Undiscovered Gems Three Small Caps with Strong Financial Foundations

Reviewed by Simply Wall St

As global markets grapple with economic slowdown concerns and fluctuating indices, small-cap stocks have faced their share of volatility. Despite these challenges, companies with strong financial foundations can offer promising opportunities for investors looking to navigate uncertain times. In this environment, identifying small-cap stocks with robust balance sheets and sustainable growth prospects becomes crucial for long-term success.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 72.09% | 7.89% | -1.99% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 72.83% | 12.17% | 19.18% | ★★★★☆☆ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| TopGum Industries | 30.51% | 15.69% | 33.91% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Triputra Agro Persada (IDX:TAPG)

Simply Wall St Value Rating: ★★★★★☆

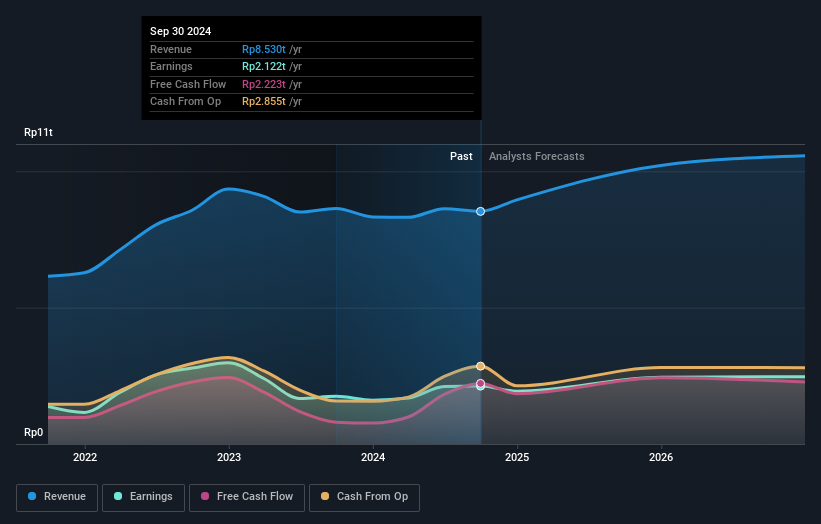

Overview: PT Triputra Agro Persada Tbk operates oil palm plantations and palm oil processing businesses in Indonesia, with a market cap of IDR15.88 billion.

Operations: PT Triputra Agro Persada Tbk generates revenue primarily from palm oil products and their derivatives (IDR8.60 billion), with a smaller contribution from rubber products and their derivatives (IDR28.47 million). The company operates within the oil palm plantations and palm oil processing sectors in Indonesia.

Triputra Agro Persada, trading at 47.3% below its fair value estimate, has seen its debt to equity ratio drop from 100.9% to 12.6% over five years. Earnings grew by 26% last year, outpacing the food industry's -6.7%. With EBIT covering interest payments 28 times over and a satisfactory net debt to equity ratio of 7.6%, the company shows strong financial health. Recent half-year results revealed sales of IDR4 trillion (US$260 million) and net income of IDR966 billion (US$62 million), doubling from the previous year.

- Delve into the full analysis health report here for a deeper understanding of Triputra Agro Persada.

China Banking (PSE:CBC)

Simply Wall St Value Rating: ★★★★☆☆

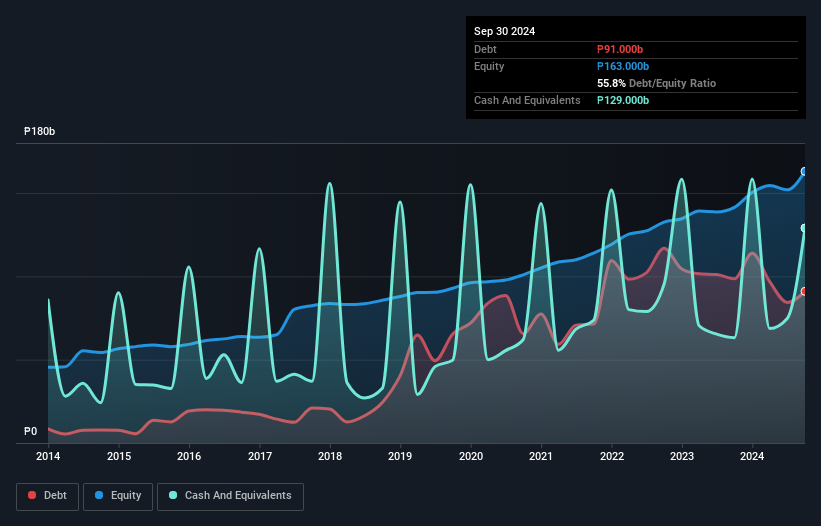

Overview: China Banking Corporation offers a range of banking and financial services to individuals and businesses in the Philippines, with a market cap of ₱110.34 billion.

Operations: China Banking Corporation generates revenue primarily through interest income from loans and advances, as well as fees and commissions from its banking services. The company's net profit margin stands at 21.45%.

China Banking Corporation (CBC) has total assets of ₱1,544.9B and equity of ₱151.9B, with deposits at ₱1,283.3B and loans totaling ₱797.2B. The bank's net interest margin stands at 4.2%. CBC's earnings grew 14% last year, outpacing the industry average of 13.7%. However, it struggles with a high level of bad loans at 2.4% and an insufficient allowance for these bad loans (91%). Recent executive changes include the promotion of Stephen Y. Tan to Senior Vice President effective September 2024.

- Click here and access our complete health analysis report to understand the dynamics of China Banking.

Explore historical data to track China Banking's performance over time in our Past section.

PSG Corporation (SET:PSG)

Simply Wall St Value Rating: ★★★★★★

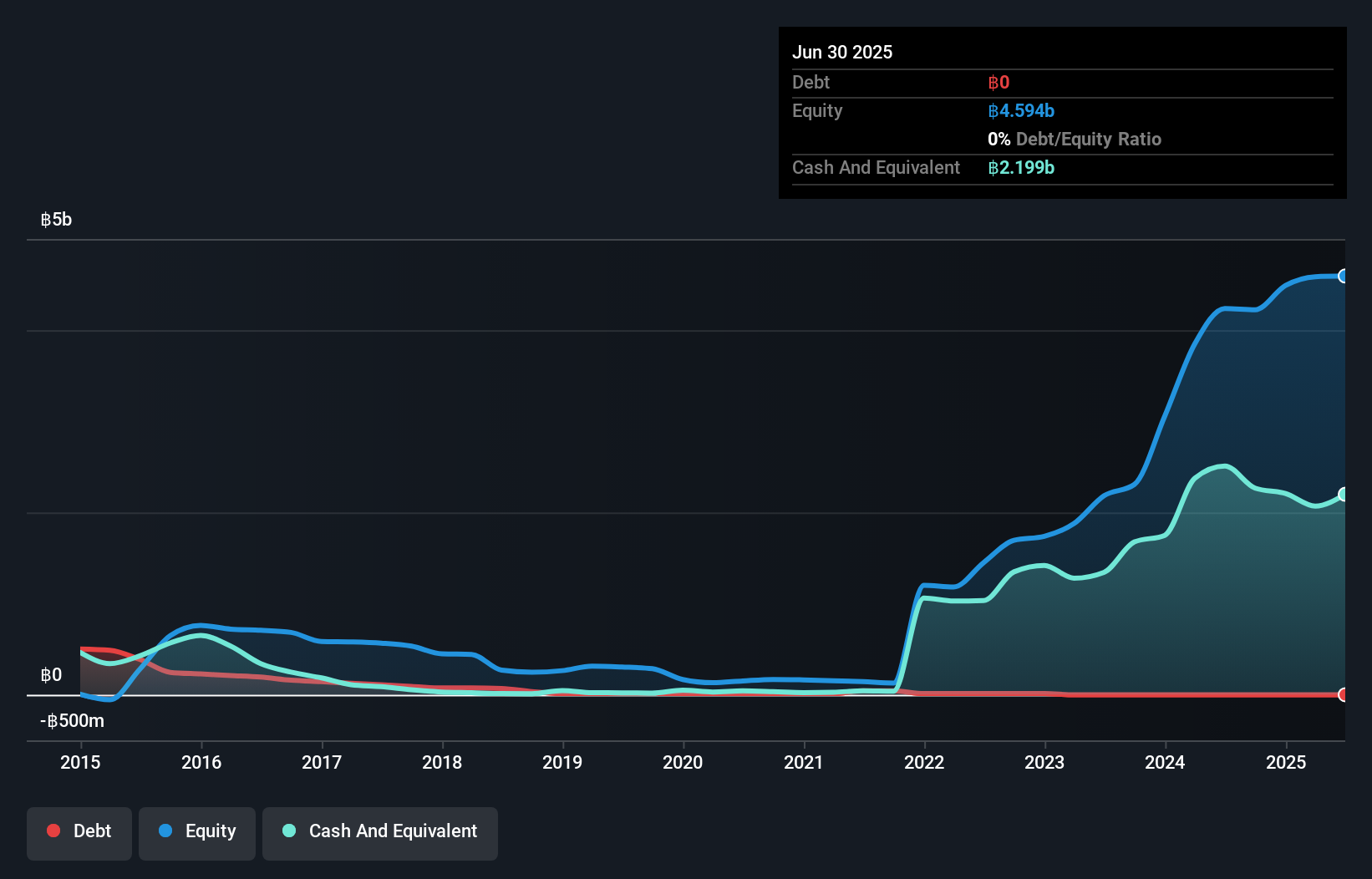

Overview: PSG Corporation Public Company Limited, along with its subsidiary PSGC (Lao) Sole Company Limited, operates in turnkey engineering, procurement, and construction (EPC) and large-scale construction projects in Thailand and the Lao People’s Democratic Republic with a market cap of THB43.54 billion.

Operations: PSG Corporation Public Company Limited generates revenue primarily from plant and building construction, amounting to THB4.15 billion. The company's market cap stands at THB43.54 billion.

PSG Corporation has shown impressive growth, with earnings surging 178.5% over the past year, far outpacing the Construction industry’s 12.5%. The company reported a net income of THB 388.76 million for Q2 2024, up from THB 300.41 million a year earlier. Trading at 58.1% below its estimated fair value and being debt-free enhances its appeal. Despite high volatility in share price recently, PSG remains profitable and boasts high-quality non-cash earnings.

Key Takeaways

- Gain an insight into the universe of 4850 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triputra Agro Persada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:TAPG

Triputra Agro Persada

Engages in the oil palm plantations and palm oil processing businesses in Indonesia.

Very undervalued with flawless balance sheet and pays a dividend.