3.2% earnings growth over 3 years has not materialized into gains for Zhongmin Baihui Retail Group (SGX:5SR) shareholders over that period

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, you risk returning less than the market. We regret to report that long term Zhongmin Baihui Retail Group Ltd. (SGX:5SR) shareholders have had that experience, with the share price dropping 36% in three years, versus a market return of about 22%. And the ride hasn't got any smoother in recent times over the last year, with the price 31% lower in that time. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

If the past week is anything to go by, investor sentiment for Zhongmin Baihui Retail Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Zhongmin Baihui Retail Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Although the share price is down over three years, Zhongmin Baihui Retail Group actually managed to grow EPS by 9.8% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Arguably the revenue decline of 8.0% per year has people thinking Zhongmin Baihui Retail Group is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

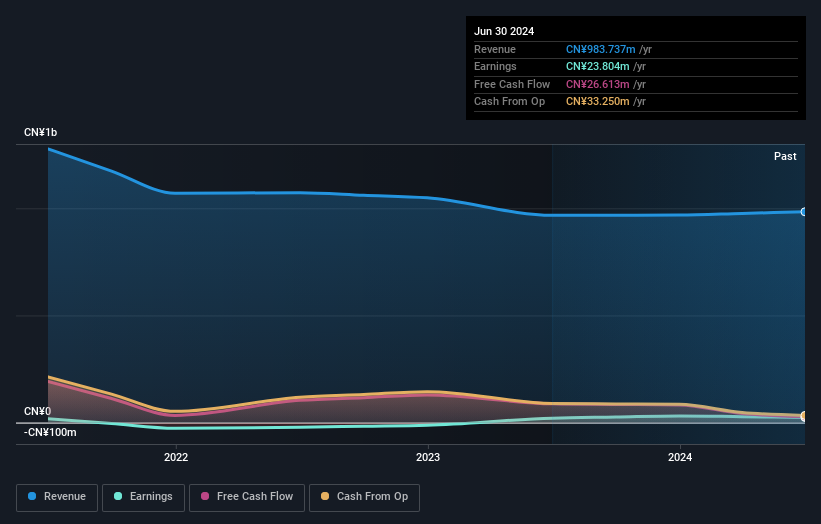

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Zhongmin Baihui Retail Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Zhongmin Baihui Retail Group shareholders are down 30% for the year (even including dividends), but the market itself is up 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Zhongmin Baihui Retail Group better, we need to consider many other factors. For instance, we've identified 5 warning signs for Zhongmin Baihui Retail Group (3 are a bit unpleasant) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhongmin Baihui Retail Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:5SR

Zhongmin Baihui Retail Group

An investment holding company, owns, operates, and manages a chain of department stores and supermarkets under the Zhongmin Parkway brand name in the People’s Republic of China.

Moderate with acceptable track record.