- China

- /

- Commercial Services

- /

- SHSE:603200

Exploring 3 Undiscovered Gems In The Asian Market

Reviewed by Simply Wall St

As the Asian markets navigate a complex landscape of economic indicators and shifting investor sentiment, small-cap stocks have shown varying performances amid global economic changes. With interest rates remaining a focal point for investors, identifying promising opportunities in this environment requires careful consideration of growth potential and resilience. In this context, uncovering lesser-known stocks with strong fundamentals and unique market positions can offer intriguing possibilities for those looking to explore undiscovered gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 26.71% | 37.25% | ★★★★★★ |

| Subaru Enterprise | NA | 1.92% | 4.82% | ★★★★★★ |

| Wuxi Xinan Technology | NA | 10.54% | 5.31% | ★★★★★★ |

| Xiamen Jiarong TechnologyLtd | 8.54% | -5.04% | -25.38% | ★★★★★★ |

| Quality Reliability Technology | 8.30% | 1.20% | -45.53% | ★★★★★★ |

| Toukei Computer | NA | 5.71% | 14.11% | ★★★★★☆ |

| Ebara JitsugyoLtd | 3.85% | 5.45% | 6.38% | ★★★★★☆ |

| Guangdong Transtek Medical Electronics | 9.03% | -12.06% | 8.47% | ★★★★★☆ |

| Zhe Jiang Dayang Biotech Group | 31.27% | 6.28% | -5.17% | ★★★★★☆ |

| Anfu CE LINK | 70.49% | 7.92% | -8.47% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Bangkok Life Assurance (SET:BLA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bangkok Life Assurance Public Company Limited, along with its subsidiaries, offers life insurance services in Thailand and has a market capitalization of THB32.61 billion.

Operations: Bangkok Life Assurance generates revenue primarily from its life insurance business, amounting to THB47.66 billion. The company's financial performance is reflected in its market capitalization of THB32.61 billion.

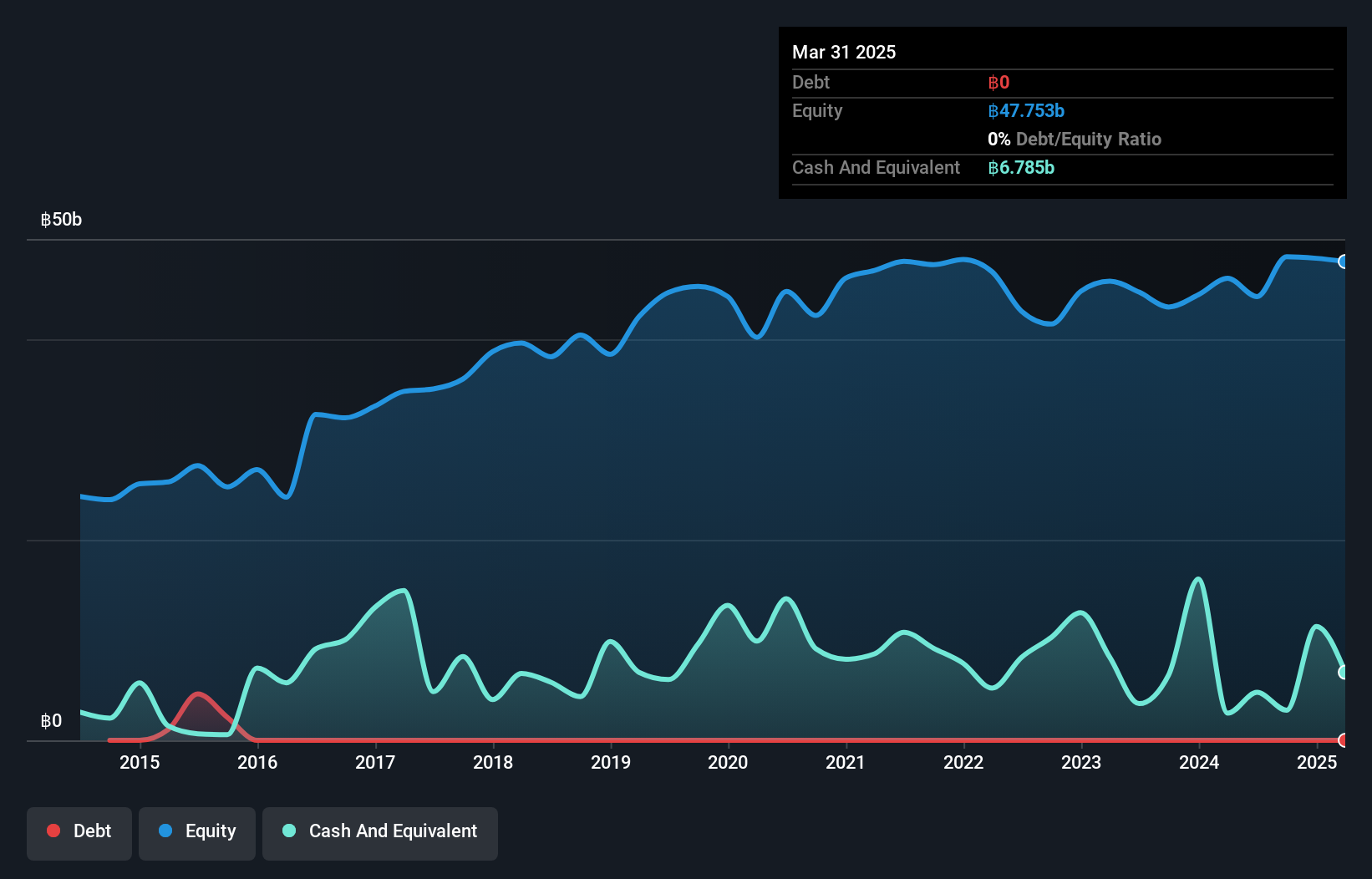

Bangkok Life Assurance, a smaller player in the insurance sector, showcases robust financial health with no debt on its books over the past five years. The company's earnings surged by 42.5% last year, outpacing the industry's -14.2%, although profit margins dipped to 11.8% from 17.2%. Trading at a good value compared to peers and industry standards, it reported a Q3 net income of THB 2.31 billion (US$), up from THB 1.50 billion (US$) a year ago, with basic earnings per share rising to THB 1.35 from THB 0.88, indicating strong operational performance despite margin pressures.

Shanghai Emperor of Cleaning Hi-Tech (SHSE:603200)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Emperor of Cleaning Hi-Tech Co., Ltd offers water treatment and air duct cleaning services in China, with a market cap of CN¥13.78 billion.

Operations: Shanghai Emperor of Cleaning Hi-Tech generates revenue primarily from its water treatment and air duct cleaning services. The company has a market cap of CN¥13.78 billion.

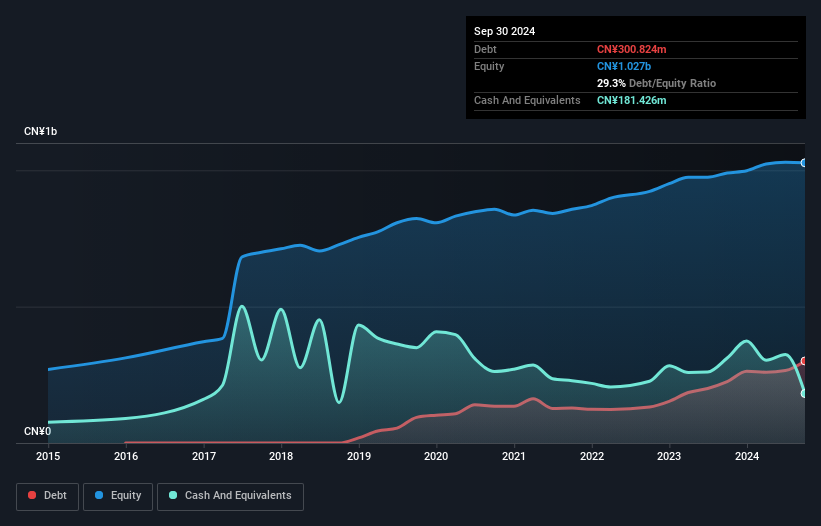

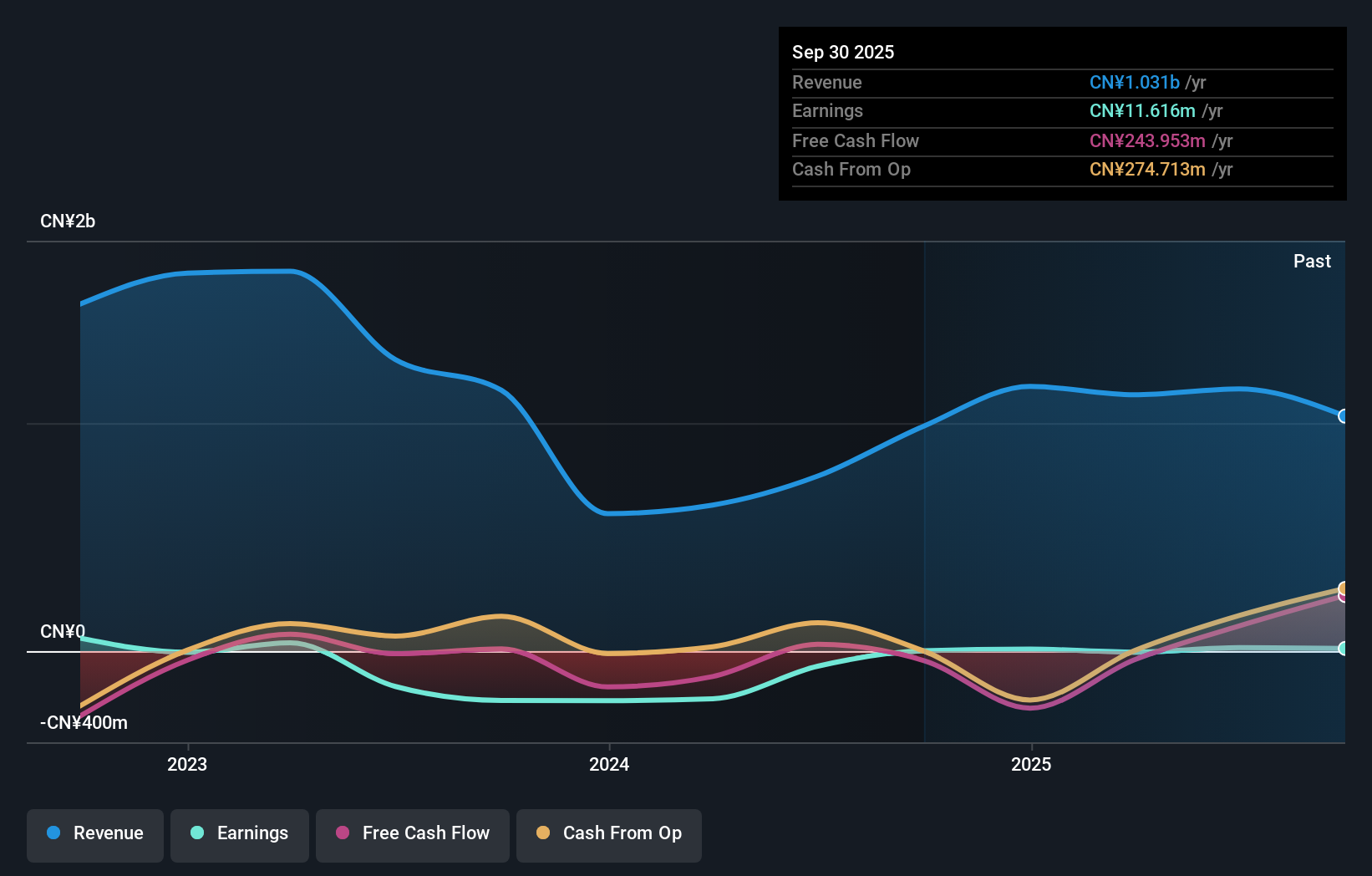

Shanghai Emperor of Cleaning Hi-Tech, a smaller player in the industry, has shown impressive financial performance despite its volatile share price. For the nine months ending September 2025, net income surged to CNY 119.46 million from CNY 48.4 million last year, with basic earnings per share jumping to CNY 0.6808 from CNY 0.2768. The company's debt-to-equity ratio climbed to 35.1% over five years but remains satisfactory at a net level of 11.6%. With earnings growth outpacing the industry at an impressive rate of 127%, Shanghai Emperor seems poised for continued strong performance given its high-quality earnings and positive free cash flow status.

China Harzone Industry (SZSE:300527)

Simply Wall St Value Rating: ★★★★★★

Overview: China Harzone Industry Corp., Ltd specializes in the production and distribution of emergency traffic engineering equipment both domestically and internationally, with a market capitalization of CN¥9.04 billion.

Operations: China Harzone Industry Corp., Ltd generates its revenue primarily through the sale of emergency traffic engineering equipment. The company's financial performance is highlighted by a net profit margin trend that shows fluctuations across reporting periods.

China Harzone Industry, a small-cap player in the machinery sector, has shown impressive earnings growth of 919.5% over the past year, significantly outpacing its industry peers' 6.3%. Despite a five-year earnings decline of 43.1% annually, recent performance suggests potential for recovery. The company is debt-free and trades at an attractive valuation, approximately 8.9% below estimated fair value. However, recent results were influenced by a CN¥22.6 million one-off gain impacting financials up to September 2025. Notably profitable with positive free cash flow, Harzone's future prospects hinge on sustaining this upward trajectory amidst competitive pressures and market conditions.

- Dive into the specifics of China Harzone Industry here with our thorough health report.

Learn about China Harzone Industry's historical performance.

Taking Advantage

- Click this link to deep-dive into the 2474 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603200

Shanghai Emperor of Cleaning Hi-Tech

Provides water treatment and air duct cleaning services in China.

High growth potential with solid track record.

Market Insights

Community Narratives