Stock Analysis

Seatrium Leads Trio Of Value Picks On SGX Based On Estimated Valuations

Reviewed by Simply Wall St

In recent times, the Singapore market has mirrored global economic trends, showing resilience amid fluctuating interest rates and varying corporate profit rates. As investors seek value in a landscape where public corporations face declining profits relative to their privately held counterparts, identifying undervalued stocks becomes crucial for those looking to optimize potential returns.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD3.98 | SGD7.83 | 49.2% |

| 17LIVE Group (SGX:LVR) | SGD0.80 | SGD1.52 | 47.5% |

| Hongkong Land Holdings (SGX:H78) | US$3.22 | US$5.63 | 42.8% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.955 | SGD1.62 | 41.1% |

| Seatrium (SGX:5E2) | SGD1.67 | SGD2.44 | 31.7% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.78 | SGD1.35 | 42.1% |

Let's dive into some prime choices out of from the screener

Seatrium (SGX:5E2)

Overview: Seatrium Limited specializes in engineering solutions for the offshore, marine, and energy sectors, with a market capitalization of approximately SGD 5.69 billion.

Operations: Seatrium's revenue is primarily generated from rigs and floaters, repairs and upgrades, offshore platforms, and specialized shipbuilding, totaling SGD 7.26 billion, with an additional SGD 31.63 million from ship chartering.

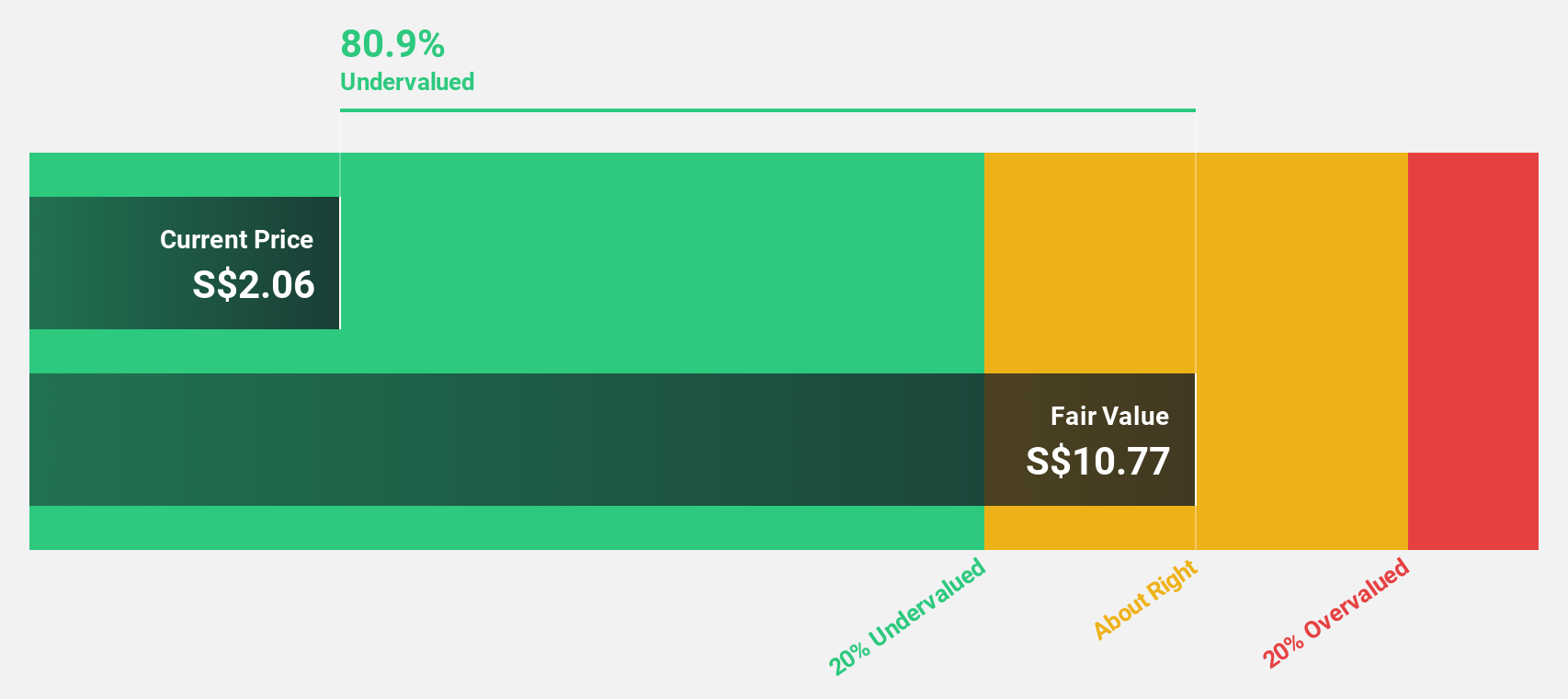

Estimated Discount To Fair Value: 31.7%

Seatrium Limited, trading at SGD1.67, is perceived as undervalued with a fair value estimate of SGD2.44 based on discounted cash flow analysis. Despite its highly volatile share price recently, analysts expect a significant upside potential of 69.6%. The company's revenue growth forecast at 8.8% annually outpaces the Singapore market's 3.7%, with profitability expected within three years alongside robust earnings growth projected at 72.23% per year. However, its forecasted Return on Equity in three years is relatively low at 8.1%.

- According our earnings growth report, there's an indication that Seatrium might be ready to expand.

- Click here to discover the nuances of Seatrium with our detailed financial health report.

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust specializing in industrial and commercial properties, with a portfolio valued at approximately S$6.4 billion and operations across Australia, Germany, Singapore, the United Kingdom, and the Netherlands; its market capitalization is about S$3.59 billion.

Operations: The revenue for Frasers Logistics & Commercial Trust is derived from its diverse portfolio of 107 industrial and commercial properties located in five developed markets: Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

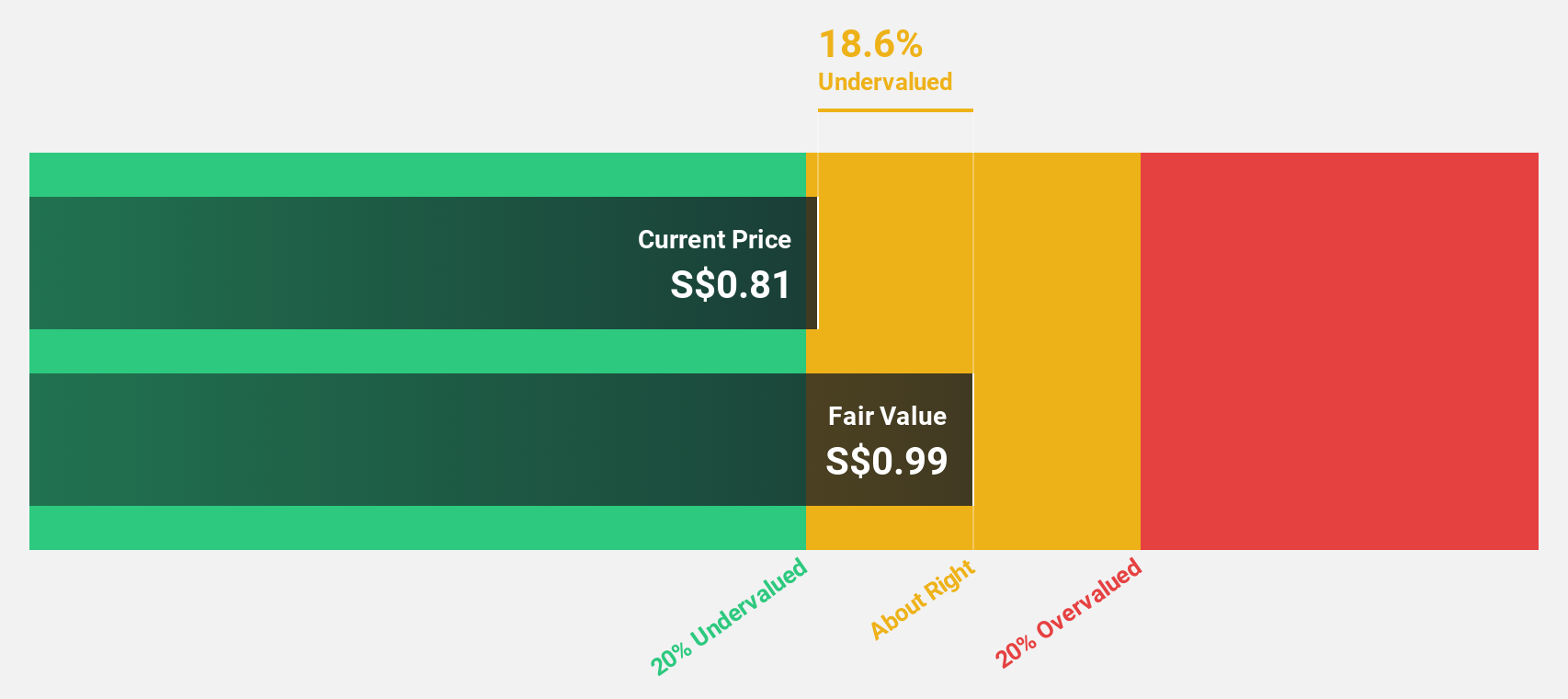

Estimated Discount To Fair Value: 41.1%

Frasers Logistics & Commercial Trust, priced at SGD0.96, is considered undervalued against a fair value estimate of SGD1.62 derived from discounted cash flow models. Although its recent financial performance shows a decline in net income and earnings per share, it maintains a positive outlook with expected revenue growth of 6% annually—outpacing the Singapore market average of 3.7%. However, its debt levels are concerning as they are poorly covered by operating cash flows, and it has an unstable dividend track record despite recent distributions totaling SGD0.0342 per share on May 14, 2024. Analyst consensus suggests potential price appreciation of 31.7%.

- Our expertly prepared growth report on Frasers Logistics & Commercial Trust implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Frasers Logistics & Commercial Trust with our comprehensive financial health report here.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited operates in the nanotechnology sector, offering solutions across Singapore, China, Japan, and Vietnam, with a market capitalization of approximately SGD 507.79 million.

Operations: Nanofilm Technologies International's revenue is derived from several segments, including Sydrogen (SGD 1.05 million), Nanofabrication (SGD 16.05 million), Advanced Materials (SGD 141.54 million), and Industrial Equipment (SGD 37.17 million).

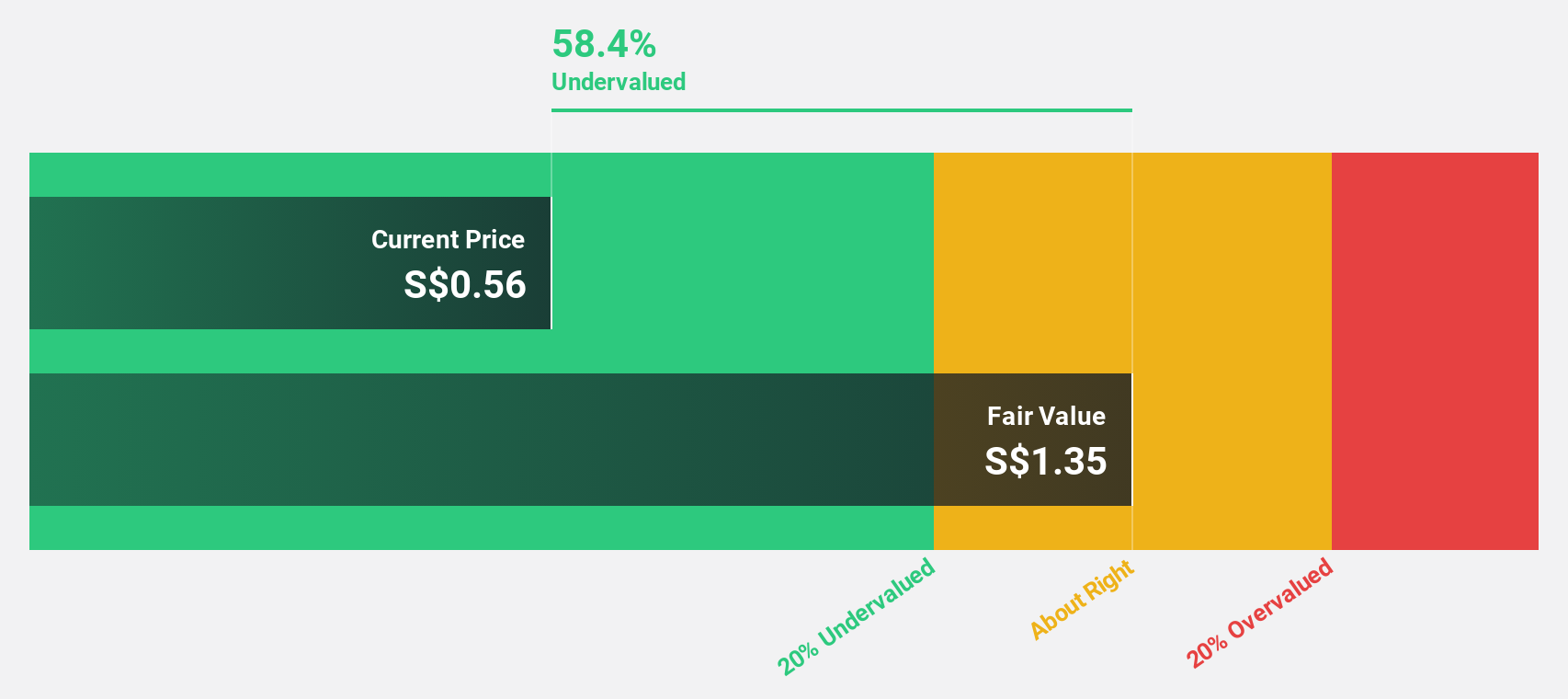

Estimated Discount To Fair Value: 42.1%

Nanofilm Technologies International, valued at SGD0.78, trades 42.1% below its estimated fair value of SGD1.35. Despite a significant profit margin drop from 18.5% to 1.8%, it forecasts robust earnings growth of 50.66% annually, outstripping the Singapore market's projection of 9.1%. The company remains optimistic about FY2024, expecting increased revenues and profits, supported by a recent dividend declaration of SGD0.0033 per share and positive earnings guidance for the year.

- Our earnings growth report unveils the potential for significant increases in Nanofilm Technologies International's future results.

- Get an in-depth perspective on Nanofilm Technologies International's balance sheet by reading our health report here.

Next Steps

- Explore the 6 names from our Undervalued SGX Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Nanofilm Technologies International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MZH

Nanofilm Technologies International

Provides nanotechnology solutions in Singapore, China, Japan, and Vietnam.

Flawless balance sheet with reasonable growth potential.