As global markets navigate the uncertainties surrounding the incoming Trump administration and fluctuating interest rates, investors are seeking stability amidst volatility. With some sectors experiencing wide dispersion in returns, dividend stocks offer a potential source of consistent income, making them an attractive option for those looking to balance risk and reward in today's economic climate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

Click here to see the full list of 1966 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

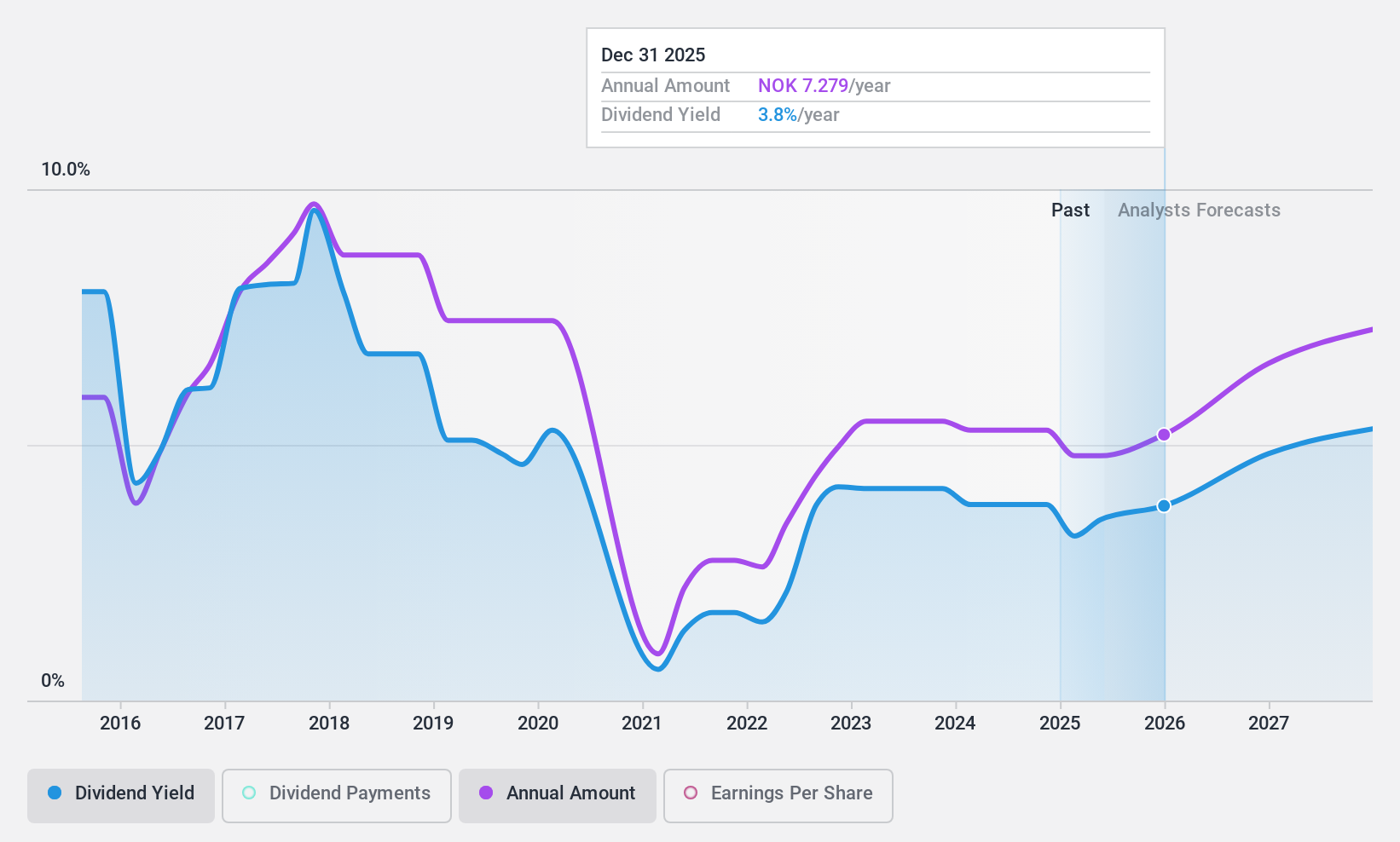

Mowi (OB:MOWI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mowi ASA is a seafood company that farms, produces, and supplies Atlantic salmon products globally, with a market cap of NOK103.99 billion.

Operations: Mowi ASA generates revenue through its segments of Feed (€1.11 billion), Farming (€3.46 billion), Sales & Marketing - Markets (€3.90 billion), and Sales and Marketing - Consumer Products (€3.68 billion).

Dividend Yield: 3.5%

Mowi's dividend payments have increased over the past decade, supported by a reasonable payout ratio of 69.1% and cash flow coverage at 59.7%. However, the dividends have been unreliable and volatile during this period. The stock trades significantly below its estimated fair value but offers a lower yield compared to top-tier Norwegian dividend payers. Recent earnings showed declining net income despite rising sales, while strategic reviews in Canada could impact future operations.

- Get an in-depth perspective on Mowi's performance by reading our dividend report here.

- The analysis detailed in our Mowi valuation report hints at an deflated share price compared to its estimated value.

TMBThanachart Bank (SET:TTB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TMBThanachart Bank Public Company Limited offers a range of commercial banking products and services to individuals, SMEs, and corporate customers mainly in Thailand, with a market capitalization of approximately THB174.35 billion.

Operations: TMBThanachart Bank Public Company Limited generates revenue primarily from its Retail Banking segment, which accounts for THB45.42 billion, and its Commercial Banking segment, contributing THB19.96 billion.

Dividend Yield: 6.7%

TMBThanachart Bank's dividend yield ranks in the top 25% of Thai dividend payers, though its history shows volatility and unreliability. Despite a high level of bad loans at 3.1%, recent earnings growth of 19.2% supports its current payout ratio of 56.1%. Dividends are forecast to remain covered by earnings, with a projected payout ratio of 58.1% in three years, maintaining sustainability despite past fluctuations in payments.

- Delve into the full analysis dividend report here for a deeper understanding of TMBThanachart Bank.

- Our valuation report unveils the possibility TMBThanachart Bank's shares may be trading at a discount.

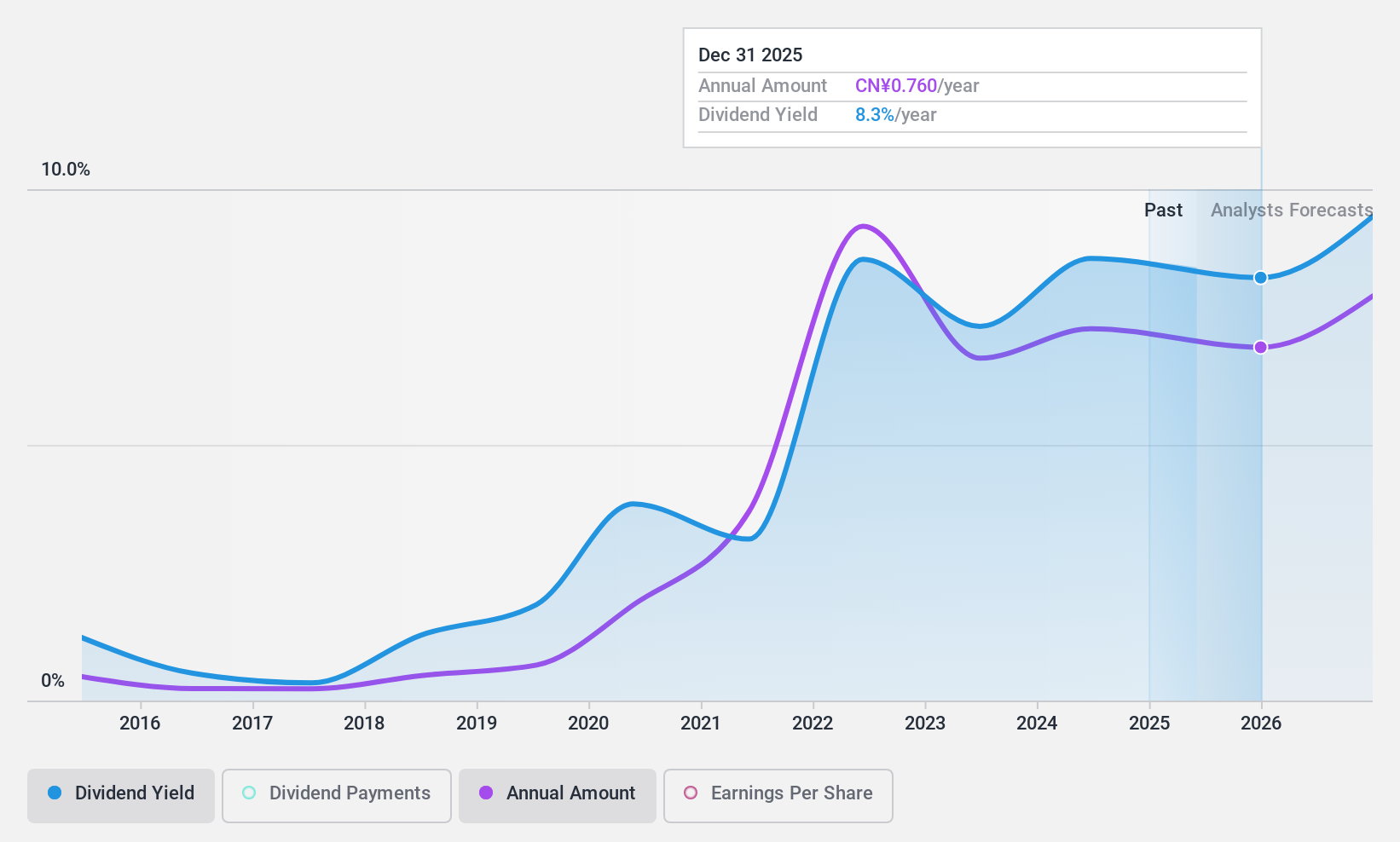

Inner Mongolia ERDOS ResourcesLtd (SHSE:600295)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inner Mongolia Erdos Resources Co., Ltd. operates in the garment, energy, chemical, and metallurgy sectors in China with a market cap of CN¥24.82 billion.

Operations: Inner Mongolia Erdos Resources Co., Ltd. generates revenue from its operations in the garment, energy, chemical, and metallurgy sectors within China.

Dividend Yield: 8.1%

Inner Mongolia ERDOS Resources Ltd. offers a high dividend yield of 8.1%, placing it among the top 25% in China, but its dividends are not well covered by earnings given a payout ratio of 106.7%. Although cash flows cover the dividend with a cash payout ratio of 60.9%, past payments have been volatile and unreliable over the last decade. The company trades at good value, being 31.7% below estimated fair value despite declining recent financial results.

- Dive into the specifics of Inner Mongolia ERDOS ResourcesLtd here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Inner Mongolia ERDOS ResourcesLtd shares in the market.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1963 more companies for you to explore.Click here to unveil our expertly curated list of 1966 Top Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TMBThanachart Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:TTB

TMBThanachart Bank

Provides various commercial banking products and services to individuals, large-sized and medium-sized business, small-size business, and corporate customers primarily in Thailand.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives