For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like EnGro (SGX:S44), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for EnGro

How Quickly Is EnGro Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud EnGro's stratospheric annual EPS growth of 40%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

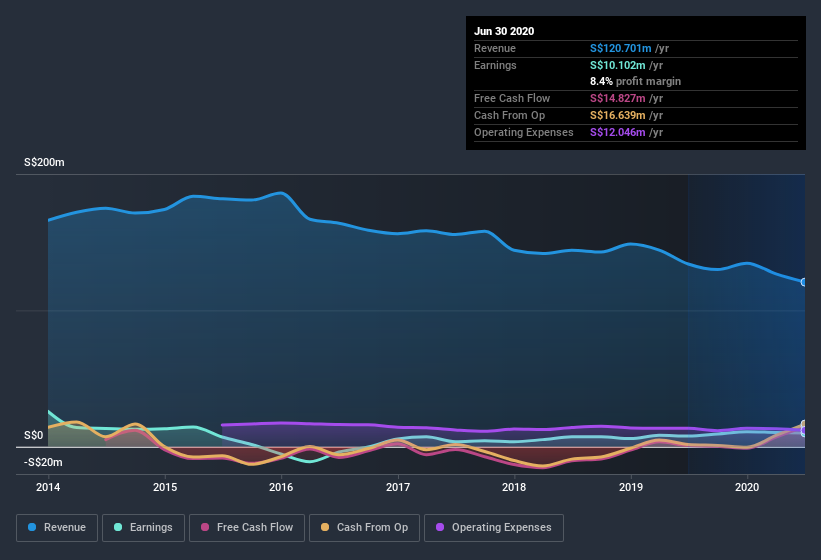

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of EnGro's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. EnGro's EBIT margins are flat but, of some concern, its revenue is actually down. Suffice it to say that is not a great sign of growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

EnGro isn't a huge company, given its market capitalization of S$116m. That makes it extra important to check on its balance sheet strength.

Are EnGro Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling EnGro shares, in the last year. So it's definitely nice that Chairman & CEO Cheng Gay Tan bought S$8.0k worth of shares at an average price of around S$0.80.

Does EnGro Deserve A Spot On Your Watchlist?

EnGro's earnings per share have taken off like a rocket aimed right at the moon. If you're like me, you'll find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. For me, this situation certainly piques my interest. Still, you should learn about the 1 warning sign we've spotted with EnGro .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of EnGro, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade EnGro, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EnGro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:S44

EnGro

An investment holding company, engages in the manufacture and sale of building materials and specialty polymers in Singapore, Malaysia, the People’s Republic of China, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives