- Japan

- /

- Real Estate

- /

- TSE:8871

Discovering Hidden Gems in January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are riding a wave of optimism, with major indices like the S&P 500 reaching record highs amid hopes for reduced tariffs and a surge in AI-related investments. Despite large-cap stocks generally outperforming their smaller-cap counterparts, the recent revival in manufacturing activity and positive investor sentiment present an intriguing backdrop for exploring small-cap opportunities. In this environment, identifying promising stocks often involves looking beyond headline-grabbing giants to uncover those companies with strong fundamentals and growth potential that may be overlooked by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Nacity Property Service GroupLtd | NA | 8.88% | 3.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Sichuan Haite High-techLtd | 49.88% | 6.40% | -10.22% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Shandong Longquan Pipe IndustryLtd | 34.82% | 2.24% | -22.15% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Aksa Akrilik Kimya Sanayii (IBSE:AKSA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aksa Akrilik Kimya Sanayii A.S., with a market cap of TRY42.62 billion, operates in the manufacturing and sale of textiles, chemicals, and other industrial products both domestically and internationally.

Operations: Aksa generates revenue primarily from its Fibres segment, contributing TRY18.91 billion, followed by Energy at TRY1.17 billion.

Aksa Akrilik Kimya Sanayii, a notable player with a modest market presence, showcases strong financial resilience. Over the past year, earnings grew by 11%, outpacing the Luxury industry's -22% downturn. The company's debt to equity ratio impressively decreased from 115% to 27% over five years, reflecting prudent financial management. Despite sales dropping to TRY 6 billion in Q3 from TRY 7.7 billion last year, net income turned positive at TRY 286 million compared to a loss previously. With a satisfactory net debt to equity ratio of 19% and EBIT covering interest payments by nearly 33 times, Aksa remains financially sound amidst industry challenges.

- Click to explore a detailed breakdown of our findings in Aksa Akrilik Kimya Sanayii's health report.

GOLDCRESTLtd (TSE:8871)

Simply Wall St Value Rating: ★★★★★☆

Overview: GOLDCREST Ltd. focuses on planning, developing, and selling new condominiums in Japan, with a market capitalization of approximately ¥99.21 billion.

Operations: The primary revenue stream for GOLDCREST Ltd. is its Real Estate Sales Business, generating ¥22.27 billion, followed by contributions from Real Estate Management and Rental at ¥4.07 billion and ¥2.99 billion respectively.

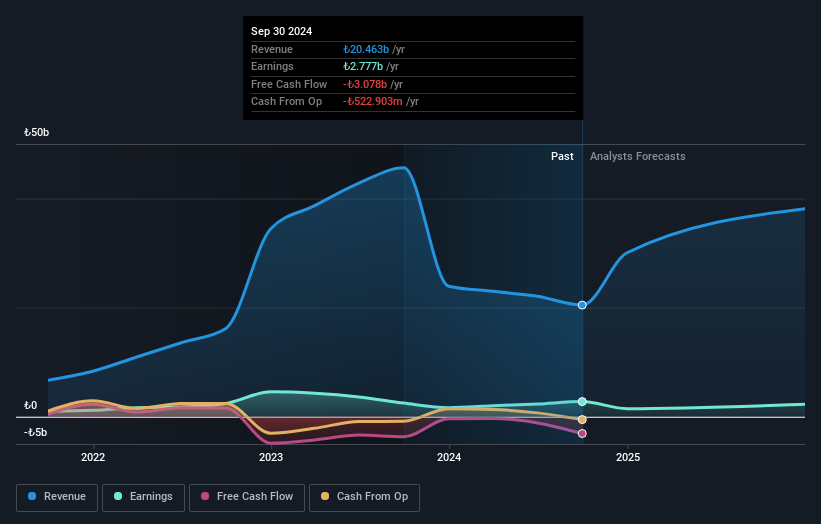

Goldcrest Ltd. stands out with its impressive earnings growth of 463% over the past year, significantly outpacing the Real Estate industry's 26%. The company's net income for the half-year ending September 2024 was JPY 2.37 billion, with basic earnings per share at JPY 71.34. Its debt-to-equity ratio improved from 42% to 39% over five years, indicating effective management of liabilities. Despite not being free cash flow positive recently, Goldcrest's interest payments are well-covered by EBIT at a multiple of nearly 28 times, showcasing financial resilience and potential for continued strong performance in its sector.

- Click here and access our complete health analysis report to understand the dynamics of GOLDCRESTLtd.

Evaluate GOLDCRESTLtd's historical performance by accessing our past performance report.

TOKAI (TSE:9729)

Simply Wall St Value Rating: ★★★★★★

Overview: TOKAI Corp. is a Japanese company that offers a range of healthy life services, with a market capitalization of approximately ¥74.51 billion.

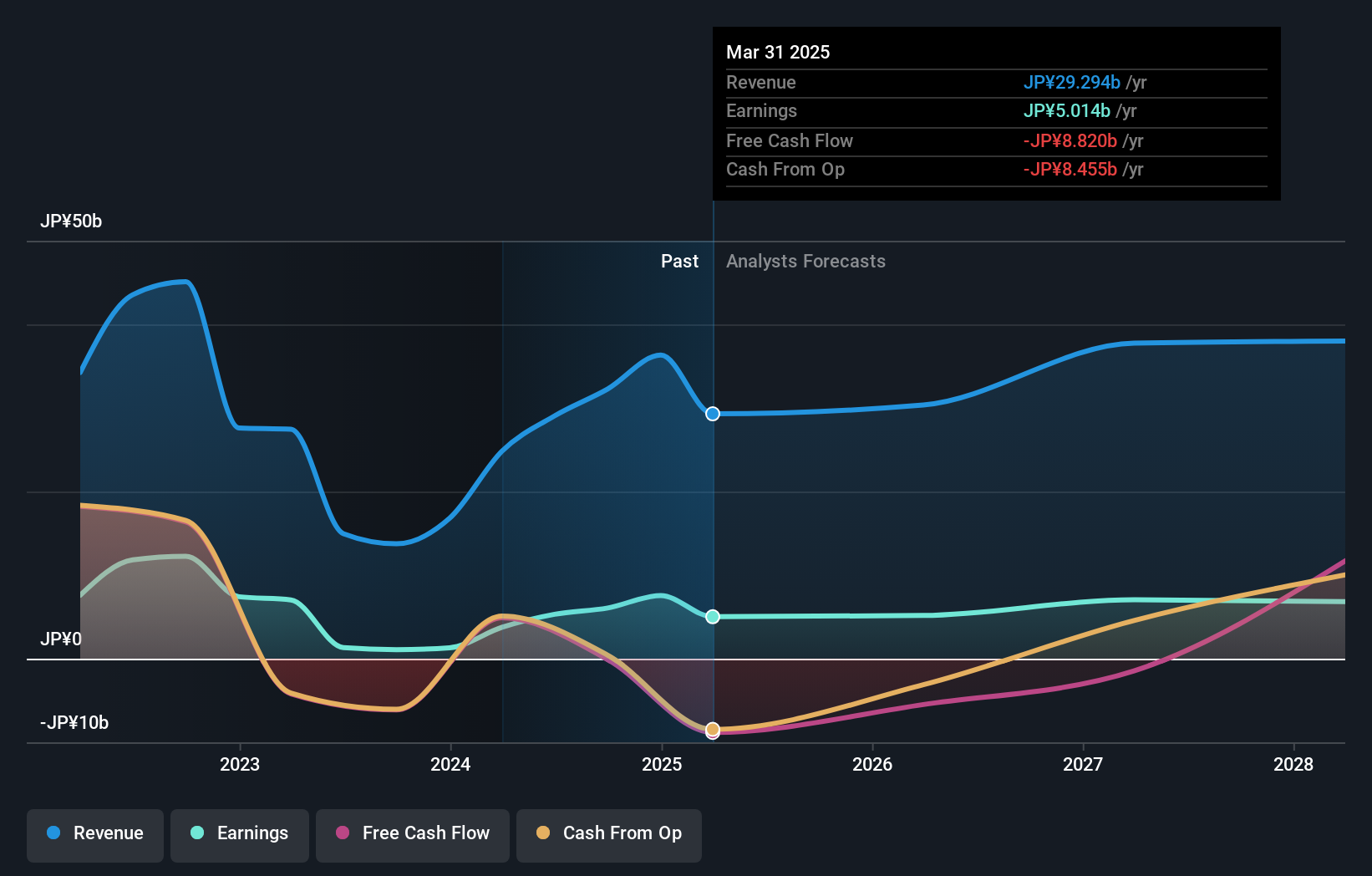

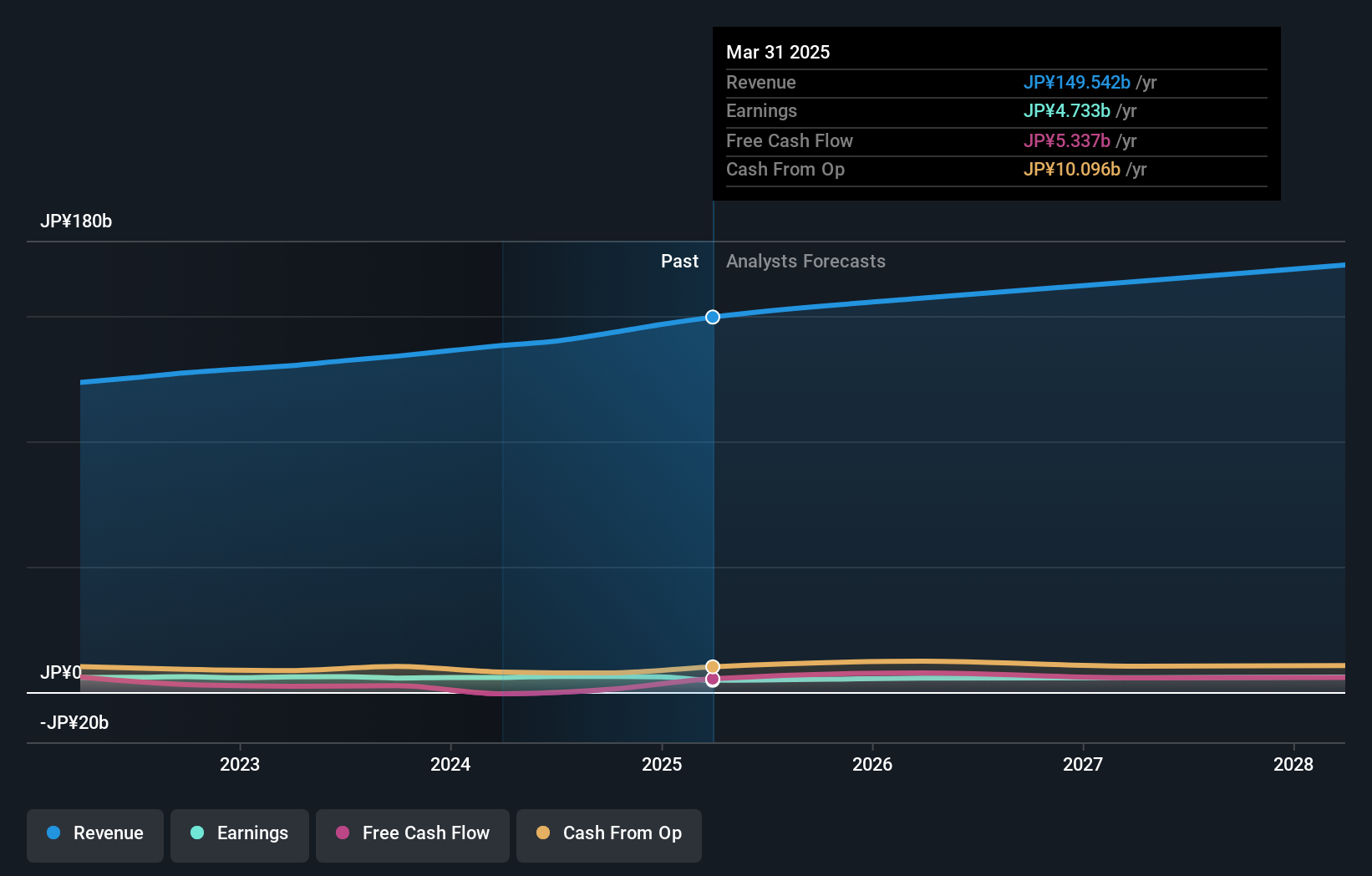

Operations: TOKAI generates revenue primarily from its Healthy Life Services, which contribute ¥73.99 billion, and Pharmaceutical Services, accounting for ¥54.70 billion. Environmental Services add another ¥14.74 billion to the total revenue stream.

TOKAI, a promising player in its sector, is trading at 50.5% below fair value estimates, indicating potential upside. Over the past year, earnings grew by 11%, outpacing the Healthcare industry's 7% growth rate. The company seems financially sound with more cash than total debt and a reduced debt-to-equity ratio from 4.3 to 1.7 over five years. Recent guidance projects net sales of ¥142 billion and an operating profit of ¥7 billion for fiscal year ending March 2025, alongside a dividend increase to ¥29 per share from last year's ¥25 per share, reflecting confidence in future prospects.

- Delve into the full analysis health report here for a deeper understanding of TOKAI.

Understand TOKAI's track record by examining our Past report.

Where To Now?

- Delve into our full catalog of 4670 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8871

GOLDCRESTLtd

Engages in planning, development, and sale of new condominiums in Japan.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives