What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, we've noticed some promising trends at Tye Soon (SGX:BFU) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Tye Soon, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = S$8.1m ÷ (S$154m - S$89m) (Based on the trailing twelve months to December 2021).

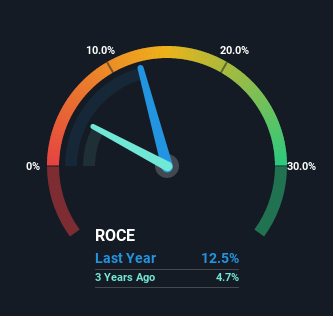

Therefore, Tye Soon has an ROCE of 12%. On its own, that's a standard return, however it's much better than the 2.8% generated by the Retail Distributors industry.

Check out our latest analysis for Tye Soon

Historical performance is a great place to start when researching a stock so above you can see the gauge for Tye Soon's ROCE against it's prior returns. If you're interested in investigating Tye Soon's past further, check out this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Tye Soon Tell Us?

Tye Soon has not disappointed with their ROCE growth. The figures show that over the last five years, ROCE has grown 289% whilst employing roughly the same amount of capital. So it's likely that the business is now reaping the full benefits of its past investments, since the capital employed hasn't changed considerably. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

On a separate but related note, it's important to know that Tye Soon has a current liabilities to total assets ratio of 58%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

Our Take On Tye Soon's ROCE

To sum it up, Tye Soon is collecting higher returns from the same amount of capital, and that's impressive. Considering the stock has delivered 38% to its stockholders over the last five years, it may be fair to think that investors aren't fully aware of the promising trends yet. So exploring more about this stock could uncover a good opportunity, if the valuation and other metrics stack up.

Tye Soon does have some risks, we noticed 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Tye Soon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BFU

Tye Soon

Imports, exports, and distributes automotive spare parts in Singapore, Malaysia, Australia, Thailand, Indonesia, Hong Kong/China, South Korea, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives