Stock Analysis

- Singapore

- /

- Real Estate

- /

- SGX:9CI

CapitaLand Investment's (SGX:9CI one-year decrease in earnings delivers investors with a 10% loss

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in CapitaLand Investment Limited (SGX:9CI) have tasted that bitter downside in the last year, as the share price dropped 14%. That falls noticeably short of the market decline of around 0.9%. Because CapitaLand Investment hasn't been listed for many years, the market is still learning about how the business performs. Unfortunately the share price momentum is still quite negative, with prices down 12% in thirty days.

With the stock having lost 5.2% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for CapitaLand Investment

SWOT Analysis for CapitaLand Investment

- Dividends are covered by earnings and cash flows.

- Earnings declined over the past year.

- Interest payments on debt are not well covered.

- Dividend is low compared to the top 25% of dividend payers in the Real Estate market.

- Annual earnings are forecast to grow faster than the Singaporean market.

- Current share price is below our estimate of fair value.

- Debt is not well covered by operating cash flow.

- Revenue is forecast to grow slower than 20% per year.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

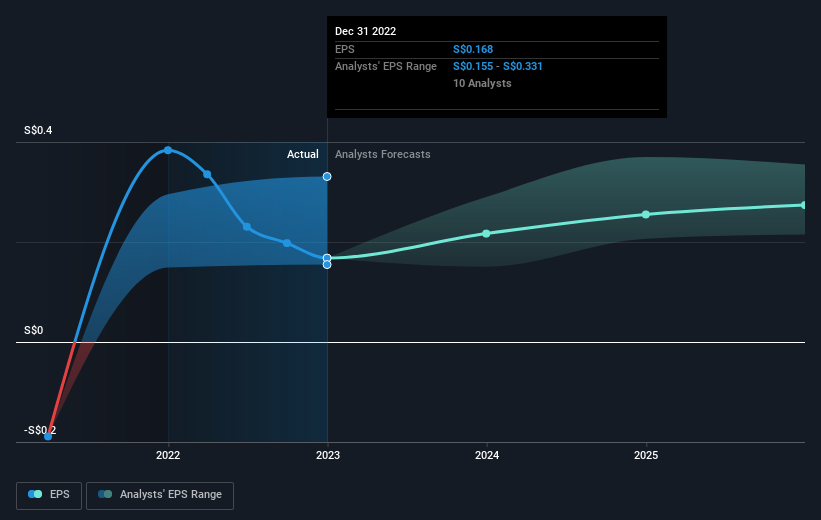

Unfortunately CapitaLand Investment reported an EPS drop of 56% for the last year. The share price fall of 14% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on CapitaLand Investment's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for CapitaLand Investment the TSR over the last 1 year was -10%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We doubt CapitaLand Investment shareholders are happy with the loss of 10% over twelve months (even including dividends). That falls short of the market, which lost 0.9%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 8.8% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with CapitaLand Investment (at least 1 which is concerning) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether CapitaLand Investment is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:9CI

CapitaLand Investment

Headquartered and listed in Singapore, CapitaLand Investment Limited (CLI) is a leading global real asset manager with a strong Asia foothold.

Fair value with moderate growth potential.