In recent times, the Singapore market has been navigating a complex global landscape, influenced by geopolitical tensions and economic shifts such as the ongoing situation in Ukraine. Amidst these uncertainties, investors often seek stability and income through dividend stocks, which can offer attractive yields even in fluctuating markets. A good dividend stock typically provides consistent payouts and demonstrates resilience against broader market volatility.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.93% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.14% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.42% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.30% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.09% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.80% | ★★★★☆☆ |

| Genting Singapore (SGX:G13) | 4.85% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.74% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.60% | ★★★★☆☆ |

| Nordic Group (SGX:MR7) | 4.24% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

YHI International (SGX:BPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited is an investment holding company that, along with its subsidiaries, distributes automotive and industrial products across Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, New Zealand and internationally with a market cap of SGD145.86 million.

Operations: YHI International Limited generates revenue from several segments, including Distribution - ASEAN (SGD119.40 million), Distribution - Other (SGD33.31 million), Manufacturing - ASEAN (SGD55.05 million), Distribution - Oceania (SGD140.24 million), Distribution - North East Asia (SGD17.99 million), and Manufacturing - North East Asia excluding rental income (SGD57.20 million).

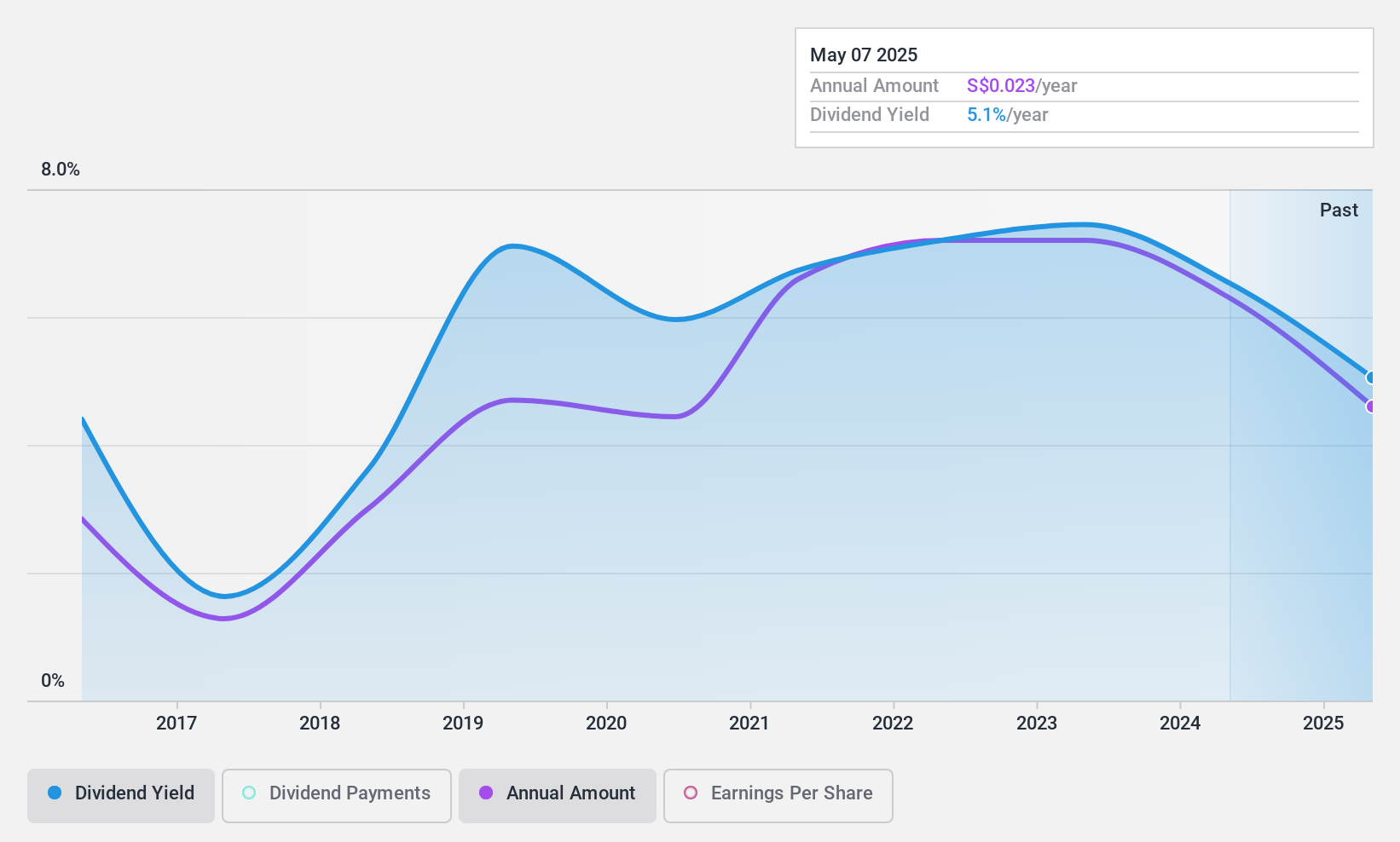

Dividend Yield: 6.3%

YHI International recently reported half-year sales of S$198.61 million, up from S$186.56 million the previous year, with net income rising slightly to S$7.71 million. Despite a volatile dividend history over the past decade, its current cash payout ratio of 43.3% suggests dividends are well-covered by cash flows, while a payout ratio of 68.9% indicates sustainability through earnings. The dividend yield is competitive within Singapore's market but lacks reliability in growth consistency.

- Dive into the specifics of YHI International here with our thorough dividend report.

- Upon reviewing our latest valuation report, YHI International's share price might be too pessimistic.

Jardine Cycle & Carriage (SGX:C07)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jardine Cycle & Carriage Limited is an investment holding company involved in financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property sectors in Indonesia and internationally with a market cap of SGD11.10 billion.

Operations: Jardine Cycle & Carriage Limited generates revenue through its diverse operations in financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property sectors.

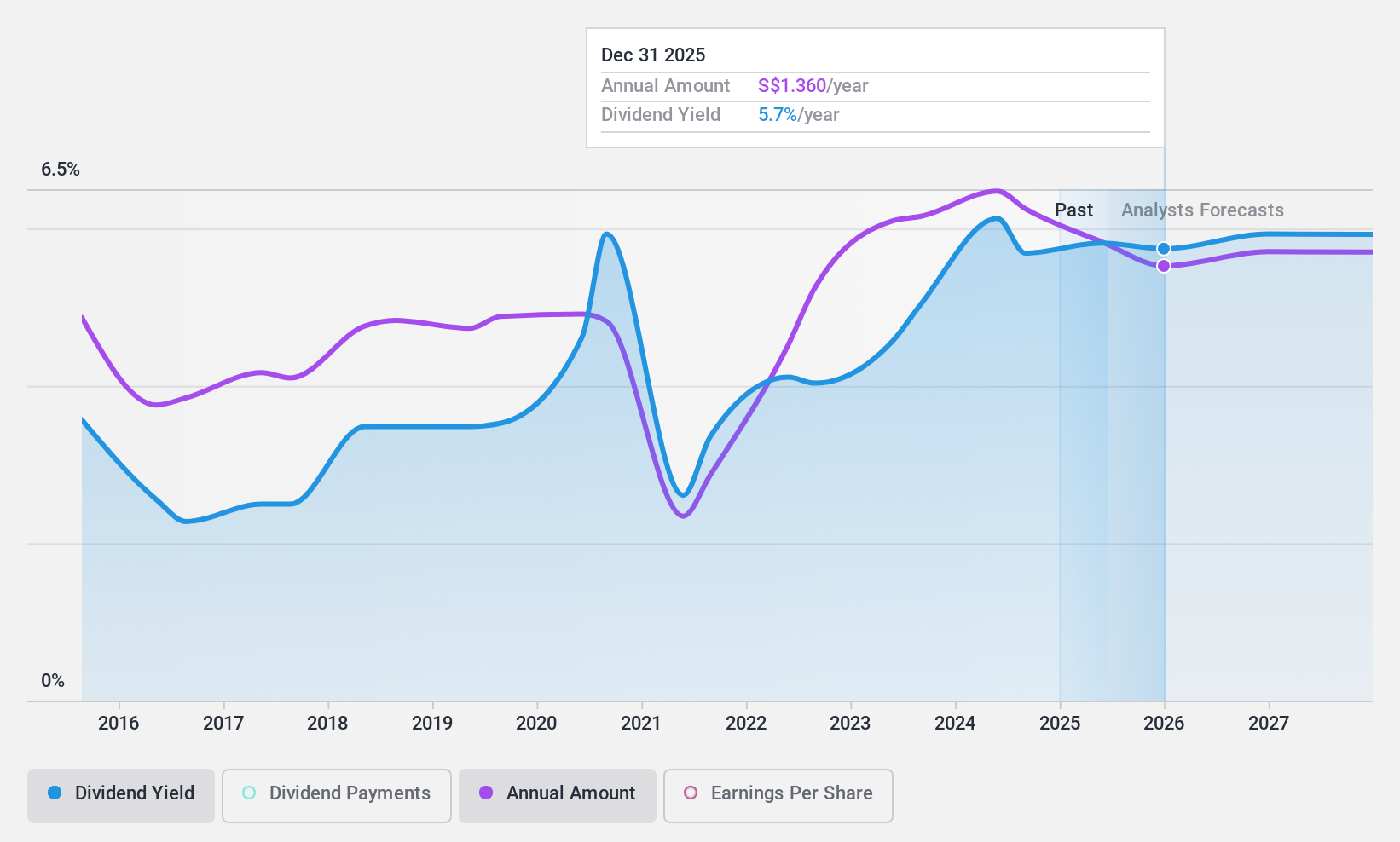

Dividend Yield: 5.6%

Jardine Cycle & Carriage's recent interim dividend of US$0.28 per share reflects its commitment to shareholder returns, though its dividend history has been volatile over the past decade. Despite this instability, the company's dividends are well-covered by a cash payout ratio of 30.8% and an earnings payout ratio of 44.4%, suggesting sustainability. However, with a dividend yield lower than the top quartile in Singapore, investors may seek more consistent growth in payouts for long-term reliability.

- Unlock comprehensive insights into our analysis of Jardine Cycle & Carriage stock in this dividend report.

- Our expertly prepared valuation report Jardine Cycle & Carriage implies its share price may be lower than expected.

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company involved in the production and trade of crude palm oil, palm kernel, and related products for refineries in Indonesia, with a market cap of SGD1.35 billion.

Operations: Bumitama Agri Ltd. generates revenue primarily from its Plantations and Palm Oil Mills segment, which amounted to IDR15.55 trillion.

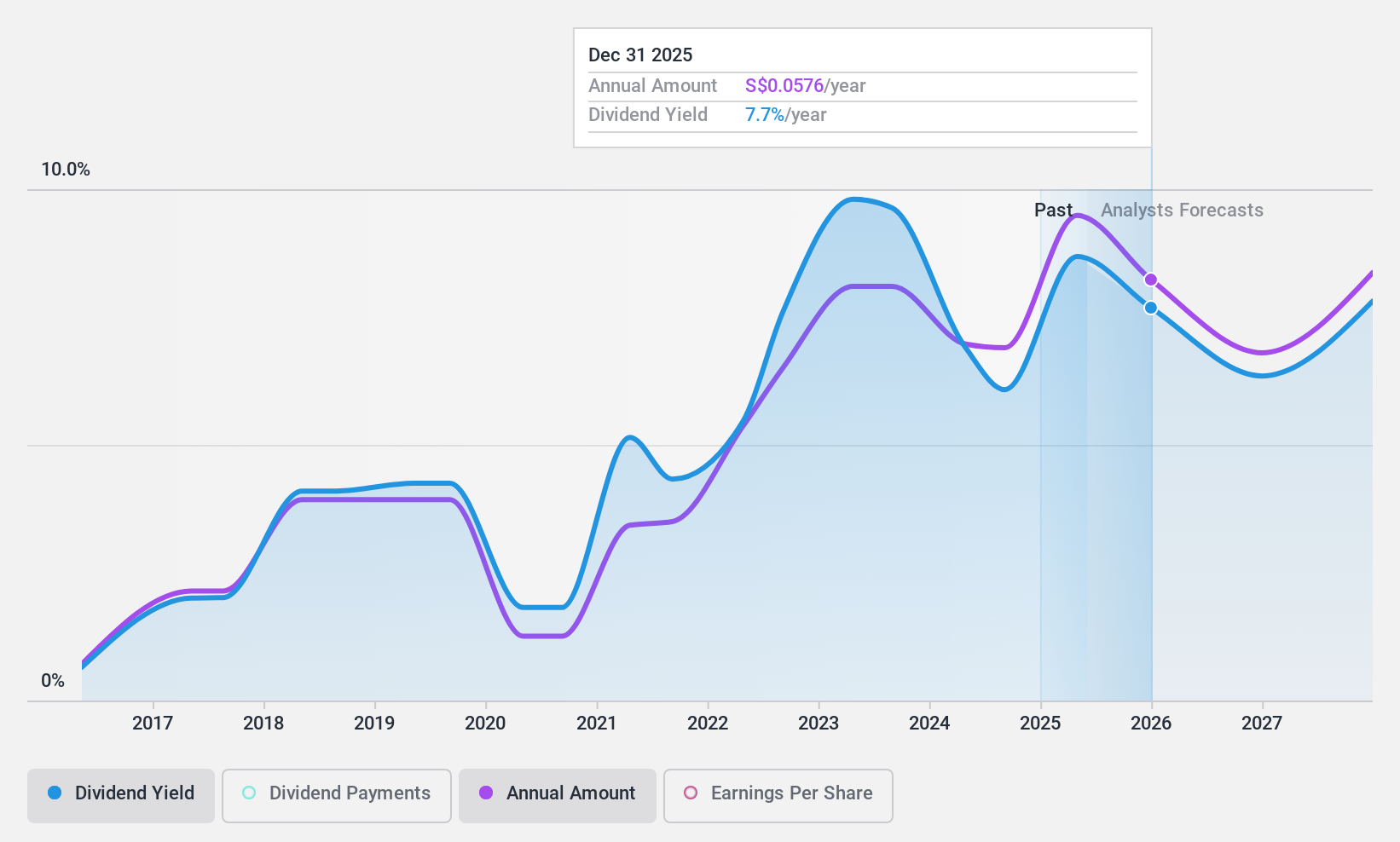

Dividend Yield: 6.1%

Bumitama Agri's dividend yield is among the top 25% in Singapore, yet its history reveals volatility and unreliability over the past decade. Despite a recent decrease in interim dividends to S$0.012 per share, payouts remain covered by earnings (47.2%) and cash flows (54.8%). The company's recent earnings report showed a decline in net income compared to last year, which may influence future dividend stability despite currently trading below estimated fair value.

- Navigate through the intricacies of Bumitama Agri with our comprehensive dividend report here.

- The analysis detailed in our Bumitama Agri valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Access the full spectrum of 19 Top SGX Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bumitama Agri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production and trade of crude palm oil (CPO), palm kernel (PK), and related products for refineries in Indonesia.

Flawless balance sheet, undervalued and pays a dividend.