- Singapore

- /

- Telecom Services and Carriers

- /

- SGX:CJLU

NetLink NBN Trust (SGX:CJLU) Margin Decline Reinforces Investor Caution on Dividend Sustainability

Reviewed by Simply Wall St

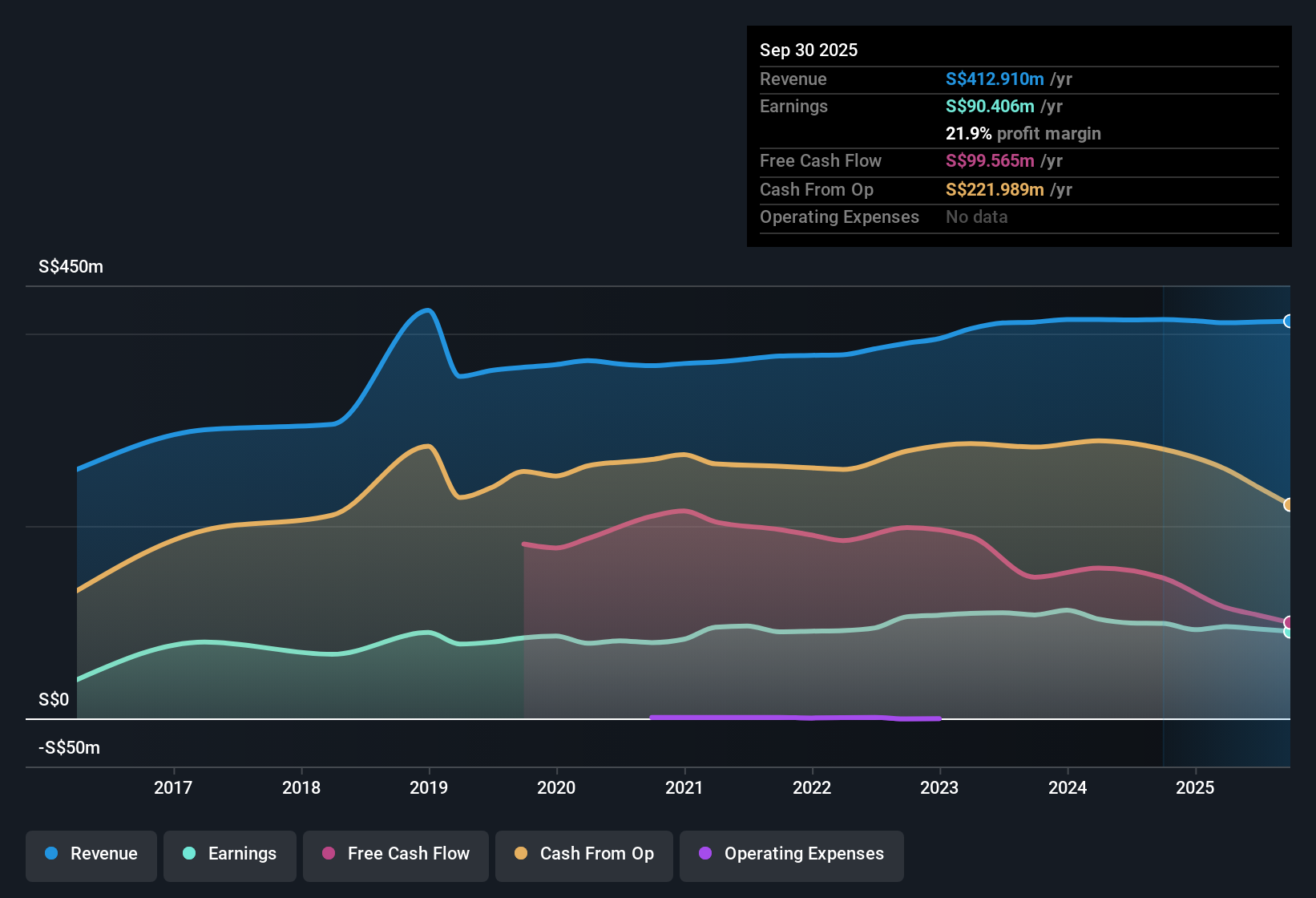

NetLink NBN Trust (SGX:CJLU) reported that earnings are forecast to grow at 7.1% per year, while revenue is projected to rise by 1.8% per year, which is slower than the wider Singapore market’s expected 3.8% growth. Net profit margins slipped to 21.9% from 23.8% the previous year, and recent earnings momentum has softened, with average earnings growth of 2.1% annually over the last five years but a decline in the most recent period. Investors are now weighing a slightly above-market earnings growth outlook and a trading price below fair value against questions about margin sustainability and last year’s negative earnings trend.

See our full analysis for NetLink NBN Trust.Next up, we’ll see how these numbers compare to the prevailing market narratives, where the consensus is reinforced, and where the results shake things up.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Narrow Despite Stable Revenue

- Net profit margins declined to 21.9%, down from 23.8% the previous year. This signals tighter profitability even though revenue continues to grow, albeit modestly at 1.8% per year.

- A prevailing theme is that investors continue to view the trust as resilient, primarily for its defensive and income-generating characteristics.

- Despite the margin compression, the business model attracts steady demand for stability and yield. This reinforces its reputation as a “steady eddy” asset during market volatility.

- However, reliance on regulated revenue means growth remains contained. Any margin slippage therefore draws sharper scrutiny compared to higher-growth peers.

P/E Ratio Stands Far Above Competitors

- The trust’s Price-To-Earnings Ratio of 42.2x is more than double that of both peers (18.7x) and the Asian Telecom industry average (16.3x). This emphasizes its premium relative valuation in exchange for perceived stability.

- The current figures highlight how the company’s strong reputation for earnings quality and consistent dividends can justify a much loftier P/E than industry averages.

- The higher multiple reflects the attractiveness of predictable cash flows and defensive exposure, which aligns with market interest in infrastructure-backed assets.

- This premium persists despite recent negative earnings growth and shrinking margins, revealing investors’ ongoing willingness to pay up for reliability in uncertain environments.

Trading Price Sits Below DCF Fair Value

- With the current share price at SGD0.98 compared to a DCF fair value of SGD1.63, the market continues to price the trust below what cash flow models suggest is warranted.

- The prevailing analysis suggests this significant gap between market price and DCF fair value strengthens the case for NetLink NBN Trust as a value pick among yield-centric investors, especially given its forecasted 7.1% annual earnings growth, which edges past the Singapore market average.

- The discounted share price, when set against a premium P/E, highlights how investor focus remains on sustainability of income and valuation support from cash flows rather than hopes of rapid upside.

- Ongoing sector interest in capital preservation and predictable yield may help bridge the price-to-value divide if performance remains steady.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NetLink NBN Trust's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

NetLink NBN Trust’s declining profit margins, muted revenue growth, and recent negative earnings trend raise concerns about its ability to sustain performance and returns.

If you prefer companies delivering steady top- and bottom-line momentum regardless of the market cycle, check out stable growth stocks screener (2089 results) that consistently grow sales and earnings in both favorable and challenging conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetLink NBN Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:CJLU

NetLink NBN Trust

An investment holding company, owns, designs, builds, and operates the passive fibre network infrastructure for residential homes and non-residential premises, and non-building address point (NBAP) connections in mainland Singapore and its connected islands.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives