- Japan

- /

- Professional Services

- /

- TSE:6028

3 Top Dividend Stocks Yielding Between 3.1% And 7.5%

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, investors are increasingly looking towards dividend stocks as a source of steady income amid market volatility. In such an environment, selecting stocks with reliable dividend yields between 3.1% and 7.5% can offer a balanced approach to maintaining income while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.20% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.00% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Southside Bancshares (NasdaqGS:SBSI) | 4.51% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.03% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.92% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.99% | ★★★★★★ |

Click here to see the full list of 2040 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

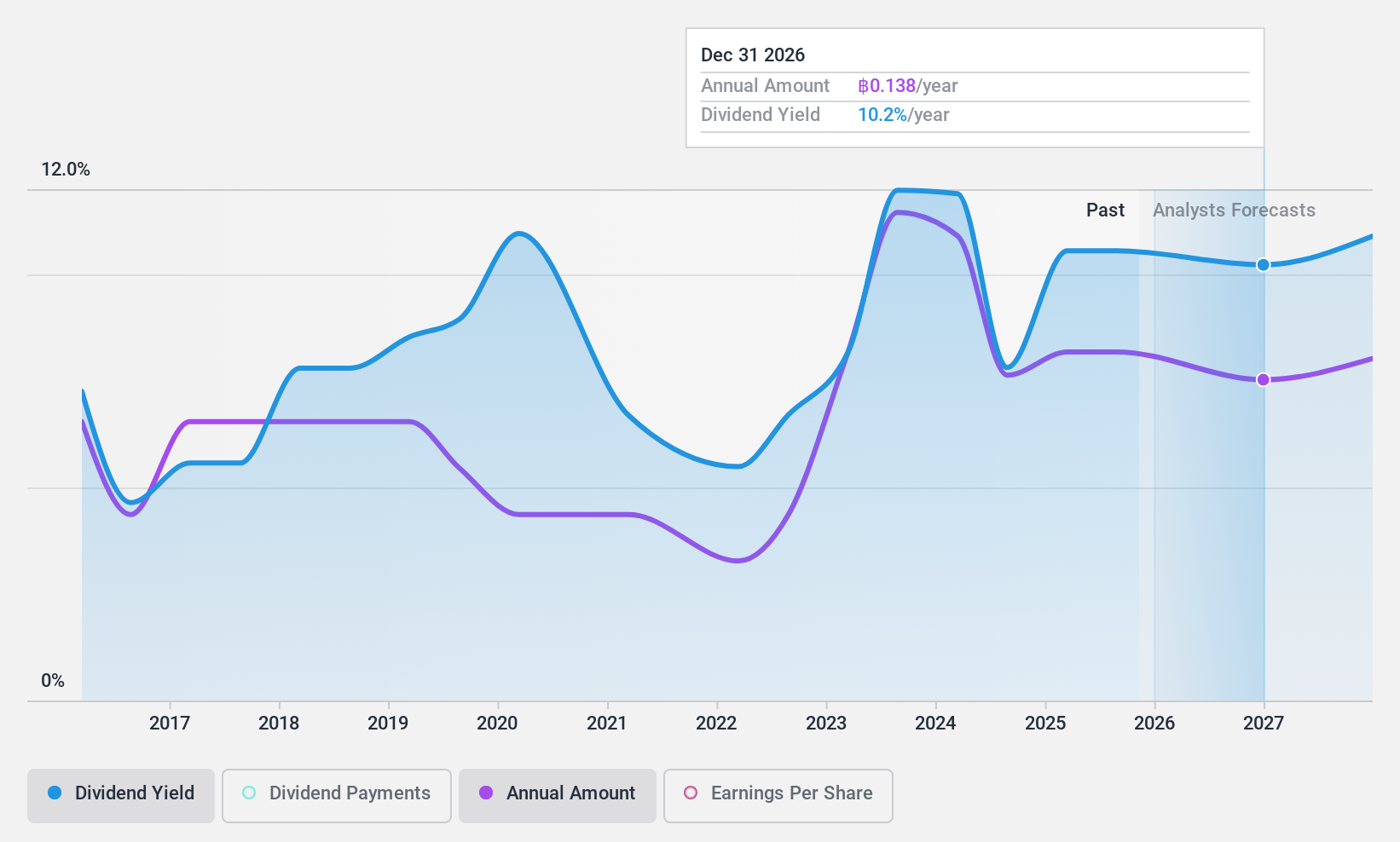

Sansiri (SET:SIRI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sansiri Public Company Limited, along with its subsidiaries, operates in the property development sector in Thailand and has a market cap of THB31.98 billion.

Operations: Sansiri's revenue is primarily derived from Real Estate at THB35.77 billion, supplemented by Building Management, Project Management and Real Estate Brokerage at THB2.15 billion, with additional contributions from its Hotel Business and Hotel Management segments at THB676 million and THB574 million respectively.

Dividend Yield: 7.6%

Sansiri's dividend yield is among the top 25% in Thailand, but its sustainability is questionable due to a high cash payout ratio of 153.5%. Recent earnings show a decline, with net income dropping to THB 2.7 billion for the first half of 2024. The company announced a reduced interim dividend of THB 0.07 per share for early 2024, reflecting potential volatility and unreliability in its dividend payments over time.

- Click here to discover the nuances of Sansiri with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Sansiri's share price might be too pessimistic.

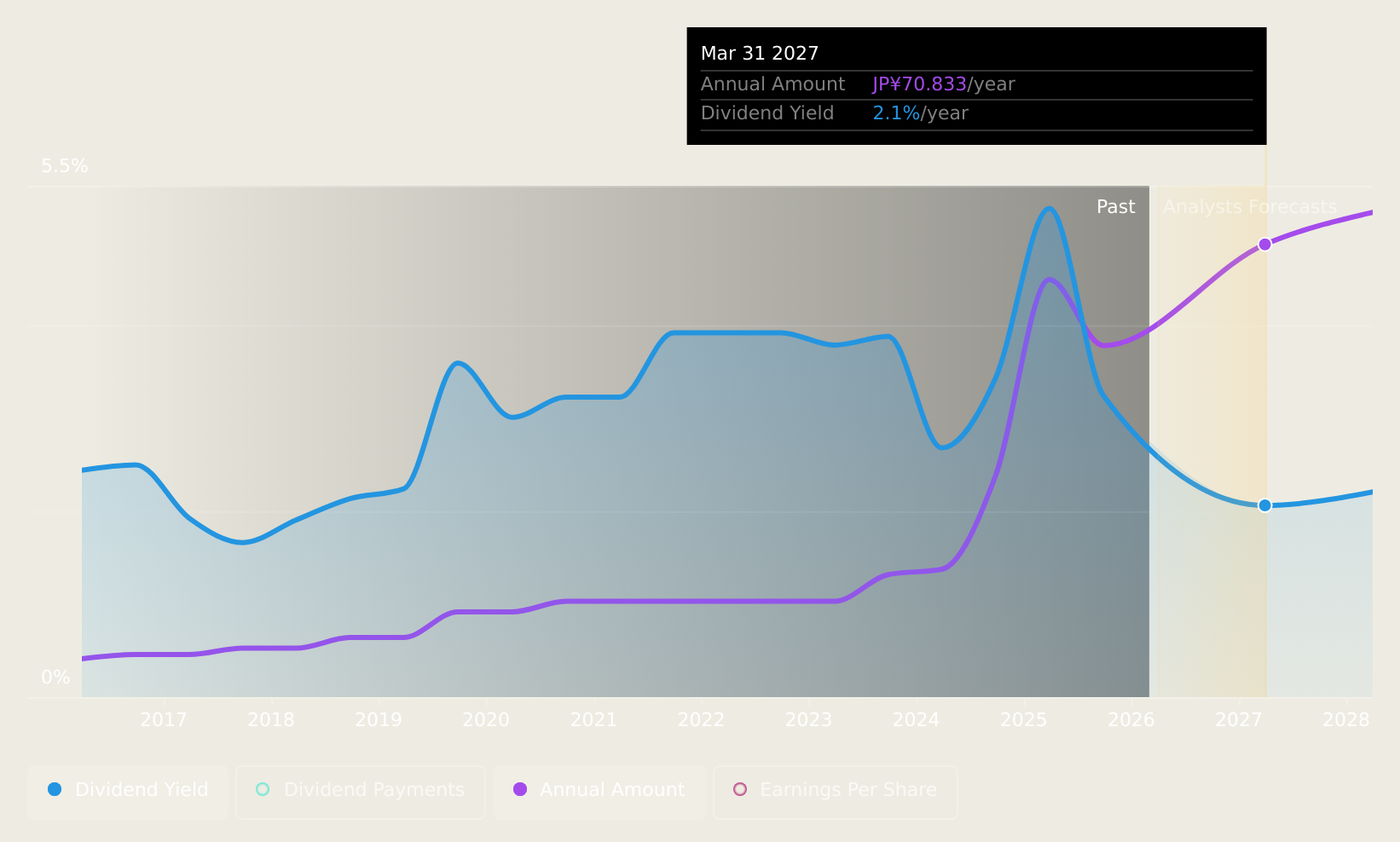

Dai-Dan (TSE:1980)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dai-Dan Co., Ltd. operates in Japan, focusing on the design, supervision, and construction of electrical, air conditioning, plumbing and sanitary, and firefighting facilities works with a market cap of ¥129.46 billion.

Operations: Dai-Dan Co., Ltd.'s revenue primarily comes from its Equipment Construction Business, generating ¥201.03 billion.

Dividend Yield: 3.4%

Dai-Dan's dividend yield of 3.44% is lower than the top 25% in Japan, and its sustainability is questionable as dividends are not covered by free cash flows despite a low payout ratio of 33.6%. Earnings grew significantly by 47.8% last year, yet share price volatility remains high. The company plans to increase its annual dividend to ¥52 per share for fiscal year ending March 2025, up from ¥48 previously, indicating a commitment to growth amidst financial challenges.

- Navigate through the intricacies of Dai-Dan with our comprehensive dividend report here.

- According our valuation report, there's an indication that Dai-Dan's share price might be on the cheaper side.

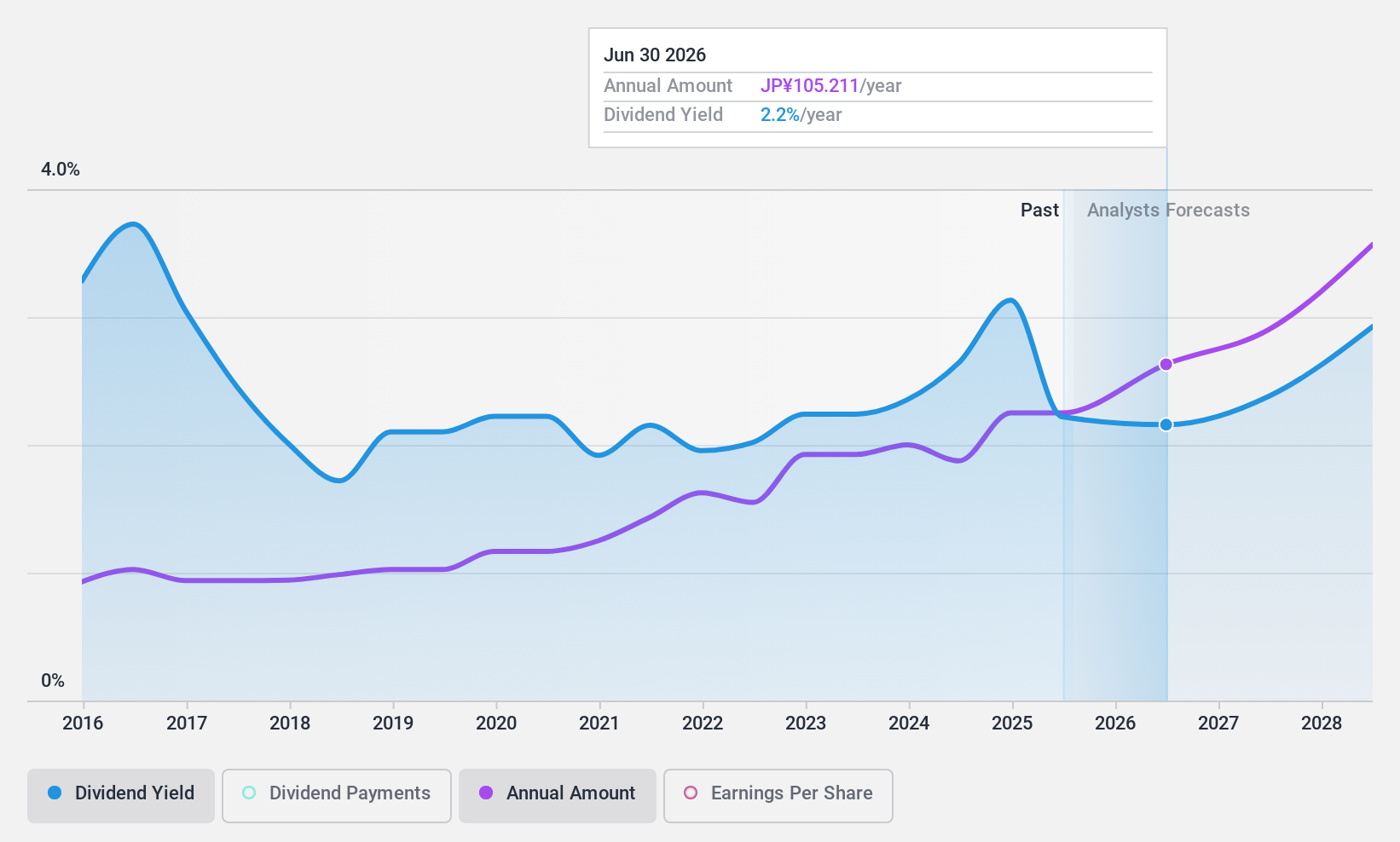

TechnoPro Holdings (TSE:6028)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TechnoPro Holdings, Inc. operates as a temporary staffing and contract work company in Japan and internationally, with a market cap of ¥293.31 billion.

Operations: TechnoPro Holdings generates revenue from its R&D Outsourcing Business (¥168.69 billion), Construction Management Outsourcing (¥23.29 billion), and Overseas Businesses (¥25.68 billion).

Dividend Yield: 3.2%

TechnoPro Holdings' dividend yield of 3.18% is below the top quartile in Japan, with a history of volatility over the past decade. Despite this, dividends are well-covered by both earnings and cash flows, with payout ratios at 58.2% and 30.5%, respectively. Recent buybacks totaling ¥3.66 billion demonstrate a focus on capital efficiency and shareholder value creation, while planned dividend increases suggest potential for growth despite historical instability in payments.

- Unlock comprehensive insights into our analysis of TechnoPro Holdings stock in this dividend report.

- Our expertly prepared valuation report TechnoPro Holdings implies its share price may be lower than expected.

Turning Ideas Into Actions

- Click here to access our complete index of 2040 Top Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnoPro Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6028

TechnoPro Holdings

Through its subsidiaries, operates as a temporary staffing and contract work company in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.