- Singapore

- /

- Renewable Energy

- /

- SGX:BWM

Earnings Working Against Zheneng Jinjiang Environment Holding Company Limited's (SGX:BWM) Share Price Following 40% Dive

Zheneng Jinjiang Environment Holding Company Limited (SGX:BWM) shareholders won't be pleased to see that the share price has had a very rough month, dropping 40% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 41% in the last year.

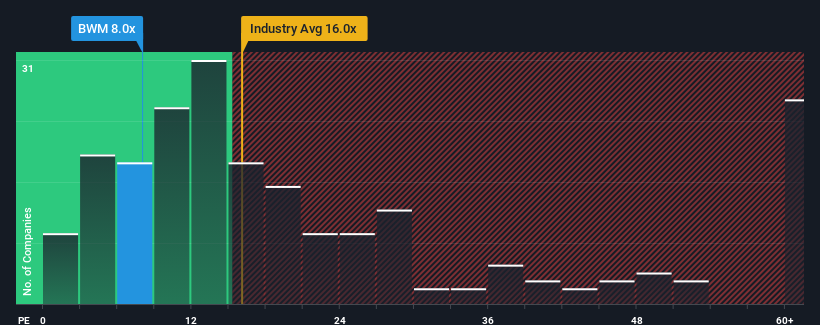

After such a large drop in price, Zheneng Jinjiang Environment Holding's price-to-earnings (or "P/E") ratio of 8x might make it look like a buy right now compared to the market in Singapore, where around half of the companies have P/E ratios above 12x and even P/E's above 21x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For instance, Zheneng Jinjiang Environment Holding's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Zheneng Jinjiang Environment Holding

Is There Any Growth For Zheneng Jinjiang Environment Holding?

In order to justify its P/E ratio, Zheneng Jinjiang Environment Holding would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 14% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 11% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Zheneng Jinjiang Environment Holding is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

Zheneng Jinjiang Environment Holding's P/E has taken a tumble along with its share price. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Zheneng Jinjiang Environment Holding maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for Zheneng Jinjiang Environment Holding you should be aware of, and 2 of them are a bit concerning.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zheneng Jinjiang Environment Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BWM

Zheneng Jinjiang Environment Holding

Engages in the generation and sale of electricity and steam in the People’s Republic of China.

Solid track record and slightly overvalued.

Market Insights

Community Narratives