In the wake of recent market fluctuations driven by policy uncertainties in the U.S. and global economic shifts, investors are seeking stability amidst volatility. With inflationary pressures and interest rate expectations influencing market sentiment, dividend stocks offer a potential avenue for income generation and portfolio resilience. When considering dividend stocks, factors such as a company's financial health, consistent payout history, and ability to sustain dividends in varying economic climates are crucial for making informed investment decisions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.66% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.47% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.88% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.55% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

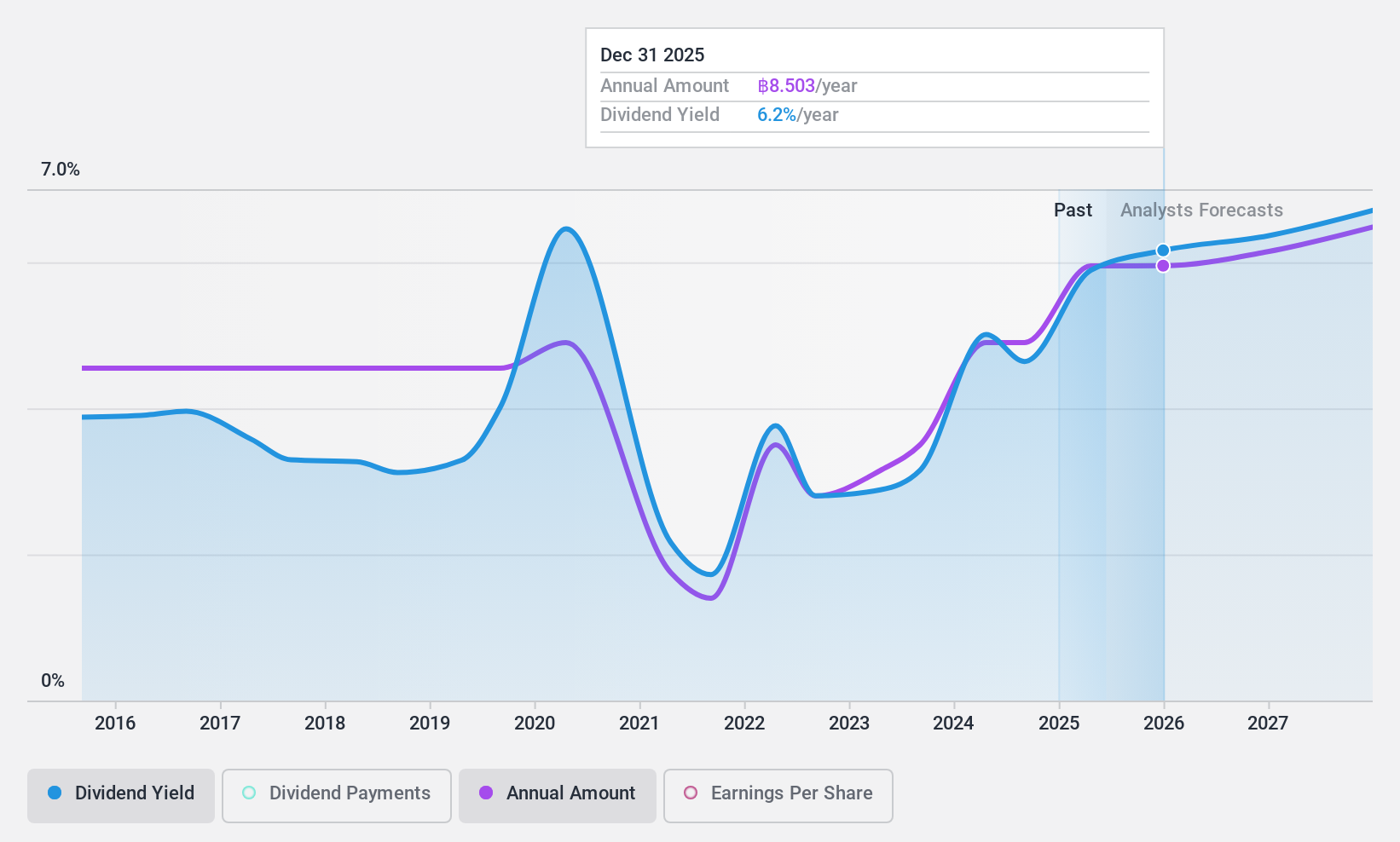

Bangkok Bank (SET:BBL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bangkok Bank Public Company Limited offers a range of commercial banking products and services both in Thailand and internationally, with a market cap of THB283.46 billion.

Operations: Bangkok Bank generates revenue from its diverse array of commercial banking products and services offered both domestically and internationally.

Dividend Yield: 4.6%

Bangkok Bank's dividend payments are well covered by earnings, with a low payout ratio of 30.6%, and are forecast to remain sustainable at 31.9% over the next three years. Despite trading at a significant discount to its estimated fair value, the bank's dividend yield of 4.64% is lower than top-tier payers in Thailand. The bank has a high level of non-performing loans at 3.9%, and its dividends have been volatile over the past decade despite recent growth in earnings and dividends affirmed for September 2024.

- Unlock comprehensive insights into our analysis of Bangkok Bank stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Bangkok Bank is priced lower than what may be justified by its financials.

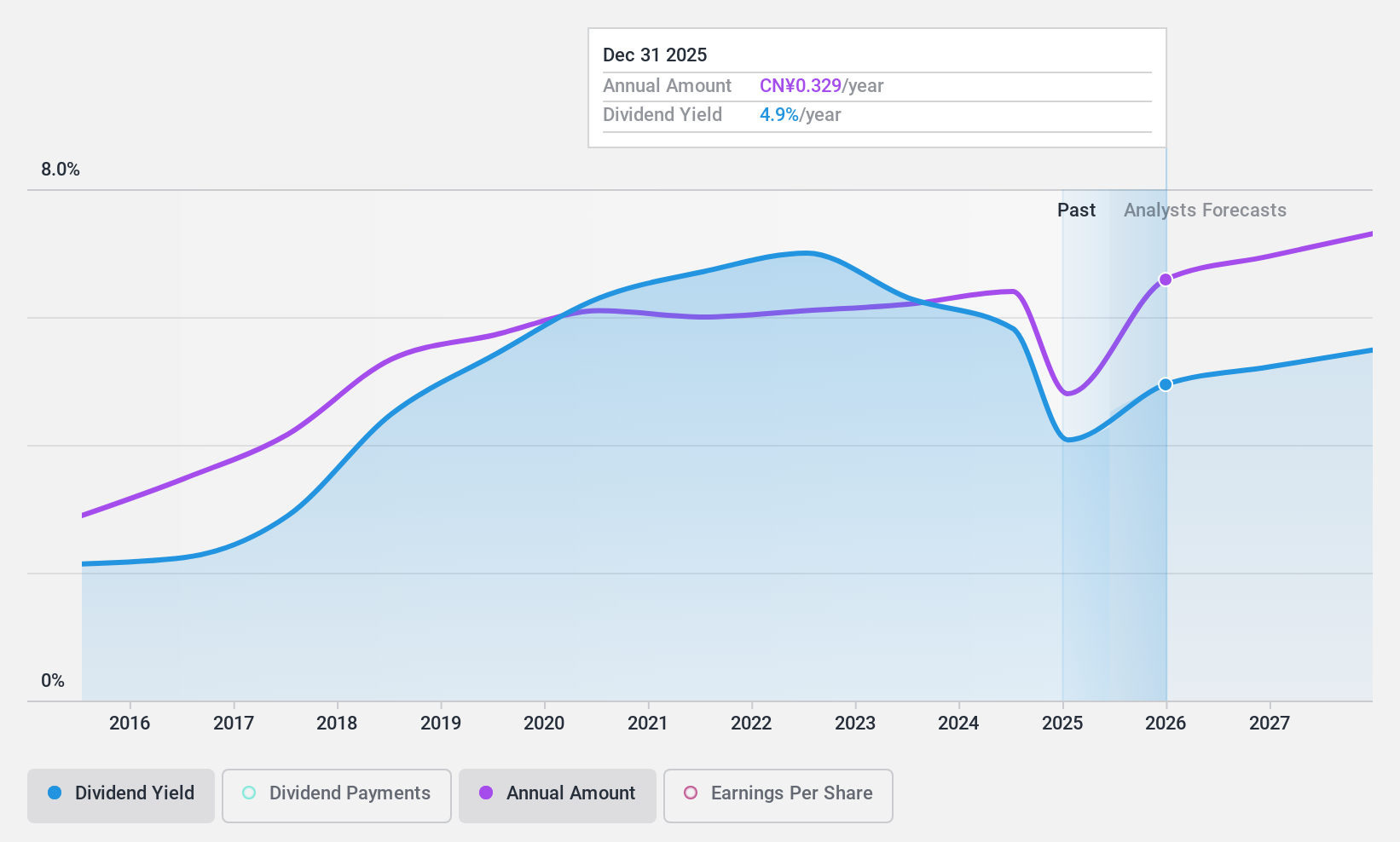

Bank of Beijing (SHSE:601169)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bank of Beijing Co., Ltd. offers a range of banking services to both personal and corporate customers in China, with a market cap of CN¥118.19 billion.

Operations: Bank of Beijing Co., Ltd. generates its revenue through a variety of banking services tailored for both individual and business clients in China.

Dividend Yield: 5.6%

Bank of Beijing offers a compelling dividend profile, trading 62.4% below its estimated fair value and providing a high yield of 5.57%, placing it in the top 25% of CN market payers. Its dividends have been stable and growing over the past decade, supported by a low payout ratio of 29.7%. Recent earnings reports show consistent growth, with net income rising to CNY 20.62 billion for the first nine months of 2024, ensuring dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Bank of Beijing.

- In light of our recent valuation report, it seems possible that Bank of Beijing is trading behind its estimated value.

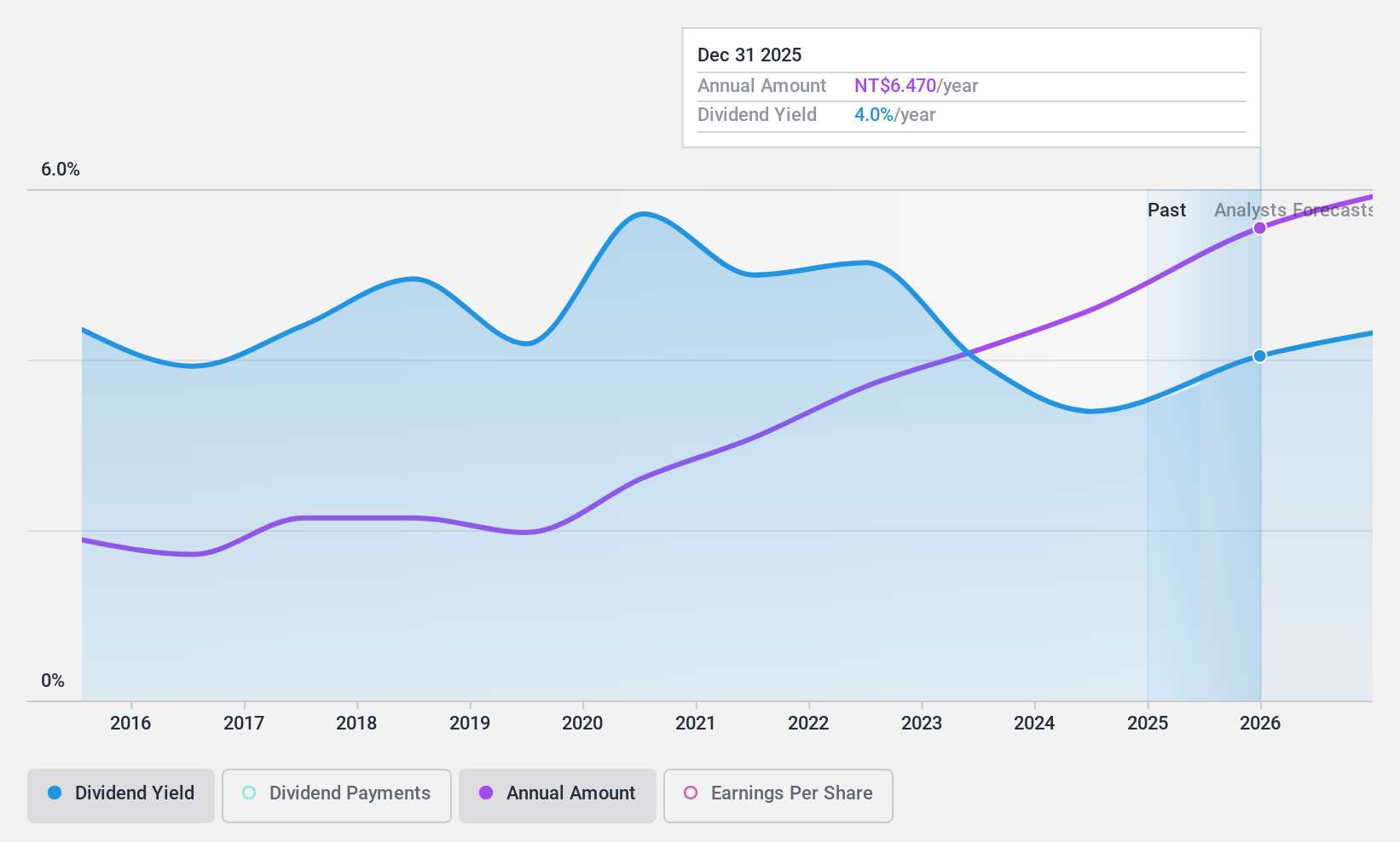

Taiwan Hon Chuan Enterprise (TWSE:9939)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Hon Chuan Enterprise Co., Ltd. manufactures and sells packaging materials for the food and beverage industries across Taiwan, Mainland China, Southeast Asia, and internationally, with a market cap of NT$46.29 billion.

Operations: Taiwan Hon Chuan Enterprise Co., Ltd. generates revenue from manufacturing and selling packaging materials primarily for the food and beverage sectors across various regions, including Taiwan, Mainland China, Southeast Asia, and other international markets.

Dividend Yield: 3.4%

Taiwan Hon Chuan Enterprise's dividend stability over the past decade is notable, though its 3.43% yield lags behind top-tier TW market payers. While dividends are covered by earnings with a payout ratio of 53.8%, they are not supported by free cash flows due to a high cash payout ratio of 854.9%. Recent earnings growth and undervaluation compared to fair value suggest potential for future appreciation, despite shareholder dilution and significant debt levels impacting financial flexibility.

- Click here to discover the nuances of Taiwan Hon Chuan Enterprise with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Taiwan Hon Chuan Enterprise shares in the market.

Key Takeaways

- Click through to start exploring the rest of the 1951 Top Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Beijing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601169

Bank of Beijing

Provides various banking services to personal and corporate customers in China.

Flawless balance sheet 6 star dividend payer.