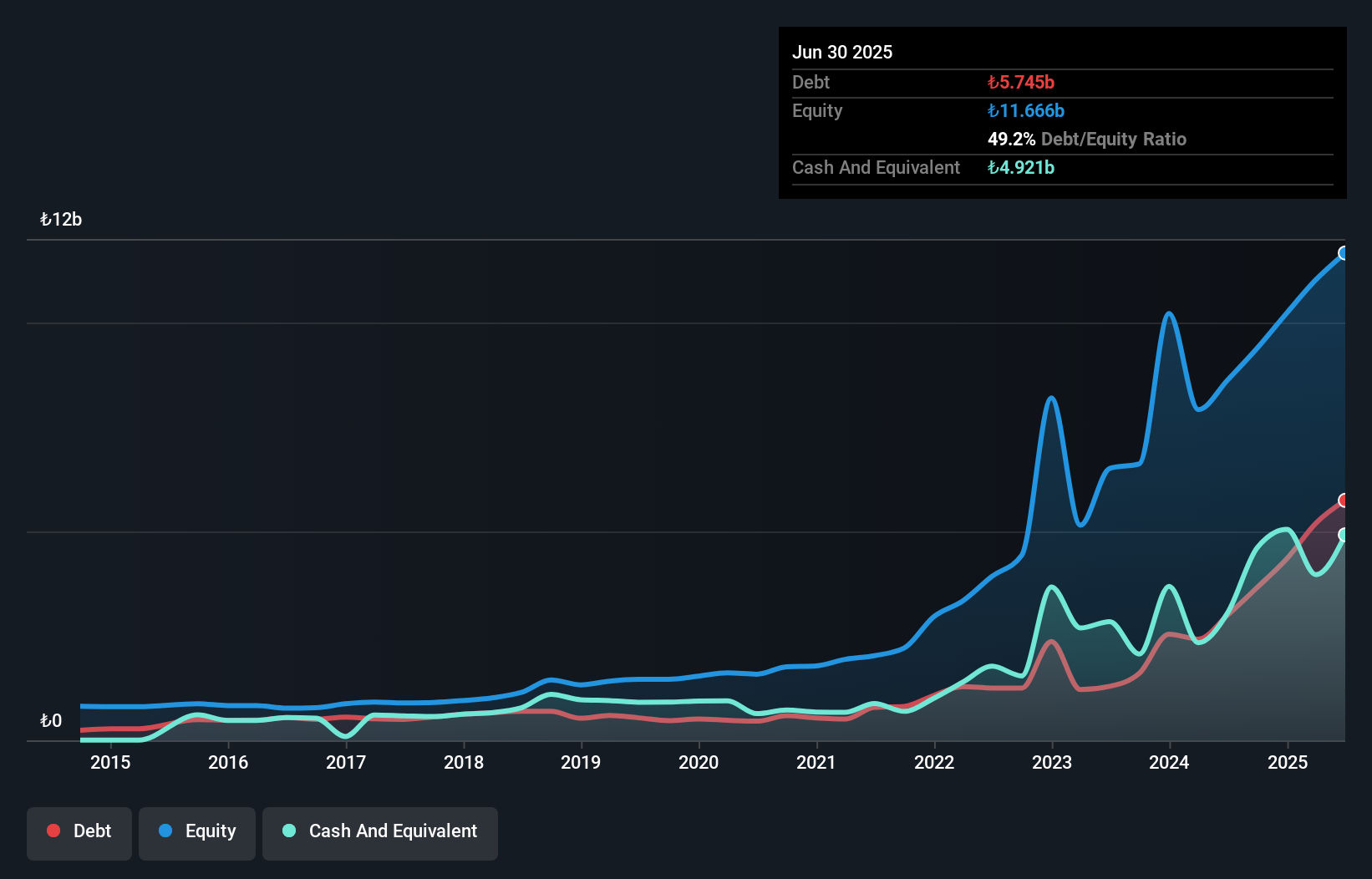

Duran Dogan Basim ve Ambalaj Sanayi (IBSE:DURDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Duran Dogan Basim ve Ambalaj Sanayi A.S., along with its subsidiaries, offers packaging products across Turkey and various international markets including Europe, the United States, the Middle East, Africa, and the Asia Pacific, with a market cap of TRY2.01 billion.

Operations: The company generates revenue primarily from its Packaging & Containers segment, totaling TRY1.91 billion.

Market Cap: TRY2B

Duran Dogan Basim ve Ambalaj Sanayi A.S., with a market cap of TRY2.01 billion, operates in the packaging sector but remains unprofitable, having reported a net loss of TRY96.72 million for Q2 2025. While sales have slightly increased to TRY548.3 million compared to the previous year, losses persist, reflecting challenges common among penny stocks. The company's operating cash flow covers 38.7% of its debt, indicating some financial stability despite a high net debt to equity ratio of 46%. Short-term assets exceed liabilities by TRY200 million, providing a buffer against immediate financial pressures amidst ongoing volatility and risk.

- Jump into the full analysis health report here for a deeper understanding of Duran Dogan Basim ve Ambalaj Sanayi.

- Review our historical performance report to gain insights into Duran Dogan Basim ve Ambalaj Sanayi's track record.

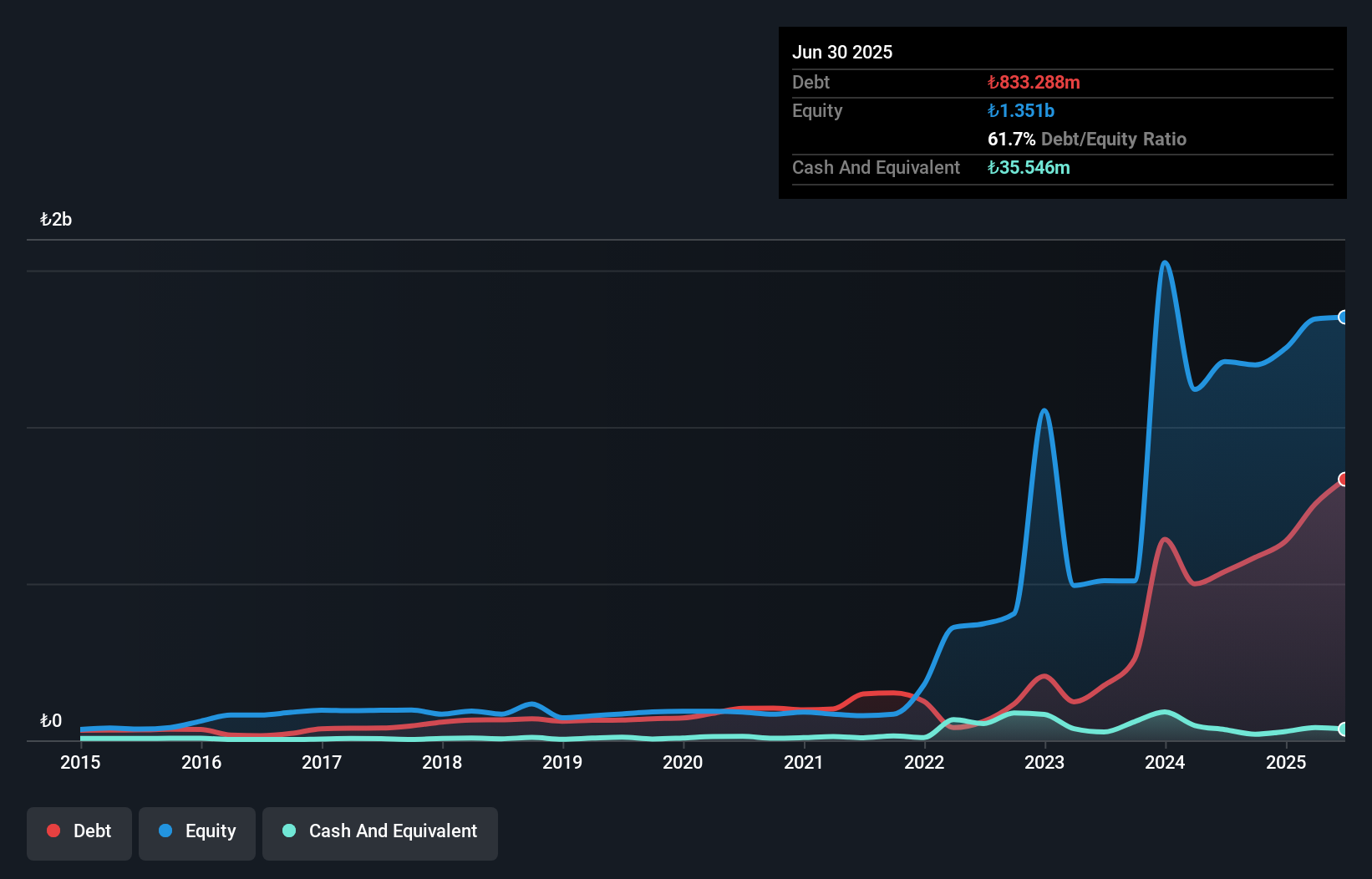

GSD Holding (IBSE:GSDHO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GSD Holding A.S. operates in finance, shipping, energy, and education sectors through its subsidiaries and has a market capitalization of TRY4.78 billion.

Operations: GSD Holding's revenue is primarily derived from its operations in Turkey, with significant contributions from the factoring segment at TRY1.76 billion, marine activities spanning both Turkey and international markets at TRY1.19 billion, banking services generating TRY799.55 million, and holding operations contributing TRY287.52 million.

Market Cap: TRY4.78B

GSD Holding A.S., with a market cap of TRY4.78 billion, operates across diverse sectors including finance and shipping, primarily in Turkey. The company recently reported a net loss for Q2 2025, highlighting some challenges typical of penny stocks. Despite this setback, GSD Holding maintains strong short-term financial health with assets exceeding both short- and long-term liabilities. Its debt levels are satisfactory relative to equity but not well-covered by operating cash flow. While the company has become profitable over the past year, its return on equity remains low at 1.1%, reflecting room for improvement in profitability metrics.

- Click here to discover the nuances of GSD Holding with our detailed analytical financial health report.

- Examine GSD Holding's past performance report to understand how it has performed in prior years.

Make It Happen

- Explore the 75 names from our Middle Eastern Penny Stocks screener here.

- Searching for a Fresh Perspective? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:GSDHO

GSD Holding

Through its subsidiaries, engages in finance, shipping, energy, and education businesses.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives