- Singapore

- /

- Real Estate

- /

- SGX:Z25

Yanlord Land Group Limited (SGX:Z25) Shares Fly 25% But Investors Aren't Buying For Growth

Yanlord Land Group Limited (SGX:Z25) shares have continued their recent momentum with a 25% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 78% in the last year.

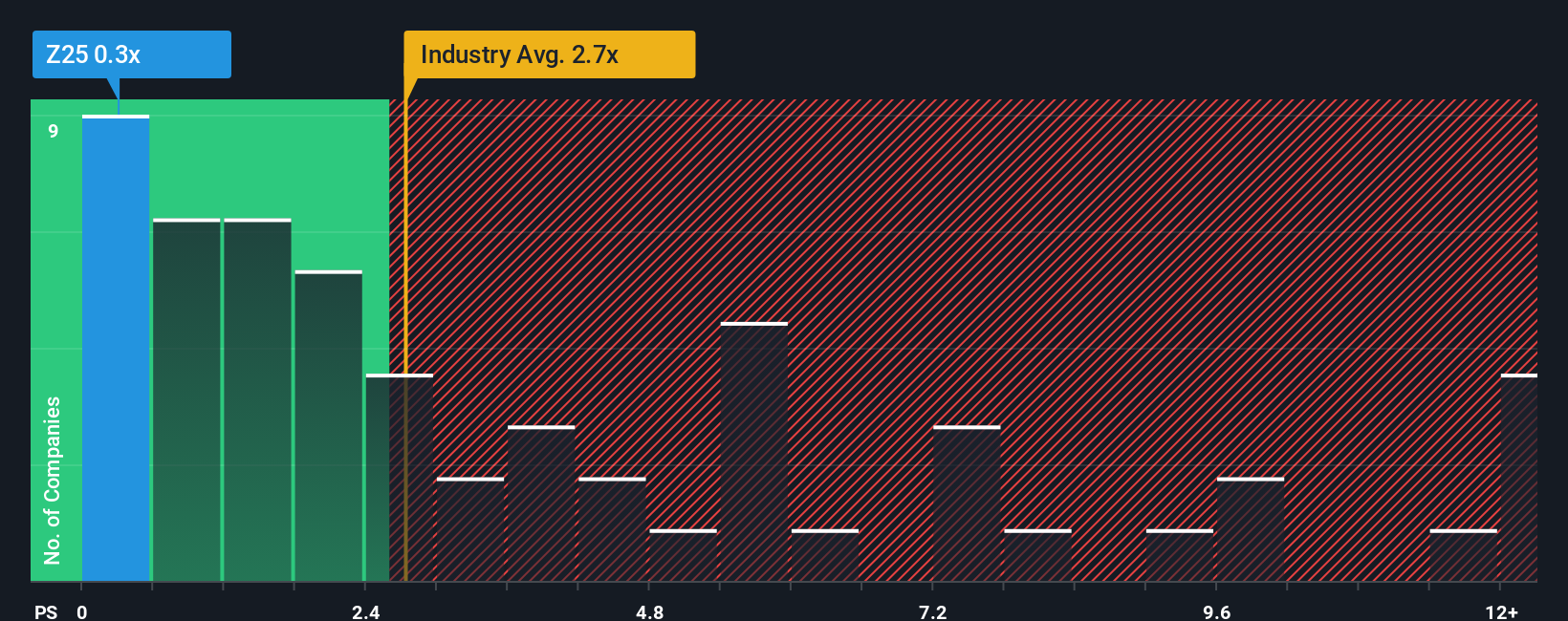

Although its price has surged higher, Yanlord Land Group's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a strong buy right now compared to the wider Real Estate industry in Singapore, where around half of the companies have P/S ratios above 2.7x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Yanlord Land Group

What Does Yanlord Land Group's P/S Mean For Shareholders?

Yanlord Land Group has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Yanlord Land Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Yanlord Land Group would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 47%. As a result, revenue from three years ago have also fallen 22% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 14% as estimated by the two analysts watching the company. Meanwhile, the broader industry is forecast to moderate by 3.0%, which indicates the company should perform poorly indeed.

With this information, it's not too hard to see why Yanlord Land Group is trading at a lower P/S in comparison. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Shares in Yanlord Land Group have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Yanlord Land Group's analyst forecasts confirms that the company's even more precarious outlook against the industry is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Yanlord Land Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:Z25

Yanlord Land Group

A real estate developer focusing on developing high-end fully-fitted residential, commercial and integrated property projects in strategically selected key and high-growth cities in the PRC and Singapore.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives