- Thailand

- /

- Auto Components

- /

- SET:STA

October 2024's Leading Growth Stocks With Insider Confidence

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and economic uncertainty, growth stocks have shown resilience, with the tech-heavy Nasdaq Composite Index managing slight gains amidst broader market challenges. In this environment, companies with high insider ownership often signal strong confidence from those closest to the business, making them compelling candidates for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

Prataap Snacks (NSEI:DIAMONDYD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Prataap Snacks Limited manufactures and sells packaged snacks in India and internationally, with a market cap of ₹24.68 billion.

Operations: The company's revenue is primarily derived from its Snacks Food segment, which generated ₹16.52 billion.

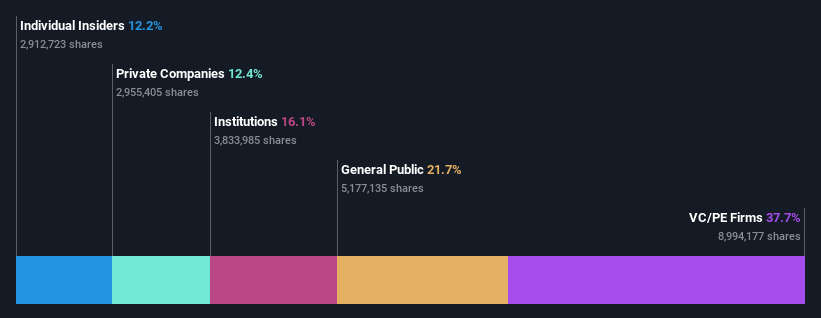

Insider Ownership: 12.2%

Revenue Growth Forecast: 11.3% p.a.

Prataap Snacks is experiencing notable growth, with earnings forecasted to rise significantly at 24.5% annually, outpacing the Indian market's average. Despite a recent dip in net income, revenue increased year-over-year. Insider ownership remains strong with no substantial selling reported recently. A significant M&A activity involves Authum Investment acquiring a large stake for INR 8.5 billion, highlighting investor confidence and potential strategic shifts within the company pending regulatory approvals.

- Click to explore a detailed breakdown of our findings in Prataap Snacks' earnings growth report.

- The valuation report we've compiled suggests that Prataap Snacks' current price could be quite moderate.

Sri Trang Agro-Industry (SET:STA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sri Trang Agro-Industry Public Company Limited, along with its subsidiaries, is engaged in the manufacturing and distribution of natural rubber products across Thailand, China, the United States, Singapore, Japan, and other international markets with a market capitalization of THB30.41 billion.

Operations: The company's revenue is primarily derived from its Natural Rubbers segment, which accounts for THB73.24 billion, and its Gloves segment, contributing THB21.49 billion.

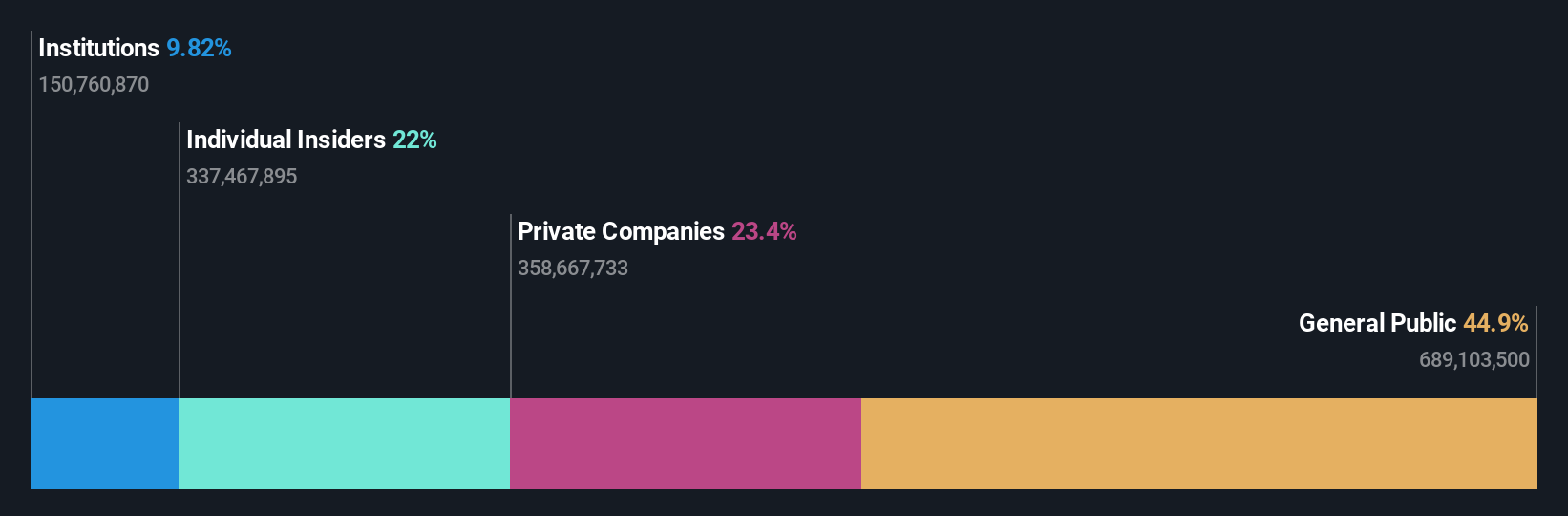

Insider Ownership: 21.6%

Revenue Growth Forecast: 14.6% p.a.

Sri Trang Agro-Industry is trading at a 28.4% discount to its estimated fair value, indicating good relative value compared to peers. The company is forecasted to achieve earnings growth of 72.34% annually, outpacing the Thai market's average profit growth and expected to become profitable within three years. Despite slower revenue growth than some high-growth benchmarks, recent earnings show improvement with net income rising significantly in the latest quarter compared to last year.

- Unlock comprehensive insights into our analysis of Sri Trang Agro-Industry stock in this growth report.

- Our valuation report unveils the possibility Sri Trang Agro-Industry's shares may be trading at a discount.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland and has a market cap of PLN1.19 billion.

Operations: The company's revenue is derived from two main segments: Solutions, contributing PLN133.13 million, and Subscriptions, accounting for PLN38.24 million.

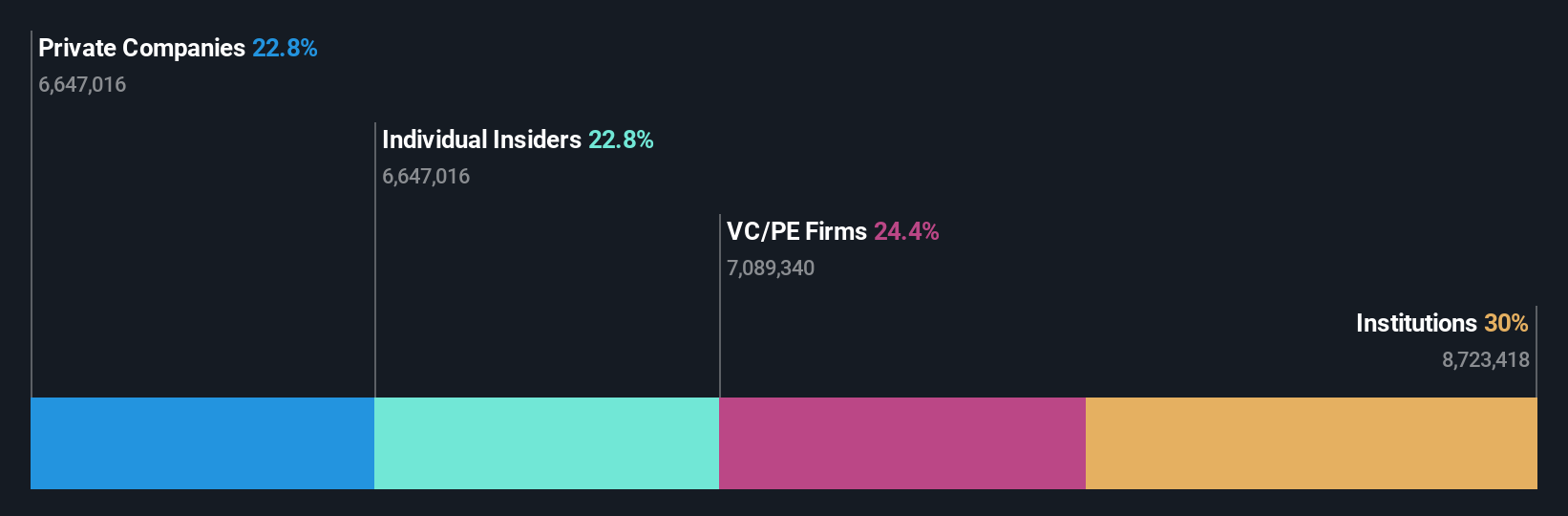

Insider Ownership: 24%

Revenue Growth Forecast: 16.6% p.a.

Shoper shows promise with earnings expected to grow significantly at 25% annually, outpacing the Polish market. Revenue is forecasted to increase by 16.6% per year, which is above the market average but below high-growth thresholds. The stock trades at an 18.3% discount to its estimated fair value, suggesting potential undervaluation. Recent half-year results reported revenue of PLN 90.3 million and net income of PLN 15.79 million, reflecting substantial year-on-year growth.

- Navigate through the intricacies of Shoper with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Shoper is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Click here to access our complete index of 1514 Fast Growing Companies With High Insider Ownership.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:STA

Sri Trang Agro-Industry

Manufactures and distributes natural rubber products in Thailand, China, the United States, Singapore, Japan, and internationally.

Reasonable growth potential slight.