- Japan

- /

- Specialty Stores

- /

- TSE:8214

Three Undiscovered Gems With Promising Potential And Strong Fundamentals

Reviewed by Simply Wall St

In the wake of recent market fluctuations, including a partial pullback in U.S. stock gains and rising long-term interest rates, investors are keenly observing how these dynamics might impact small-cap stocks. Amidst this climate of uncertainty and shifting policy landscapes, identifying stocks with strong fundamentals can provide a measure of stability and potential growth opportunities. In this context, uncovering lesser-known companies with robust financial health can be particularly rewarding for those seeking to navigate the current economic terrain effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Intelligent Wave | NA | 7.39% | 15.42% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 0.80% | 18.00% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Shenzhen Longtech Smart Control | 3.11% | 18.50% | 15.96% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Yeo Teknoloji Enerji Ve Endustri Anonim Sirketi (IBSE:YEOTK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yeo Teknoloji Enerji Ve Endustri Anonim Sirketi operates in the design, engineering, procurement, integration, installation, and commissioning of automation, electrification, and digitization solutions both in Turkey and internationally with a market cap of TRY20.74 billion.

Operations: Yeo Teknoloji generates revenue primarily through its automation, electrification, and digitization solutions. The company's net profit margin has shown notable fluctuations over recent periods.

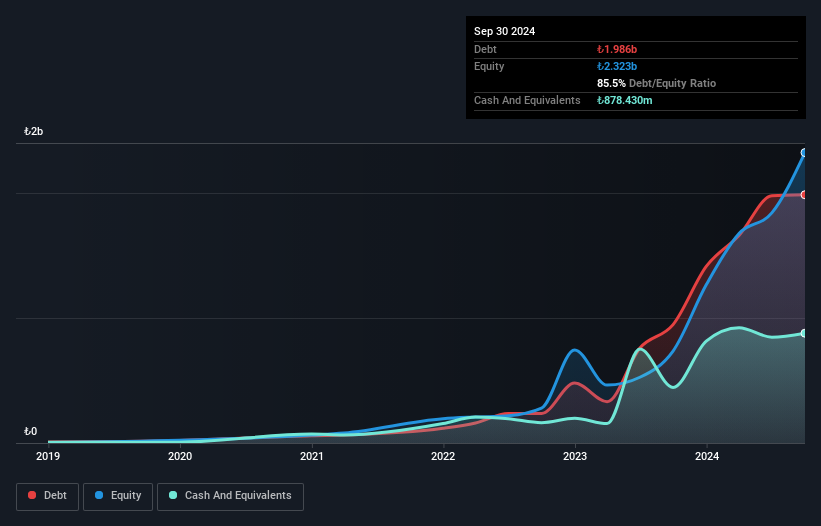

Yeo Teknoloji Enerji Ve Endustri Anonim Sirketi, a notable player in the electrical sector, has demonstrated impressive earnings growth of 28% over the past year, outpacing industry averages. Despite a high net debt to equity ratio of 48%, its interest payments are well-covered by EBIT at 15 times. The company's price-to-earnings ratio stands at 35x, which is favorable compared to the industry average of 53x. Recent results show robust sales growth with TRY 5.45 billion for Q3 and net income rising to TRY 648 million from TRY 312 million year-on-year, showcasing its potential in an evolving market landscape.

AOKI Holdings (TSE:8214)

Simply Wall St Value Rating: ★★★★★☆

Overview: AOKI Holdings Inc. operates in Japan across fashion, anniversary and bridal services, entertainment, and real estate rental sectors with a market cap of ¥101.25 billion.

Operations: AOKI Holdings generates revenue from its diverse operations in fashion, bridal services, entertainment, and real estate rentals. The company's financial performance includes a market cap of ¥101.25 billion.

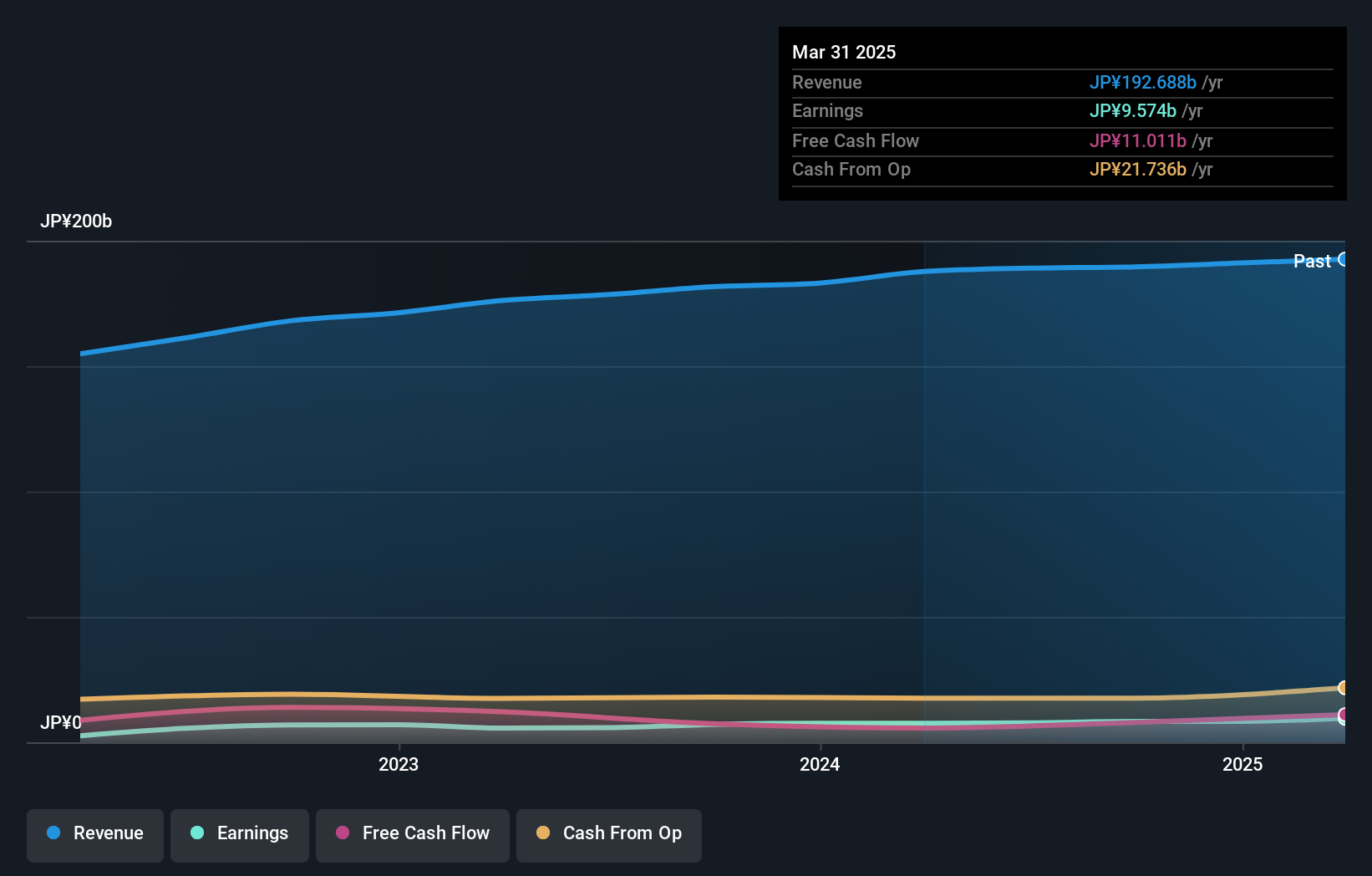

AOKI Holdings, a relatively smaller player in its industry, showcases robust financial health with a recent earnings growth of 16.8%, outpacing the Specialty Retail sector's 3.6%. The company's net debt to equity ratio stands at a satisfactory 6.6%, indicating prudent financial management. Recent half-year results reveal sales of ¥82,933 million and net income of ¥2,791 million, both improved from the previous year. A dividend increase to ¥15 per share further signals confidence in its fiscal outlook. With interest payments well-covered by EBIT at 93x, AOKI seems poised for continued stability and potential growth in the coming period.

Taiwan Hon Chuan Enterprise (TWSE:9939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taiwan Hon Chuan Enterprise Co., Ltd. specializes in manufacturing and selling packaging materials for the food and beverage industries across Taiwan, Mainland China, Southeast Asia, and globally, with a market capitalization of NT$46.29 billion.

Operations: The company generates revenue primarily through the sale of packaging materials to the food and beverage sectors across various regions, including Taiwan, Mainland China, and Southeast Asia. It operates with a market capitalization of NT$46.29 billion.

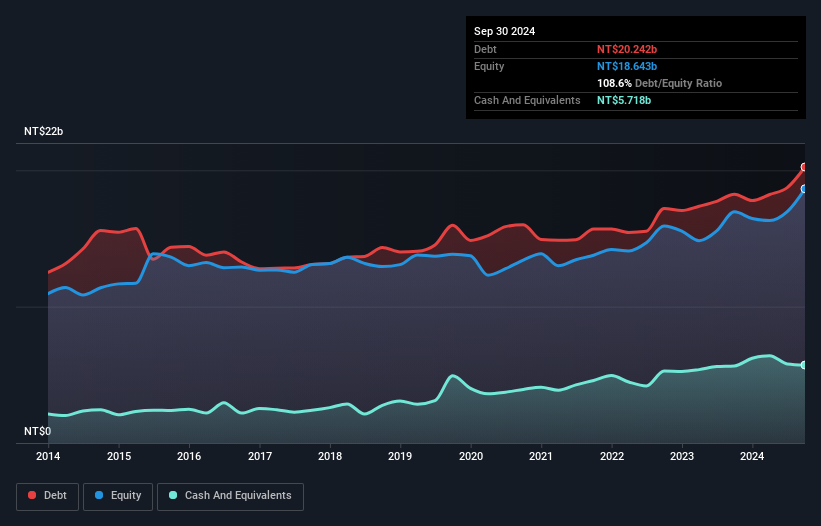

Taiwan Hon Chuan Enterprise, a notable player in the packaging sector, has been making strategic moves to bolster its position. Recent earnings reports show net income for Q3 at TWD 858 million, slightly up from TWD 855 million year-on-year, with sales climbing to TWD 7.89 billion from TWD 7.37 billion. The company also announced a private placement of shares worth over TWD 1 billion and is investing in new facilities with an estimated cost of TWD 858 million. Despite high debt levels with a net debt-to-equity ratio of nearly 78%, interest payments are well-covered by EBIT at a robust multiple of 19 times.

Turning Ideas Into Actions

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4651 more companies for you to explore.Click here to unveil our expertly curated list of 4654 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8214

AOKI Holdings

Engages in the fashion, anniversary and bridal, entertainment, and real estate rental businesses in Japan.

Excellent balance sheet established dividend payer.