- Philippines

- /

- Real Estate

- /

- PSE:VLL

3 Penny Stocks With Market Caps Under US$400M To Consider

Reviewed by Simply Wall St

As global markets react to recent interest rate cuts and prepare for potential further adjustments, investors are increasingly looking toward smaller-cap opportunities. Penny stocks, often seen as relics of past market eras, continue to attract attention due to their affordability and potential growth prospects. By focusing on companies with strong financial foundations, investors can uncover hidden value in these lesser-known equities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.12 | £804.39M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.00 | HK$44.05B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.775 | £186M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.89M | ★★★★☆☆ |

Click here to see the full list of 5,742 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S. specializes in the manufacturing of on-vehicle equipment and has a market cap of TRY2.40 billion.

Operations: The company generates revenue of TRY739.03 million from its vehicle equipment manufacturing segment.

Market Cap: TRY2.4B

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S. offers a mixed outlook for investors interested in penny stocks. The company trades significantly below its estimated fair value, suggesting potential undervaluation. Its net debt to equity ratio is satisfactory at 31.1%, and short-term assets comfortably cover both short- and long-term liabilities, indicating solid financial management. However, the company is currently unprofitable with declining earnings over the past five years, and recent earnings reports show a substantial drop in sales and net income compared to last year. Despite these challenges, Katmerciler's inclusion in the S&P Global BMI Index may enhance visibility among investors.

- Jump into the full analysis health report here for a deeper understanding of Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret.

- Understand Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret's track record by examining our performance history report.

Vista Land & Lifescapes (PSE:VLL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vista Land & Lifescapes, Inc. is an investment holding company that functions as an integrated property developer and homebuilder in the Philippines, with a market capitalization of approximately ₱19.43 billion.

Operations: The company's revenue is derived entirely from its operations in the Philippines, amounting to ₱35.61 billion.

Market Cap: ₱19.43B

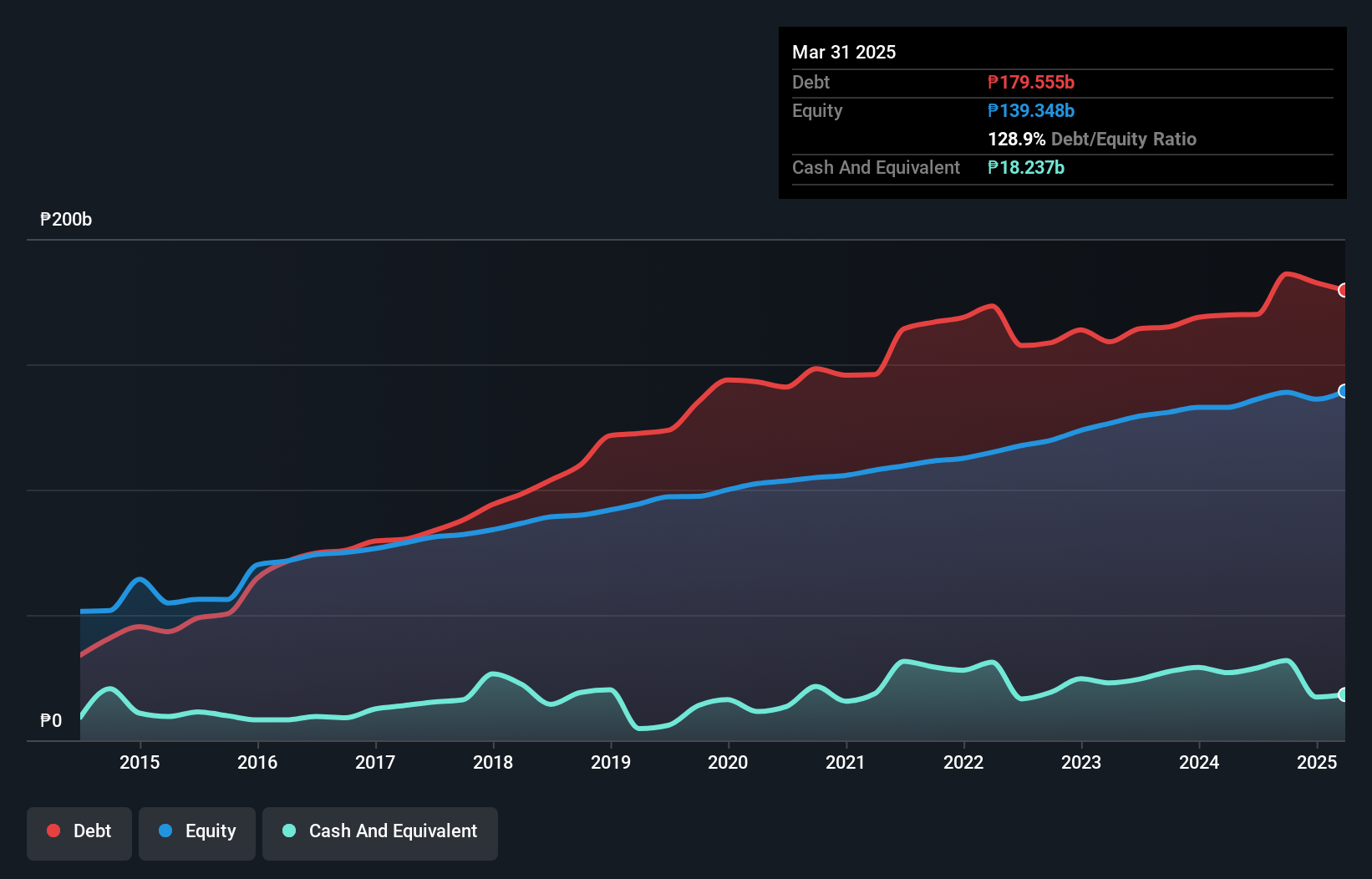

Vista Land & Lifescapes presents a mixed picture for penny stock investors. The company trades at a good value compared to peers, with stable weekly volatility and seasoned management. Recent earnings show modest growth, with third-quarter revenue rising slightly to ₱8.87 billion from last year. However, the net debt to equity ratio remains high at 111.1%, and operating cash flow does not adequately cover debt levels, indicating financial strain. Although dividends have increased, they are not well covered by earnings, raising sustainability concerns despite analysts' optimism about potential price appreciation of 28.8%.

- Click to explore a detailed breakdown of our findings in Vista Land & Lifescapes' financial health report.

- Examine Vista Land & Lifescapes' earnings growth report to understand how analysts expect it to perform.

GBA Holdings (SEHK:261)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GBA Holdings Limited is an investment holding company involved in property development activities in Mainland China and Hong Kong, with a market cap of HK$194.03 million.

Operations: The company's revenue is primarily derived from its Catering and Related Food Business, which generated HK$39.49 million, followed by its Property Business at HK$30.14 million and Finance Business contributing HK$5.87 million.

Market Cap: HK$194.03M

GBA Holdings Limited's recent delisting from OTC Equity due to inactivity raises concerns for penny stock investors. The company has a market cap of HK$194.03 million, with revenue primarily from its Catering and Related Food Business (HK$39.49 million). Despite having more cash than debt and short-term assets exceeding liabilities, GBA remains unprofitable with a negative return on equity (-19.24%). While its debt-to-equity ratio has improved over five years, the company's high volatility and inexperienced board suggest caution. The management team is relatively seasoned, but earnings have declined slightly over the past five years.

- Dive into the specifics of GBA Holdings here with our thorough balance sheet health report.

- Examine GBA Holdings' past performance report to understand how it has performed in prior years.

Make It Happen

- Gain an insight into the universe of 5,742 Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:VLL

Vista Land & Lifescapes

An investment holding company, operates as an integrated property developer and homebuilder in the Philippines.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives