- Turkey

- /

- Construction

- /

- IBSE:ENKAI

Middle Eastern Dividend Stocks To Consider

Reviewed by Simply Wall St

As major Gulf markets experience a downturn due to global trade war concerns, investors in the Middle East are cautiously navigating the economic landscape, with particular attention on how U.S. tariffs might impact regional growth. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to mitigate risk amidst market volatility.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Peninsula Group (TASE:PEN) | 6.50% | ★★★★★★ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.60% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.94% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.87% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.42% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.63% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.50% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.75% | ★★★★★☆ |

| Nuh Çimento Sanayi (IBSE:NUHCM) | 3.16% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.34% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Middle Eastern Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

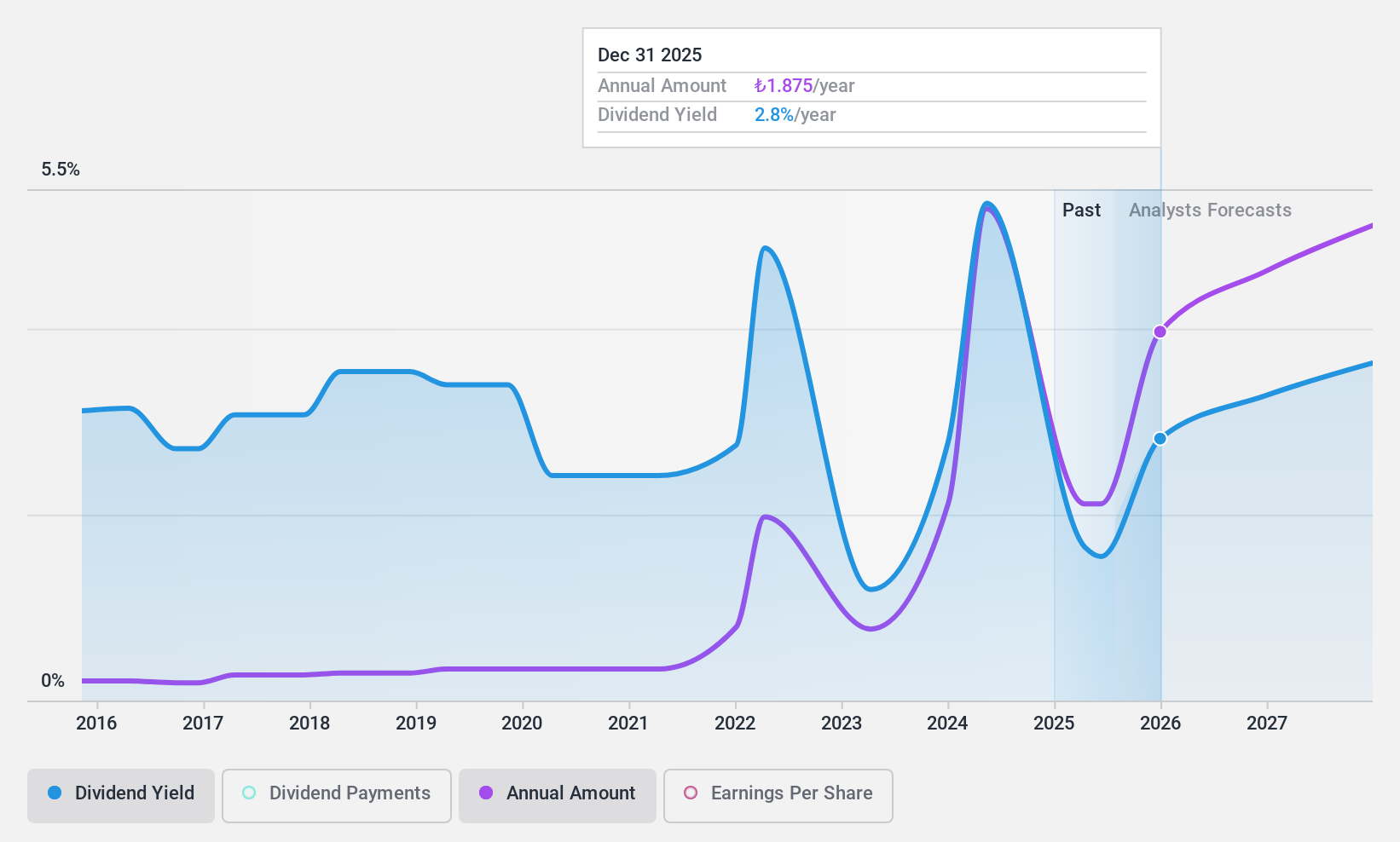

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi (IBSE:AVPGY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi operates in real estate development, leasing, and business administration in Turkey with a market cap of TRY26.38 billion.

Operations: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi generates revenue through its operations in real estate development, leasing, and business administration activities within Turkey.

Dividend Yield: 3.2%

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi's dividend payments are well-supported by both earnings and cash flows, with a payout ratio of 20.4% and a cash payout ratio of 17.6%. Despite recent initiation of dividends, the yield stands at 3.18%, placing it in the top quartile among Turkish dividend stocks. Recent earnings growth to TRY 7,380.6 million further strengthens its capacity for future payouts, though long-term stability remains unproven due to the nascent nature of its dividend history.

- Navigate through the intricacies of Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi's current price could be quite moderate.

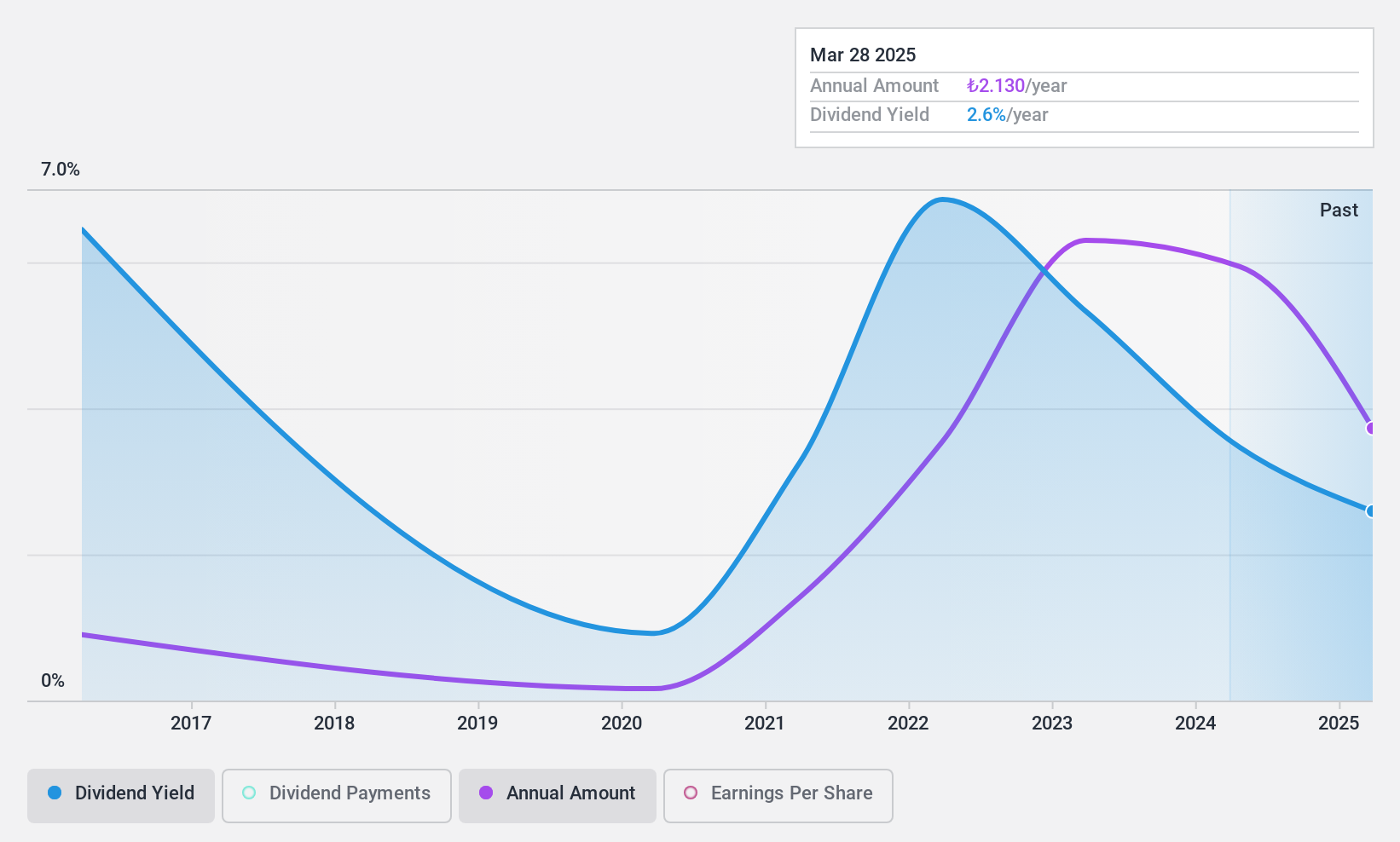

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret (IBSE:BRISA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S. is a leading tire manufacturing company with a market cap of TRY26.47 billion, operating in the automotive sector.

Operations: Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S. generates revenue of TRY34.55 billion from its vehicle tires segment.

Dividend Yield: 3.9%

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret's dividend yield of 3.91% ranks in the top 25% in Turkey, yet its sustainability is uncertain due to a high cash payout ratio of 332.2%. Recent earnings have declined significantly, with net income dropping to TRY 1.52 billion from TRY 5.75 billion the previous year, impacting dividend reliability and stability. Although dividends have grown over the past decade, they remain volatile and not well-covered by free cash flows or earnings.

- Dive into the specifics of Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret here with our thorough dividend report.

- Our expertly prepared valuation report Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret implies its share price may be lower than expected.

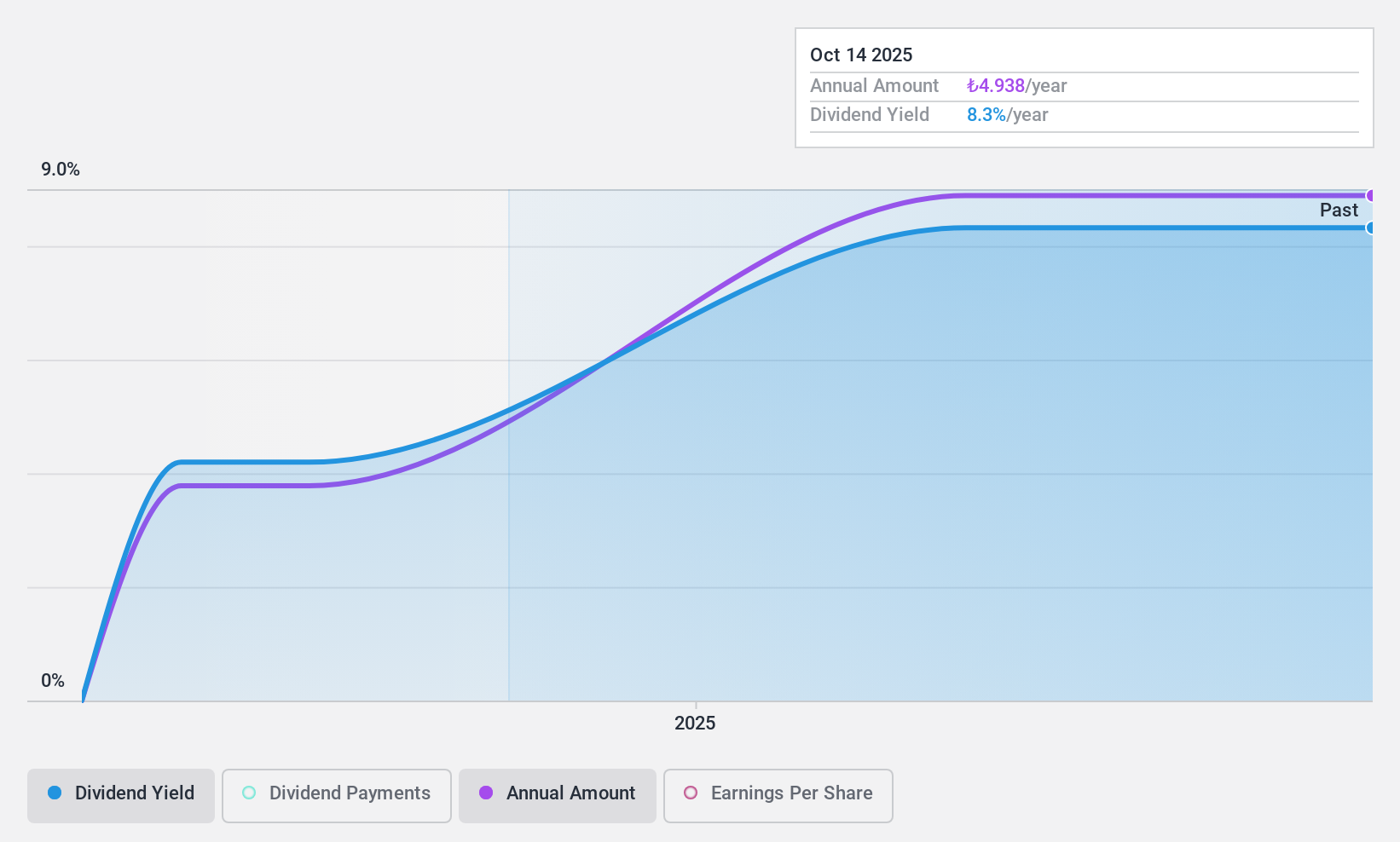

Enka Insaat ve Sanayi (IBSE:ENKAI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Enka Insaat ve Sanayi A.S., along with its subsidiaries, is a construction company operating in Turkey, Russia, Kazakhstan, Georgia, Europe, and internationally with a market cap of TRY315.71 billion.

Operations: Enka Insaat ve Sanayi A.S. generates its revenue from several segments, including Trade (TRY9.14 billion), Energy (TRY10.74 billion), Real Estate Lease (TRY11 billion), and Construction Contracts (TRY73.91 billion).

Dividend Yield: 4.6%

Enka Insaat ve Sanayi offers a dividend yield of 4.64%, placing it in the top 25% of Turkish dividend payers. However, its sustainability is questionable due to a high cash payout ratio of 216.1%, despite being well-covered by earnings with a low payout ratio of 30.2%. While dividends have grown over the past decade, they have been volatile and unreliable, as recent earnings improvements to TRY 24.69 billion may not ensure consistent payouts.

- Click to explore a detailed breakdown of our findings in Enka Insaat ve Sanayi's dividend report.

- Upon reviewing our latest valuation report, Enka Insaat ve Sanayi's share price might be too optimistic.

Key Takeaways

- Navigate through the entire inventory of 60 Top Middle Eastern Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enka Insaat ve Sanayi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ENKAI

Enka Insaat ve Sanayi

Engages in construction activities in Turkey, Georgia, Turkmenistan, Kazakhstan, Kenya, Libya, and Europe.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives