Middle East's Hidden Treasures Albaraka Türk Katilim Bankasi and 2 Promising Small Caps

Reviewed by Simply Wall St

As Gulf markets experience a dip amid investor caution surrounding global economic indicators such as Nvidia's earnings and U.S. jobs data, the Middle East remains a region of intrigue for those seeking unique investment opportunities. In this context, identifying stocks that demonstrate resilience and potential amidst broader market uncertainties can be particularly rewarding, with Albaraka Türk Katilim Bankasi and two promising small-cap companies emerging as hidden treasures worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.85% | 5.17% | 7.38% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.46% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Y.D. More Investments | 50.84% | 28.28% | 35.02% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.57% | -36.80% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Albaraka Türk Katilim Bankasi (IBSE:ALBRK)

Simply Wall St Value Rating: ★★★★★★

Overview: Albaraka Türk Katilim Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY19.33 billion.

Operations: The bank generates revenue primarily from its Commercial and Corporate segment, contributing TRY39.57 billion, followed by the Treasury segment at TRY24.32 billion, and Retail banking at TRY9.67 billion.

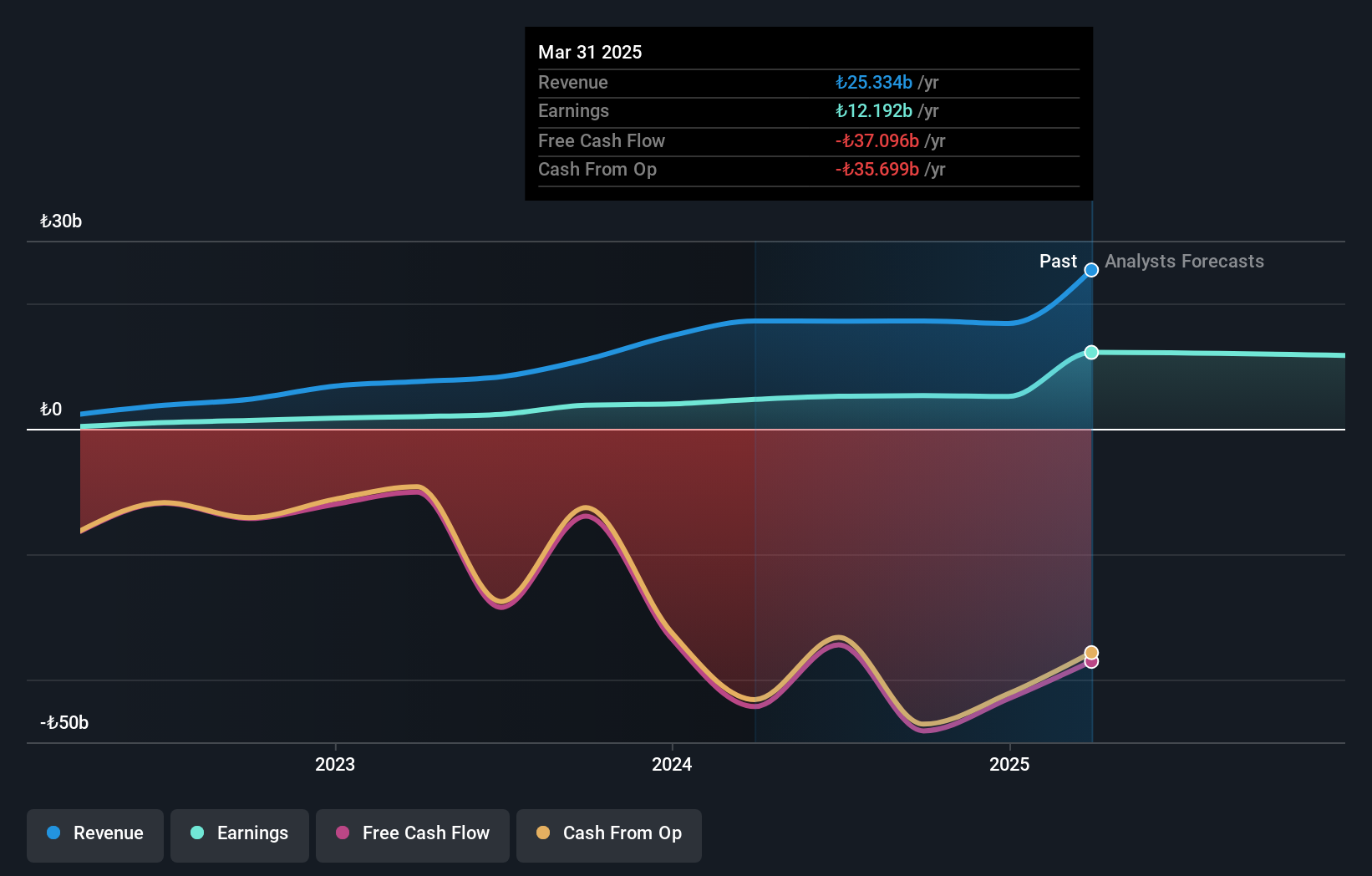

Albaraka Türk Katilim Bankasi, a notable player in the Middle East's financial landscape, showcases impressive earnings growth of 122.7% over the past year, outpacing the industry average of 13.6%. With total assets at TRY421.4 billion and equity standing at TRY23.9 billion, its financial health seems robust. The bank maintains an appropriate bad loans ratio of 1.5% with a sufficient allowance covering 149% of these loans, indicating prudent risk management practices. Despite its low price-to-earnings ratio of 1.6x compared to the TR market's 17.7x, future earnings are expected to decline by an average of 50.4% annually over three years.

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Value Rating: ★★★★★★

Overview: Anadolu Hayat Emeklilik Anonim Sirketi is a Turkish company offering private pension and insurance products, with a market capitalization of TRY42.14 billion.

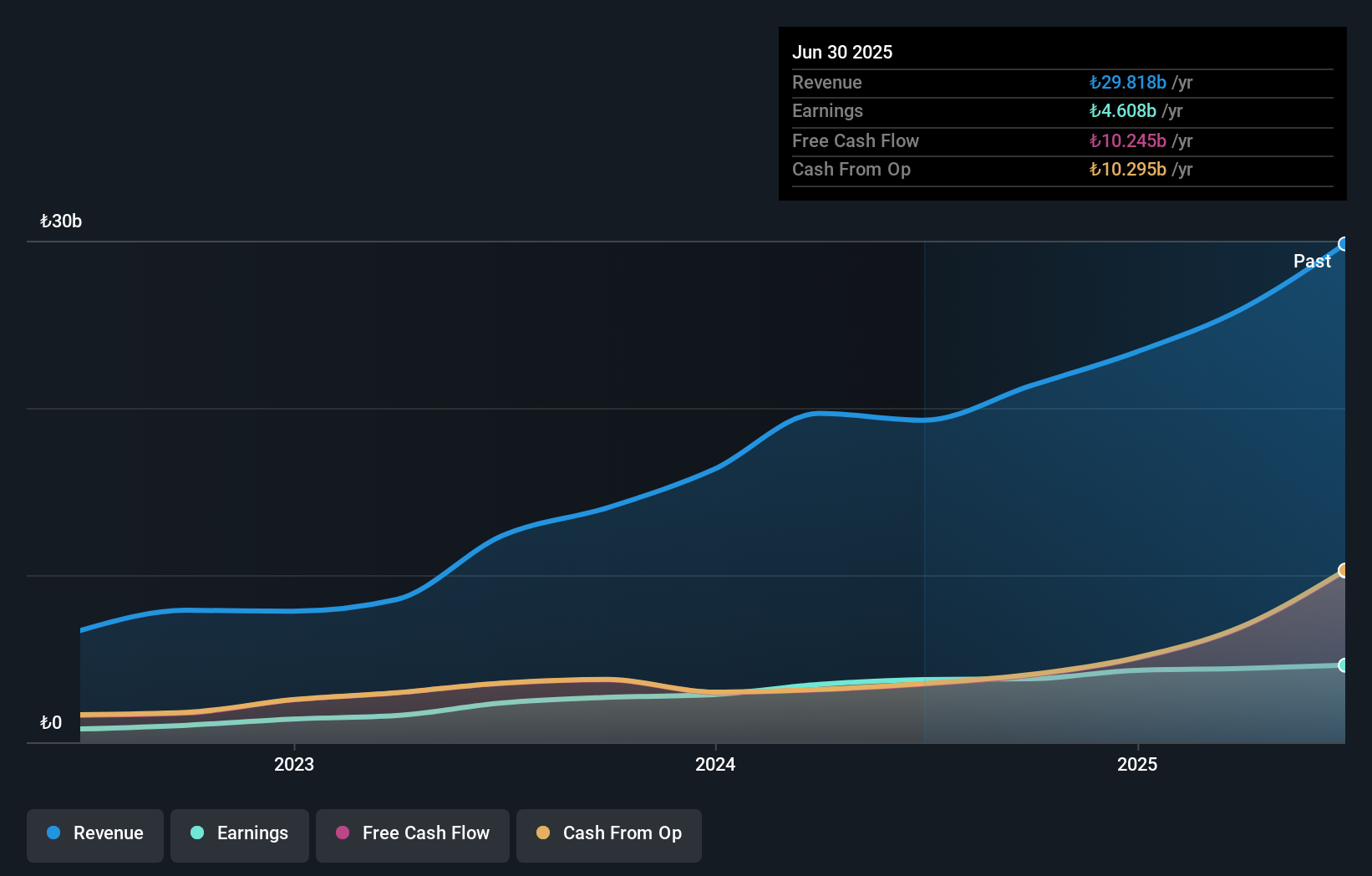

Operations: Anadolu Hayat Emeklilik generates revenue primarily from its Life segment, contributing TRY26.16 billion, and its Retirement segment, contributing TRY7.40 billion. The Non-Life segment adds a smaller portion at TRY7.31 million to the overall revenue mix.

Anadolu Hayat Emeklilik, a notable player in the insurance sector, showcases strong financial health with a debt-free status and impressive earnings growth of 103.9% over the past year, outpacing industry averages. The company reported net income of TRY 1.55 billion for Q3 2025, nearly doubling from TRY 776 million last year, highlighting its robust performance. Its price-to-earnings ratio stands at an attractive 6.8x against the TR market's average of 17.7x, suggesting potential value for investors seeking opportunities in this region's dynamic landscape. With high-quality earnings and positive free cash flow, Anadolu Hayat Emeklilik seems well-positioned for continued success.

Borusan Yatirim ve Pazarlama (IBSE:BRYAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Borusan Yatirim ve Pazarlama A.S., along with its subsidiaries, engages in investments across the industrial, commercial, and service sectors with a market capitalization of TRY67.89 billion.

Operations: Borusan Yatirim ve Pazarlama focuses on generating revenue through its investments in the industrial, commercial, and service sectors. The company's financial performance is reflected in its market capitalization of TRY67.89 billion.

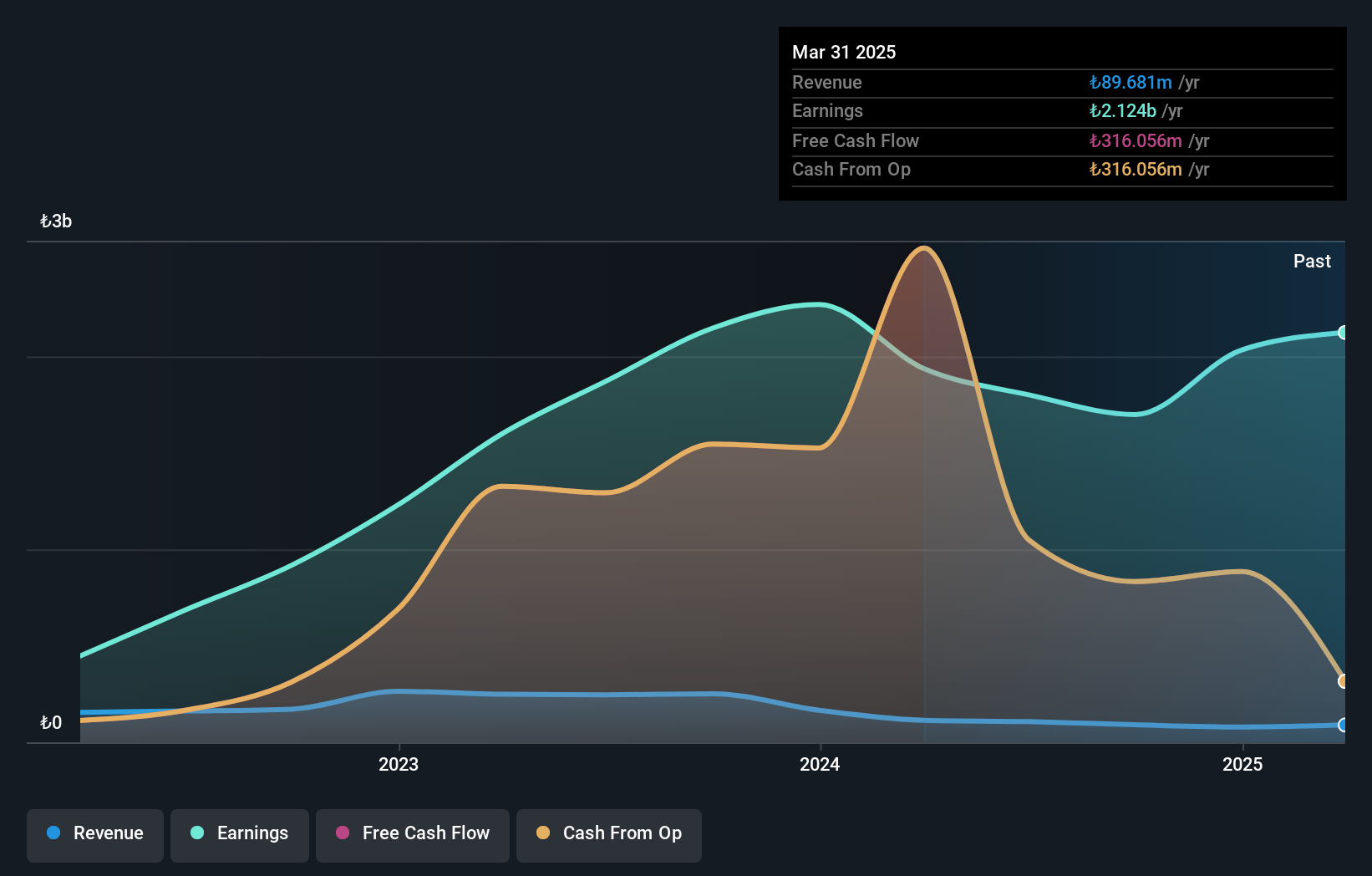

Borusan Yatirim ve Pazarlama, a nimble player in the market, showcases robust financial health with no debt and high-quality earnings. Over the past five years, its earnings have surged by 40% annually, yet recent figures indicate a slowdown with Q3 net income at TRY 405.95 million compared to TRY 501.11 million last year. Despite this dip, nine-month sales rose to TRY 89.68 million from TRY 79.45 million previously. The company's free cash flow remains positive, although its share price has been highly volatile recently, hinting at potential market uncertainties ahead.

- Get an in-depth perspective on Borusan Yatirim ve Pazarlama's performance by reading our health report here.

Gain insights into Borusan Yatirim ve Pazarlama's past trends and performance with our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 195 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ANHYT

Anadolu Hayat Emeklilik Anonim Sirketi

Provides private pension and insurance products in Turkey in Turkey.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives