- Turkey

- /

- Residential REITs

- /

- IBSE:SNGYO

Middle Eastern Market Insights: Fonet Bilgi Teknolojileri And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern markets have recently been characterized by muted performances across most Gulf bourses, influenced by fluctuating oil prices and uncertainties surrounding U.S. Federal Reserve rate decisions. Despite these broader market challenges, investors continue to explore opportunities within the region's diverse economic landscape. Penny stocks, often associated with smaller or newer companies, present an intriguing investment avenue due to their affordability and potential for growth when supported by robust financials. In this article, we will examine three such stocks from the Middle East that stand out for their financial strength and potential long-term prospects.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.39 | SAR1.35B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.169 | ₪298.89M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.02 | AED2.08B | ✅ 4 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED377.69M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.25 | AED13.99B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.80 | AED2.3B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.818 | AED497.55M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.70 | ₪211.95M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 81 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Fonet Bilgi Teknolojileri (IBSE:FONET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fonet Bilgi Teknolojileri A.S. offers information technology services focused on the healthcare sector both in Turkey and internationally, with a market cap of TRY2.72 billion.

Operations: Fonet Bilgi Teknolojileri A.S. has not reported any specific revenue segments.

Market Cap: TRY2.72B

Fonet Bilgi Teknolojileri A.S. has shown mixed financial performance, with recent earnings indicating a significant rise in third-quarter sales to TRY209.61 million from TRY131.53 million the previous year, while net income increased to TRY68.78 million from TRY15.02 million. Despite this growth, the company's annual earnings have declined compared to last year, and profit margins have decreased from 63% to 25.6%. The company maintains strong cash flow coverage for its debt and has reduced its debt-to-equity ratio over five years but faces challenges with high volatility and negative earnings growth recently impacting investor confidence.

- Navigate through the intricacies of Fonet Bilgi Teknolojileri with our comprehensive balance sheet health report here.

- Gain insights into Fonet Bilgi Teknolojileri's past trends and performance with our report on the company's historical track record.

QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret (IBSE:QUAGR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret operates in the construction materials industry, focusing on granite production and sales, with a market cap of TRY12.99 billion.

Operations: The company generates revenue of TRY7.14 billion from its construction materials segment.

Market Cap: TRY12.99B

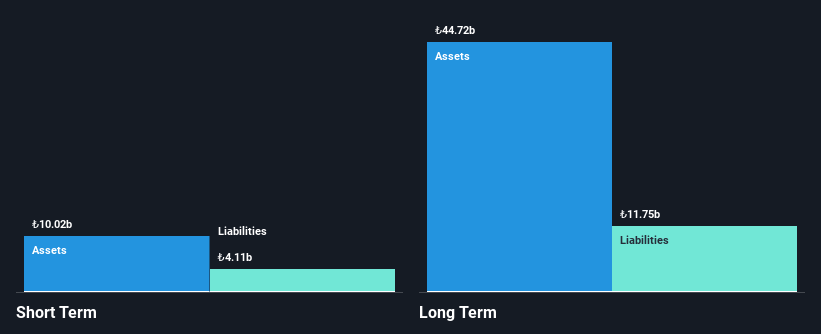

QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret operates in a challenging financial landscape, with its earnings declining by a very large rate annually over the past five years. Despite reporting TRY2.65 billion in sales for the recent quarter, the company remains unprofitable with high net debt to equity at 47.9%. Interest payments are inadequately covered by EBIT, indicating financial strain. However, short-term assets significantly exceed liabilities, providing some liquidity cushion. The board's average tenure is short at 0.8 years, suggesting potential instability in governance. The stock trades well below estimated fair value but experiences high volatility impacting investor sentiment.

- Unlock comprehensive insights into our analysis of QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret stock in this financial health report.

- Review our historical performance report to gain insights into QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret's track record.

Sinpas Gayrimenkul Yatirim Ortakligi (IBSE:SNGYO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sinpas Gayrimenkul Yatirim Ortakligi A.S. is a Turkish real estate investment trust (REIT) focused on property development and management, with a market cap of TRY18.88 billion.

Operations: Sinpas Gayrimenkul Yatirim Ortakligi A.S. has not reported any specific revenue segments.

Market Cap: TRY18.88B

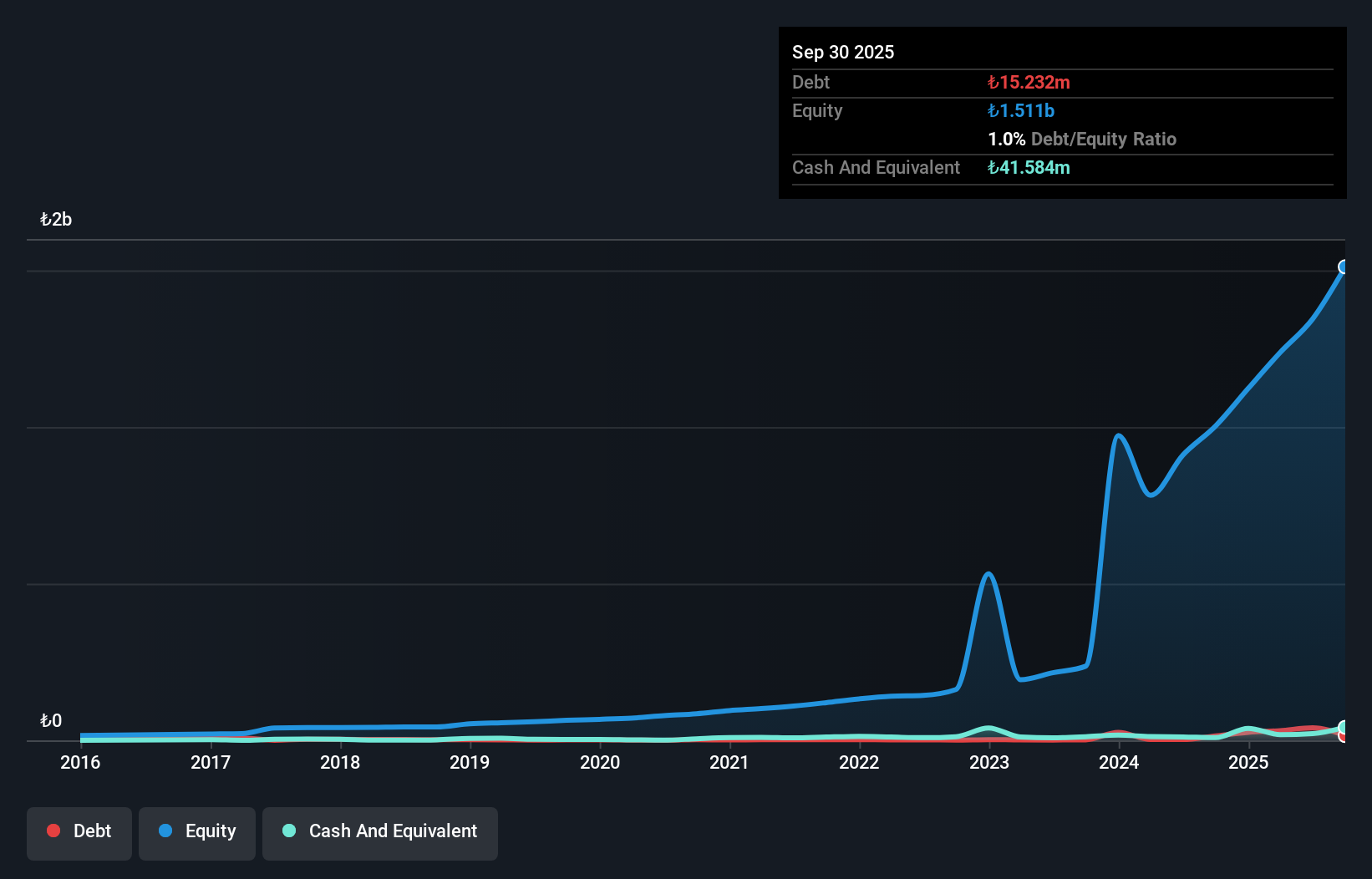

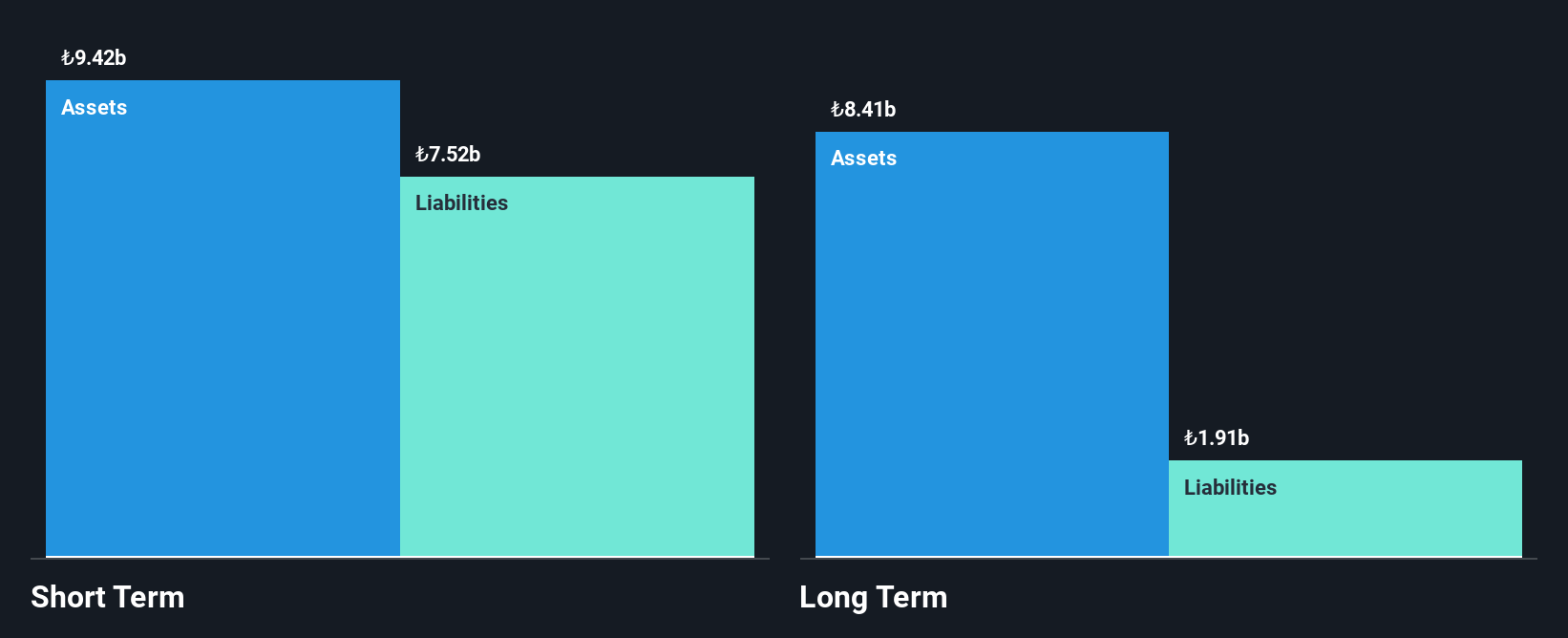

Sinpas Gayrimenkul Yatirim Ortakligi A.S. demonstrates a mixed financial profile as a penny stock in the Middle East. The company's short-term assets exceed both its long and short-term liabilities, indicating solid liquidity. It has reduced its debt to equity ratio significantly over five years, now at 14.1%, though operating cash flow coverage remains weak at 4.3%. Earnings have surged by 269.9% over the past year, surpassing industry growth, yet recent results show a third-quarter net loss of TRY13.4 million due to large one-off gains impacting quality earnings. Despite these challenges, the P/E ratio is attractively low at 3.6x compared to the market average.

- Click here and access our complete financial health analysis report to understand the dynamics of Sinpas Gayrimenkul Yatirim Ortakligi.

- Understand Sinpas Gayrimenkul Yatirim Ortakligi's track record by examining our performance history report.

Summing It All Up

- Embark on your investment journey to our 81 Middle Eastern Penny Stocks selection here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SNGYO

Sinpas Gayrimenkul Yatirim Ortakligi

Sinpas Gayrimenkul Yatirim Ortakligi A.S., formerly Sinpas Insaat, is a Turkish real estate investment trust (REIT) established in 2006 and transformed into a REIT in 2007.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives