- Thailand

- /

- Consumer Finance

- /

- SET:JMT

3 Asian Dividend Stocks Yielding Up To 5.2%

Reviewed by Simply Wall St

As global markets navigate through economic uncertainties, including a weakening U.S. labor market and fluctuating interest rates, Asian markets have shown resilience with varied performances across different regions. In this context, dividend stocks in Asia offer an attractive proposition for investors seeking stable income streams; these stocks are often characterized by strong fundamentals and the ability to maintain payouts even amidst broader market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.91% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.63% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.70% | ★★★★★★ |

| NCD (TSE:4783) | 4.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Daicel (TSE:4202) | 4.26% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

Click here to see the full list of 996 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

JMT Network Services (SET:JMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JMT Network Services Public Company Limited, with a market cap of THB18.68 billion, offers debt tracking and collection services to financial institutions and entrepreneurs in Thailand through its subsidiaries.

Operations: JMT Network Services generates revenue primarily from its Non-Performing Accounts Receivable Management Business at THB4.17 billion, followed by its Debt Collection Business at THB227 million and Insurance Business at THB147 million.

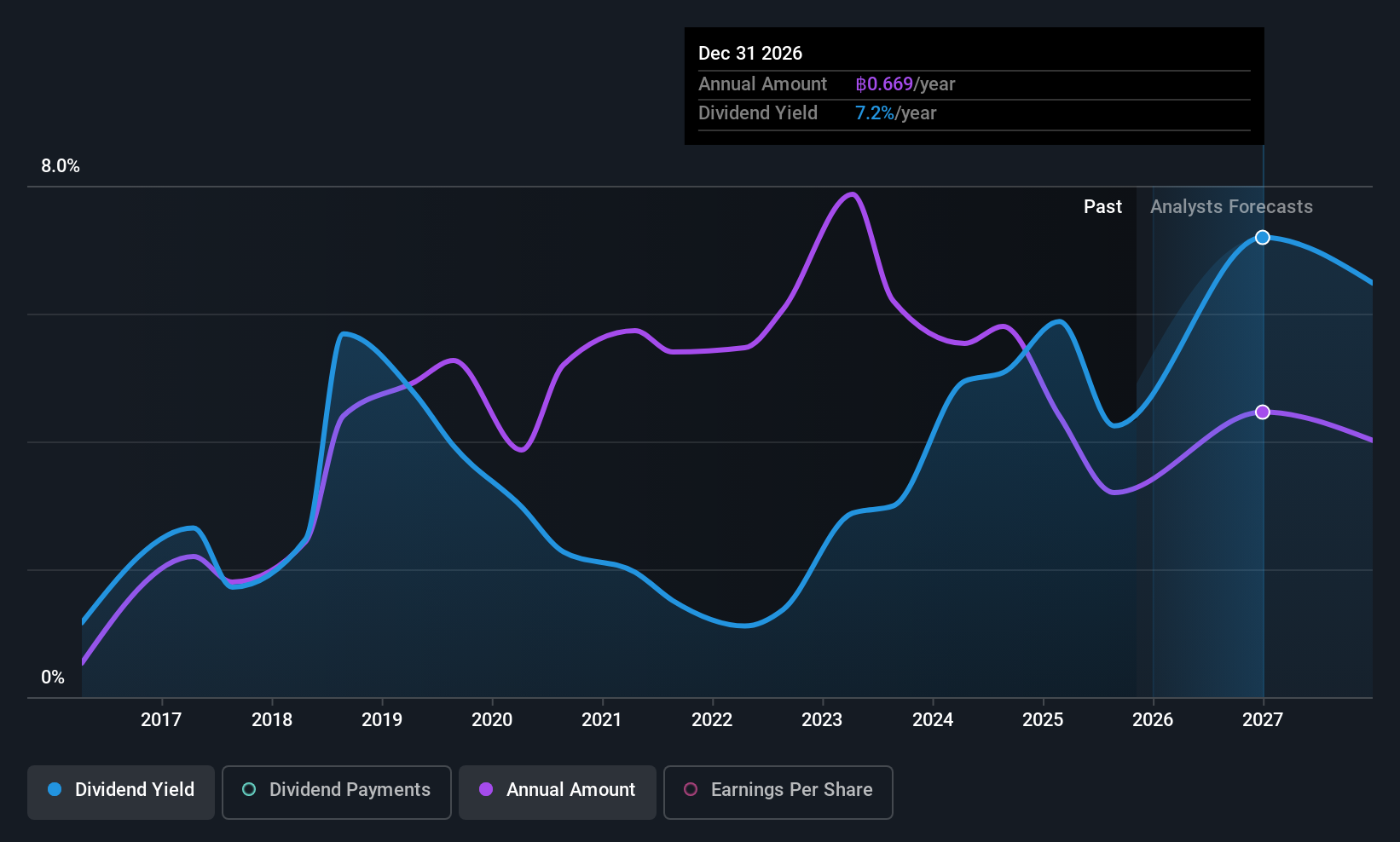

Dividend Yield: 3.7%

JMT Network Services' recent dividend of THB 0.24 per share reflects a decrease, highlighting its volatile dividend history over the past decade. Despite this, dividends are well-covered by earnings and cash flows with payout ratios of 54% and 41.5%, respectively. However, JMT's dividend yield is relatively low in the Thai market at 3.75%. Recent financial results show declining revenue and net income compared to the previous year, which may impact future payouts.

- Navigate through the intricacies of JMT Network Services with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, JMT Network Services' share price might be too optimistic.

Life Travel & Tourist Service (TPEX:2745)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Life Travel & Tourist Service Co., Ltd., along with its subsidiaries, offers a range of package tour services in Taiwan and has a market capitalization of NT$4.23 billion.

Operations: Life Travel & Tourist Service Co., Ltd.'s revenue segment includes NT$8.12 billion from travel services.

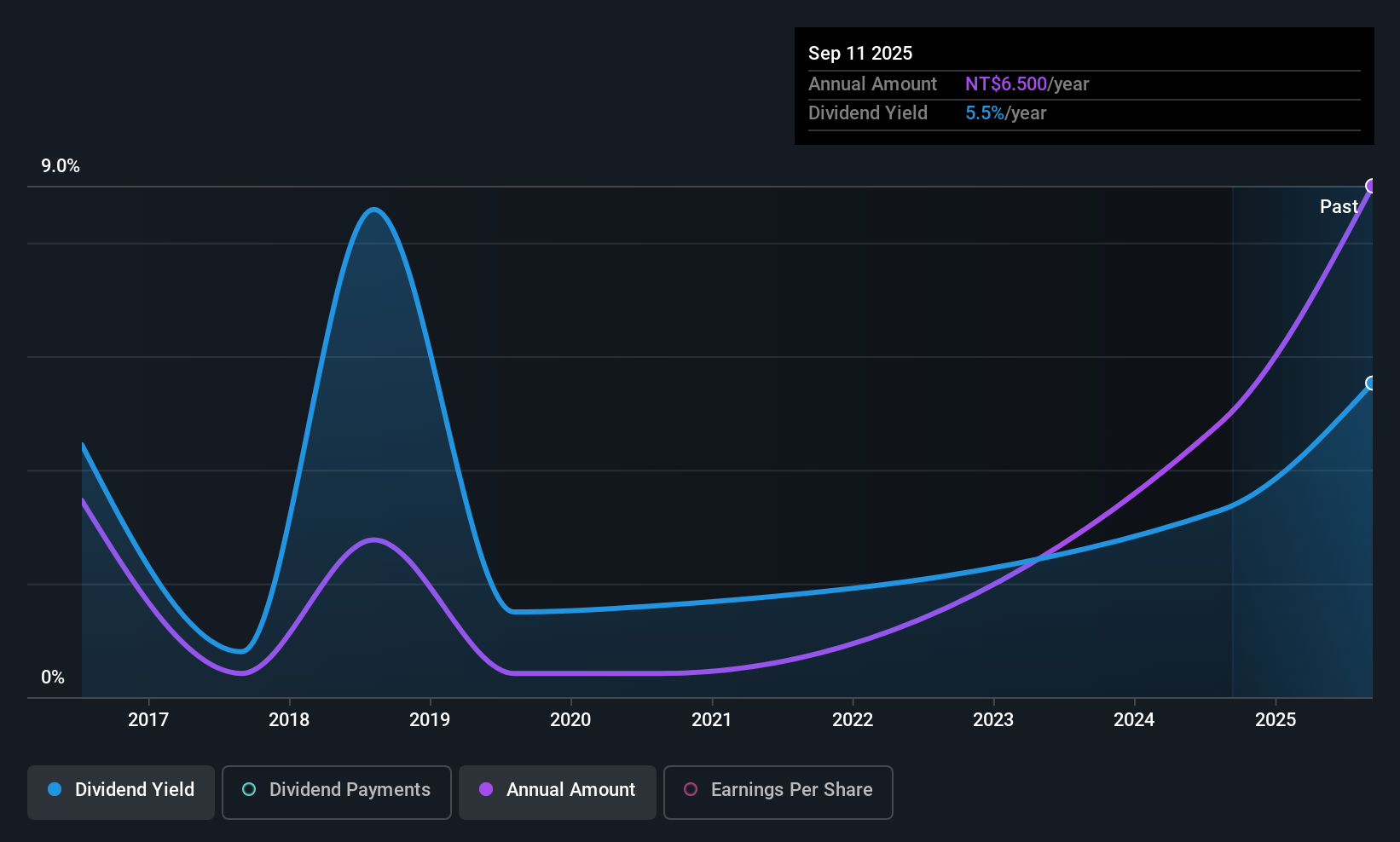

Dividend Yield: 5.2%

Life Travel & Tourist Service's recent financial results reveal a decline in net income, impacting its dividend reliability. Despite a volatile dividend history, the company's payouts are covered by earnings and cash flows with payout ratios of 63.4% and 55.2%, respectively. The price-to-earnings ratio of 14.7x suggests good value relative to the TW market average of 21.4x, though its dividend yield is slightly below top-tier levels at 5.2%.

- Dive into the specifics of Life Travel & Tourist Service here with our thorough dividend report.

- Our expertly prepared valuation report Life Travel & Tourist Service implies its share price may be too high.

Sankyo Seiko (TSE:8018)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sankyo Seiko Co., Ltd. operates in the fashion, textile, and real estate sectors both in Japan and internationally, with a market cap of ¥26.30 billion.

Operations: Sankyo Seiko Co., Ltd.'s revenue is derived from its fashion-related business at ¥9.94 billion, textile-related business at ¥11.23 billion, and real estate-related business at ¥2.65 billion.

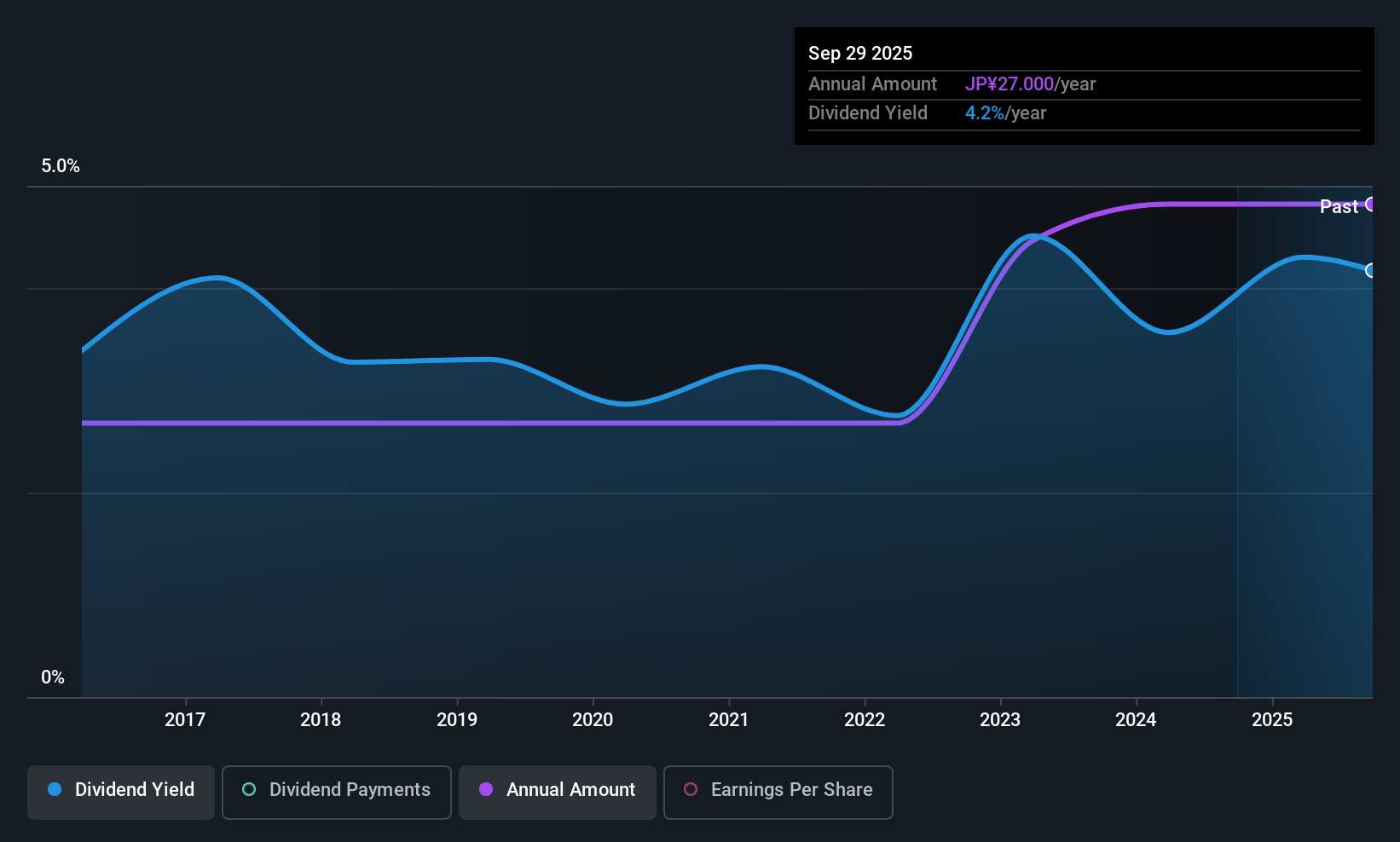

Dividend Yield: 3.9%

Sankyo Seiko offers a dividend yield of 3.92%, placing it in the top 25% of dividend payers in Japan. Despite stable and growing dividends over the past decade, its payouts are not supported by free cash flows, raising concerns about sustainability. The payout ratio is reasonable at 51.1%, indicating coverage by earnings, but not cash flows. With a price-to-earnings ratio of 12.9x below the market average, it presents potential value for investors seeking dividends.

- Click here to discover the nuances of Sankyo Seiko with our detailed analytical dividend report.

- Our valuation report here indicates Sankyo Seiko may be overvalued.

Next Steps

- Discover the full array of 996 Top Asian Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:JMT

JMT Network Services

Provides debt tracking and collection services for financial institutions and entrepreneurs in Thailand.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives