- Singapore

- /

- Basic Materials

- /

- SGX:S44

These 4 Measures Indicate That EnGro (SGX:S44) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that EnGro Corporation Limited (SGX:S44) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Our analysis indicates that S44 is potentially undervalued!

What Is EnGro's Net Debt?

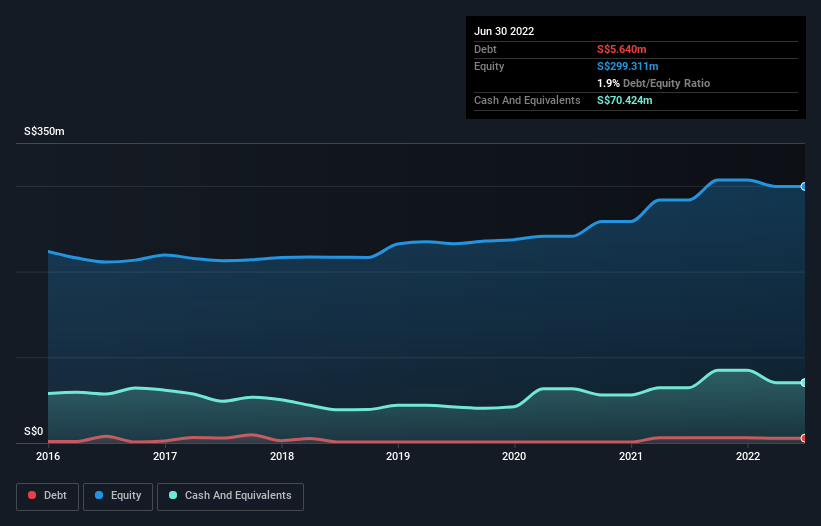

The image below, which you can click on for greater detail, shows that EnGro had debt of S$5.64m at the end of June 2022, a reduction from S$6.15m over a year. But on the other hand it also has S$70.4m in cash, leading to a S$64.8m net cash position.

How Strong Is EnGro's Balance Sheet?

We can see from the most recent balance sheet that EnGro had liabilities of S$18.9m falling due within a year, and liabilities of S$21.5m due beyond that. Offsetting this, it had S$70.4m in cash and S$34.1m in receivables that were due within 12 months. So it can boast S$64.2m more liquid assets than total liabilities.

This luscious liquidity implies that EnGro's balance sheet is sturdy like a giant sequoia tree. Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that EnGro has more cash than debt is arguably a good indication that it can manage its debt safely.

It was also good to see that despite losing money on the EBIT line last year, EnGro turned things around in the last 12 months, delivering and EBIT of S$1.1m. The balance sheet is clearly the area to focus on when you are analysing debt. But it is EnGro's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While EnGro has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last year, EnGro burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While it is always sensible to investigate a company's debt, in this case EnGro has S$64.8m in net cash and a decent-looking balance sheet. So we don't have any problem with EnGro's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with EnGro (including 1 which shouldn't be ignored) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if EnGro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:S44

EnGro

An investment holding company, engages in the manufacture and sale of building materials and specialty polymers in Singapore, Malaysia, the People’s Republic of China, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives