- Singapore

- /

- Real Estate

- /

- SGX:H78

Hongkong Land (SGX:H78) Welcomes New Directors: Assessing Valuation as Board Gains Investment Leaders

Reviewed by Simply Wall St

Hongkong Land Holdings (SGX:H78) just revealed that Alan Miyasaki and Lincoln Pan will join its board from November 1, 2025. Both bring deep experience in Asian real estate and investment leadership.

See our latest analysis for Hongkong Land Holdings.

The news of these high-profile board appointments follows strong momentum for Hongkong Land Holdings. After a stretch of subdued trading, the company’s share price has gained nearly 38% year-to-date, and its total shareholder return over the past year sits at an impressive 43.2%. The addition of top-tier investment leadership could reinforce optimism about strategic changes, especially as investors look for clues around longer-term value following a 104% five-year total shareholder return.

If you’re keen to spot the next breakout, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Given the stock’s robust gains and high-profile board appointments, the key question is whether Hongkong Land Holdings remains undervalued and presents more upside for investors, or if the market has already priced in future growth potential.

Price-to-Sales Ratio of 7.4x: Is it justified?

At a last close price of $6.11, Hongkong Land Holdings trades with a price-to-sales (P/S) ratio of 7.4x, a premium compared to both sector and peer averages. This highlights its higher valuation in the current market setting.

The price-to-sales ratio measures how much investors are willing to pay per dollar of revenue generated by the company. It is especially relevant for real estate firms, where profits can fluctuate but revenues offer a baseline for comparing market expectations.

Despite its strong stock performance, this elevated multiple suggests the market has already factored in strong improvement prospects. However, when compared to the Singapore Real Estate industry’s average P/S of just 2.9x, Hongkong Land’s ratio appears expensive. Relative to a fair price-to-sales ratio of 4x, this is an aggressive valuation level that may be difficult to justify without unexpected upside.

Explore the SWS fair ratio for Hongkong Land Holdings

Result: Price-to-Sales of 7.4x (OVERVALUED)

However, sustained revenue declines and recent negative returns over the last month signal risks that could quickly shift market sentiment, even in light of recent gains.

Find out about the key risks to this Hongkong Land Holdings narrative.

Another View: Discounted Cash Flow Perspective

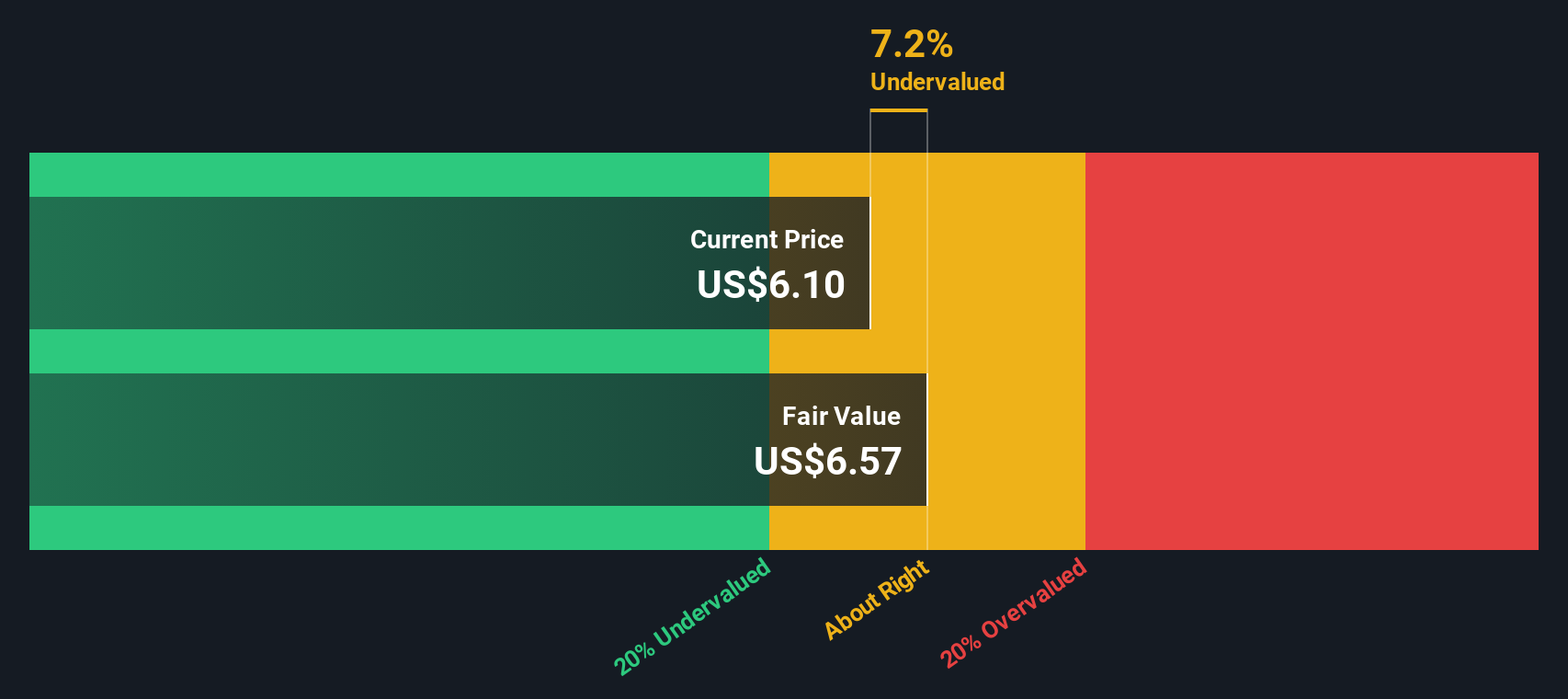

Taking another lens, our SWS DCF model estimates Hongkong Land Holdings is trading at about 6.9% below its intrinsic fair value. Instead of focusing solely on market multiples, the DCF approach suggests there may actually be some value left on the table for long-term investors. Which outlook will guide the market from here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hongkong Land Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hongkong Land Holdings Narrative

If you have a different take or prefer to dive into the numbers on your own, you can easily craft your own narrative in just a few minutes, and Do it your way.

A great starting point for your Hongkong Land Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Fuel your portfolio with fresh opportunities today. Don’t wait; unique stocks with hidden potential could soon be out of reach if you hesitate now.

- Take charge of your financial future by targeting income stability from these 22 dividend stocks with yields > 3% offering yields above 3%.

- Spot market disruptors and get ahead of the trend with these 26 AI penny stocks focused on artificial intelligence innovation.

- Strengthen your positions by hunting down great value through these 832 undervalued stocks based on cash flows identified by strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hongkong Land Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H78

Hongkong Land Holdings

Engages in the investment, development, and management of properties in Hong Kong, Macau, Mainland China, Southeast Asia, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives