- Singapore

- /

- Real Estate

- /

- SGX:H78

Is Boardroom Expertise from Blackstone and PAG Shaping Hongkong Land Holdings’ (SGX:H78) Strategic Direction?

Reviewed by Sasha Jovanovic

- Hongkong Land Holdings Limited recently appointed Alan Miyasaki as an Independent Non-Executive Director and Lincoln Pan as a Non-Executive Director, both effective November 1, 2025; Alan joins the Audit and Investment Committees, while Lincoln also becomes CEO-designate of Jardine Matheson Holdings Limited.

- These appointments introduce board expertise from leaders with substantial experience at Blackstone and PAG, potentially shaping the company's strategic direction and governance.

- We will examine how the arrival of directors with global real estate credentials could influence Hongkong Land Holdings’ longer-term investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Hongkong Land Holdings Investment Narrative Recap

For shareholders, the key belief is that Hongkong Land Holdings can deliver long-term value through disciplined capital recycling, prudent balance sheet management, and leveraging its iconic property portfolio in Central Hong Kong. The recent addition of Alan Miyasaki and Lincoln Pan to the board brings significant global real estate experience, but does not materially alter the primary short-term catalyst, progress on capital recycling and earnings stabilization, or the biggest near-term risk around uncertainty in the Mainland China property exit. Among recent announcements, the ongoing US$200 million share buyback program stands out, having already achieved US$134 million in repurchases. Share buybacks, alongside asset sales and a focus on core markets, remain closely watched as key to supporting earnings and net asset value, especially in a period of subdued property sentiment in China. However, while experienced leadership adds credibility, questions remain for investors around...

Read the full narrative on Hongkong Land Holdings (it's free!)

Hongkong Land Holdings' narrative projects $2.1 billion in revenue and $929.4 million in earnings by 2028. This requires 6.0% yearly revenue growth and a $1,260.4 million earnings increase from the current loss of $331.0 million.

Uncover how Hongkong Land Holdings' forecasts yield a $6.86 fair value, a 12% upside to its current price.

Exploring Other Perspectives

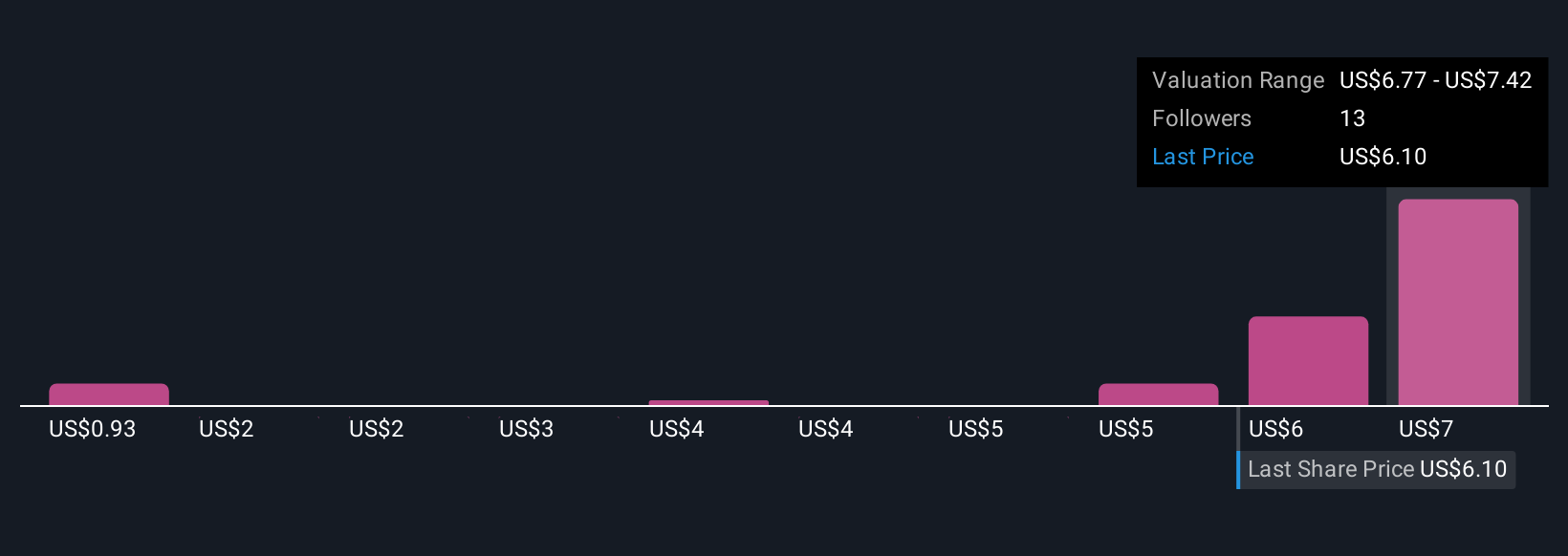

Eight members of the Simply Wall St Community offered fair value estimates ranging from US$0.93 to US$7.42, reflecting broad perspectives. Meanwhile, ongoing exposure to China’s weaker property market continues to shape debate on future profitability and risk.

Explore 8 other fair value estimates on Hongkong Land Holdings - why the stock might be worth as much as 22% more than the current price!

Build Your Own Hongkong Land Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hongkong Land Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hongkong Land Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hongkong Land Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hongkong Land Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H78

Hongkong Land Holdings

Engages in the investment, development, and management of properties in Hong Kong, Macau, Mainland China, Southeast Asia, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives