- Thailand

- /

- Real Estate

- /

- SET:AP

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a mixed performance across various sectors. With U.S. stocks giving back some gains and inflation data influencing interest rate expectations, dividend stocks continue to attract attention for their potential to provide steady income amid market volatility. In this environment, a good dividend stock is often characterized by its ability to maintain consistent payouts and demonstrate resilience against economic shifts, making it an appealing option for those seeking stability in turbulent times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.95% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

AP (Thailand) (SET:AP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AP (Thailand) Public Company Limited, with a market cap of THB27.37 billion, operates in the real estate development sector in Thailand through its subsidiaries.

Operations: AP (Thailand) Public Company Limited generates revenue primarily from its Low-Rise Segment with THB32.09 billion and High-Rise Segment with THB3.46 billion.

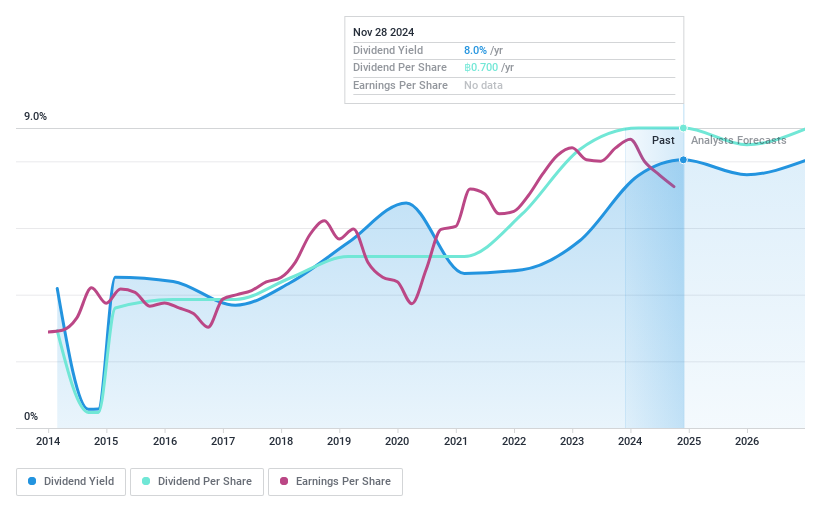

Dividend Yield: 7.9%

AP (Thailand) offers a high dividend yield of 7.91%, placing it in the top 25% of Thai market payers, yet its dividends have been volatile over the past decade. Despite a low payout ratio of 43.5%, dividends are not well covered by cash flows, with a cash payout ratio at 234.4%. The stock trades at good value with a P/E ratio of 5.5x and analysts anticipate price growth. Recent earnings showed declining net income year-over-year.

- Dive into the specifics of AP (Thailand) here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of AP (Thailand) shares in the market.

S & J International Enterprises (SET:S&J)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: S & J International Enterprises Public Company Limited, along with its subsidiaries, is engaged in the manufacturing and distribution of cosmetic products both in Thailand and globally, with a market capitalization of approximately THB5.88 billion.

Operations: S & J International Enterprises Public Company Limited generates revenue through the manufacturing and distribution of cosmetic products across domestic and international markets.

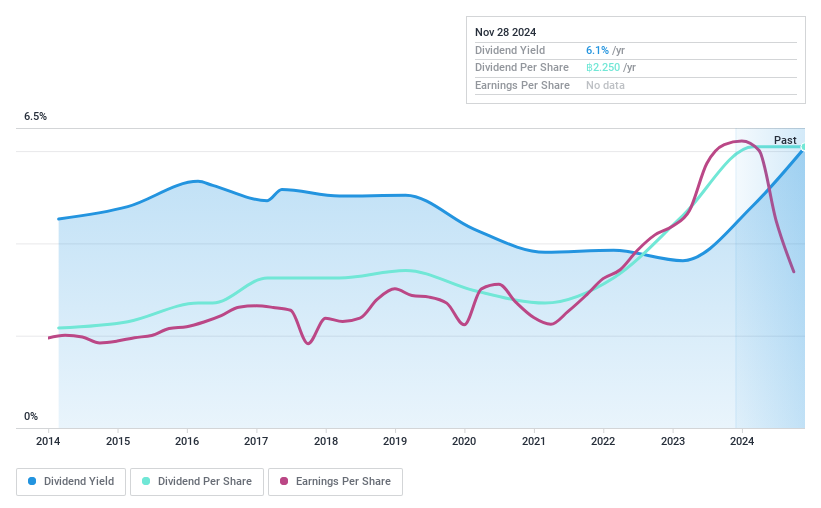

Dividend Yield: 5.8%

S & J International Enterprises has maintained stable and growing dividends over the past decade, though its current payout ratio of 86.2% suggests coverage by earnings is tight. The dividend yield of 5.77% is below the top quartile in Thailand, and high cash payout ratio (172.4%) indicates poor coverage by free cash flows. Recent earnings show a significant decline in net income, with Q3 figures at THB 48.38 million compared to THB 174.4 million last year, potentially impacting future payouts.

- Click here to discover the nuances of S & J International Enterprises with our detailed analytical dividend report.

- The valuation report we've compiled suggests that S & J International Enterprises' current price could be inflated.

Thai Steel Cable (SET:TSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thai Steel Cable Public Company Limited manufactures and distributes automobile and motorcycle control cables, as well as automobile window regulators in Thailand, with a market cap of THB3.72 billion.

Operations: Thai Steel Cable's revenue primarily comes from its control cables for automobiles and motorcycles, along with automobile window regulators, totaling THB2.78 billion.

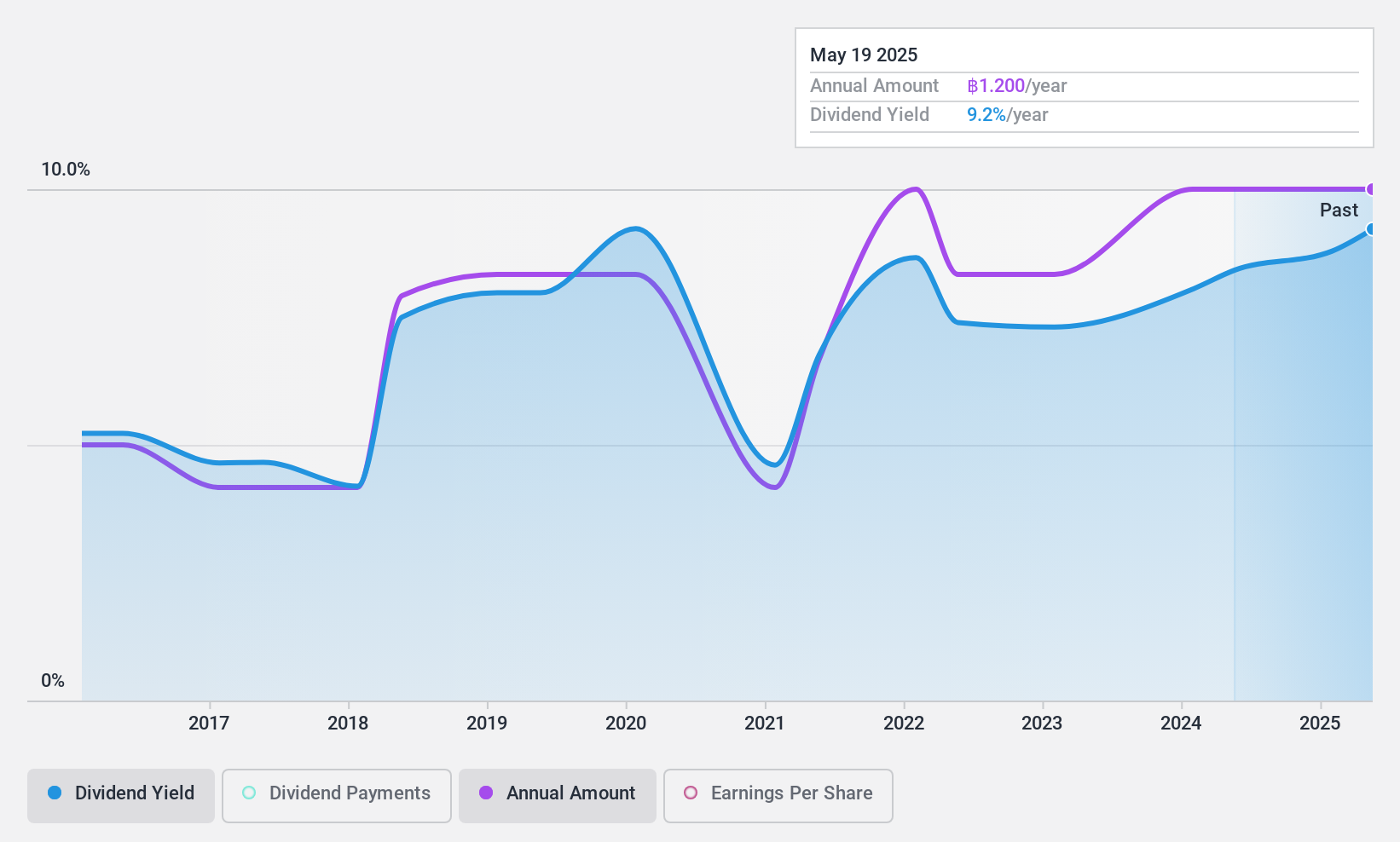

Dividend Yield: 8.2%

Thai Steel Cable's dividend yield of 8.16% ranks in the top 25% of Thai market payers, yet its sustainability is questionable given a high payout ratio of 97.8%, indicating poor earnings coverage. Although dividends have increased over the past decade, they remain volatile with significant annual drops. Despite trading significantly below estimated fair value and reasonable cash flow coverage (74.6%), recent executive changes might introduce uncertainty in financial management stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Thai Steel Cable.

- The analysis detailed in our Thai Steel Cable valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Delve into our full catalog of 1957 Top Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:AP

AP (Thailand)

Engages in the real estate development business in Thailand.

Good value with adequate balance sheet and pays a dividend.