- Singapore

- /

- Real Estate

- /

- SGX:1F3

There's No Escaping Aspen (Group) Holdings Limited's (SGX:1F3) Muted Earnings Despite A 95% Share Price Rise

The Aspen (Group) Holdings Limited (SGX:1F3) share price has done very well over the last month, posting an excellent gain of 95%. Notwithstanding the latest gain, the annual share price return of 7.9% isn't as impressive.

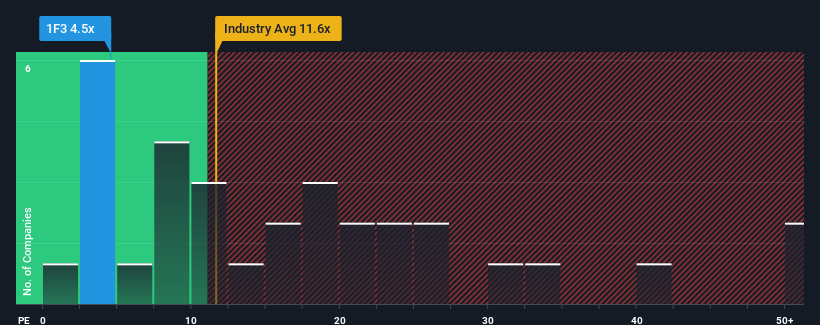

Even after such a large jump in price, Aspen (Group) Holdings' price-to-earnings (or "P/E") ratio of 4.5x might still make it look like a strong buy right now compared to the market in Singapore, where around half of the companies have P/E ratios above 13x and even P/E's above 23x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For example, consider that Aspen (Group) Holdings' financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Aspen (Group) Holdings

How Is Aspen (Group) Holdings' Growth Trending?

In order to justify its P/E ratio, Aspen (Group) Holdings would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. The last three years don't look nice either as the company has shrunk EPS by 56% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 10% shows it's an unpleasant look.

In light of this, it's understandable that Aspen (Group) Holdings' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On Aspen (Group) Holdings' P/E

Shares in Aspen (Group) Holdings are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Aspen (Group) Holdings maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 4 warning signs for Aspen (Group) Holdings (2 are a bit concerning!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:1F3

Aspen (Group) Holdings

An investment holding company, engages in property development activities in Malaysia.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success