- Thailand

- /

- Renewable Energy

- /

- SET:ETC

Grandshores Technology Group Leads These 3 Prominent Penny Stocks

Reviewed by Simply Wall St

As global markets continue to react to recent political shifts and economic policy changes, investors are exploring diverse opportunities across various sectors. Penny stocks, while often associated with smaller or newer companies, remain a relevant investment area due to their potential for growth at lower price points. When these stocks exhibit strong financial health and solid fundamentals, they can offer significant upside potential without many of the typical risks associated with this segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.46 | MYR2.29B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.06 | THB1.67B | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.63 | £190.08M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.93 | MYR2.02B | ★★★★★☆ |

Click here to see the full list of 5,754 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Grandshores Technology Group (SEHK:1647)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Grandshores Technology Group Limited is an investment holding company that offers integrated building services in Singapore, Hong Kong, and the People's Republic of China, with a market cap of HK$146.99 million.

Operations: The company's revenue is derived from three main segments: Building Construction Works (SGD 20.79 million), Integrated Building Services (SGD 56.06 million), and Information Technology Development and Application (SGD 7.68 million).

Market Cap: HK$146.99M

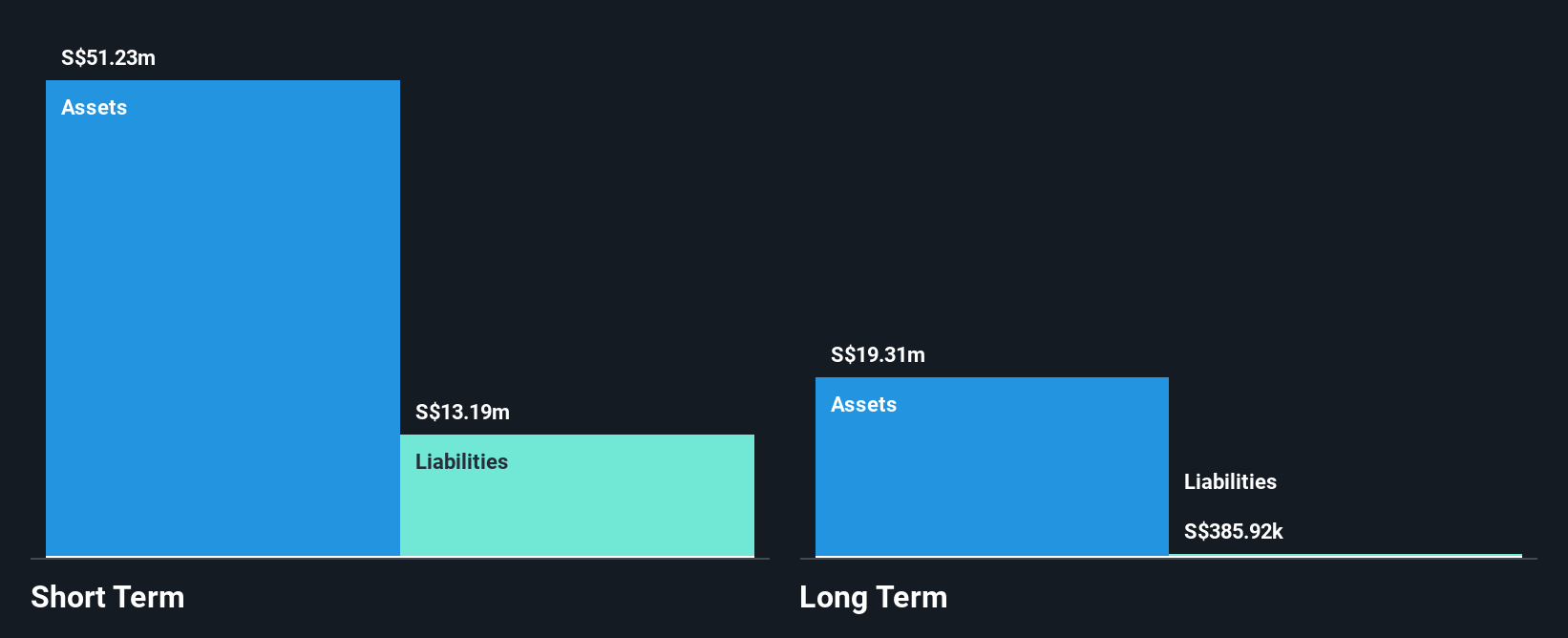

Grandshores Technology Group Limited, with a market cap of HK$146.99 million, operates in building construction and IT development across Singapore, Hong Kong, and China. The company has recently achieved profitability despite a historical decline in earnings by 46.3% annually over five years. It is debt-free with short-term assets (SGD54.7M) comfortably covering both short-term (SGD14.3M) and long-term liabilities (SGD250.6K). However, the stock exhibits high volatility with increased weekly fluctuations from 17% to 24% over the past year and maintains low return on equity at 3.4%. The board is experienced but management tenure data is insufficient for evaluation.

- Jump into the full analysis health report here for a deeper understanding of Grandshores Technology Group.

- Review our historical performance report to gain insights into Grandshores Technology Group's track record.

China PengFei Group (SEHK:3348)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China PengFei Group Limited, with a market cap of HK$555 million, is an investment holding company that manufactures and installs rotary kilns, grinding equipment, and related machinery in Mainland China and internationally.

Operations: The company's revenue is derived from its Machinery & Industrial Equipment segment, totaling CN¥1.52 billion.

Market Cap: HK$555M

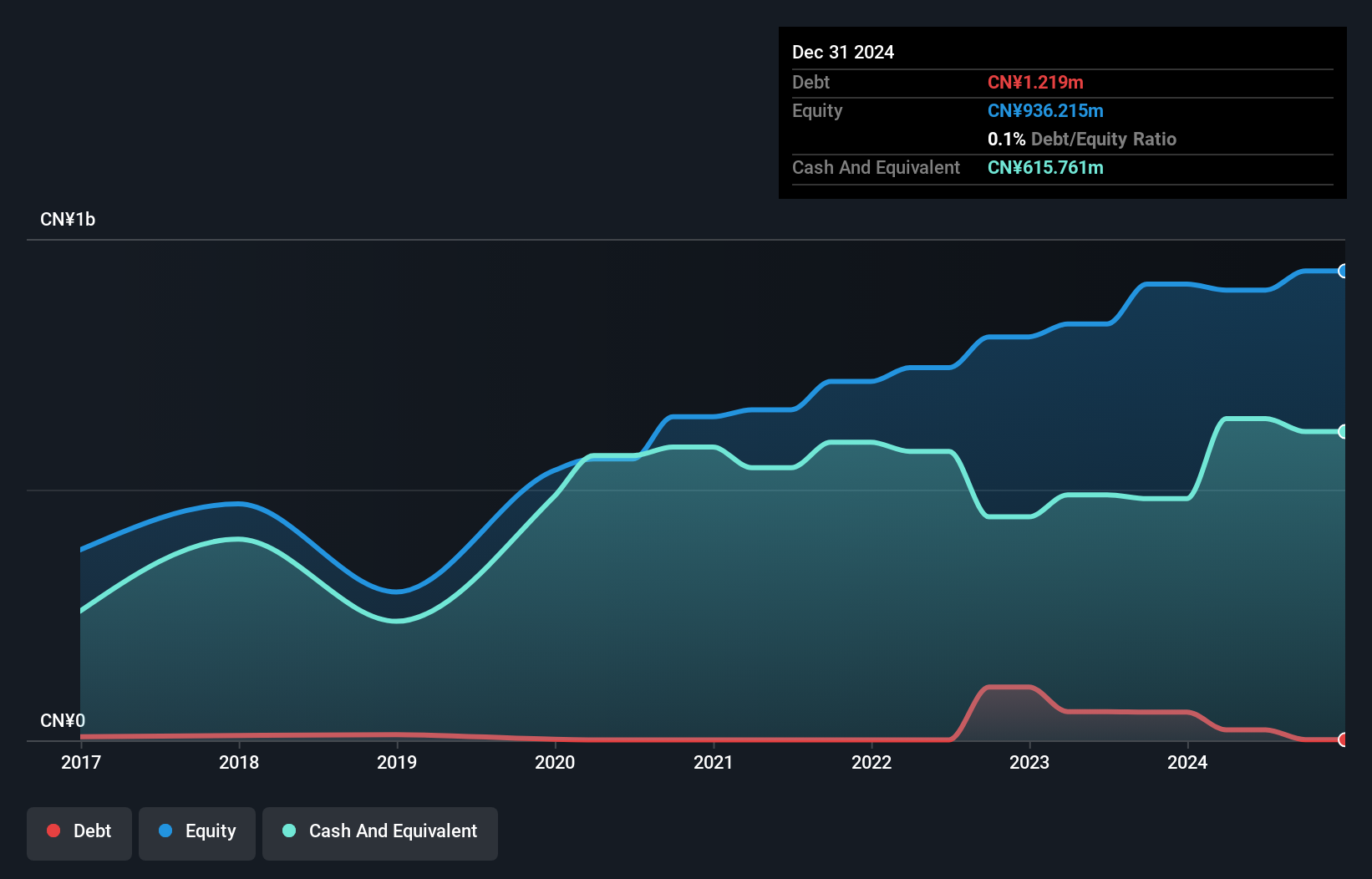

China PengFei Group Limited, with a market cap of HK$555 million, has shown resilience despite recent challenges. The company's short-term assets (CN¥1.9 billion) comfortably cover both its short-term (CN¥1.5 billion) and long-term liabilities (CN¥68.4 million), indicating strong liquidity. However, earnings have declined by 12.1% over the past year, with net income for the first half of 2024 dropping to CN¥31.3 million from CN¥63.92 million a year earlier, reflecting pressure on profit margins and negative growth compared to industry averages. Despite this, debt is well-covered by operating cash flow at 1133%, and no significant shareholder dilution occurred recently.

- Dive into the specifics of China PengFei Group here with our thorough balance sheet health report.

- Gain insights into China PengFei Group's historical outcomes by reviewing our past performance report.

Earth Tech Environment (SET:ETC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Earth Tech Environment Public Company Limited operates in Thailand by generating and distributing electricity from industrial waste, with a market capitalization of THB4.66 billion.

Operations: The company's revenue is primarily derived from the Power Business segment, which accounts for THB746.20 million, with an additional contribution of THB43.56 million from Construction activities.

Market Cap: THB4.66B

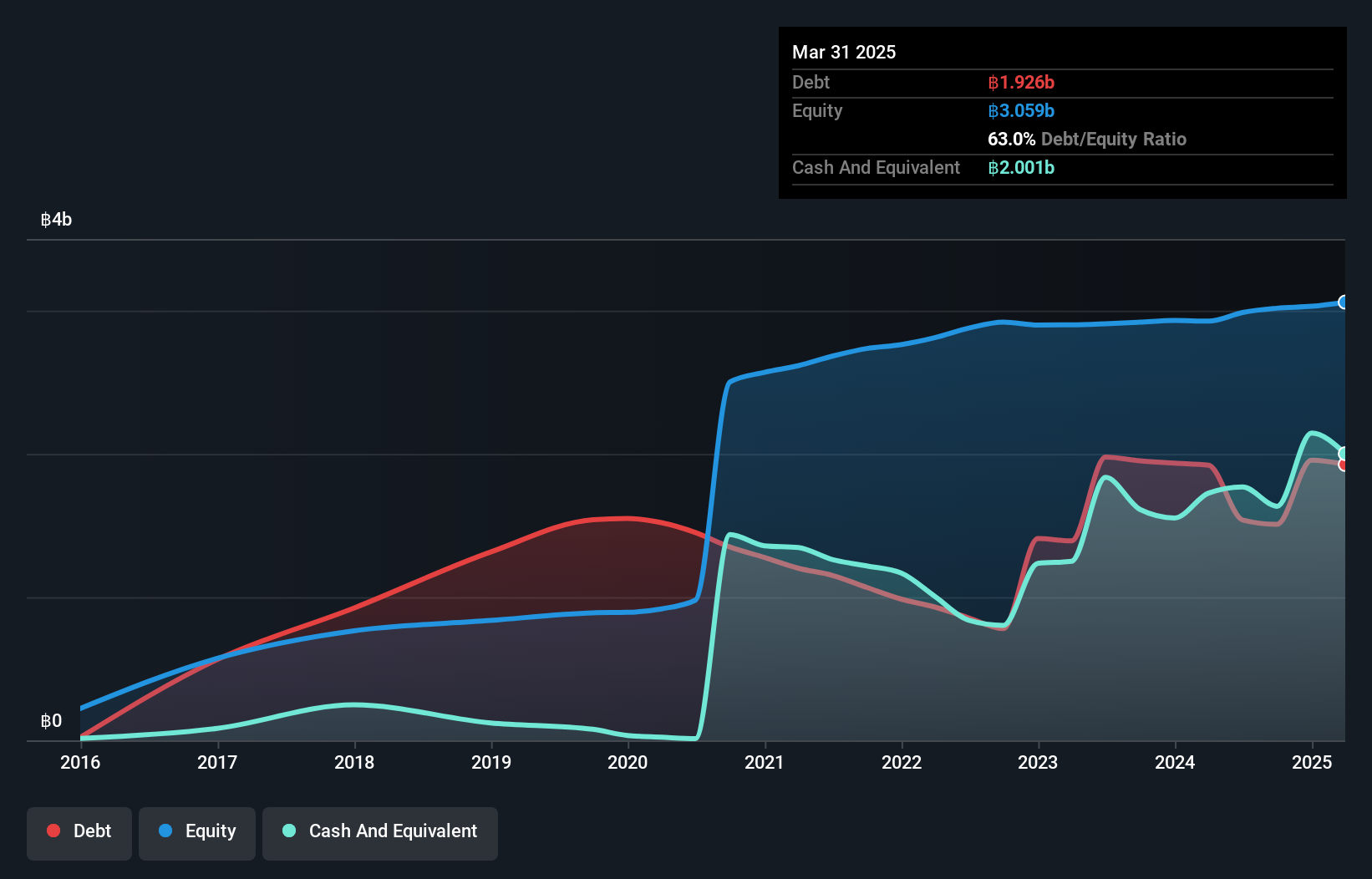

Earth Tech Environment, with a market cap of THB4.66 billion, has recently reported significant earnings growth of 184.4% over the past year despite a large one-off gain impacting results. The company's financial health is bolstered by having more cash than debt and reducing its debt-to-equity ratio from 163.6% to 51.5% over five years, though operating cash flow coverage remains low at 5.8%. Net profit margins improved to 10.1%, but return on equity is low at 2.7%. Recently, Earth Tech announced an unsecured debenture offering of THB500 million due in 2027 to strengthen its capital structure further.

- Navigate through the intricacies of Earth Tech Environment with our comprehensive balance sheet health report here.

- Evaluate Earth Tech Environment's historical performance by accessing our past performance report.

Taking Advantage

- Unlock more gems! Our Penny Stocks screener has unearthed 5,751 more companies for you to explore.Click here to unveil our expertly curated list of 5,754 Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Earth Tech Environment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:ETC

Earth Tech Environment

Engages in the generation and distribution of electricity from industrial waste in Thailand.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives