- Singapore

- /

- Telecom Services and Carriers

- /

- SGX:CJLU

NetLink NBN Trust (SGX:CJLU) Is Increasing Its Dividend To SGD0.0265

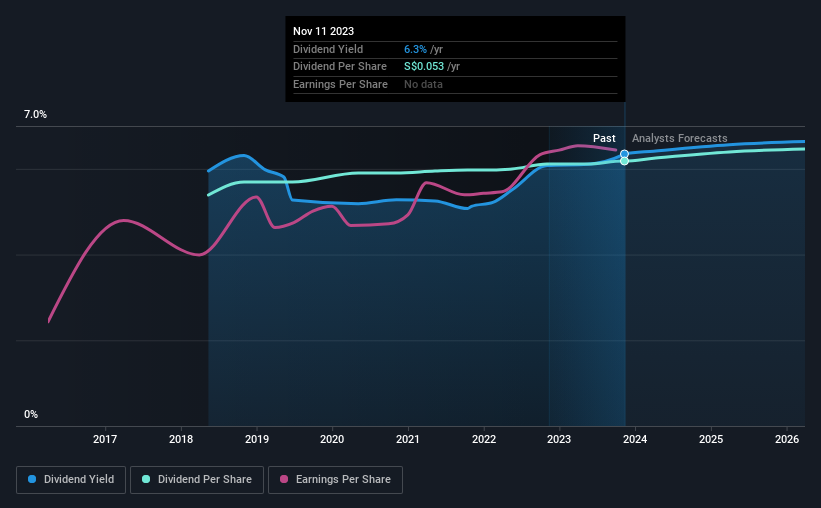

The board of NetLink NBN Trust (SGX:CJLU) has announced that the dividend on 1st of December will be increased to SGD0.0265, which will be 1.1% higher than last year's payment of SGD0.0262 which covered the same period. This makes the dividend yield 6.3%, which is above the industry average.

See our latest analysis for NetLink NBN Trust

NetLink NBN Trust Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before making this announcement, the company's dividend was much higher than its earnings. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

The next 12 months is set to see EPS grow by 6.7%. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 180% over the next year.

NetLink NBN Trust Is Still Building Its Track Record

It is great to see that NetLink NBN Trust has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. The dividend has gone from an annual total of SGD0.0462 in 2018 to the most recent total annual payment of SGD0.053. This works out to be a compound annual growth rate (CAGR) of approximately 2.8% a year over that time. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

The Dividend's Growth Prospects Are Limited

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Earnings have grown at around 3.8% a year for the past five years, which isn't massive but still better than seeing them shrink. With anaemic earnings growth, it's not confidence inspiring to see NetLink NBN Trust paying out more than double what it is earning. Meaning that on balance, the dividend is more likely to fall in the future than to grow.

NetLink NBN Trust's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think NetLink NBN Trust will make a great income stock. The track record isn't great, and the payments are a bit high to be considered sustainable. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for NetLink NBN Trust that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if NetLink NBN Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:CJLU

NetLink NBN Trust

An investment holding company, owns, designs, builds, and operates the passive fibre network infrastructure for residential homes and non-residential premises, and non-building address point (NBAP) connections in mainland Singapore and its connected islands.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives