Stock Analysis

- Singapore

- /

- Real Estate

- /

- SGX:H13

Shareholders 14% loss in Ho Bee Land (SGX:H13) partly attributable to the company's decline in earnings over past year

This week we saw the Ho Bee Land Limited (SGX:H13) share price climb by 13%. But that is minimal compensation for the share price under-performance over the last year. In fact, the price has declined 17% in a year, falling short of the returns you could get by investing in an index fund.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Ho Bee Land

SWOT Analysis for Ho Bee Land

- Debt is well covered by earnings.

- Earnings declined over the past year.

- Dividend is low compared to the top 25% of dividend payers in the Real Estate market.

- Current share price is above our estimate of fair value.

- H13's financial characteristics indicate limited near-term opportunities for shareholders.

- Lack of analyst coverage makes it difficult to determine H13's earnings prospects.

- Debt is not well covered by operating cash flow.

- Dividends are not covered by cash flow.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

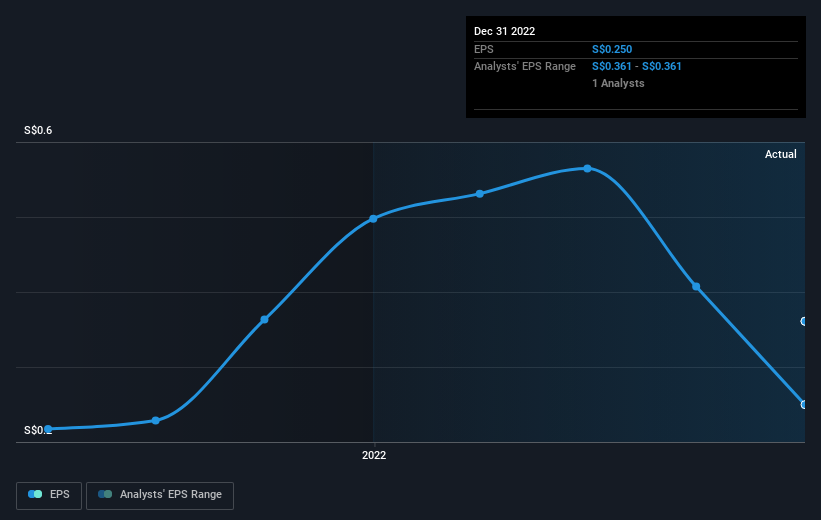

Unfortunately Ho Bee Land reported an EPS drop of 50% for the last year. The share price fall of 17% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Ho Bee Land's key metrics by checking this interactive graph of Ho Bee Land's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Ho Bee Land, it has a TSR of -14% for the last 1 year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Ho Bee Land shareholders are down 14% for the year (even including dividends), but the market itself is up 6.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Ho Bee Land better, we need to consider many other factors. For instance, we've identified 4 warning signs for Ho Bee Land (1 is significant) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Ho Bee Land is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:H13

Ho Bee Land

Ho Bee Land Limited is a real estate company founded in 1987.

Worrying balance sheet not a dividend payer.