The Singapore market has shown resilience amid global economic uncertainties, with the Straits Times Index reflecting steady performance. In this environment, dividend stocks can offer a reliable income stream for investors seeking stability and consistent returns.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.08% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.65% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.16% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.31% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.66% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.10% | ★★★★★☆ |

| Civmec Singapore (SGX:P9D) | 5.59% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.39% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 6.05% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited, with a market cap of SGD620.03 million, specializes in the prefabrication of steel reinforcement for concrete across various regions including Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and other international markets.

Operations: BRC Asia Limited's revenue segments consist of SGD319.71 million from Trading and SGD1.35 billion from Fabrication and Manufacturing.

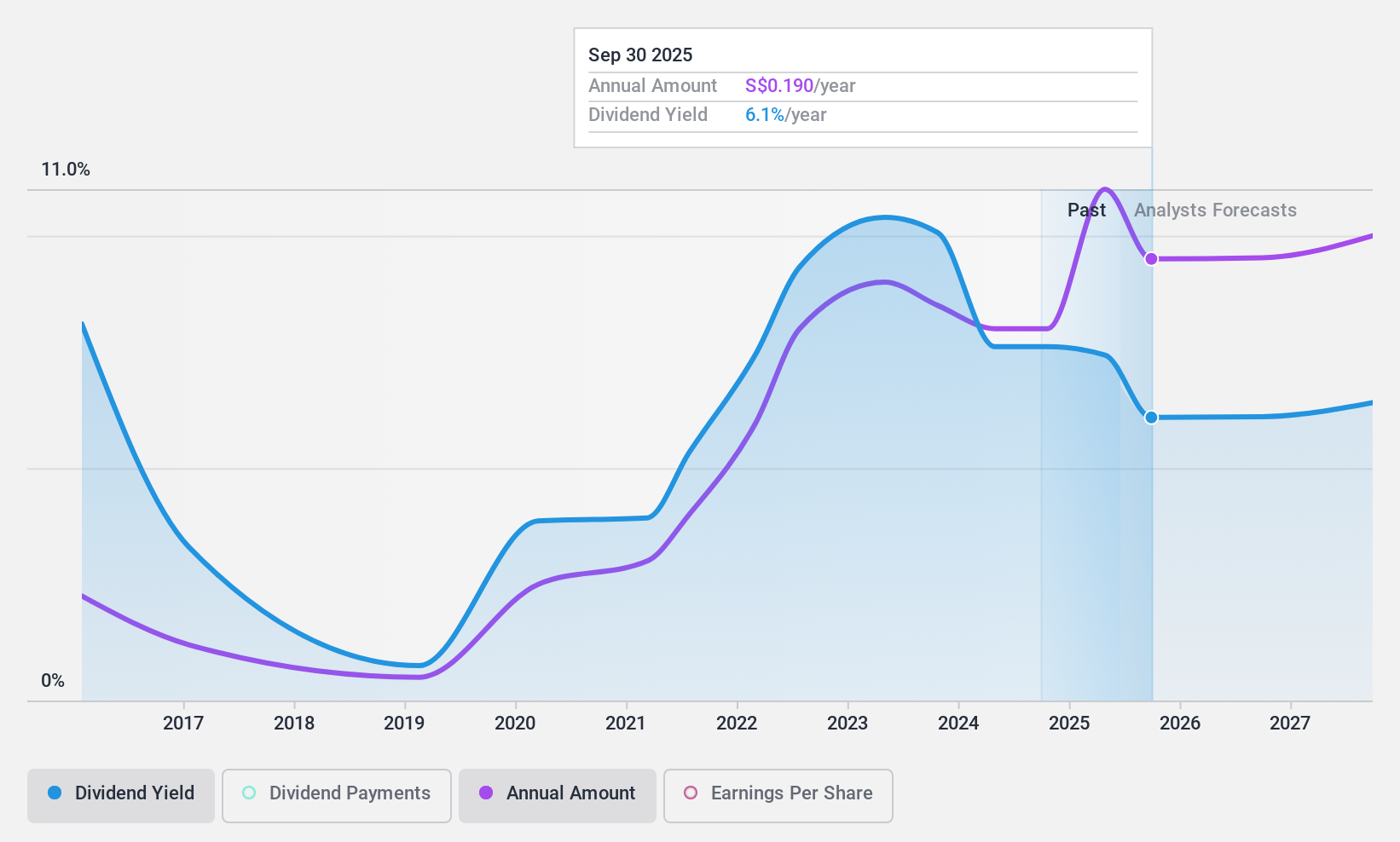

Dividend Yield: 7.1%

BRC Asia's dividend payments are well-covered by earnings (payout ratio: 35.9%) and cash flows (cash payout ratio: 85.3%). Despite an unstable dividend track record over the past decade, recent earnings growth of 14.9% supports sustainability. The company trades at good value compared to peers and offers a high dividend yield (7.08%), placing it in the top 25% of Singaporean market payers. Recently, BRC Asia announced an interim tax-exempt dividend of S$0.06 per share, payable on November 15, 2024.

- Take a closer look at BRC Asia's potential here in our dividend report.

- Our valuation report here indicates BRC Asia may be undervalued.

YHI International (SGX:BPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited, with a market cap of SGD138.56 million, is an investment holding company that distributes automotive and industrial products across Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand and internationally through its subsidiaries.

Operations: YHI International Limited's revenue segments include Distribution - ASEAN (SGD119.40 million), Distribution - Other (SGD33.31 million), Manufacturing - ASEAN (SGD55.05 million), Distribution - Oceania (SGD140.24 million), Distribution - North East Asia (SGD17.99 million), and Manufacturing - North East Asia excluding rental (SGD57.20 million).

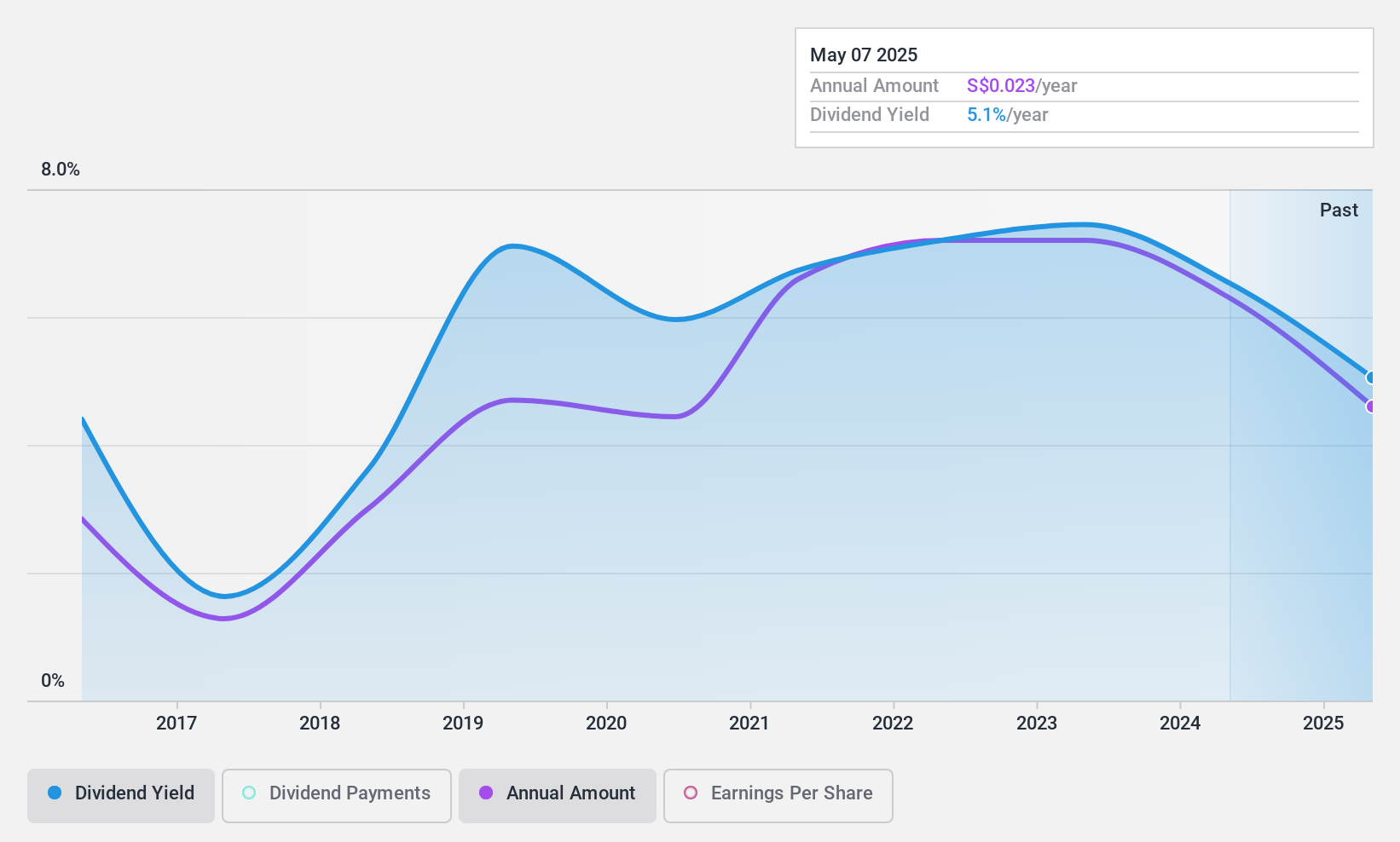

Dividend Yield: 6.6%

YHI International's dividend payments are well-covered by earnings (payout ratio: 68.9%) and cash flows (cash payout ratio: 43.3%). Despite a volatile dividend history, recent earnings growth of 6.4% supports sustainability. The company trades at a significant discount to its estimated fair value and offers a competitive dividend yield, placing it in the top quartile of Singaporean market payers. Recent half-year results show increased sales (SG$198.61 million) and net income (SG$7.71 million).

- Delve into the full analysis dividend report here for a deeper understanding of YHI International.

- Our comprehensive valuation report raises the possibility that YHI International is priced lower than what may be justified by its financials.

DBS Group Holdings (SGX:D05)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd is a commercial banking and financial services provider operating in Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally with a market cap of SGD104.10 billion.

Operations: DBS Group Holdings Ltd generates revenue primarily from Consumer Banking/Wealth Management (SGD9.34 billion), Institutional Banking (SGD9.18 billion), and Treasury Markets (SGD695 million).

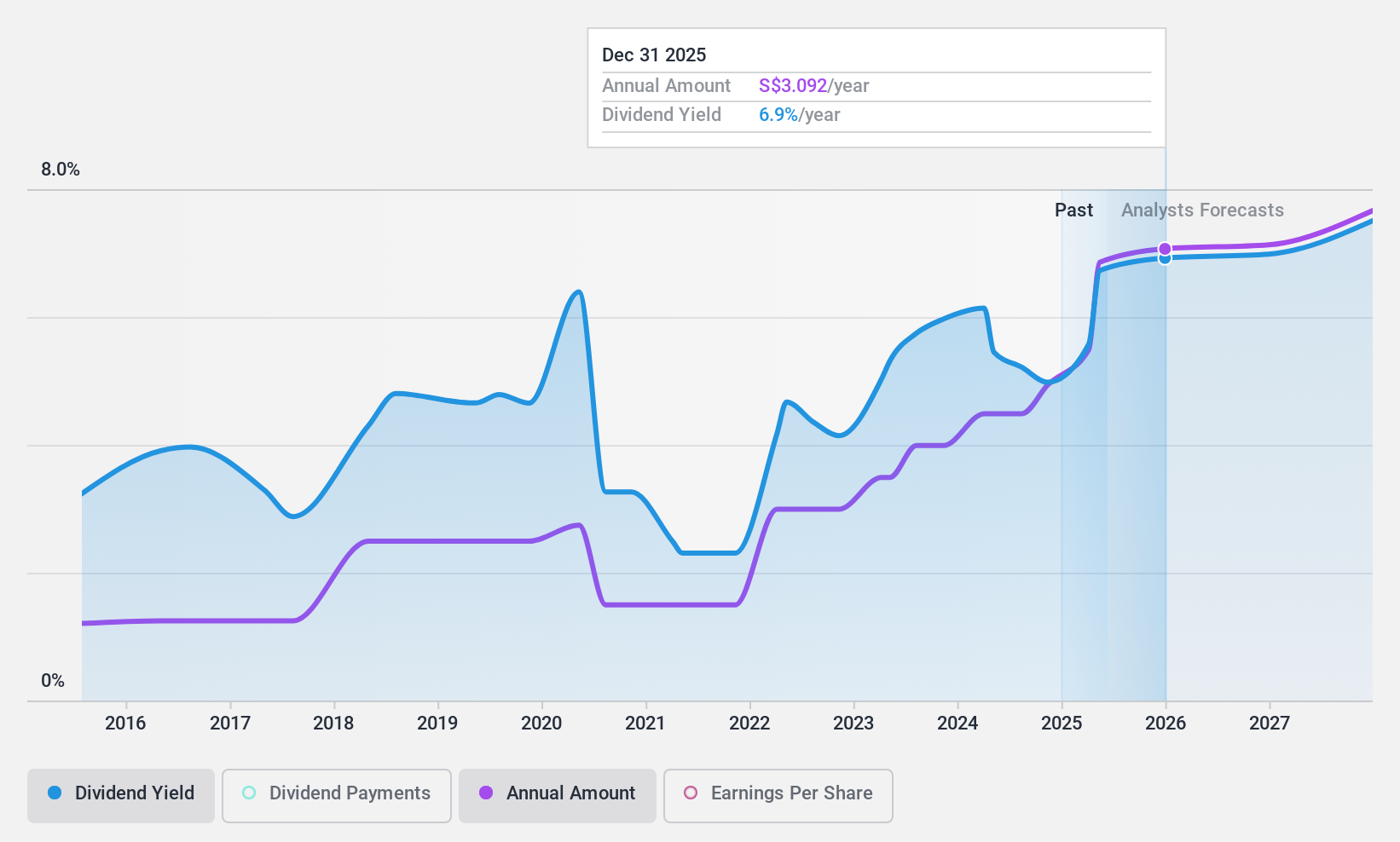

Dividend Yield: 5.9%

DBS Group Holdings' dividend payments have been volatile over the past decade but are currently covered by earnings (54.1% payout ratio) and forecasted to remain so (65.4%). Despite a lower dividend yield compared to top-tier payers, the company trades at a significant discount to its estimated fair value. Recent half-year results show strong earnings growth with net interest income of SG$7.10 billion and net income of SG$5.74 billion, supporting dividend sustainability amidst executive leadership changes.

- Click to explore a detailed breakdown of our findings in DBS Group Holdings' dividend report.

- Our expertly prepared valuation report DBS Group Holdings implies its share price may be lower than expected.

Seize The Opportunity

- Click this link to deep-dive into the 20 companies within our Top SGX Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRC Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BEC

BRC Asia

Engages in the prefabrication of steel reinforcement for use in concrete in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India, and internationally.

Flawless balance sheet, undervalued and pays a dividend.