- Singapore

- /

- Specialized REITs

- /

- SGX:DCRU

3 SGX Stocks Estimated To Be Trading Below Intrinsic Value By Up To 41.9%

Reviewed by Simply Wall St

As the Singapore market navigates a period of economic uncertainty, investors are keenly observing opportunities for value amidst fluctuating indices and mixed corporate earnings reports. In this environment, identifying stocks that are trading below their intrinsic value can be particularly appealing, offering potential for growth when broader market conditions stabilize.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.70 | SGD7.32 | 35.8% |

| Digital Core REIT (SGX:DCRU) | US$0.595 | US$0.82 | 27.7% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.09 | SGD1.98 | 44.8% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.83 | SGD1.43 | 41.9% |

| Seatrium (SGX:5E2) | SGD1.96 | SGD3.04 | 35.5% |

Here we highlight a subset of our preferred stocks from the screener.

Digital Core REIT (SGX:DCRU)

Overview: Digital Core REIT (SGX: DCRU) is a Singapore-listed pure-play data centre REIT sponsored by Digital Realty, with a market cap of $772.39 million.

Operations: The company's revenue is derived entirely from its commercial REIT segment, amounting to $70.76 million.

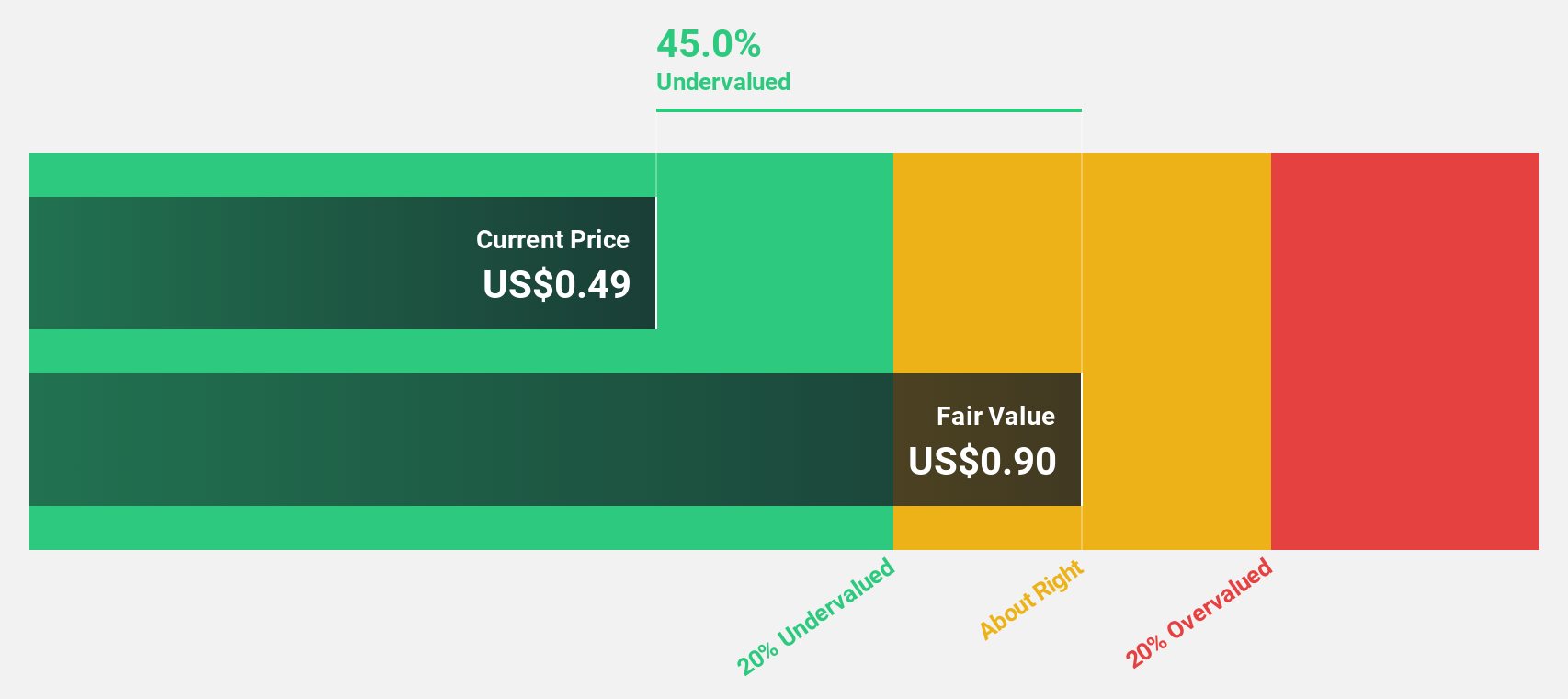

Estimated Discount To Fair Value: 27.7%

Digital Core REIT is trading at US$0.60, significantly below its estimated fair value of US$0.82, indicating potential undervaluation based on discounted cash flow analysis. The REIT's revenue is projected to grow at 12.1% annually, outpacing the Singapore market average of 3.7%, with earnings expected to increase by a large margin yearly and become profitable within three years despite an unstable dividend history and low future return on equity forecasts.

- Our expertly prepared growth report on Digital Core REIT implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Digital Core REIT with our comprehensive financial health report here.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD540.39 million, offers nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: The company's revenue is primarily derived from its Advanced Materials segment at SGD153.32 million, followed by Nanofabrication at SGD18.37 million, Industrial Equipment at SGD28.71 million, and Sydrogen contributing SGD1.40 million.

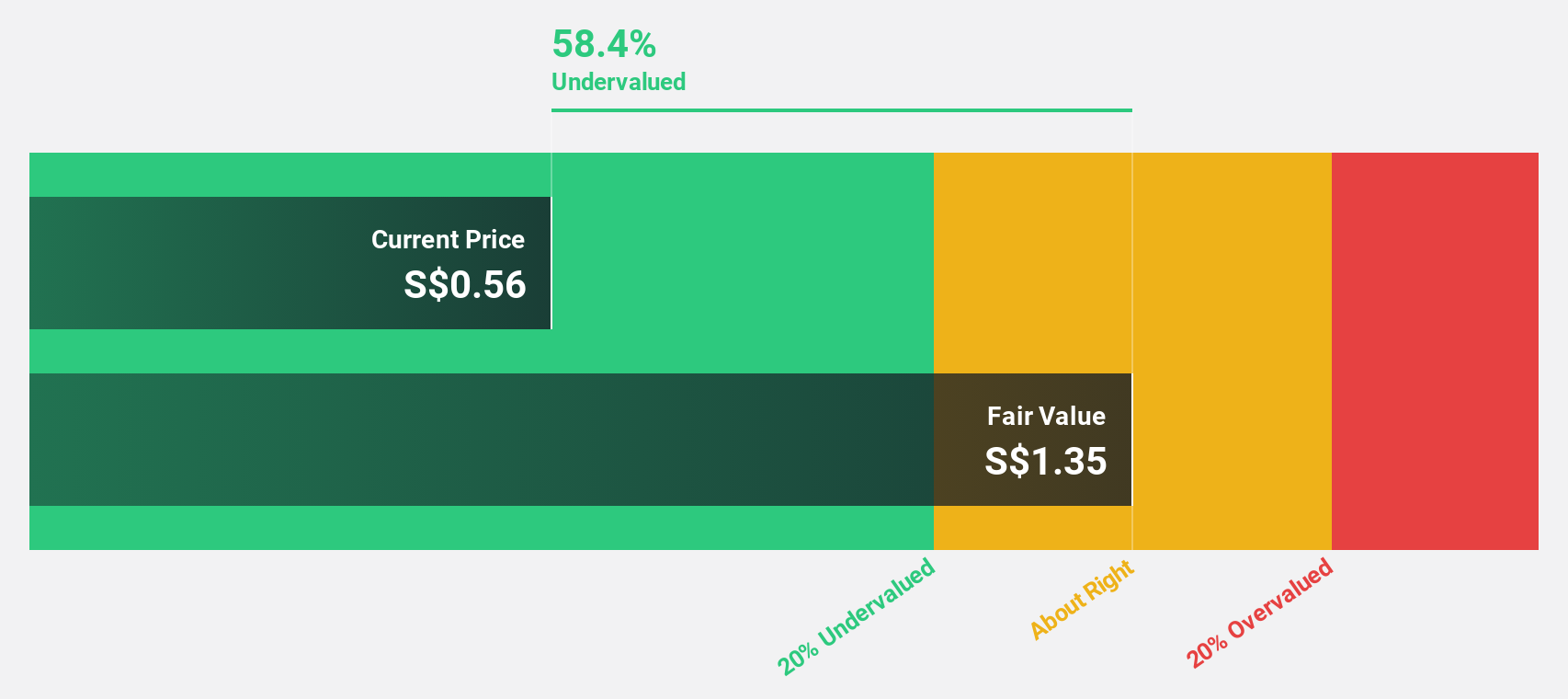

Estimated Discount To Fair Value: 41.9%

Nanofilm Technologies International is trading at SGD 0.83, considerably below its estimated fair value of SGD 1.43, highlighting potential undervaluation based on cash flows. Despite a net loss of SGD 3.74 million for the first half of 2024, the company anticipates improved earnings in the second half, albeit lower than last year's figures. Revenue growth is projected at 16.1% annually, surpassing the Singapore market's average and supporting future profitability prospects despite recent executive changes.

- The growth report we've compiled suggests that Nanofilm Technologies International's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Nanofilm Technologies International stock in this financial health report.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD14.65 billion.

Operations: The company's revenue is derived from three main segments: Commercial Aerospace at SGD4.34 billion, Urban Solutions & Satcom at SGD2.01 billion, and Defence & Public Security at SGD4.54 billion.

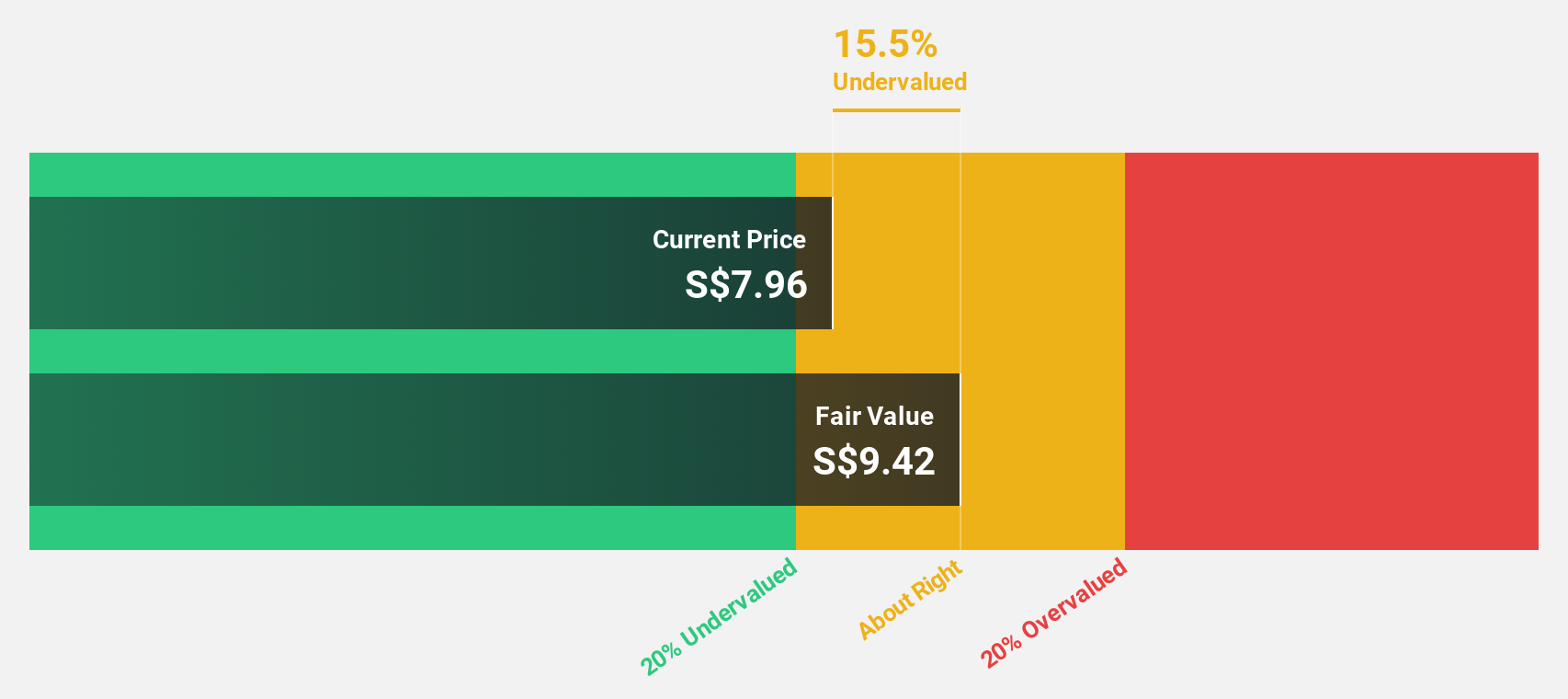

Estimated Discount To Fair Value: 35.8%

Singapore Technologies Engineering is trading at SGD 4.70, significantly below its estimated fair value of SGD 7.32, suggesting potential undervaluation based on cash flows. The company's earnings grew by 19.9% over the past year and are forecast to grow annually by 11.3%, surpassing the Singapore market average. Recent strategic alliances in quantum security bolster its market position, although debt coverage by operating cash flow remains a concern amidst an unstable dividend track record.

- Upon reviewing our latest growth report, Singapore Technologies Engineering's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Singapore Technologies Engineering's balance sheet by reading our health report here.

Key Takeaways

- Navigate through the entire inventory of 5 Undervalued SGX Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:DCRU

Digital Core REIT

Digital Core REIT (SGX: DCRU) is a leading pure-play data centre REIT listed in Singapore and sponsored by Digital Realty, the largest global data centre owner and operator.

Reasonable growth potential and fair value.