As the global economy stabilizes post-pandemic, inflation rates across various countries, including Singapore, are showing signs of convergence. This environment presents unique opportunities within the Singapore Exchange (SGX) to identify stocks that may be undervalued due to broader market influences. In such a climate, a good stock often reflects strong fundamentals and potential for growth despite external economic pressures.

Top 3 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.63 | SGD7.28 | 36.4% |

| Digital Core REIT (SGX:DCRU) | US$0.575 | US$0.82 | 29.5% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.825 | SGD1.42 | 42% |

| Seatrium (SGX:5E2) | SGD1.98 | SGD3.04 | 34.8% |

We're going to check out a few of the best picks from our screener tool.

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore, sponsored by Digital Realty, with a market cap of $747.20 million.

Operations: The company's revenue is generated entirely from its commercial REIT segment, amounting to $70.76 million.

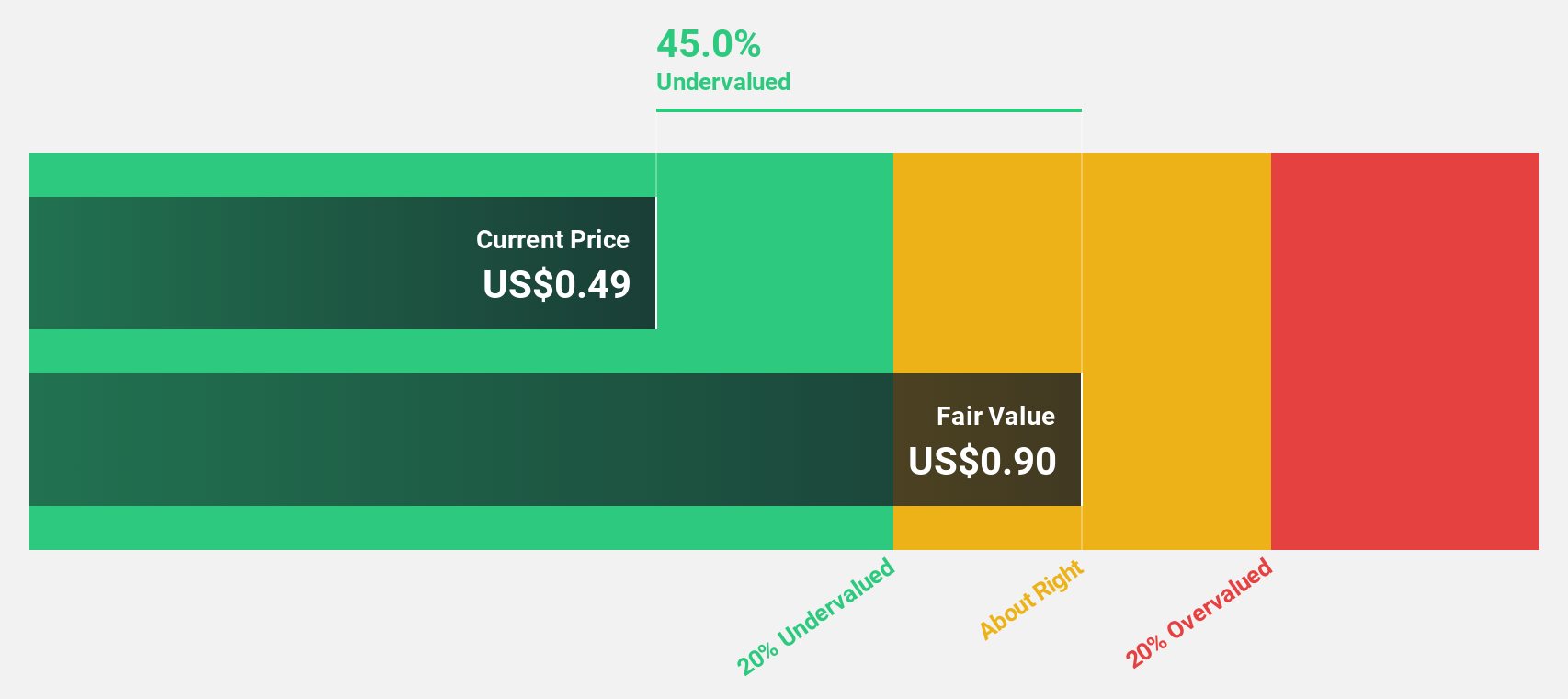

Estimated Discount To Fair Value: 29.5%

Digital Core REIT, trading at US$0.58, is undervalued by over 20% against its estimated fair value of US$0.82 and 29.5% below broader market estimates. Despite a decrease in revenue to US$48.26 million for H1 2024, net income rose substantially to US$18.63 million from the previous year, indicating strong cash flow potential despite an unstable dividend track record and past shareholder dilution. Analysts expect a significant stock price increase of nearly 30%.

- In light of our recent growth report, it seems possible that Digital Core REIT's financial performance will exceed current levels.

- Dive into the specifics of Digital Core REIT here with our thorough financial health report.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD540.39 million, offers nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: The company's revenue is primarily derived from its Advanced Materials segment at SGD153.32 million, followed by Nanofabrication at SGD18.37 million, Industrial Equipment at SGD28.71 million, and Sydrogen contributing SGD1.40 million.

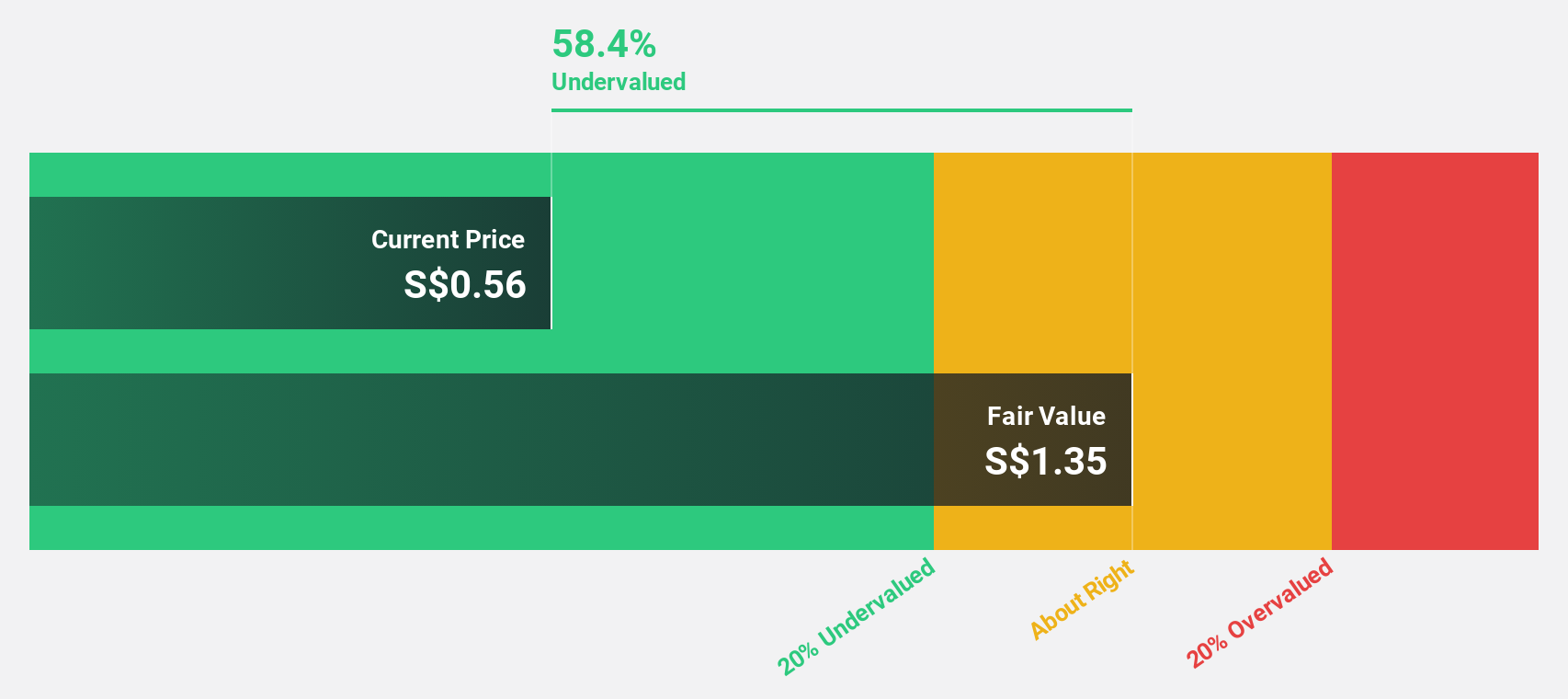

Estimated Discount To Fair Value: 42%

Nanofilm Technologies International is trading at SGD 0.83, significantly undervalued by more than 20% against its estimated fair value of SGD 1.42. Despite a challenging year with a net loss of SGD 3.74 million for H1 2024, the company anticipates improved revenue and profit in the second half, driven by expected earnings growth surpassing market averages over the next three years. Recent board changes aim to strengthen governance amidst these financial developments.

- Upon reviewing our latest growth report, Nanofilm Technologies International's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Nanofilm Technologies International with our comprehensive financial health report here.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market capitalization of SGD14.43 billion.

Operations: The company generates revenue from its Commercial Aerospace segment at SGD4.34 billion, Urban Solutions & Satcom at SGD2.01 billion, and Defence & Public Security at SGD4.54 billion.

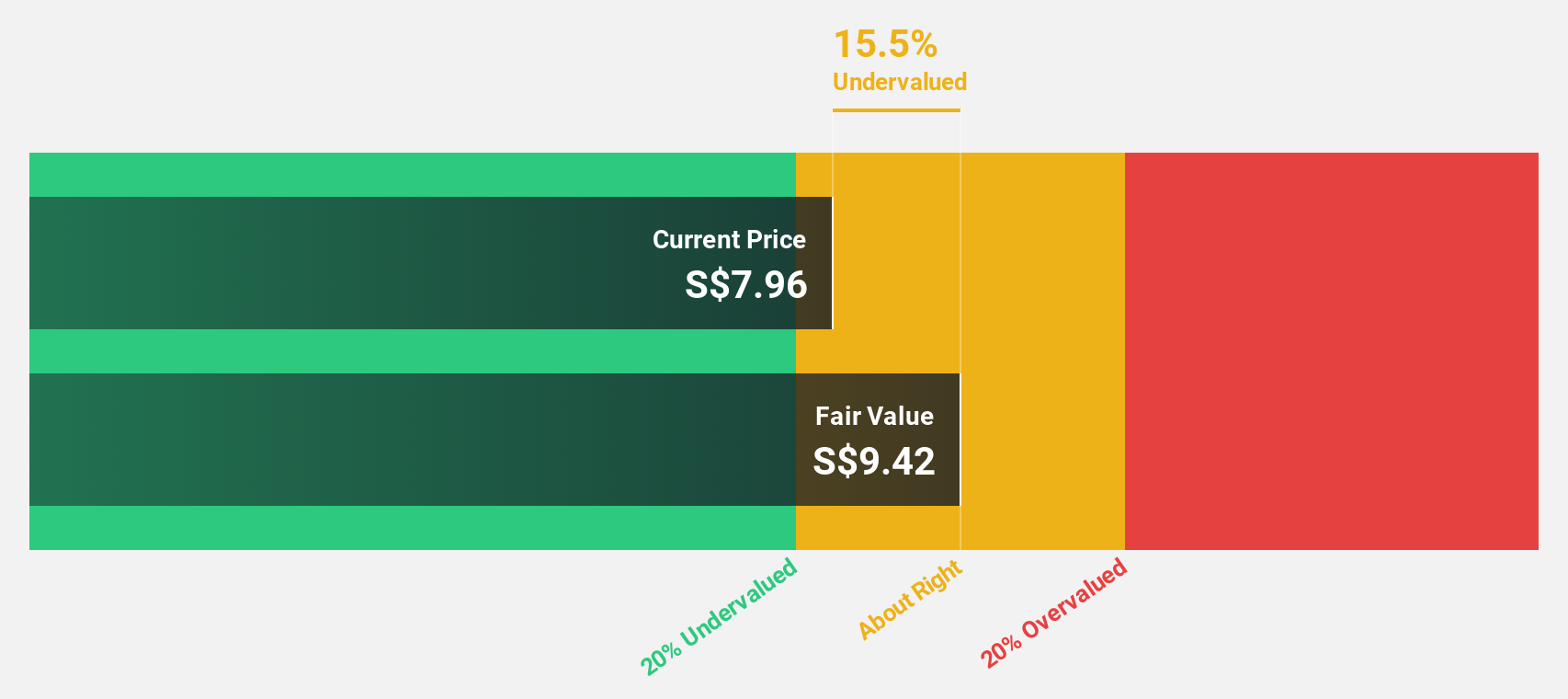

Estimated Discount To Fair Value: 36.4%

Singapore Technologies Engineering is trading at S$4.63, significantly undervalued by over 20% compared to its estimated fair value of S$7.28. Despite a robust earnings growth forecast of 11.3% annually, surpassing the Singapore market average, the company's debt coverage by operating cash flow remains insufficient. Recent strategic alliances in quantum security enhance its market position, while consistent revenue and profit growth highlight potential for long-term value appreciation despite an unstable dividend history.

- Insights from our recent growth report point to a promising forecast for Singapore Technologies Engineering's business outlook.

- Get an in-depth perspective on Singapore Technologies Engineering's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued SGX Stocks Based On Cash Flows screener has unearthed 1 more companies for you to explore.Click here to unveil our expertly curated list of 4 Undervalued SGX Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanofilm Technologies International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MZH

Nanofilm Technologies International

Provides nanotechnology solutions in Singapore, China, Japan, and Vietnam.

Flawless balance sheet with reasonable growth potential.