- China

- /

- Medical Equipment

- /

- SZSE:300482

November 2024's Top Growth Companies With Insider Ownership

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, investors are keenly observing how these factors influence stock performance across major indices. In this environment, companies with strong growth potential and high insider ownership can offer unique insights into confidence levels among those closest to the business, potentially indicating alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 101.9% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

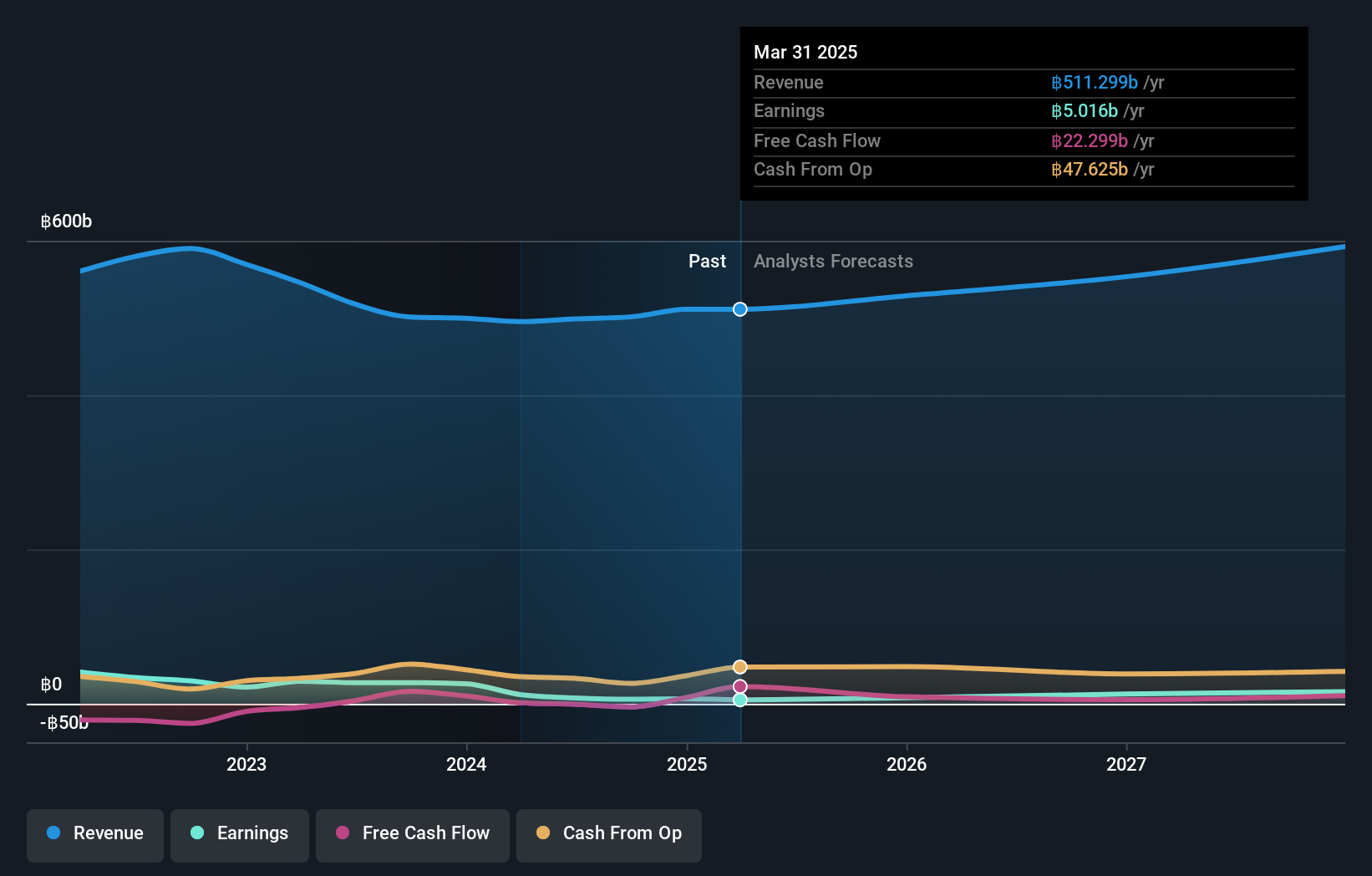

Siam Cement (SET:SCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Siam Cement Public Company Limited, along with its subsidiaries, engages in the cement and building materials, chemicals, and packaging sectors both in Thailand and internationally, with a market cap of THB246 billion.

Operations: Revenue Segments (in millions of THB): Cement and building materials contribute THB182,000 million, chemicals account for THB245,000 million, and packaging generates THB100,000 million.

Insider Ownership: 33.6%

Siam Cement's revenue is forecast to grow at 8.9% annually, outpacing the Thai market, while earnings are expected to rise significantly at 57.8% per year. Despite trading at a substantial discount to its estimated fair value, recent financial results show declining net income and profit margins compared to last year. The company has no recent insider trading activity and faces challenges with debt coverage by operating cash flow and large one-off items affecting earnings quality.

- Click here and access our complete growth analysis report to understand the dynamics of Siam Cement.

- Our comprehensive valuation report raises the possibility that Siam Cement is priced lower than what may be justified by its financials.

KEBODA TECHNOLOGY (SHSE:603786)

Simply Wall St Growth Rating: ★★★★★★

Overview: KEBODA TECHNOLOGY Co., Ltd. manufactures and sells automotive electronics and related products for the automotive industry in China, with a market cap of CN¥23.57 billion.

Operations: KEBODA TECHNOLOGY Co., Ltd. generates revenue from the manufacture and sale of automotive electronics and related products within China's automotive sector.

Insider Ownership: 12.8%

KEBODA TECHNOLOGY's recent earnings report highlights strong growth, with sales reaching CNY 4.27 billion, up from CNY 3.19 billion a year ago, and net income increasing to CNY 606.57 million from CNY 455.25 million. The company's revenue is forecast to grow at a robust pace of over 20% annually, outpacing the market average significantly. Its price-to-earnings ratio of 30x is below the China market average, suggesting potential value for investors despite an unstable dividend track record and no recent insider trading activity.

- Dive into the specifics of KEBODA TECHNOLOGY here with our thorough growth forecast report.

- According our valuation report, there's an indication that KEBODA TECHNOLOGY's share price might be on the expensive side.

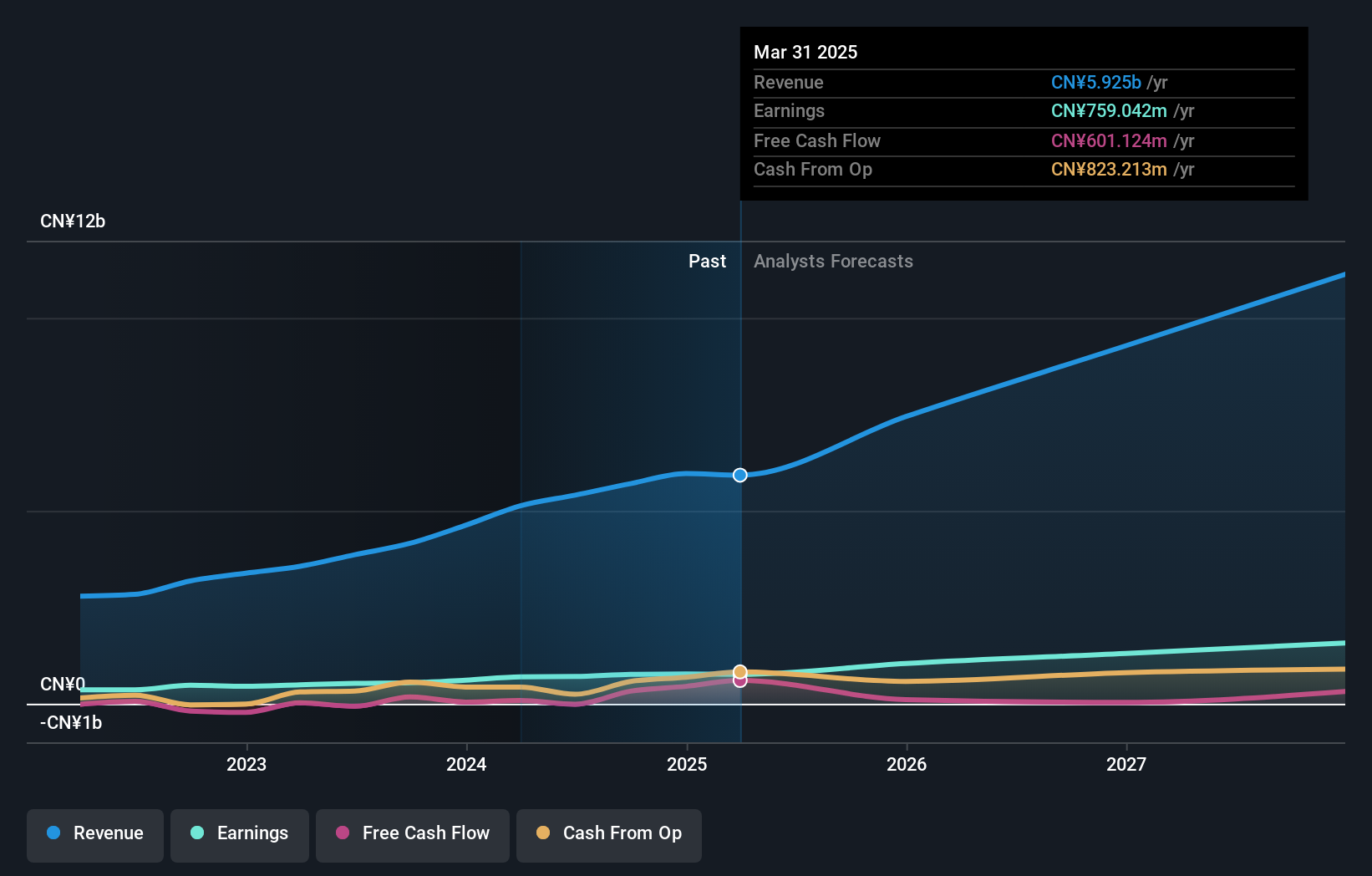

Guangzhou Wondfo BiotechLtd (SZSE:300482)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Wondfo Biotech Co., Ltd is an in vitro diagnostics company focused on the R&D, production, and sale of point-of-care testing products and rapid diagnosis solutions in China, with a market cap of CN¥11.92 billion.

Operations: The company generates revenue primarily from its Diagnostic Kits and Equipment segment, amounting to CN¥2.94 billion.

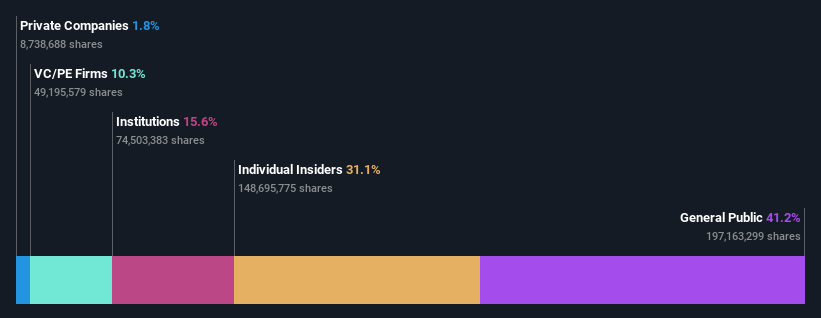

Insider Ownership: 31.1%

Guangzhou Wondfo Biotech's recent earnings show a steady increase, with sales reaching CNY 2.18 billion, up from CNY 2 billion last year, and net income rising to CNY 435.94 million. The company's revenue is projected to grow over 21% annually, surpassing the market average. Its price-to-earnings ratio of 22.6x suggests good value compared to the broader CN market, despite past shareholder dilution and a dividend yield not well-covered by free cash flows.

- Click here to discover the nuances of Guangzhou Wondfo BiotechLtd with our detailed analytical future growth report.

- Our valuation report here indicates Guangzhou Wondfo BiotechLtd may be undervalued.

Next Steps

- Access the full spectrum of 1527 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300482

Guangzhou Wondfo BiotechLtd

An in vitro diagnostics company, engages in the research and development, production, and sale of point-of-care testing products, and rapid diagnosis and chronic disease management solutions in China.

High growth potential with solid track record.