- Kuwait

- /

- Specialty Stores

- /

- KWSE:ALG

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets continue their recovery from the early August sell-off, investor sentiment has been buoyed by positive news on inflation and economic growth, raising hopes for a "soft landing" in the U.S. economy. Amid this backdrop of cautious optimism, small-cap stocks have shown resilience, with indices like the S&P MidCap 400 and Russell 2000 posting notable gains. In such an environment, identifying promising stocks often involves looking beyond headline-grabbing giants to uncover lesser-known companies with strong fundamentals and growth potential. Here are three undiscovered gems that could offer significant opportunities for investors willing to explore beyond the obvious choices.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 46.79% | 18.26% | -3.91% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Taclink Optoelectronics Technology | 1.29% | 24.61% | -1.11% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Britam Holdings | 10.05% | 3.47% | 16.62% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 6.93% | 8.35% | 16.18% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Ali Al-Ghanim Sons Automotive Company K.S.C.P (KWSE:ALG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ali Al-Ghanim Sons Automotive Company K.S.C.P., along with its subsidiaries, operates in the automotive sector across Kuwait, Iraq, Egypt, and the United Arab Emirates and has a market cap of KWD323.24 million.

Operations: The company generates revenue primarily through automotive sales and services across Kuwait, Iraq, Egypt, and the United Arab Emirates. It has a market cap of KWD323.24 million.

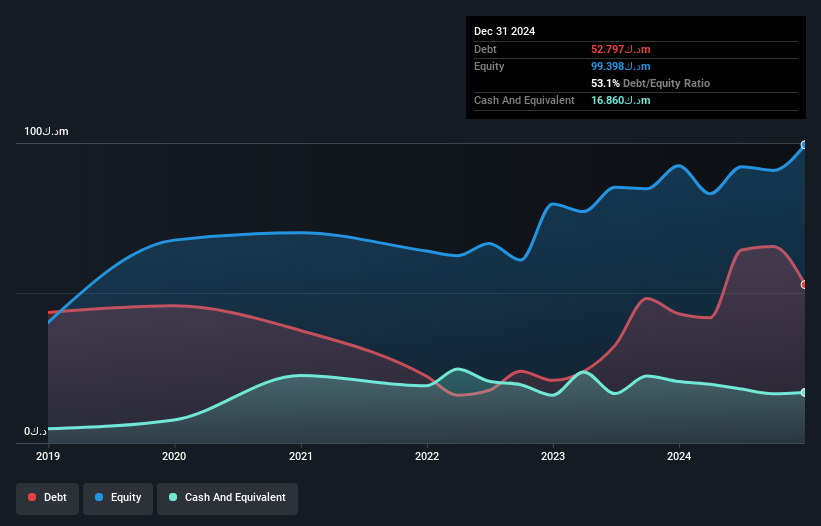

Ali Al-Ghanim Sons Automotive Company K.S.C.P. has shown impressive earnings growth of 21.5% over the past year, outpacing the Specialty Retail industry’s 3.4%. The company reported Q2 2024 sales of KWD 66.23 million, up from KWD 64.25 million a year ago, with net income rising to KWD 7.94 million from KWD 7.42 million in the same period last year. Despite a high net debt to equity ratio of 50.3%, their EBIT covers interest payments well at a ratio of 12.4x and their price-to-earnings ratio stands at an attractive value of 11x compared to the KW market's average of 14x.

- Dive into the specifics of Ali Al-Ghanim Sons Automotive Company K.S.C.P here with our thorough health report.

Learn about Ali Al-Ghanim Sons Automotive Company K.S.C.P's historical performance.

Ditto (Thailand) (SET:DITTO)

Simply Wall St Value Rating: ★★★★★★

Overview: Ditto (Thailand) Public Company Limited distributes data and document management solutions in Thailand with a market cap of THB11.17 billion.

Operations: Ditto (Thailand) generates revenue from three primary segments: Technology Engineering Services (THB926.39 million), Data and Document Management Solutions (THB709.59 million), and Photocopiers, Printers, and Technology Products (THB551.91 million).

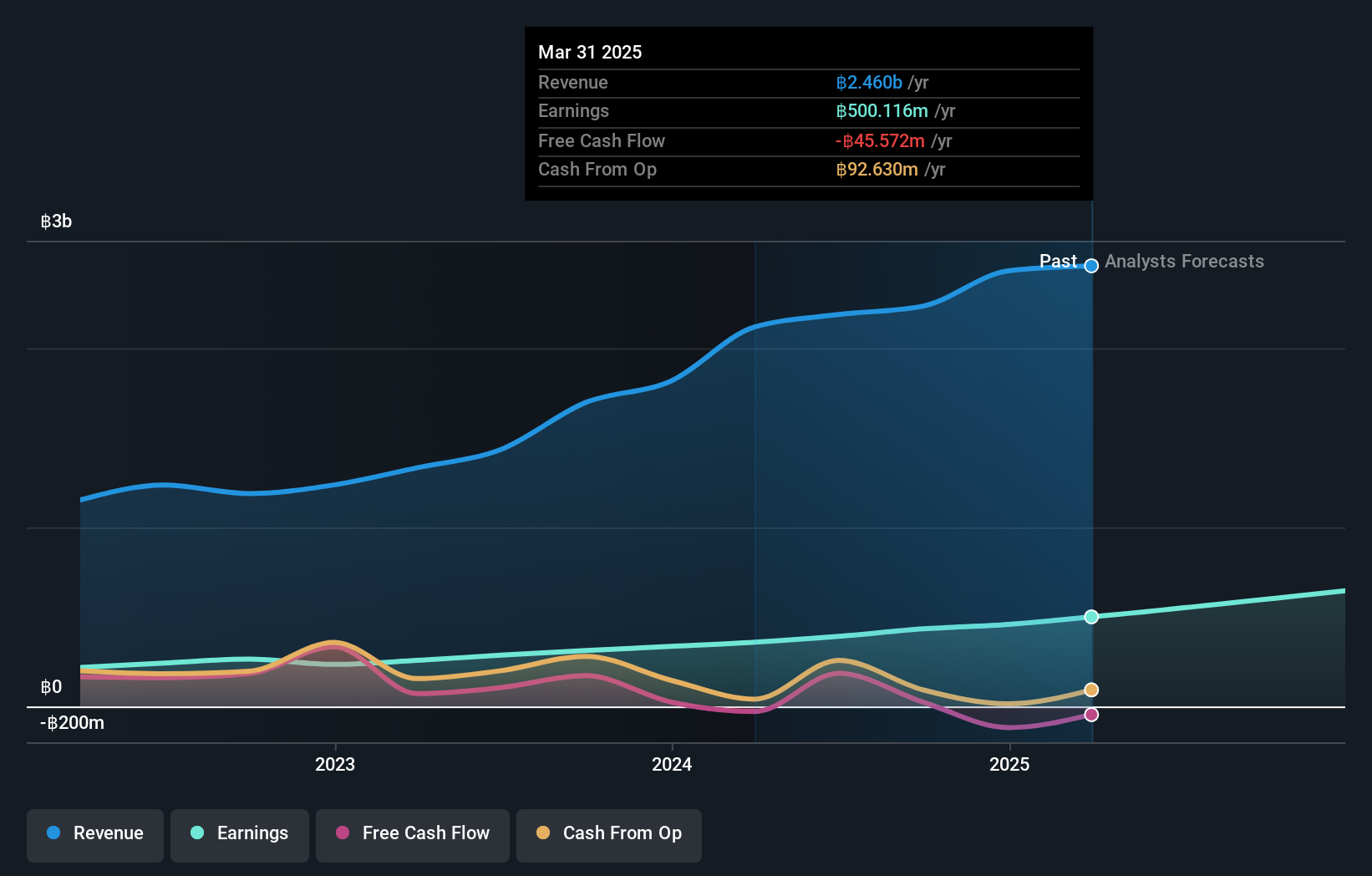

Ditto, a promising player from Thailand, has demonstrated impressive financial health. Over the past five years, its debt to equity ratio plummeted from 65.1% to 0.08%, indicating prudent management of liabilities. The company’s earnings grew by 36.7% last year, outpacing the electronic industry's average growth of 12%. Trading at a discount of 17.4% below estimated fair value, Ditto is forecasted to grow earnings by an annual rate of 27.41%, showcasing significant potential for future gains.

- Get an in-depth perspective on Ditto (Thailand)'s performance by reading our health report here.

Assess Ditto (Thailand)'s past performance with our detailed historical performance reports.

Tigerair Taiwan (TWSE:6757)

Simply Wall St Value Rating: ★★★★★★

Overview: Tigerair Taiwan Co., Ltd. provides airline services in Taiwan and has a market cap of NT$23.57 billion.

Operations: The company generates revenue primarily from passenger and cargo air transportation services, totaling NT$15.21 billion.

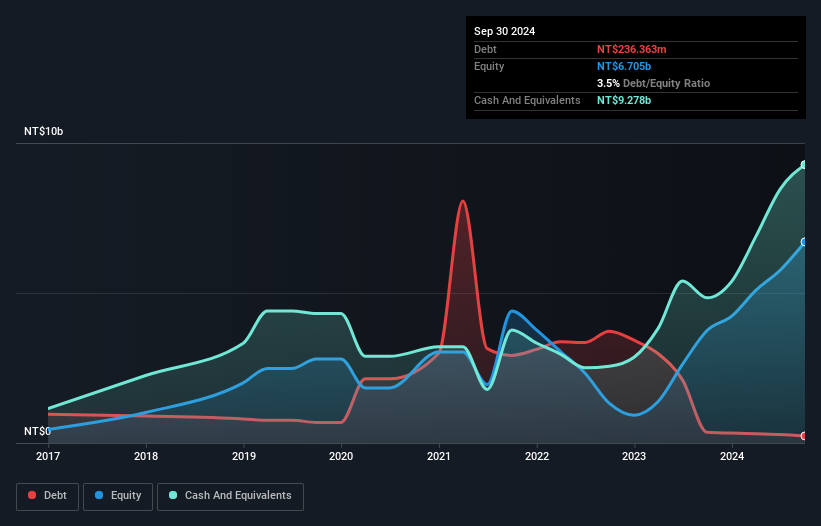

Tigerair Taiwan has been making strides, becoming profitable this year and trading at 80.2% below its estimated fair value. The company's debt to equity ratio improved significantly from 30.5% to 4.9% over the past five years, showcasing strong financial health. EBIT covers interest payments 78.9 times, indicating robust earnings quality and low risk of default on debt obligations. Recent executive changes include the dismissal of key directors from China Airlines' representation and resignations effective July 31, 2024.

- Navigate through the intricacies of Tigerair Taiwan with our comprehensive health report here.

Examine Tigerair Taiwan's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Navigate through the entire inventory of 4890 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KWSE:ALG

Ali Al-Ghanim Sons Automotive Company K.S.C.P

Operates in the automotive business in Kuwait, Iraq, Egypt, and the United Arab Emirates.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives