SGX Stocks Including Seatrium That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the global focus on artificial intelligence intensifies, Singapore's market is experiencing a ripple effect from international tech events like GITEX Global, highlighting the potential for growth in tech-driven sectors. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities amidst evolving digital trends and economic shifts.

Top 3 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.67 | SGD7.29 | 35.9% |

| Digital Core REIT (SGX:DCRU) | US$0.595 | US$0.82 | 27.6% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.845 | SGD1.43 | 40.8% |

| Seatrium (SGX:5E2) | SGD2.03 | SGD3.05 | 33.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

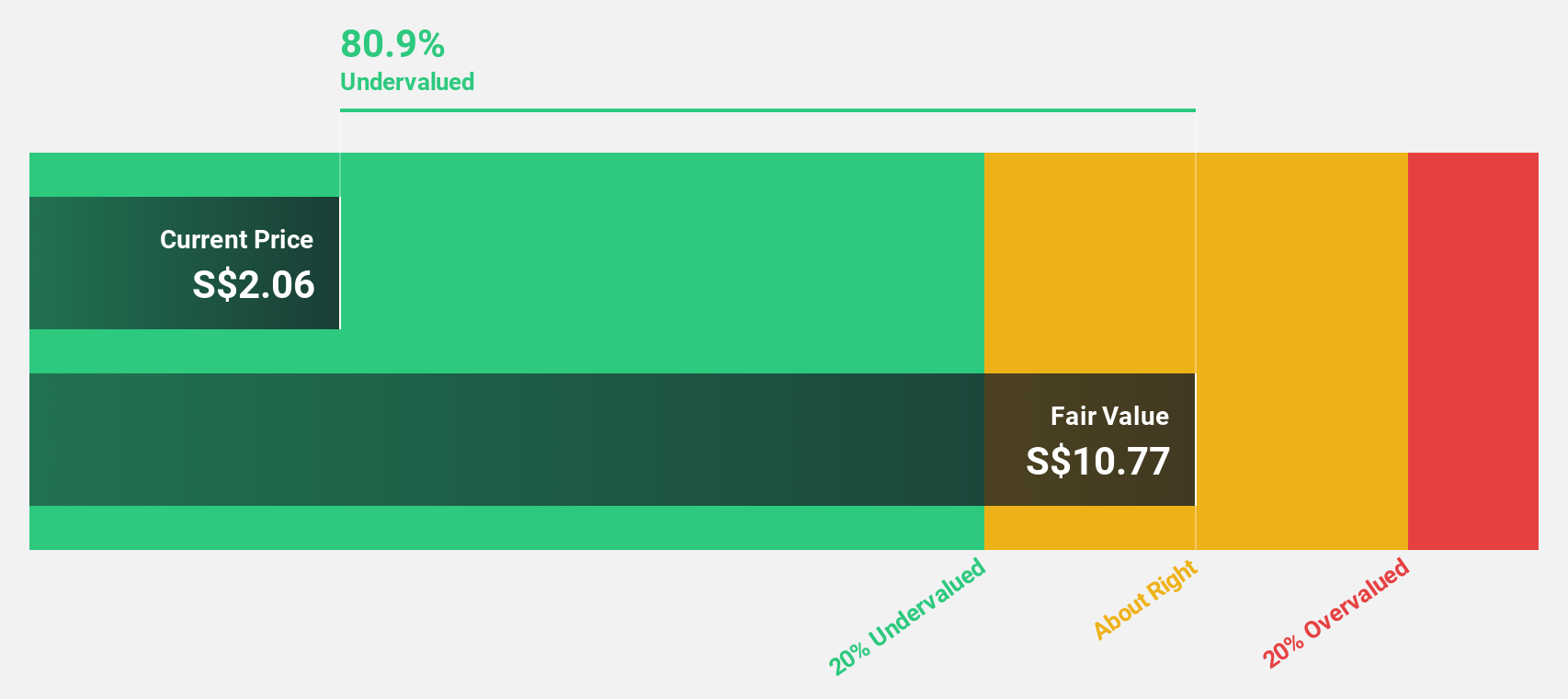

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries with a market cap of SGD6.89 billion.

Operations: The company's revenue segments include Ship Chartering, which generated SGD24.71 million, and Rigs & Floaters, Repairs & Upgrades, Offshore Platforms and Specialised Shipbuilding, which contributed SGD8.39 billion.

Estimated Discount To Fair Value: 33.6%

Seatrium Limited is trading at 33.6% below its estimated fair value of S$3.05, with a current price of S$2.03, indicating it may be undervalued based on discounted cash flow analysis. The company reported significant sales growth to S$4 billion and turned profitable with a net income of S$35.97 million for H1 2024, compared to a loss the previous year. Recent successful project deliveries further bolster its operational credibility and potential for future profitability growth above market averages.

- According our earnings growth report, there's an indication that Seatrium might be ready to expand.

- Navigate through the intricacies of Seatrium with our comprehensive financial health report here.

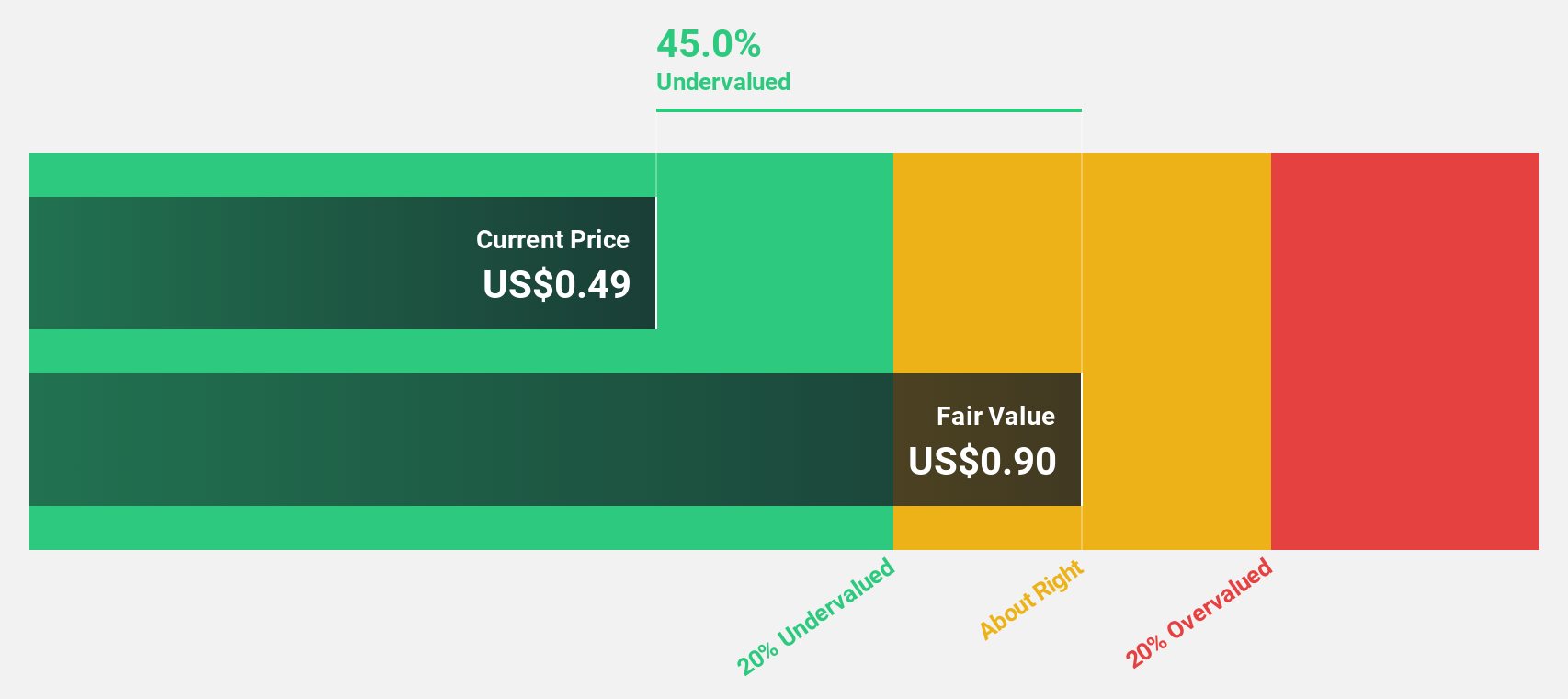

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a Singapore-listed pure-play data centre real estate investment trust sponsored by Digital Realty, with a market cap of $773.33 million.

Operations: The company's revenue is derived entirely from its commercial REIT segment, amounting to $70.76 million.

Estimated Discount To Fair Value: 27.6%

Digital Core REIT is trading at US$0.6, which is 27.6% below its estimated fair value of US$0.82, highlighting potential undervaluation based on cash flow analysis. Despite a recent dividend decrease and shareholder dilution, the REIT's revenue is projected to grow 12% annually, surpassing the Singapore market average growth rate of 3.7%. Earnings are expected to rise significantly by 96.09% per year as it moves towards profitability within three years.

- The growth report we've compiled suggests that Digital Core REIT's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Digital Core REIT.

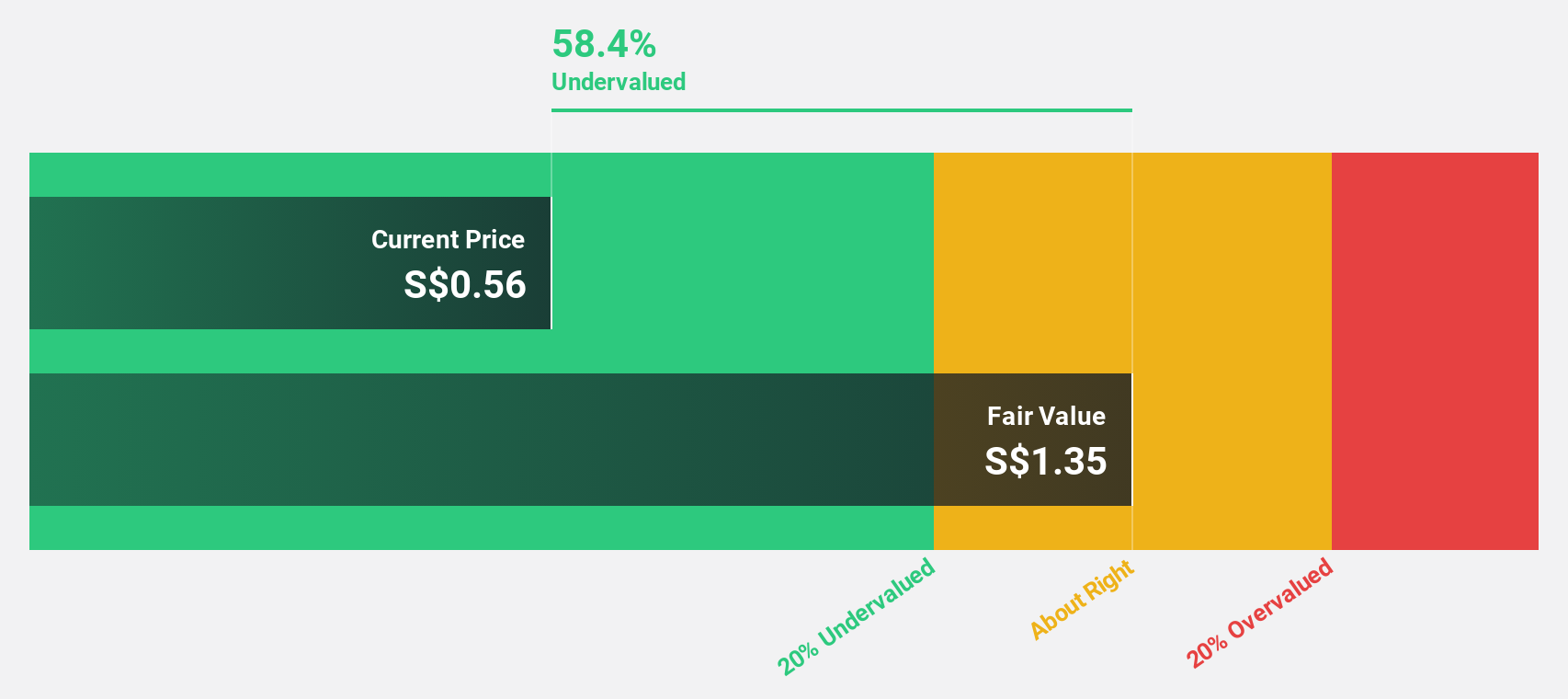

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD550.16 million, offers nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: The company's revenue is derived from segments including Advanced Materials (SGD153.32 million), Industrial Equipment (SGD28.71 million), Nanofabrication (SGD18.37 million), and Sydrogen (SGD1.40 million).

Estimated Discount To Fair Value: 40.8%

Nanofilm Technologies International is trading at SGD 0.85, significantly below its estimated fair value of SGD 1.43, suggesting it may be undervalued based on cash flow analysis. While profit margins have decreased from last year, earnings are expected to grow substantially over the next three years at a rate exceeding the Singapore market average. Despite recent executive changes and lower anticipated second-half earnings compared to last year, revenue growth remains robust at 16.1% annually.

- Upon reviewing our latest growth report, Nanofilm Technologies International's projected financial performance appears quite optimistic.

- Take a closer look at Nanofilm Technologies International's balance sheet health here in our report.

Key Takeaways

- Click this link to deep-dive into the 4 companies within our Undervalued SGX Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanofilm Technologies International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MZH

Nanofilm Technologies International

Provides nanotechnology solutions in Singapore, China, Japan, and Vietnam.

Flawless balance sheet with reasonable growth potential.