In the wake of recent global market shifts, particularly with U.S. indices reaching record highs following a significant political shift, investors are reevaluating their strategies amid expectations of economic growth and policy changes. As markets react to these developments, dividend stocks continue to attract attention for their potential to provide steady income streams and resilience during periods of volatility. In such an environment, selecting dividend stocks with strong fundamentals can offer a reliable way to navigate the evolving financial landscape while potentially benefiting from both income and capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Haci Ömer Sabanci Holding (IBSE:SAHOL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Haci Ömer Sabanci Holding A.S. operates primarily in the finance, manufacturing, and trading sectors worldwide, with a market cap of TRY182.63 billion.

Operations: Haci Ömer Sabanci Holding A.S. generates revenue primarily from its Banking segment at TRY465.63 billion, followed by the Energy sector at TRY156.09 billion, Digital operations at TRY52.14 billion, and Financial Services contributing TRY42.20 billion.

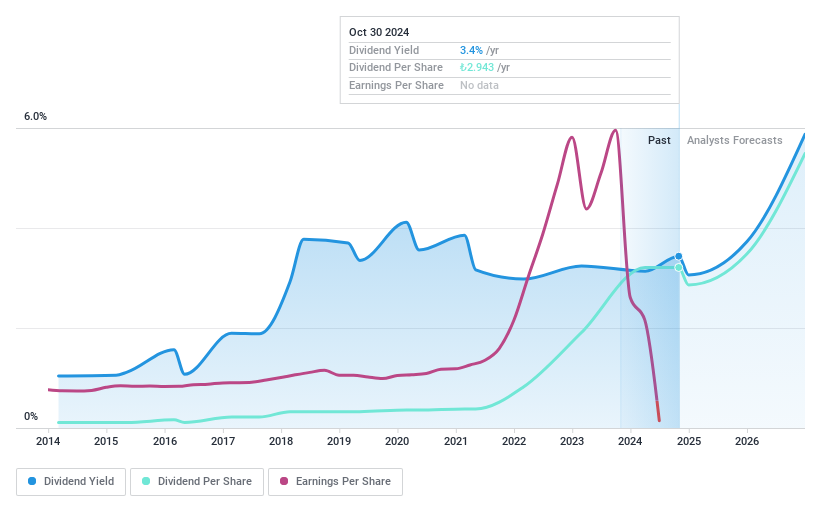

Dividend Yield: 3.4%

Haci Ömer Sabanci Holding's dividend yield of 3.38% ranks in the top 25% of Turkish market payers, but its dividends have been unreliable and volatile over the past decade. Recent earnings reports show significant net losses and a high payout ratio of 392.4%, indicating dividends are not well covered by earnings currently or forecasted for three years. Despite this, analysts expect stock price growth, and future dividends may become sustainable with a projected 14% payout ratio in three years.

- Unlock comprehensive insights into our analysis of Haci Ömer Sabanci Holding stock in this dividend report.

- The analysis detailed in our Haci Ömer Sabanci Holding valuation report hints at an inflated share price compared to its estimated value.

Shanghai Zijiang Enterprise Group (SHSE:600210)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanghai Zijiang Enterprise Group Co., Ltd. operates in diverse sectors including packaging and real estate, with a market cap of approximately CN¥12.24 billion.

Operations: Shanghai Zijiang Enterprise Group Co., Ltd. generates its revenue from sectors such as packaging and real estate.

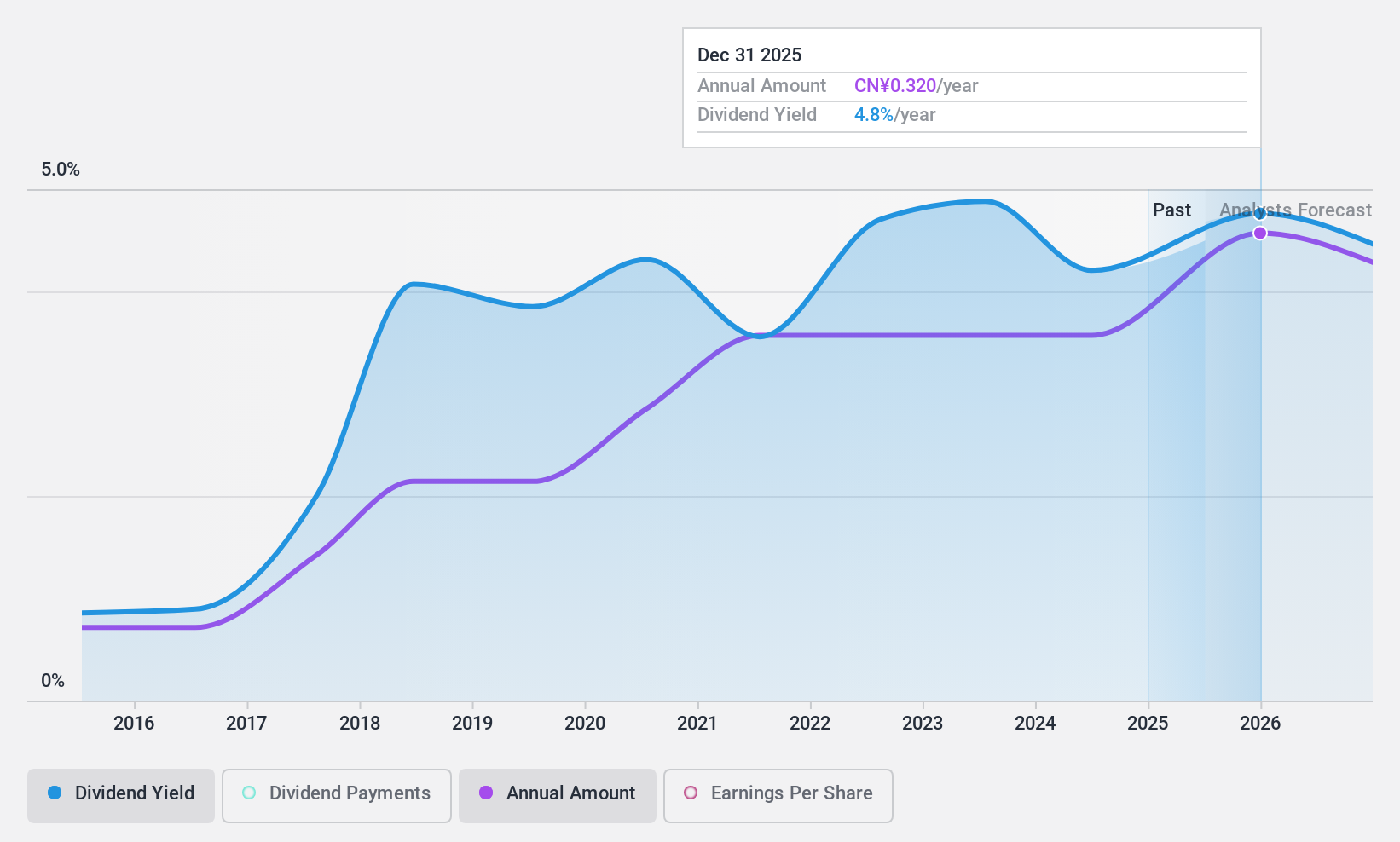

Dividend Yield: 3.1%

Shanghai Zijiang Enterprise Group's dividend yield of 3.1% places it among the top 25% of dividend payers in China. While its dividends have grown over the past decade, they have been unstable and volatile, with significant annual drops. The company's dividends are well-covered by earnings and cash flows, with a payout ratio of 59.5% and a cash payout ratio of 23.2%. Recent earnings show an increase in net income to CNY 527.56 million for the nine months ended September 2024, despite a slight decrease in revenue compared to last year.

- Get an in-depth perspective on Shanghai Zijiang Enterprise Group's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Shanghai Zijiang Enterprise Group's current price could be quite moderate.

Matrix IT (TASE:MTRX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Matrix IT Ltd. offers information technology solutions and services across Israel, the United States, Europe, and other international markets, with a market cap of ₪5.06 billion.

Operations: Matrix IT Ltd.'s revenue segments include Training and Implementation (₪168.61 million), Cloud and Computing Infrastructure (₪1.54 billion), Marketing and Support of Software Products (₪404.38 million), Information Technology Solutions and Services in the United States (₪493.73 million), and Information Technology Solutions, Consulting, and Management in Israel (₪3.05 billion).

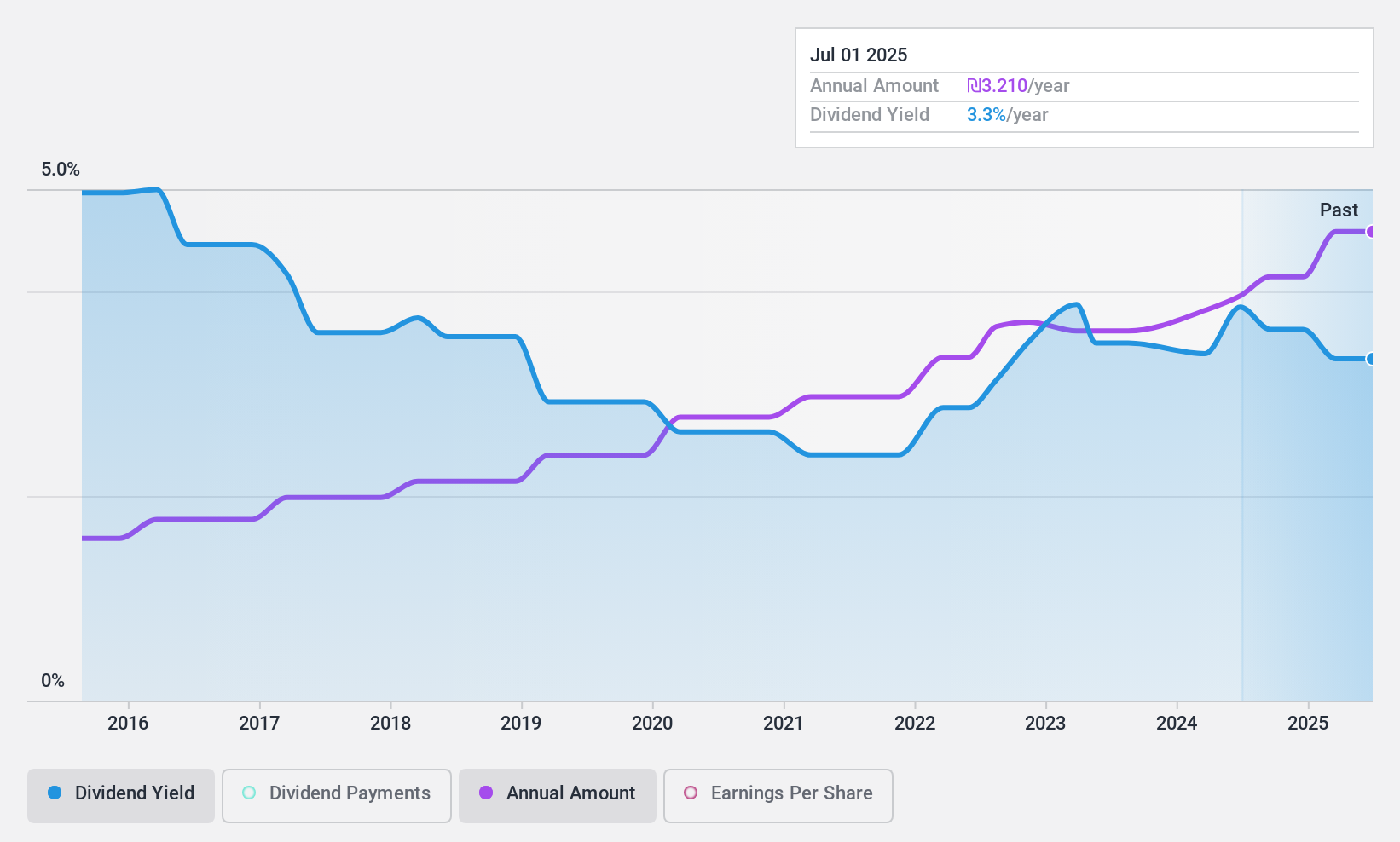

Dividend Yield: 3.6%

Matrix IT's dividend yield of 3.64% is lower than the top 25% of dividend payers in the IL market. However, its dividends are well-covered by both earnings and cash flows, with payout ratios of 74.9% and 35.9%, respectively, indicating sustainability. The company has maintained stable and reliable dividends over the past decade, supported by a recent earnings growth of 13.9%. Additionally, Matrix IT trades significantly below its estimated fair value, potentially offering good value for investors seeking income stability.

- Take a closer look at Matrix IT's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Matrix IT shares in the market.

Taking Advantage

- Explore the 1939 names from our Top Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600210

Shanghai Zijiang Enterprise Group

Shanghai Zijiang Enterprise Group Co., Ltd.

Flawless balance sheet established dividend payer.