As the Singapore market continues to adapt and evolve, major initiatives like Santander's recent collaboration with Apple in Germany highlight the dynamic nature of global financial strategies. This underscores the importance of stability and consistent returns, qualities that make dividend stocks particularly appealing in fluctuating markets.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| Civmec (SGX:P9D) | 5.98% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.54% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.27% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.73% | ★★★★★☆ |

| BRC Asia (SGX:BEC) | 7.58% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.99% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.07% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 5.88% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Hour Glass (SGX:AGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited operates as an investment holding company that retails and distributes watches, jewelry, and other luxury products across Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market capitalization of SGD 1.01 billion.

Operations: The Hour Glass Limited generates SGD 1.13 billion primarily from the retail and distribution of watches, jewelry, and luxury products.

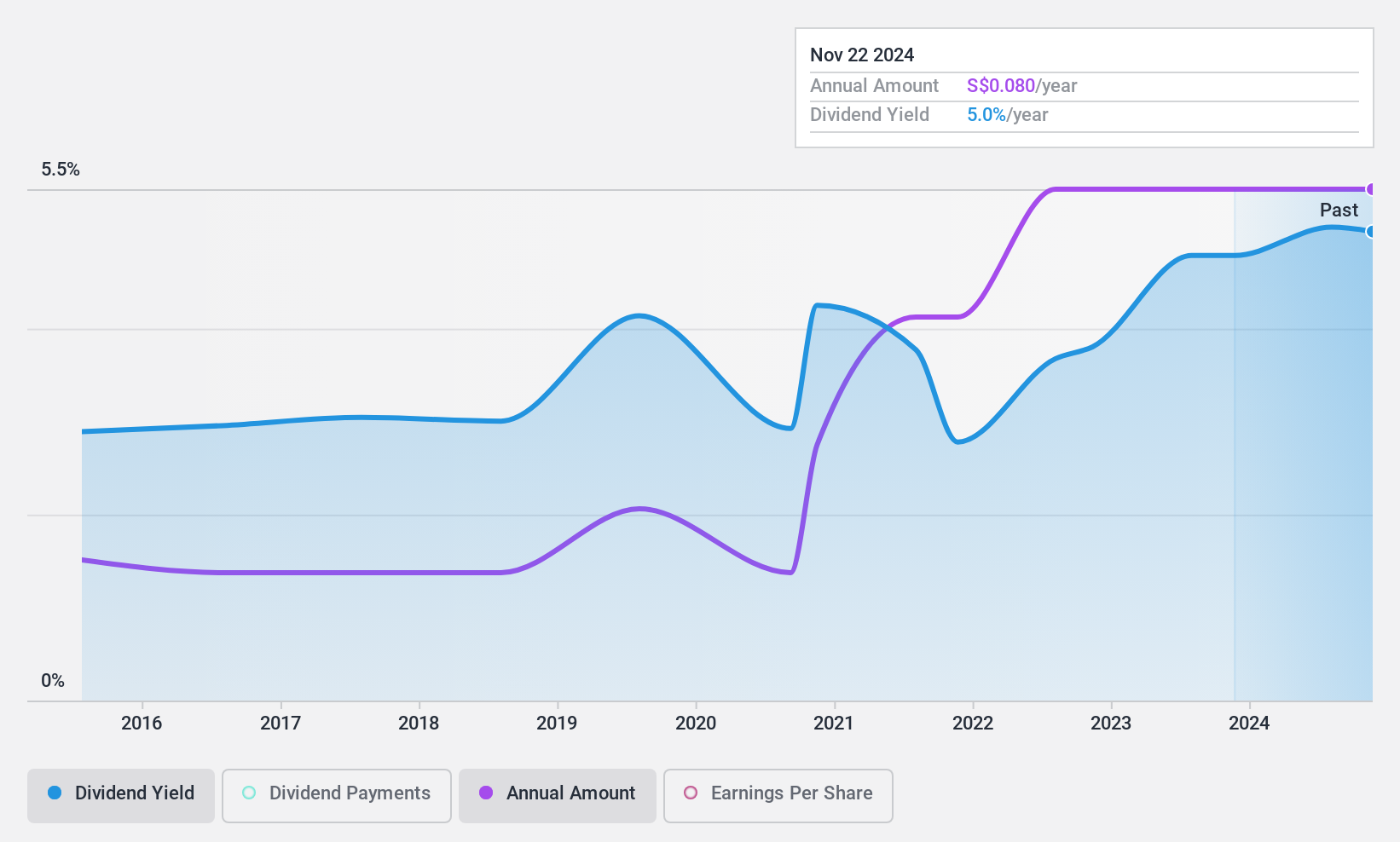

Dividend Yield: 5.2%

Hour Glass, with a P/E ratio of 6.4x, offers value below the Singapore market average. Despite its dividend yield of 5.19% not reaching the top quartile in Singapore, its dividends are sustainably covered by both earnings and cash flows, with payout ratios at 33.5% and 46.3%, respectively. However, dividend reliability may concern investors due to historical volatility over the past decade. Recently affirmed dividends and stable sales figures suggest a cautious optimism for maintaining payouts.

- Navigate through the intricacies of Hour Glass with our comprehensive dividend report here.

- Our expertly prepared valuation report Hour Glass implies its share price may be too high.

Singapore Airlines (SGX:C6L)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Airlines Limited operates passenger and cargo air transportation under the Singapore Airlines and Scoot brands across various regions including East Asia, the Americas, Europe, Southwest Pacific, West Asia, and Africa, with a market capitalization of SGD 24.24 billion.

Operations: Singapore Airlines Limited generates revenue primarily through its Full Service Carrier (FSC) segment, which brought in SGD 16.18 billion, and its Low-Cost Carrier (LCC) operations, contributing SGD 2.45 billion, along with Engineering Services at SGD 1.09 billion.

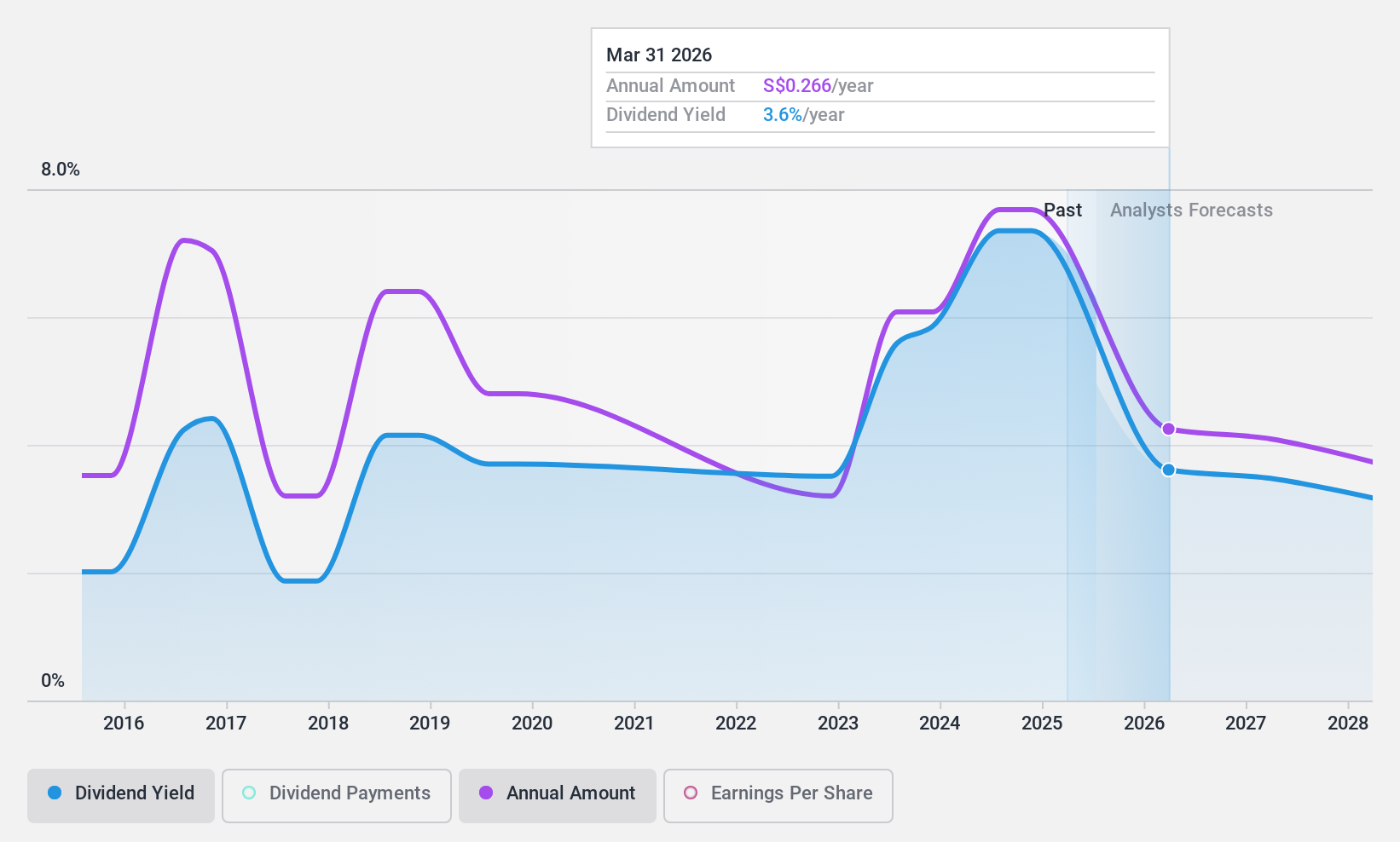

Dividend Yield: 7.1%

Singapore Airlines reported a robust increase in annual sales to SGD 19.01 billion and net income to SGD 2.67 billion, reflecting solid operational performance with higher passenger volumes and load factors. Despite this, the dividend track record remains unstable, characterized by significant fluctuations over the past decade. The payout ratio stands at 75.9%, suggesting dividends are well-covered by earnings, yet cash flow coverage is lower at 45.9%, indicating potential pressure on sustaining dividends if operational cash flows vary.

- Take a closer look at Singapore Airlines' potential here in our dividend report.

- The analysis detailed in our Singapore Airlines valuation report hints at an deflated share price compared to its estimated value.

Delfi (SGX:P34)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfi Limited is an investment holding company that specializes in manufacturing, marketing, distributing, and selling chocolate and related consumer products across Indonesia, the Philippines, Malaysia, Singapore, and other international markets with a market cap of SGD 534.76 million.

Operations: Delfi Limited generates revenue primarily from its operations in Indonesia, contributing SGD 370.41 million, and its regional markets, adding another SGD 185.07 million.

Dividend Yield: 6.6%

Delfi Limited, with a dividend yield of 6.64%, ranks in the top 25% of Singaporean dividend stocks but faces challenges with sustainability. Its high cash payout ratio at 17.77 times suggests dividends are not well-supported by cash flows, and historical data reveal inconsistent dividend payments over the past decade. Despite a forecasted earnings growth of 3.07% per year and trading at a significant discount to fair value, analysts anticipate a potential stock price increase of 26.4%. Recent board changes could impact governance and strategic direction.

- Dive into the specifics of Delfi here with our thorough dividend report.

- Our valuation report here indicates Delfi may be undervalued.

Summing It All Up

- Take a closer look at our Top SGX Dividend Stocks list of 19 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C6L

Singapore Airlines

Together with subsidiaries, provides passenger and cargo air transportation services under the Singapore Airlines and Scoot brands in East Asia, the Americas, Europe, Southwest Pacific, West Asia, and Africa.

Undervalued with excellent balance sheet and pays a dividend.